College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 1PB

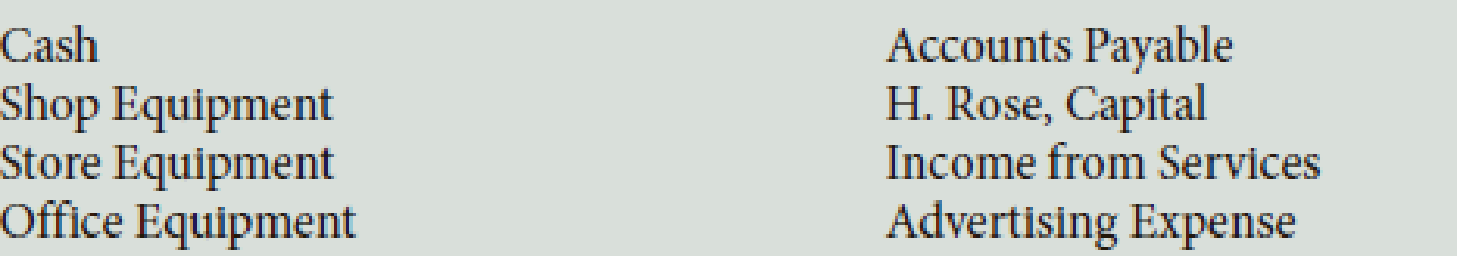

During February of this year, H. Rose established Rose Shoe Hospital. The following asset, liability, and owner’s equity accounts are included in the chart of accounts:

The following transactions occurred during the month of February:

- a. Rose deposited $25,000 cash in a bank account in the name of the business.

- b. Bought shop equipment for cash, $1,525, Ck. No. 1000.

- c. Bought advertising on account from Milland Company, $325.

- d. Bought store shelving on account from Inger Hardware, $750.

- e. Bought office equipment from Shara’s Office Supply, $625, paying $225 in cash and placing the balance on account, Ck. No. 1001.

- f. Paid on account to Inger Hardware, $750, Ck. No. 1002.

- g. Rose invested his personal leather working tools with a fair market value of $800 in the business

- h. Sold services for the month of February for cash, $250.

PART 1: The Accounting Cycle for a Service Business: Analyzing Business Transactions

Required

- 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental

accounting equation , as well as the plus and minus signs and Debit and Credit. - 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts.

- 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction.

- 4. Foot and balance the accounts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Journalize the following:

1. On the books & records of Company A:

On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received

April May

2. On the books & records of Company A:

In January, Company A purchased Investment in XYZ for $100. Payment was made in cash.

In March, Company A sold Investment in XYZ for $150. Payment was received in cash.

3. On the books & records of Company A:

On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18.

Record 4/1/17 entry for payment of $1,200

Record 4/30/17 journal entry

4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…

The following are the transactions of Spotlighter, Incorporated, for the month of January.

a. Borrowed $4,390 from a local bank on a note due in six months.

b. Received $5,080 cash from investors and issued common stock to them.

c. Purchased $1,900 in equipment, paying $650 cash and promising the rest on a note due in one year.

d. Paid $750 cash for supplies.

e. Bought and received $1,150 of supplies on account.

Required:

Post the effects to the appropriate T-accounts and determine ending account balances. Show a beginni

Debit

Beginning Balance

Ending Balance

Debit

F

Cash

Equipment

Credit

Credit

Debit

Beginning Balance

Ending Balance

Debit

Supplies

Accounts Payable

The following are the transactions of Spotlighter, Incorporated, for the month of January.

Borrowed $3,940 from a local bank on a note due in six months.

Received $4,630 cash from investors and issued common stock to them.

Purchased $1,000 in equipment, paying $200 cash and promising the rest on a note due in one year.

Paid $300 cash for supplies.

Bought and received $700 of supplies on account.

Required:Prepare journal entries for each transaction.

Chapter 2 Solutions

College Accounting (Book Only): A Career Approach

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - On a sheet of paper, draw the fundamental...Ch. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - A fellow accounting student has difficulty...Ch. 2 - What Would You Do? A new bookkeeper cant find the...

Additional Business Textbook Solutions

Find more solutions based on key concepts

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

Principles Of Taxation For Business And Investment Planning 2020 Edition

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (5th Edition)

Dave Nelson recently retired at age 48, courtesy of the numerous stock options he had been granted while presid...

Managerial Accounting: Creating Value in a Dynamic Business Environment

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals Of Cost Accounting (6th Edition)

Calculating certain information using the direct method (Learning Objective 4) 20-25 min. Trudeaus Marine, Inc....

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardAnalyzing the Accounts The controller for Summit Sales Inc. provides the following information on transactions that occurred during the year: a. Purchased supplies on credit, $18,600 b. Paid $14,800 cash toward the purchase in Transaction a c. Provided services to customers on credit1 $46,925 d. Collected $39,650 cash from accounts receivable e. Recorded depreciation expense, $8,175 f. Employee salaries accrued, $15,650 g. Paid $15,650 cash to employees for salaries earned h. Accrued interest expense on long-term debt, $1,950 i. Paid a total of $25,000 on long-term debt, which includes $1.950 interest from Transaction h j. Paid $2,220 cash for l years insurance coverage in advance k. Recognized insurance expense, $1,340, that was paid in a previous period l. Sold equipment with a book value of $7,500 for $7,500 cash m. Declared cash dividend, $12,000 n. Paid cash dividend declared in Transaction m o. Purchased new equipment for $28,300 cash. p. Issued common stock for $60,000 cash q. Used $10,700 of supplies to produce revenues Summit Sales uses the indirect method to prepare its statement of cash flows. Required: 1. Construct a table similar to the one shown at the top of the next page. Analyze each transaction and indicate its effect on the fundamental accounting equation. If the transaction increases a financial statement element, write the amount of the increase preceded by a plus sign (+) in the appropriate column. If the transaction decreases a financial statement element, write the amount of the decrease preceded by a minus sign (-) in the appropriate column. 2. Indicate whether each transaction results in a cash inflow or a cash outflow in the Effect on Cash Flows column. If the transaction has no effect on cash flow, then indicate this by placing none in the Effect on Cash Flows column. 3. For each transaction that affected cash flows, indicate whether the cash flow would be classified as a cash flow from operating activities, cash flow from investing activities, or cash flow from financing activities. If there is no effect on cash flows, indicate this as a non-cash activity.arrow_forwardPrepare journal entries to record the following transactions for the month of November: A. on first day of the month, issued common stock for cash, $20,000 B. on third day of month, purchased equipment for cash, $10,500 C. on tenth day of month, received cash for accounting services, $14,250 D. on fifteenth day of month, paid miscellaneous expenses, $3,200 E. on last day of month, paid employee salaries, $8,600arrow_forward

- Prepare journal entries to record the following transactions that occurred in March: A. on first day of the month, purchased building for cash, $75,000 B. on fourth day of month, purchased inventory, on account, $6,875 C. on eleventh day of month, billed customer for services provided, $8,390 D. on nineteenth day of month, paid current month utility bill, $2,000 E. on last day of month, paid suppliers for previous purchases, $2,850arrow_forwardThe transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardOn April 1, 20Y8, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April: Opened a business bank account with a deposit of $33,000 in exchange for common stock. Purchased supplies on account, $3,320. Paid creditor on account, $2,100. Earned sales commissions, receiving cash, $33,920. Paid rent on office and equipment for the month, $6,650. Paid dividends, $11,000. Paid automobile expenses for month, $3,190, and miscellaneous expenses, $1,530. Paid office salaries, $4,000. Determined that the cost of supplies on hand was $1,120; therefore, the cost of supplies used was $2,200. Required: Question Content Area 1. Indicate the effect of each transaction and the balances after each transaction. For those boxes in which no entry is required, leave the box blank. If required, enter negative values as negative numbers using a minus sign.arrow_forward

- On April 1, 20Y8, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April: Opened a business bank account with a deposit of $24,000 in exchange for common stock. Purchased supplies on account, $2,410. Paid creditor on account, $1,530. Earned sales commissions, receiving cash, $24,620. Paid rent on office and equipment for the month, $4,830. Paid dividends, $8,000. Paid automobile expenses for month, $2,310, and miscellaneous expenses, $1,110. Paid office salaries, $2,910. Determined that the cost of supplies on hand was $810; therefore, the cost of supplies used was $1,600.arrow_forwardRecord each of these transactions in Journal entries and prepare the Ledger for Cash & Cash Equivalents, Accounts Receivable and Accounts Payable: 1st Sunny Barcelona started the business by depositing $50,000 received from the sale of capital stock in the company bank account. 22nd Purchased a building for $36,000, paying $6,000 in cash and issuing a note payable for the remaining $30,000. 25th Purchased tools and equipment on account, $13,800. 27th Sold some of the tools at a price equal to their cost, $1,800, collectible within 45 days. 2nd Received $600 in partial collection of the account receivable from the sale of tools. 7th Paid $6,800 in partial payment of an account payable. 11th Received $2,200 of sales revenue in cash. 2oth Purchased radio advertising from RAC105 to be aired in March. The cost was $470, payable within 30 days. 22nd Purchased office equipment for $15,000 cash. 26th Performed repair services and billed clients $2,000. The entire amount will…arrow_forwardOn October 17, Nickle Company purchased a building and a plot of land for $582,300. The building was valued at $302,796 while the land carried a value of $279,504. Nickle paid $56,300 down in cash and signed a note payable for the balance. Required: Provide the journal entry for this transaction. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTSNickle CompanyGeneral Ledger ASSETS 11 Cash 12 Accounts Receivable 13 Supplies 14 Prepaid Insurance 15 Land 16 Office Equipment 17 Building 18 Truck LIABILITIES 21 Notes Payable 22 Accounts Payable 23 Unearned Revenue EQUITY 31 Marlene Nickle, Capital 32 Marlene Nickle, Drawing REVENUE 41 Fees Earned EXPENSES 51 Wages Expense 53 Rent Expense 54 Utilities Expense 55 Maintenance Expense 59 Miscellaneous Expensearrow_forward

- The Dog & Cat Hospital, owned by Kate Miller, a veterinarian, opened for business on December 1 of the current year. Using the horizontal worksheet below, record the following December transactions. Total the columns to show that assets equal liabilities plus stockholders' equity as of December 31. 1. Miller opened a checking account on December 1 at Biltmore Bank in the name of The Dog & Cat Hospital and deposited $12,500 Miller received common stock for her investment. 2. Paid rent for December, $750. 3. Purchased office equipment on account, $1,450. 4. Purchased supplies for cash, $950. 5. Billed clients for services rendered, $3,650. 6. Paid secretary's salary, $975. 7. Paid $750 on account for the equipment purchased on December 3. 8. Collected $2,900 from clients previously billed for services. 9. The firm paid stockholders $1,500 cash as a dividend. Note: Use negative signs with answers, when appropriate. Assets Liabilities Stockholders' Equity = Accounts Office Accounts Common…arrow_forwardTanwir commenced his business on 1 October 20X9, with capital in the bank of $20,000. During his first month of trading, his transactions were as follows. 1 October Purchase inventories for $3,500 on credit from A Jones 3 October Paid $1,200 rental of premises, by cheque 5 October Paid $5,000 for office equipment, by cheque 10 October Sold goods costing $1,000 for $1,750, on credit to P Duncan 15 October Returned inventories costing $500 to A Jones 18 October Purchased inventories for $2,400 on credit from A Jones 25 October Paid A Jones for the net purchases of 1 October, by cheque 28 October P Duncan paid $500 on account, by cheque The balance on the account of A Jones at 31 October 20X9 was $ ........................................arrow_forwardPrepare the following journal entry, all transactions that occurred in January: The Corporation purchased a Delivery Van for customer deliveries. The Delivery Van cost $21,400. A down payment of cash in the amount of $5,000 was paid to the Car Dealership, and a promissory note was signed for the remaining amount owed.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY