Concept explainers

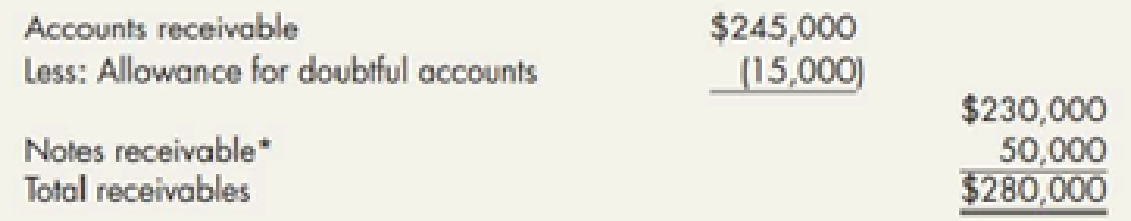

Comprehensive Receivables Problem Blackmon Corporation’s December 31, 2018, balance sheet disclosed the following information relating to its receivables:

*The company has a recourse liability of $700 related to a note receivable sold to a bank.

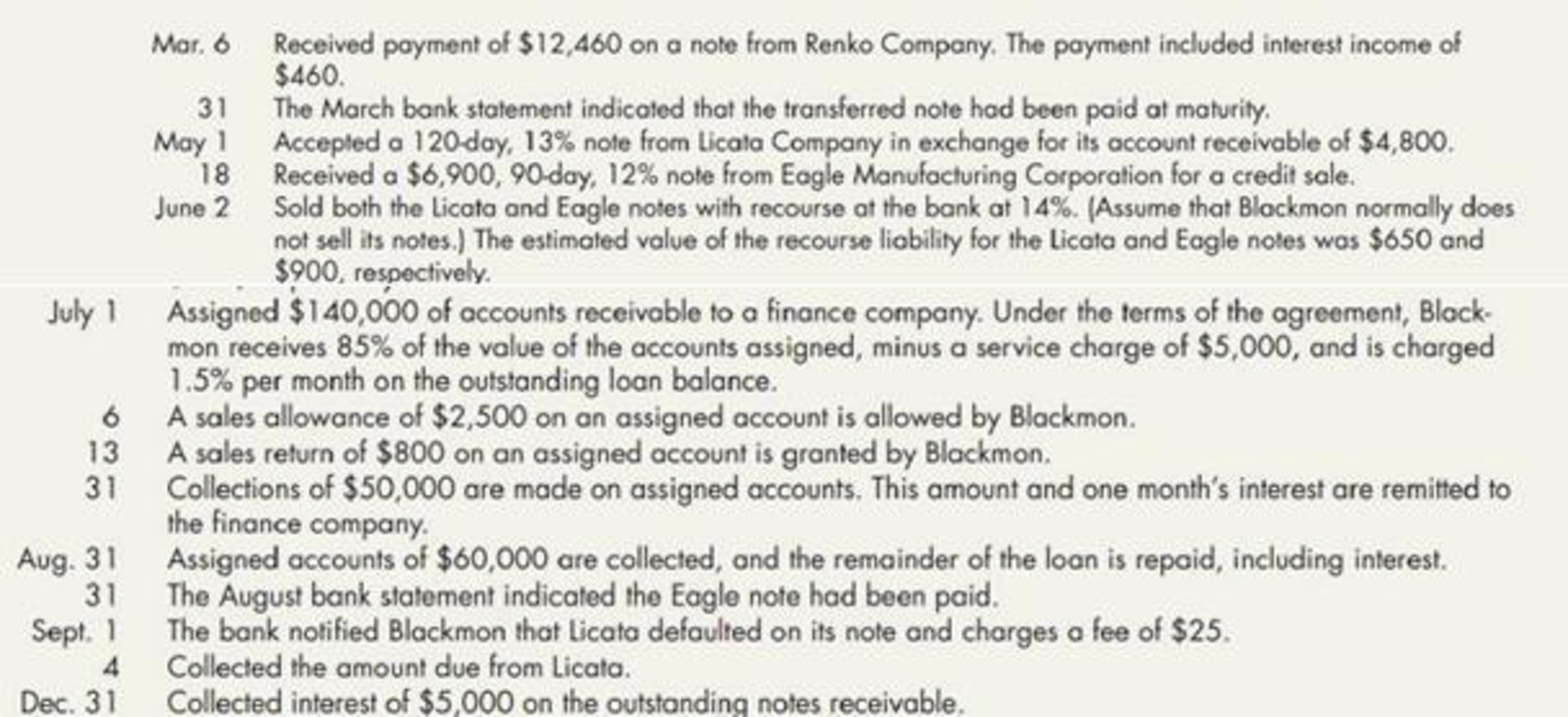

During 2019, credit sales (terms, n/EOM) totaled $2,200,000, and collections on accounts receivable (unassigned) amounted to $1,900,000. Uncollectible accounts totaling $18,000 from several customers were written off, and a $1,350 accounts receivable previously written off was collected. Additionally, the following transactions relating to Blackmon’s receivables occurred during the year:

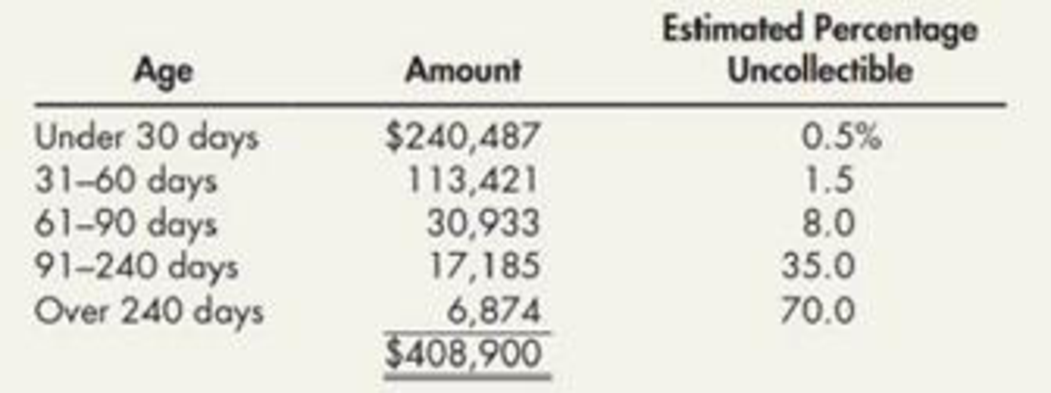

On December 31, 2019, an aging of the accounts receivable balance indicated the following:

Required:

- 1. Prepare the

journal entries to record the preceding receivable transactions during 2019 and the necessaryadjusting entry on December 31, 2019. Assume a 360-day year for interest calculations and round calculations to the nearest dollar. - 2. Prepare the receivables portion of Blackmon’s December 31, 2019, balance sheet.

- 3. Next Level Compute Blackmon’s accounts receivable turnover in days, assuming a 360-day business year. What is your evaluation of its collection policies?

- 4. If Blackmon uses IFRS, what might be the heading of the section for the receivables reported in Requirement 2?

1.

Journalize the entries to record the previous receivables transaction and prepare the necessary adjusting entry on December 31, 2019.

Explanation of Solution

Accounts receivable:

Accounts receivable refers to the amounts to be received within a short period from customers upon the sale of goods and services on account. In other words, accounts receivable are amounts customers owe to the business. Accounts receivable is an asset of a business.

Prepare journal entries:

| Date | Account Title and Explanation | Debit | Credit |

| Accounts receivable | $2,200,000 | ||

| Sales revenue | $2,200,000 | ||

| (To record the sale on credit) |

Table (1)

| Date | Account Title and Explanation | Debit | Credit |

| Cash | $1,900,000 | ||

| Accounts receivable | $1,900,000 | ||

| ( To record payment received) |

Table (2)

| Date | Account Title and Explanation | Debit | Credit |

| Allowance for doubtful accounts | $18,000 | ||

| Accounts receivable | $18,000 | ||

| (To record accounts receivables written- off) |

Table (3)

| Date | Account Title and Explanation | Debit | Credit |

| Accounts receivable | $1,350 | ||

| Allowance for doubtful accounts | $1,350 | ||

| (To record accounts receivables written- off) |

Table (4)

| Date | Account Title and Explanation | Debit | Credit |

| March 6 | Cash | $1,350 | |

| Accounts receivable | $1,350 | ||

| (To record cash collected on accounts) |

Table (5)

| Date | Account Title and Explanation | Debit | Credit |

| March 6 | Cash | $12,460 | |

| Notes receivable | $12,000 | ||

| Interest income | $460 | ||

| (To record the cash collected from notes receivable along with interest) |

Table (6)

| Date | Account Title and Explanation | Debit | Credit |

| March 31 | Recourse liability | $700 | |

| Gain from sale of note | $700 | ||

| (To record the fair value of recourse liability) |

Table (7)

| Date | Account Title and Explanation | Debit | Credit |

| May 1 | Notes Receivable | $4,800 | |

| Accounts receivable | $4,800 | ||

| (To record the notes receivable) |

Table (8)

| Date | Account Title and Explanation | Debit | Credit |

| May 18 | Notes receivable | $6,900 | |

| Sales revenue | $6,900 | ||

| (To record the receipt of the interest bearing note) |

Table (10)

| Date | Account Title and Explanation | Debit | Credit |

| June 2 | Cash | $11,736 | |

|

Loss from sale of receivable | $1,603 | ||

| Notes receivable | $11,700 | ||

| Interest income | $89.97 | ||

| Recourse liability | $1,550 | ||

| (To record the factoring of accounts receivable) |

Table (11)

Note: For the values of amount refer to Table (26) and Table (27)

| Date | Account Title and Explanation | Debit | Credit |

| July 1 | Cash (balancing figure) | $114,000 | |

| Assignment service charge expense | $5,000 | ||

| Notes payable (11) | $119,000 | ||

| (To record the assignment service charge expense) |

Table (12)

| Date | Account Title and Explanation | Debit | Credit |

| July 1 | Accounts receivable assigned | 140,000 | |

| Accounts receivables | 140,000 | ||

| ( To record the remaining accounts owed) |

Table (13)

| Date | Account Title and Explanation | Debit | Credit |

| July 6 | Return liability | 2,500 | |

| Accounts receivable assigned | 2,500 | ||

| (To record the return liability of accounts receivable assigned) |

Table (14)

| Date | Account Title and Explanation | Debit | Credit |

| July 13 | Return liability | 800 | |

| Accounts receivable assigned | 800 | ||

| (To record the return liability of accounts receivable assigned) |

Table (15)

| Date | Account Title and Explanation | Debit | Credit |

| July 31 | Cash | 50,000 | |

| Accounts receivable assigned | 50,000 | ||

| (To record the receipt of accounts receivable assigned) |

Table (16)

| Date | Account Title and Explanation | Debit | Credit |

| July 31 | Notes payable | 50,000 | |

| Interest expense (12) | 1,785 | ||

| Cash | 51,785 | ||

| (To record the interest expense on notes payable) |

Table (17)

| Date | Account Title and Explanation | Debit | Credit |

| August 31 | Cash | 60,000 | |

| Accounts receivable assigned | 60,000 | ||

| (To record the receipt of cash) |

Table (18)

| Date | Account Title and Explanation | Debit | Credit |

| August 31 | Notes payable (15) | 69,000 | |

| Interest expense (13) | 1,035 | ||

| Cash | 70,035 | ||

| (To record the interest expense on notes payable) |

Table (19)

| Date | Account Title and Explanation | Debit | Credit |

| August 31 | Accounts receivable | 26,700 | |

| Accounts receivable assigned | 26,700 | ||

| (To record the accounts receivable assigned) |

Table (20)

Note:

| Date | Account Title and Explanation | Debit | Credit |

| August 31 | Recourse liability | 900 | |

| Gain from sale of notes | 900 | ||

| (To record the fair value of recourse liability) |

Table (21)

| Date | Account Title and Explanation | Debit | Credit |

| September 1 | Notes receivable dishonored | 4,383 | |

| Recourse liability | 650 | ||

| Cash (14) | 5,033 | ||

| (To record the notes dishonored) |

Table (22)

| Date | Account Title and Explanation | Debit | Credit |

| September 4 | Cash (14) | 5,033 | |

| Notes receivables dishonored | 4,383 | ||

| Gain from collection of dishonored note | 650 | ||

| (To record the ) |

Table (23)

| Date | Account Title and Explanation | Debit | Credit |

| December 31 | Cash | 5,000 | |

| Interest income | 5,000 | ||

| (To record the interest income) |

Table (24)

| Date | Account Title and Explanation | Debit | Credit |

| December 31 |

Bad debt expense | 17,855 | |

| Allowance for doubtful accounts | 17,855 | ||

| (To record the bad debt expenses of the period) |

Table (25)

Working note:

(1) Calculate the amount of loss from receivable:

| Particulars | Amount ($) |

| Face value of the note | 4,800 |

| Interest to maturity (2) | 208 |

| Maturity value of note | 5,008 |

| Less: Discount (3) | (171.38) |

| Proceeds | 4,836.62 |

| Less: Book value of note (4) | (4,855.47) |

| Recourse liability | (650) |

| Loss from sale of receivable | (668.85) |

Table (26)

(2) Calculate the interest to maturity:

(3) Calculate the amount of discount:

Note: 88 days is calculated by subtracting 120 days from 32 days (May 1 to June 2).

(4) Calculate the book value of note:

(5) Calculate accrued interest income:

Note: 20 days is calculated from November 1 to November 20.

(6) Calculate the amount of loss from receivable of Company E:

| Particulars | Amount ($) |

| Face value of the note | 6,900 |

| Interest to maturity (7) | 207 |

| Maturity value of note | 7,107 |

| Less: Discount (8) | (207.29) |

| Proceeds | 6,899.71 |

| Less: Book value of note (9) | (6,934.50) |

| Recourse liability | (900) |

| Loss from sale of receivable | (934.79) |

Table (27)

(7) Calculate the interest to maturity:

(8) Calculate the amount of discount:

Note: 75 days is calculated by subtracting 90 days from 15 days (May 18 to June 2).

(9) Calculate the book value of note:

(10) Calculate accrued interest income:

Note: 20 days is calculated from November 1 to November 20.

(11) Calculate the advance amount of accounts receivable:

(12) Calculate the amount of interest expense on July 31:

(13) Calculate the interest expense on August 31:

(14) Calculate the amount of cash on September 1:

(15) Calculate the amount of cash on August 1:

2.

Prepare the receivable portion of Company B as on December 31, 2019.

Explanation of Solution

Receivables portion of Company B is prepared as follows:

| Particulars | Amount | Amount |

| Accounts receivables (16) | $408,900 | |

| Less: Allowance for doubtful accounts (16) | ($16,205) | |

| $392,695 | ||

| Notes receivables | $38,000 | |

| Total receivables | $430,695 |

Table (28)

Working note:

(16) Calculate the estimated total amount of uncollectible:

| Age | Amount (a) | Estimated Percentage uncollectible (b) | Estimated amount of uncollectible |

| Under 30 days | $240.487 | 0.5% | 1,202 |

| 30–60 days | $113,421 | 1.5% | 1,701 |

| 61–90 days | $30,933 | 8.0% | 2,475 |

| 91–240 days | $17,185 | 35% | 6,015 |

| Over 240 days | $6,874 | 70% | 4,812 |

| $408,900 | $16,205 |

Table (29)

3.

Calculate the accounts receivable turnover in days and analyze its collection policy.

Explanation of Solution

Accounts receivable turnover:

Accounts receivable turnover is a liquidity measure of accounts receivable in times, which is calculated by dividing the net credit sales by the average amount of net accounts receivables. In other words, it indicates the number of times the average amount of net accounts receivables collected during a particular period.

Average collection period:

Average collection period indicates the number of days taken by a business to collect its outstanding amount of accounts receivable on an average.

Calculate the receivables turnover in days:

The receivables turnover in days for Corporation B is 51 days and it seems to be slow, therefore, the company must be very violent in its collection policies.

Working note:

(17) Compute the receivables turnover ratio:

(18) Calculate average accounts receivable (net):

4.

State the heading for the accounts receivable section in requirement 2, if Company B uses IFRS.

Explanation of Solution

“Loans and Receivables” can be used as the heading for the accounts receivables section, if Company B uses IFRS.

Want to see more full solutions like this?

Chapter 6 Solutions

Intermediate Accounting: Reporting And Analysis

- Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120 in its accounts receivable. Additionally, Karras had a credit balance in its allowance for doubtful accounts of 4,350 and 9,420 at the beginning and end of the year, respectively. During the year, Karras made credit sales of 1,530,000, collected receivables in the amount of 1,445,700, and recorded bad debt expense of 83, 750. Required: Next Level Compute the amount of accounts receivable that Karras wrote off during the year and the amount of accounts receivable at the beginning of the year.arrow_forwardEstimating Bad Debts from Receivables Balances The following information is extracted from Shelton Corporations accounting records at the beginning of 2019: During 2019, sales on credit amounted to 575,000, 557,400 was collected on outstanding receivables and 2,600 of receivables were written off as uncollectible. On December 31, 2019, Shell on estimastes its bad debts to be 4% of the outstanding gross accounts receivable balance. Required: 1. Prepare the journal entry necessary to record Sheltons estimate of bad debt expense for 2019. 2. Prepare the Accounts Receivable section of Shelton's December 31, 2019, balance sheet. 3. Compute Shelton's receivables turnover. (Round to one decimal place.) 4. It Sheldon uses IFRS, what might be the heading for the accounts receivable section in Requirement 2?arrow_forwardReceivables Issues Magrath Company has an operating cycle of less than one year and provides credit terms for all of its customers. On April 3, 2019, the company factored, without recourse, some of its accounts receivable. Magrath does not normally factor its receivables. On August 1, 2019, Magrath sold special order merchandise and received an interest-bearing note due April 30, 2020. Magrath uses the allowance method to account for uncollectible accounts. During 2019, some accounts were written off as uncollectible, and other accounts previously written off as uncollectible were collected. Required: 1. Explain how Magrath should account for and report the accounts receivable factored on April 3, 2019. Why is this accounting treatment appropriate? 2. Explain how Magrath should report the effects of the interest-bearing note on its income statement for the year ended December 31, 2019, and its December 31, 2019, balance sheet. 3. Explain how Magrath should account for the collection of the accounts previously written off as uncollectible. 4. What are the two basic approaches to estimating uncollectible accounts under the allowance method? What is the rationale for each approach?arrow_forward

- McKinney Co. estimates its uncollectible accounts as a percentage of credit sales. McKinney made credit sales of 1,500,000 in 2019. McKinney estimates 2.5% of its sales will be uncollectible. Prepare the journal entry to record bad debt expense for McKinney at the end of 2019.arrow_forwardAccounting for Notes Receivable Yarnell Electronics sells computer systems to small businesses. Yarnell engaged in the following activities involving notes receivable: a. On September 1, 2019, Yarnell sold a $10,000 system to Ross Company. Ross gave Yarnell a 6-month, 7% note as payment. b. On December 1, 2019, Yarnell sold a $6,000 system to Searfoss Inc. Searfoss gave Yarnell a 9-month, 9% note as payment. c. On March 1, 2020, Ross paid the amount due on its note. d. On September 1, 2020, Searfoss paid the amount due on its note. Required: Prepare the necessary journal and adjusting entries for Yarnell Electronics to record these transactions.arrow_forwardPrior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts Receivable and the related Allowance for Doubtful Accounts were 1,200,000 and 60,000, respectively. An aging of accounts receivable indicated that 106,000 of the December 31, 2019, receivables may be uncollectible. The net realizable value of accounts receivable at December 31, 2019, was: a. 1,034,000 b. 1,094,000 c. 1,140,000 d. 1,154,000arrow_forward

- Interest-Bearing and Non-Interest-Bearing Notes On December 11, 2019, Hooper Inc. made a credit sale to Marshall Company and required Marshall to sign a 12,000,60-day note. Required: Prepare the journal entries necessary to record the receipt of the note by Hooper, the accrual of interest on December 31, 2019, and the customers repayment on February 9, 2020, assuming: 1. Interest of 12% was in addition to the face value of the note. 2. The note was issued as a 12,000 non-interest-bearing note with a present value of 11,765. The implicit interest rate on the note receivable was 12%. Assume a 360-day year. (Round to the nearest dollar.)arrow_forwardAccounts receivable At December 31, 2021, House Co. reported the following information on its balance sheet. Less: Allowance for doubtful accounts 1. 2. During 2022, the company had the following transactions related to receivables. 3. 4. 5. n Sales on account Sales returns and allowances o $960,000 80,000 Show Transcribed Text Collections of accounts receivable Write-offs of accounts receivable deemed uncollectible Recovery of accounts previously written off as uncollectible $3,700,000 50,000 2,810,000 90,000 29,000 1.) Compute the accounts receivable turnover and average collection period for 2022arrow_forwardAccounts receivable, net of P520,000 allowance va Company reported the following receivables on December 31, 2018: for doubtful accounts Interest receivable Notes receivable 3,840,000 190,000 4,000,000 • The notës receivable comprised: P1.000,000 note dated October 31, 2018, with principal and interest payable on October 31, 2019. P3.000,000 note dated March 31, 2018, with principal and 8% interest payable on March 31, 2019. • During 2019, sales revenue totaled P21,200,000, P19,800,000 cash was collected from customers, and P410,000 in accounts receivable were written off. All sales are made on a credit basis. • Doubtful accounts expense is recorded at year-end by adjusting the allowance account to an amount equal to 10% of year-end accounts receivable. 1. What amount should be reported as interest income for 2019? а. 110,000 b. 240,000 60,000 d. с. 80,000 2. What amount should be reported as doubtful accounts expense for 2019? a. 535,000 b. 425,000 c. 110,000 d. 410,000arrow_forward

- Aging Method On December 31, 2021, Smith Ltd. has the following balances for accounts receivable and allowance for doubtful accounts: Accounts Receivable $382,000 Allowance for Doubtful Accounts (a credit balance) 4,200 During 2022, Smith had $2,865,000 of credit sales, collected $2,905,000 of accounts receivable, and wrote off $3,850 of accounts receivable as uncollectible. At year-end, Smith performs an aging of its accounts receivable balance and estimates that $3,800 will be uncollectible. Required: 1. Calculate Smith's preadjustment balance in accounts receivable on December 31, 2022.arrow_forwardJournalizing note receivable transactions including a dishonored note On September 30, 2018, Team Bank loaned $94,000 to Kendall Warner on a one-year, 6% note. Team’s fiscal year ends on December 31. Requirements Journalize all entries for Team Bank related to the note for 2018 and 2019. Which party has a a. note receivable? b. note payable? c. interest revenue? d. interest expense? 3. Suppose that Kendall Warner defaulted on the note. What entry would Team record for the dishonored note?arrow_forwardAn analysis and aging of Eagle Corporation accounts receivable at December 31, 2021 , disclosed the following Amount estimated to be uncollectible P 1,800,000 Accounts receivable 17,500,000 Allowance for doubtful accounts (per books) 1,250,000 What is the net realizable value of Eagle Corporation’s receivables at December 31, 2021? A. P 14,450,000 B. P 16,250,000 C. P 15,700,000 D. P 17,500,000arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning