College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1PB

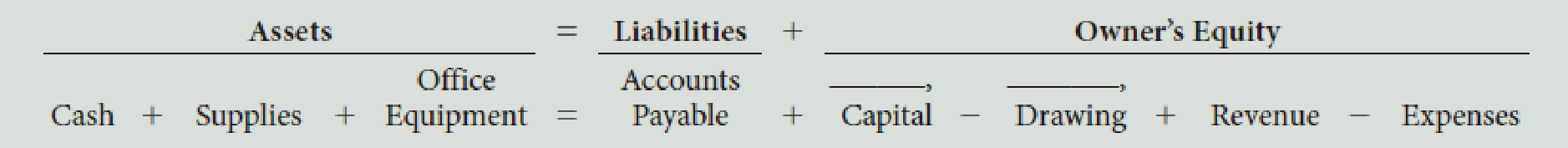

In July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow.

- a. Wallace deposited $24,000 in a bank account in the name of the business.

- b. Paid the office rent for the current month, $650, Ck. No. 1000.

- c. Bought office supplies for cash, $375, Ck. No. 1001.

- d. Bought office equipment on account from Dellos Computers, $6,300.

- e. Received a bill from the City Crier for advertising, $455.

- f. Sold services for cash, $3,944.

- g. Paid on account to Dellos Computers, $1,500, Ck. No. 1002.

- h. Received and paid the bill for utilities, $340, Ck. No. 1003.

- i. Paid on account to the City Crier, $455, Ck. No. 1004.

- j. Paid truck expenses, $435, Ck. No. 1005.

- k. Wallace withdrew cash for personal use, $1,500, Ck. No. 1006.

Required

- 1. Record the transactions and the balance after each transaction.

- 2. Total the left side of the

accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

S. Waweru starts business on 1st July 2020, when he deposits Shs. 18,000 into his business bank account and Shs. 2,500 in his cash account. During the month of July, he undertakes the following transactions:-

2020

July 3 He purchases shop fittings for sh. 2,500 and pays by cheque.

July 4 He buys a motor vehicle from AB & Co. on credit Sh. 3,000.

July 6 He buys stock for Sh. 1,500 and pays through bank.

July 8 He sells goods for cash Sh.1,000.

July 10 Buys goods on credit from XY & Co. for Sh. 1,200

July 12 Sells goods to A. Smith for Sh. 900 on credit

July 13 Pays wages Sh. 120 by cash

July 14 A. Smith returns goods worth Sh. 200

July 15 Pays to AB & Co. Sh. 3,000 by cheque

July 17 Goods returned to XY & Co. amounting to Sh. 350

July 21 Receives from A. Smith a cheque for Sh. 700

July 25 Sells goods for cash Sh. 300.

July 30…

S. Waweru starts business on 1st July 2020, when he deposits Shs. 18,000 into his business bank account and Shs. 2,500 in his cash account. During the month of July, he undertakes the following transactions:-

2020

July 3 He purchases shop fittings for sh. 2,500 and pays by cheque.

July 4 He buys a motor vehicle from AB & Co. on credit Sh. 3,000.

July 6 He buys stock for Sh. 1,500 and pays through bank.

July 8 He sells goods for cash Sh.1,000.

July 10 Buys goods on credit from XY & Co. for Sh. 1,200

July 12 Sells goods to A. Smith for Sh. 900 on credit

July 13 Pays wages Sh. 120 by cash

July 14 A. Smith returns goods worth Sh. 200

July 15 Pays to AB & Co. Sh. 3,000 by cheque

July 17 Goods returned to XY & Co. amounting to Sh. 350

July 21 Receives from A. Smith a cheque for Sh. 700

July 25 Sells goods for cash Sh. 300.

July 30…

On July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July:

a. Opened a business bank account with a deposit of $30,000 from personal funds.

b. Purchased office supplies on account, $3,010.

c. Paid creditor on account, $1,900.

d. Earned sales commissions, receiving cash, $30,690.

Chapter 1 Solutions

College Accounting (Book Only): A Career Approach

Ch. 1 - Prob. 1QYCh. 1 - Prob. 2QYCh. 1 - Which of the following accounts would increase...Ch. 1 - Which of the following statements is true? a....Ch. 1 - M. Parish purchased supplies on credit. What is...Ch. 1 - Define assets, liabilities, owners equity,...Ch. 1 - Prob. 2DQCh. 1 - How do Accounts Payable and Accounts Receivable...Ch. 1 - Describe two ways to increase owners equity and...Ch. 1 - What is the effect on the fundamental accounting...

Ch. 1 - When an owner withdraws cash or goods from the...Ch. 1 - Define chart of accounts and identify the...Ch. 1 - What account titles would you suggest for the...Ch. 1 - Prob. 1ECh. 1 - Determine the following amounts: a. The amount of...Ch. 1 - Dr. L. M. Patton is an ophthalmologist. As of...Ch. 1 - Describe a business transaction that will do the...Ch. 1 - Describe a transaction that resulted in each of...Ch. 1 - Label each of the following accounts as asset (A),...Ch. 1 - Describe a transaction that resulted in the...Ch. 1 - Describe the transactions that are recorded in the...Ch. 1 - On June 1 of this year, J. Larkin, Optometrist,...Ch. 1 - On July 1 of this year, R. Green established the...Ch. 1 - S. Davis, a graphic artist, opened a studio for...Ch. 1 - On March 1 of this year, B. Gervais established...Ch. 1 - In April, J. Rodriguez established an apartment...Ch. 1 - In July of this year, M. Wallace established a...Ch. 1 - In March, K. Haas, M.D., established the Haas...Ch. 1 - P. Schwartz, Attorney at Law, opened his office on...Ch. 1 - In March, T. Carter established Carter Delivery...Ch. 1 - In October, A. Nguyen established an apartment...Ch. 1 - Why Does It Matter? MACS CUSTOM CATERING, Eugene,...Ch. 1 - What Would You Say? A friend of yours wants to...Ch. 1 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

Principles Of Taxation For Business And Investment Planning 2020 Edition

The amount that should be recorded by Company R for building under historical cost principle.

Financial Accounting (11th Edition)

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

INTERMEDIATE ACCOUNTING

Dave Nelson recently retired at age 48, courtesy of the numerous stock options he had been granted while presid...

Managerial Accounting: Creating Value in a Dynamic Business Environment

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting: Tools for Business Decision Making, 8th Edition

Preparing Financial Statements from a Trial Balance The following accounts are taken from Equilibrium Riding, I...

Fundamentals of Financial Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the following: 1. On the books & records of Company A: On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received April May 2. On the books & records of Company A: In January, Company A purchased Investment in XYZ for $100. Payment was made in cash. In March, Company A sold Investment in XYZ for $150. Payment was received in cash. 3. On the books & records of Company A: On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18. Record 4/1/17 entry for payment of $1,200 Record 4/30/17 journal entry 4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…arrow_forwardDomingo Company started its business on January 1, 2019. The following transactions occurredduring the month of May. Prepare the journal entries in the journal on Page 1.A. The owners invested $10,000 from their personal account to the business account.B. Paid rent $500 with check #101.C. Initiated a petty cash fund $500 with check #102.D. Received $1,000 cash for services rendered.E. Purchased office supplies for $158 with check #103.F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30days.G. Received $800 cash for services rendered.H. Paid wages $600, check #105.I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77,miscellaneous expense $55. Cash on hand $11. Check #106.J. Increased petty cash by $30, check #107.arrow_forwardThe following are the transactions of Spotlighter, Incorporated, for the month of January. a. Borrowed $3.990 from a local bank on a note due in six months. b. Received $4,680 cash from investors and issued common stock to them. C. Purchased $1,100 in equipment, paying $250 cash and promising the rest on a note due in one year. d. Paid $350 cash for supplies. e. Bought and received $750 of supplies on account. Required: Post the effects to the appropriate T-accounts and determine ending account balances. Show a beginning balance of zero.arrow_forward

- On April 1, 2019, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April:a. Opened a business bank account with a deposit of $24,000 from personal funds.b. Paid rent on office and equipment for the month, $3,600.c. Paid automobile expenses (including rental charge) for the month, $1,350, and miscellaneous expenses, $600.d. Purchased office supplies on account, $1,200.e. Earned sales commissions (revenue) from selling real estate, receiving cash, $19,800.f. Paid creditor on account, $750.g. Paid office salaries, $2,500.h. Withdrew cash for personal use, $3,500.i. Determined that the cost of supplies on hand was $300; therefore, the cost of supplies used was $900.arrow_forwardOn July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July:a. Opened a business bank account with a deposit of $25,000 from personal funds.b. Purchased office supplies on account, $1,850. c. Paid creditor on account, $1,200.d. Earned sales commissions, receiving cash, $41,500.e. Paid rent on office and equipment for the month, $3,600.f. Withdrew cash for personal use, $4,000.g. Paid automobile expenses (including rental charge) for the month, $3,050, and miscellaneous expenses, $1,600.h. Paid office salaries, $5,000.i. Determined that the cost of supplies on hand was $950; therefore, the cost of supplies used was $900.arrow_forwardOn July 1, 20Y7, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July: A. Opened a business bank account with a deposit of $20,000 from personal funds. B. C. D. E. பட் H. Purchased office supplies on account, $1,800. Paid creditor on account, $1,350. Earned sales commissions, receiving cash, $40,000. G. Paid automobile expenses (including rental charge) for month, $3,050, and miscellaneous expenses, $1,600. Paid office salaries, $3,500. Determined that the cost of supplies on hand was $850; therefore, the cost of supplies used was $950. I. Paid rent on office and equipment for the month, $3,300. Withdrew cash for personal use, $3,600. Need Accounting equation grid income statement statement of owners equity balance sheetarrow_forward

- On November 1, 20Y9, Lexi Martin established an interior decorating business, Heritage Designs. During the month, Lexi completed the following transactions related to the business: Nov. 1 Lexi transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $27,200. 1 Paid rent for period of November 1 to end of month, $4,000. 6 Purchased office equipment on account, $12,820. 8 Purchased a truck for $30,800 paying $6,900 cash and giving a note payable for the remainder. 10 Purchased supplies for cash, $1,650. 12 Received cash for job completed, $8,000. 15 Paid annual premiums on property and casualty insurance, $2,300. 23 Recorded jobs completed on account and sent invoices to customers, $12,000. 24 Received an invoice for truck expenses, to be paid in November, $1,190. Enter the following transactions on Page 2 of the two-column journal: Nov. 29 Paid utilities expense, $3,560. 29…arrow_forwardThe following are the transactions of Spotlighter, Incorporated, for the month of January. a. Borrowed $4,390 from a local bank on a note due in six months. b. Received $5,080 cash from investors and issued common stock to them. c. Purchased $1,900 in equipment, paying $650 cash and promising the rest on a note due in one year. d. Paid $750 cash for supplies. e. Bought and received $1,150 of supplies on account. Required: Post the effects to the appropriate T-accounts and determine ending account balances. Show a beginni Debit Beginning Balance Ending Balance Debit F Cash Equipment Credit Credit Debit Beginning Balance Ending Balance Debit Supplies Accounts Payablearrow_forwardYou are the Accountant for Ching Wei Tai, a sole trader business operating downtown, Kingston. The following transactions occurred during the year. 2021 December Started Business with capital of $16,000 in the bank and $13,600 in cash. Bought goods on credit from the following persons: Grant $3,200; Brown $4,800 and Ricketts $3,000 Sold goods on credit to: Marvin $10,000; Jamie $24,800; Ruth $1,800 4. 5 Paid Rent by cash $2,080. 6. Marvin paid us his account by cheque $2000 Jamie paid us $1,400 by cheque. 10 We paid the following by cheque: Grant S1,600; Brown $2,000. 12 Paid Electricity bill by cash $1000 31 The owner, Ching Wei Tai, took $2,400 from the bank for personal use. 31 Required: Enter the following transactions in the Ledger Accounts (T-Accounts) of Ching Wei Tai Balance off the accounts (where appropriate, do the Balance brought down/Balance Brought Forward as at January 1, 2022) Extract a trial balance as at December 31, 2021 for Ching Wei Tai. I. II. IIarrow_forward

- B. Mr. Abdullah formed Al-Noor Enterprises on February 2021. During the month, the following financial transactions occurred: Review and find the mistake of the following transactions which is recorded in general journal and rewrite them. 2021, February 10 Paid the month's rent OR 700 16 Withdrew OR 10,000 for personal use. 23 Collected OR 9,000 from Bahwan Company. 28 Sold goods for cash - OMR 15,000 Al-Noor Enterprises for January Date Particulars Ref. Debit Credit 2020 Feb. 11 Rent Expense 700 Cash 700 16 Abdullah, Withdrawal 10,000 Expense 10,000 10,000 Cash Accounts Payable 23 10,000 30 Sales 15,000 Cash 15,000arrow_forwardOn November 1, 20Y9, Lexi Martin established an interior decorating business, Heritage Designs. During the month, Lexi completed the following transctions related to the business: Nov. 1 Lexi transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $50,000.1 Paid rent for period of November 1 to end of month, $4,000.6 Purchased office equipment on account, $15,000.8 Purchased a truck for $38,500 paying $5,000 cash and giving a note payable for the remainder. 1Purchased supplies for cash, $1,750.01Received cash for job completed, $11,500. 15 Paid annual premiums on property and casualty insurance, $2,400. 23 Recorded jobs completed on account and sent invoices to customers, $22,300.24 Received an invoice for truck expenses, to be paid in November, $1,250. Enter the following transactions on Page 2 of the two-column journal:Nov. 29 Paid utilities expense, $4,500.29 Paid miscellaneous expenses, $1,000.30 Received cash from…arrow_forwardDomingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. A. The owners invested $10,000 from their personal account to the business account.B. Paid rent $700 with check #101.C. Initiated a petty cash fund $500 with check #102.D. Received $1,100 cash for services rendered.E. Purchased office supplies for $158 with check #103.F. Purchased computer equipment $2,500, paid $1,250 with check #104, and will pay the remainder in 30 days.G. Received $800 cash for services rendered.H. Paid wages $600, check #105.I. Petty cash reimbursement: office supplies $256, maintenance expense $110, postage expense $79, miscellaneous expense $57. Cash on hand $10. Check #106.J. Increased petty cash by $30, check #107. Domingo Company received the following bank statement. Bank Statement Beginning balance $0 Deposits Checks A. $10,000 101 $700 D. 1,100 102 500 103 158 106 490 Bank service…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY