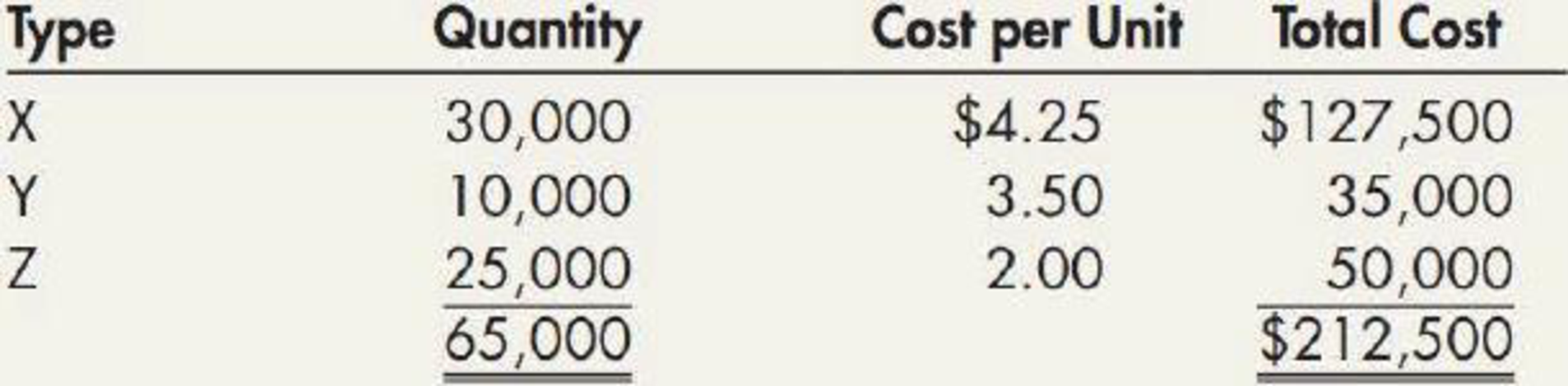

Webster Company adopted do liar-value LIFO on January 1, 2019. Webster produces three products: X, Y, and Z. Webster’s beginning inventory consisted of the following:

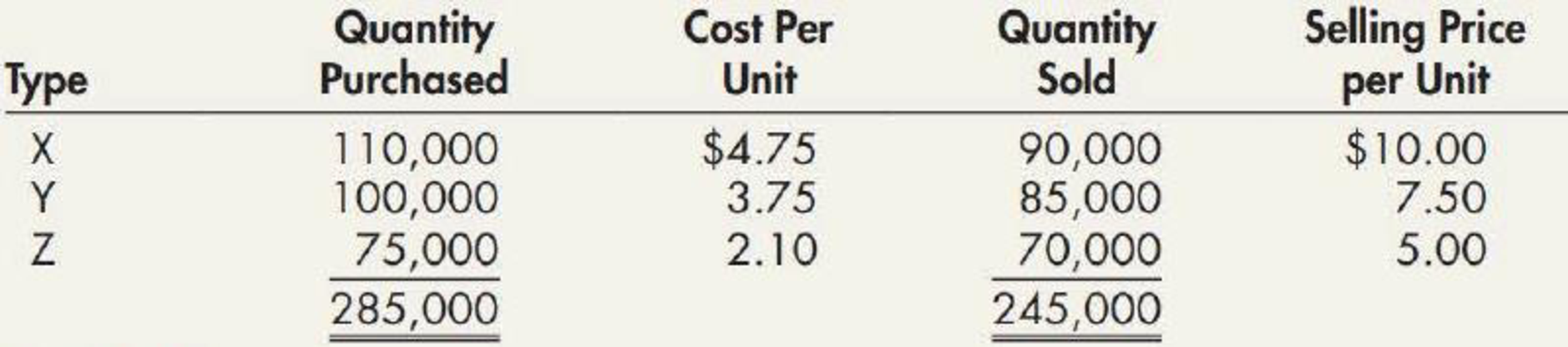

During 2019, Webster had the following purchases and sales:

Required:

- 1. Compute the LIFO cost of the ending inventory assuming Webster uses a single inventory pool. Round cost index to 4 decimal places.

- 2. Compute the LIFO cost of the ending inventory assuming Webster uses three inventory pools. Round cost indexes to 4 decimal places.

1.

Calculate the ending inventory for LIFO cost if single inventory pool is used.

Explanation of Solution

Cost index:

Cost index refer to the index which relates the inventory cost of current year with the base year. The cost index is usually prepared with a sample from the total inventory.

Double-extension method:

Under the double-extension method of cost index, the ending inventory of the current year are valued at the current year costs and related with the base year’s cost.

Calculate the ending inventory in units:

| Particulars | Product X | Product Y | Product Z |

| Beginning inventory | 30,000 | 10,000 | 25,000 |

| Add: Net Purchases | 110,000 | 100,000 | 75,000 |

| Units available for sale | 140,000 | 110,000 | 100,000 |

| Less: Sales | (90,000) | (85,000) | (70,000) |

| Ending inventory | 50,000 | 25,000 | 30,000 |

Table (1)

Calculate the cost index:

Calculate the ending inventory at the Base year cost:

Calculate the increase in inventory at the Base year cost:

Calculate the layer increase in inventory at the Current year cost:

Calculate the LIFO ending inventory cost:

Thus, the ending inventory for LIFO cost if single inventory pool is used is $374,033.

2.

Calculate the ending inventory for LIFO cost if three inventory pools are used.

Explanation of Solution

Calculate the cost index for Product X:

Calculate the ending inventory at the Base year cost for Product X:

Calculate the increase in inventory at the Base year cost for Product X:

Calculate the layer increase in inventory at the Current year cost for Product X:

Calculate the LIFO ending inventory cost for Product X:

Thus, the ending inventory for LIFO cost for Product X if three inventory pools are used is $222,500.

Calculate the cost index for Product Y:

Calculate the ending inventory at the Base year cost for Product Y:

Calculate the increase in inventory at the Base year cost for Product Y:

Calculate the layer increase in inventory at the Current year cost for Product Y:

Calculate the LIFO ending inventory cost for Product Y:

Thus, the ending inventory for LIFO cost for Product Y if three inventory pools are used is $91,252.

Calculate the cost index for Product Z:

Calculate the ending inventory at the Base year cost for Product Z:

Calculate the increase in inventory at the Base year cost for Product Z:

Calculate the layer increase in inventory at the Current year cost for Product Z:

Calculate the LIFO ending inventory cost for Product Z:

Thus, the ending inventory for LIFO cost for Product Z if three inventory pools are used is $60,500.

Calculate the LIFO ending inventory cost:

Thus, the ending inventory for LIFO cost if three inventory pools are used is $374,252.

Want to see more full solutions like this?

Chapter 7 Solutions

Intermediate Accounting: Reporting And Analysis

- Fava Company began operations in 2018 and used the LIFO inventory method for both financial reporting and income taxes. At the beginning of 2019, the anticipated cost trends in the industry had changed, so that it adopted the FIFO method for both financial reporting and income taxes. Fava reported revenues of 300,000 and 270,000 in 2019 and 2018, respectively. Fava reported expenses (excluding income tax expense) of 125,000 and 120,000 in 2019 and 2018, which included cost of goods sold of 55,000 and 45,000, respectively. An analysis indicates that the FIFO cost of goods sold would have been lower by 8,000 in 2018. The tax rate is 21%. Fava has a simple capital structure with 15,000 shares of common stock outstanding during 2018 and 2019. It paid no dividends in either year. Required: 1. Prepare the journal entry to reflect the change. 2. At the end of 2019, prepare the comparative income statements for 2019 and 2018. Notes to the financial statements are not necessary. 3. At the end of 2019, prepare the comparative retained earnings statements for 2019 and 2018.arrow_forwardThe cost of the inventory on January 31, 2019, under the FIFO method is: a. 400 b. 2,700 c. 3,100 d. 3,200arrow_forwardAt December 31, 2019, the following information was available from Crisford Companys books: Sales for the year totaled 110,600; markdowns amounted to 1,400. Under the approximate lower of average cost or market retail method, Crisfords inventory at December 31, 2019, was: a. 30,800 b. 28.000 c. 21,560 d. 19,600arrow_forward

- Borys Companys periodic inventory at December 31, 2019, is understated by 10,000, but purchases are correct. Johnson correctly values its 2020 ending inventory. What is the effect of this error on Boryss 2019 and 2020 financial statements?arrow_forwardInventory Pools Stone Shoe Company adopted dollar-value LIFO on January 1, 2019. The company produces four products and uses a single inventory pool. The companys beginning inventory consists of the following: During 2019, the company has the following purchases and sales: Required: 1. Compute the dollar-value LIFO cost of the ending inventory. Round the cost index to 4 decimal places and all other amounts to the nearest dollar. 2. Next Level By how much would the companys gross profit differ if it had used four pools instead of a single pool?arrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the direct method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forward

- Olson Company adopted the dollar-value LIFO method for inventory valuation at the beginning of 2015. The following information about the inventory at the end of each year is available from Olsons records: Required: 1. Calculate the dollar-value LIFO inventory at the end of each year. 2. Prepare the appropriate disclosures for the 2021 annual report if Olson uses current cost internally and LIFO for financial reporting.arrow_forwardThe moving average inventory cost flow assumption is applicable to which of the following inventory systems? Questions M7-6 and M7-7 are based on the following data: City Stationers Inc. had 200 calculators on hand on January 1, 2019, costing 18 each. Purchases and sales of calculators during the month of January were as follows: City uses a periodic inventory system. According to a physical count, 150 calculators were on hand at January 31, 2019.arrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the allowance method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forward

- Kraft Manufacturing Company manufactures two products: Mult and Tran. At December 31, 2019, Kraft used the FIFO inventory method. Effective January 1, 2020, Kraft changed to the LIFO inventory method. The cumulative effect of this change is not determinable, and, as a result, the ending inventory of 2019, for which the FIFO method was used, is also the beginning inventory for 2020 for the LIFO method. Any layers added during 2020 should be costed by reference to the first acquisitions of 2020, and any layers liquidated during 2020 should be considered a permanent liquidation. The following information was available from Krafts inventory records for the two most recent years: Required: Compute the effect on income before income taxes for the year ended December 31, 2020, resulting from the change from the FIFO to the LIFO inventory method.arrow_forwardCompany Edgar reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 12,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?arrow_forwardGivens Company uses a periodic inventory system.Its records show the following for the month of december 2019,in which 68 units were sold at$100 per unit. Units Units Cost Total Cost December 1 Beginning inventory 30 $9 $270 15 Purchase 25 $11 $275 24 Purchase 35 $12 $420 Totals 90 $965 Required: (show all calculate the Cost of Goods Sold on December 31,2019 for Given Company using the following cost flow assumptions: a.Calculate the Cost of Goods Sold on December 31,2019 for Given Company using the following cost flow assumptions: i)Weighted Average Cost method and ii) First-In-First-Out(FIFO) method. b.calculate the Gross Profit for the month ended December 31,2019 for Given Company using the following cost flow assumptions: i)Weighted Average Cost method and ii) First-In-First-Out(FIFO) method.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College