Concept explainers

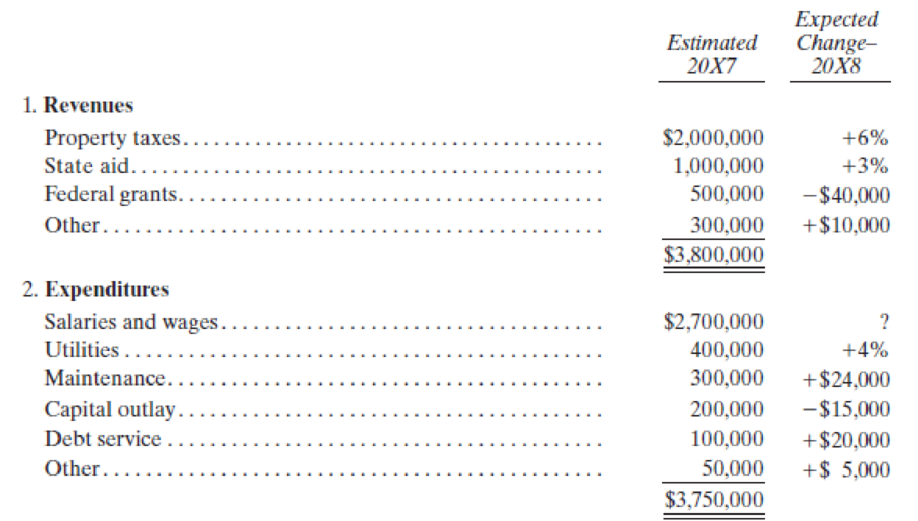

(Operating Budget Preparation) The finance director of the Bethandy Independent School District is making preliminary estimates of the budget outlook for the General Fund for the 20X8 fiscal year. These estimates will permit the superintendent to advise the department heads properly when budget instructions and forms are distributed. She has assembled the following information:

3. Fund balance at the end of 20X7 is expected to be $1,600,000; at least $1,500,000 must be available at the end of 20X8 for carryover to help finance 20X9 operations.

- a. Prepare a draft operating budget for the Bethandy Independent School District for the 20X8 fiscal year, including 20X7 comparative data and expected change computations. Assume that 20X8 appropriations are to equal 20X8 estimated revenues.

- b. What total salaries and wages amount and average percentage increase or decrease are implied in the draft operating budget prepared in part (a)? What are the maximum salary and wages amount and percentage increase that seem to be feasible in 20X8?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Governmental and Nonprofit Accounting (11th Edition)

Additional Business Textbook Solutions

Accounting for Governmental & Nonprofit Entities

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Fundamentals of Cost Accounting

Principles of Accounting Volume 1

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

- Tri-County Social Service Agency is a not-for-profit organization in the Midwest. Use the following Information to complete the cash budget for the year ending December 31. The Board of Trustees requires that Tri-County maintain a minimum cash balance of $8,000. If cash is short, the agency may borrow from an endowment fund the amount required to maintain the $8,000 minimum. It is anticipated that the year will begin with an $11,000 cash balance. Contract revenue is received evenly during the year. Mental health Income is expected to grow by $5,000 in the second and third quarters; no change is expected in the fourth quarter. Required: 2. Complete the cash budget for each quarter and the year as a whole. 3. Determine the amount that the agency will owe the endowment fund at year-end. Complete this question by entering your answers in the tabs below. Required 2 Required 3 Complete the cash budget for each quarter and the year as a whole. (Cash deficiency and repayments should be…arrow_forwardThe Bellflower City school district formally adopted a budget wi revenues of $800 and approved expenditures of $780. Which of is the appropriate entry to record the budget? MATER OLARA O Debit Estimated revenues $800; Credit Appropriations $780; Credit F $20. EFERE Debit Appropriations $780: Debit Fund balance $20: Credit Estimated $800. Debit Encumbrances $780: Debit Fund balance $20; Credit Estimated $800. Memorandum entry only.arrow_forwardThe City of Bedford Falls debt service fund budgeted $150,000 (2 payments of $75,000) for interest and an annual principal payment of $500,000. Funding will be transferred from the general fund at the time payments are to be made. Interest payments will be December 15 and June 15. Principal will be paid on June 15. Journalize the budget for July 1 Journal any necessary December 15 entry(ies) What is the amount of accrued interest to be recorded in the Debt Service Fund at June 30?arrow_forward

- Fairview Medical Supply has applied for a loan. First American Bank has requested a budgeted balance sheet as of April 30, and a combined cash budget for April. As Fairview Medical Supply's controller, you have assembled the following information: a. March 31 equipment balance, $52,700; accumulated depreciation, $41,100. b. April capital expenditures of $42,700 budgeted for cash purchase of equipment. c. April depreciation expense, $500. d. Cost of goods sold, 60% of sales. e. Other April operating expenses, including income tax, total $13,400, 30%of which will be paid in cash and the remainder accrued at April 30. f. March 31 owners' equity, $93,600. g. March 31 cash balance, $40,100. h. April budgeted sales, $91,000, 70% of which is for cash. Of the remaining 30%, half will be collected in April and half in May. i. April cash collections on March sales, $29,200. j. April cash payments of March 31 liabilities incurred…arrow_forwardEmmanuel Macron has the following budgeted business transactions for the month of May 2020: insurance refund received: $500; payments to be made to materials suppliers: $15,000; payments to be made to employees: $4,000; cash expected from customers: $25,000; budgeted depreciation charge on non-current assets: $800; budgeted interest paid to bank: $40; personal drawings: $2,000. At 1 May 2020, Emmanuel is budgeting an overdraft at the bank of $4,000. What is Emmanuel's budgeted cash position at the end of May 2020? $340 overdrawn $340 cash in the bank $460 cash in the bank $460 overdrawnarrow_forwardThe city council of Temecula approved the 2013 budget as follows: Budgeted 2013 revenues from: Property taxes $6,000,000 Sales taxes $2,000,000 Appropriations for 2013: Salaries $5,600,000 Materials $2,200,000 Equipment $125,000 Required: Prepare the general journal entry necessary to initially record the budget on 1/1/13 Date Account Debit Creditarrow_forward

- Hugo Medical Supply has applied for a loan. Pacific Commerce Bank has requested a budgeted balance sheet as of April 30, and a combined cash budget for April. As Hugo Medical Supply's controller, you have assembled the following information: a. March 31 equipment balance, $52,600; accumulated depreciation, $41,300. b. April capital expenditures of $ 42,400 budgeted for cash purchase of equipment. c. April depreciation expense, $700. d. Cost of goods sold, 60%of sales. e. Other April operating expenses, including income tax, total $14,200, 35% of which will be paid in cash and the remainder accrued at April 30. f. March 31 owners' equity, $92,600. g. March 31 cash balance, $40,300. h. April budgeted sales, $90,000, 70% of which is for cash. Of the remaining 30%, half will be collected in April and half in May. i. April cash collections on March sales, $29,100. j. April cash payments of March 31 liabilities incurred for March…arrow_forwardIn an organization that plans by using comprehensive budgeting, the master budget is The booklet containing budget guidelines, policies, and forms to use in the budgeting process. The current budget updated for operations for part of the current year. A compilation of all the separate operational and financial budget schedules of the organization. A budget of a not-for-profit organization after it is approved by the appropriate authoritative body.arrow_forwardhow about these 3 requirments Prepare a direct materials budget for the first quarter of the financial year ending 30 September 2022. Prepare a cash budget for the first quarter of the financial year ending 30 September 2022 including any necessary schedules. Prepare a budgeted income statement for the first quarter of the financial year ending 30 September 2022.arrow_forward

- Budget planners for a certain community have determined that $9,235,400 will be required to provide all government services next year. The total assessed property value in the community is $122,500,000. What tax rate is required to meet the budgetary demands? (Express your answer as a tax rate per $100 and round to the nearest hundredth)arrow_forwardYou have been awarded a project to start in the next six months. One of your tasks is to determine a budget based on the scope of works provided. State four (4) benefits of Budgeting to Management?arrow_forwardTune Printing Supply of Baltimore has applied for a loan. Its bank has requested a budgeted income statement for April 2024 and budgeted balance sheet at April 30, 2024. The March 31, 2024, balance sheet follows: As Tune Printing Supply's controller, you have assembled the following additional information: a. April dividends of $6,000 were declared and paid. b. April capital expenditures of $16,200 budgeted for cash purchase of equipment. c. April depreciation expense, $500. d. Cost of goods sold, 45% of sales. e. Desired ending inventory for April is $22,800. f. April selling and administrative expenses include salaries of $32,000, 30% of which will be paid in cash and the remainder paid next month. g. Additional April selling and administrative expenses also include miscellaneous expenses of 15% of sales, all paid in April. h. April budgeted sales, $86,000, 50% collected in April and 50% in May. i. April cash payments of…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning