ADDITIONAL FUNDS NEEDED Morrissey Technologies Inc.’s 2019 financial statements are shown here.

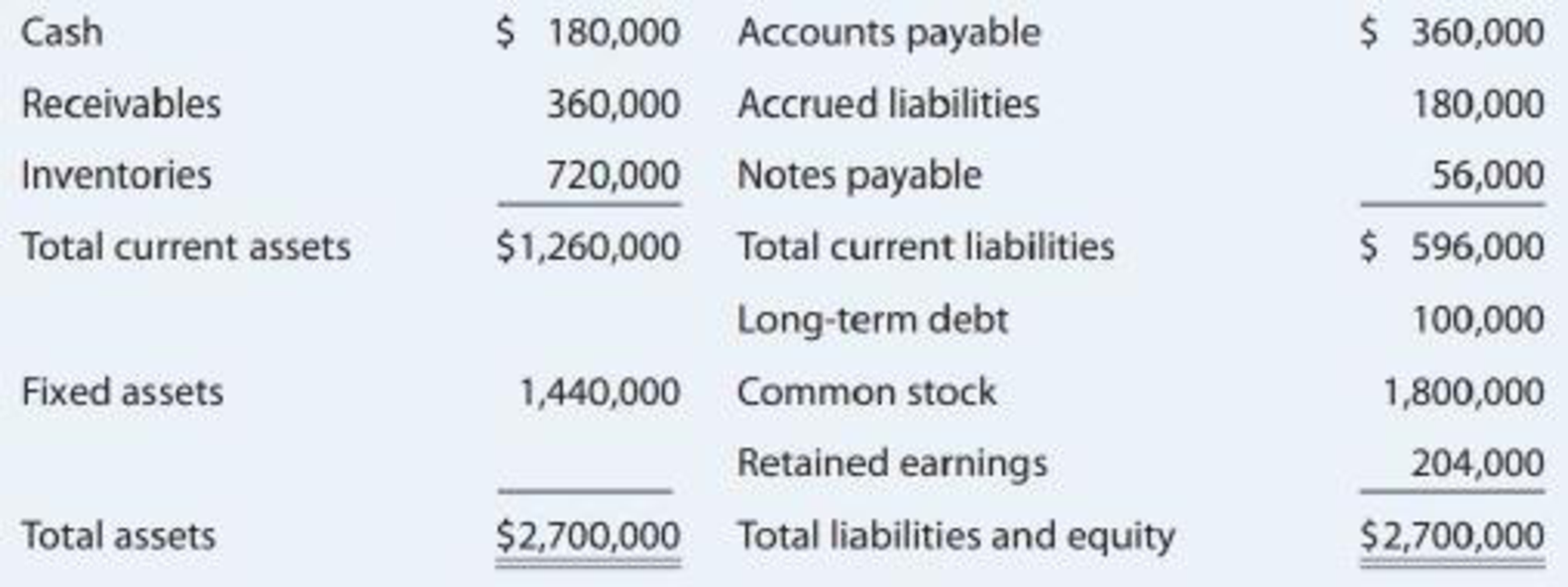

Morrissey Technologies Inc.: Balance Sheet as of December 31, 2019

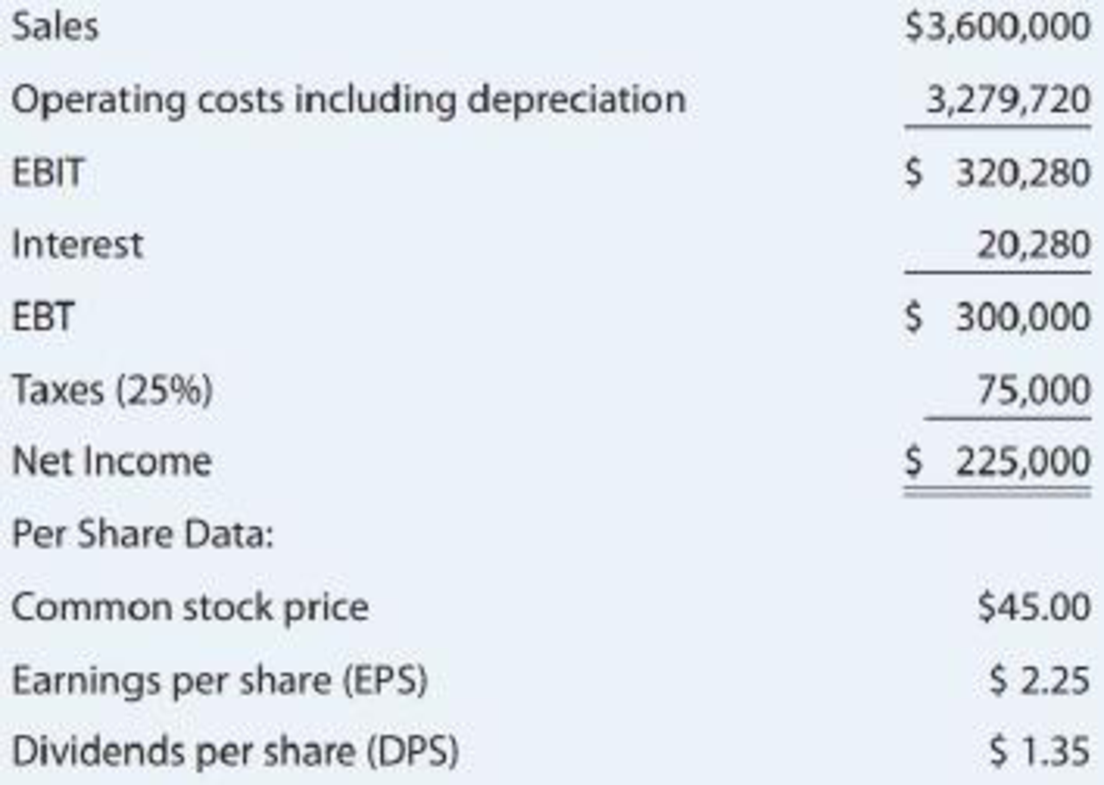

Morrissey Technologies Inc.: Income Statement for December 31, 2019

Suppose that in 2020, sales increase by 10% over 2019 sales. The firm currently has 100,000 shares outstanding. It expects to maintain its 2019 dividend payout ratio and believes that its assets should grow at the same rate as sales. The firm has no excess capacity. However, the firm would like to reduce its operating costs/sales ratio to 87.5% and increase its total liabilities-to-assets ratio to 30%. (It believes its liabilities-to-assets ratio currently is too low relative to the industry average.) The firm will raise 30% of the 2020 forecasted interest-bearing debt as notes payable, and it will issue long-term bonds for the remainder. The firm

- a. Construct the forecasted financial statements assuming that these changes are made. What are the firm’s forecasted notes payable and long-term debt balances? What is the forecasted addition to

retained earnings ? - b. If the profit margin remains at 6.25% and the dividend payout ratio remains at 60%, at what growth rate in sales will the additional financing requirements be exactly zero? In other words, what is the firm’s sustainable growth rate? (Hint: Set AFN equal to zero and solve for g.)

Trending nowThis is a popular solution!

Chapter 16 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

- LONG-TERM FINANCING NEEDED At year-end 2019, total assets for Arrington Inc. were 1.8 million and accounts payable were 450,000. Sales, which in 2019 were 3.0 million, are expected to increase by 25% in 2020. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington typically uses no current liabilities other than accounts payable. Common stock amounted to 500,000 in 2019, and retained earnings were 475,000. Arrington plans to sell new common stock in the amount of 130,000. The firms profit margin on sates is 5%; 35% of earnings will be retained. a. What were Arringtons total liabilities in 2019? b. How much new long-term debt financing will be needed in 2020? (Hint: AFN - New stock = New long-term debt.)arrow_forwardStevens Textile Corporations 2019 financial statements are shown here. Stevens grew rapidly in 2019 and financed the growth with notes payable and long-term bonds. Stevens expects sales to grow by 15% in the next year but will finance the growth with a line of credit, not notes payable or long-term bonds. Use the forecasted financial statement method to forecast a balance sheet and income statement for December 31, 2020. The interest rate on all debt is 10%, and cash earns no interest income. The line of credit is added at the end of the year, which means that you should base the forecasted interest expense on the balance of debt at the beginning of the year. Use the forecasted income statement to determine the addition to retained earnings. Assume that the company was operating at full capacity in 2019, that it cannot sell off any of its fixed assets, and that assets, spontaneous liabilities, and operating costs are expected to increase by the same percentage as sales. a. What is the projected value for earnings before interest and taxes? b. What is the projected value for pre-tax earnings? c. What is the projected net income? d. What is the projected addition to retained earnings? e. What is the projected value of total current assets? f. What is the projected value of total assets? g. What is the projected sum of accounts payable, accruals, and notes payable? h. What is the forecasted line of credit? Balance Sheet as of December 31, 2019 (Thousands of Dollars) Income Statement for December 31, 2019 (Thousands of Dollars)arrow_forwardDIVIDENDS Brooks Sporting Inc. is prepared to report the following 2019 income statement (shown in thousands of dollars). Prior to reporting this income statement, the company wants to determine its annual dividend. The company has 320,000 shares of common stock outstanding, and its stock trades at 37 per share. a. The company had a 25% dividend payout ratio in 2018. If Brooks wants to maintain this payout ratio in 2019, what will be its per-share dividend in 2019? b. If the company maintains this 25% payout ratio, what will be the current dividend yield on the companys stock? c. The company reported net income of 1.35 million in 2018. Assume that the number of shares outstanding has remained constant. What was the companys per-share dividend in 2018? d. As an alternative to maintaining the same dividend payout ratio. Brooks is considering maintaining the same per-share dividend in 2019 that it paid in 2018. If it chooses this policy, what will be the companys dividend payout ratio in 2019? e. Assume that the company is interested in dramatically expanding its operations and that this expansion will require significant amounts of capital. The company would like to avoid transactions costs involved in issuing new equity. Given this scenario, would it make more sense for the company to maintain a constant dividend payout ratio or to maintain the same per-share dividend? Explain.arrow_forward

- The most recent financial statements for xyz inc. follow. Sales for 2019 are projected to grow by 22 percent. Interest expense will remain constant, the tax rate and dividend payout rate will also remain constant. Costs, other expenses, current assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued. How much external financing is needed to support the 16 percent growth rate in sales? Income statement 2019 Net sales 17,300 Cost of Goods Sold 10,600 Depreciation 3,250 Earning before interest and taxes 3,450 Interest paid 680 Taxable income 2,770 Taxes 940 Net income…arrow_forwardMorrissey Technologies Inc.'s 2019 financial statements are shown here. Suppose that in 2020, sales increase by 10% over 2019 sales. The firm currently has 100,000 shares outstanding. It expects to maintain its 2019 dividend payout ratio and believes that its assets should grow at the same rate as sales. The firm has no excess capacity. However, the firm would like to reduce its operating costs/sales ratio to 87.5% and increase its total liabilities-to-assets ratio to 30%. (It believes its liabilities- to-assets ratio currently is too low relative to the industry average.) The firm will raise 30% of the 2020 forecasted interest-bearing debt as notes payable, and it will issue long-term bonds for the remainder. The firm forecasts that its before-tax cost of debt (which includes both short- and long-term debt) is 12.5%. Assume that any common stock issuances or repurchases can be made at the firm's current stock price of $45.a. Construct the forecasted financial…arrow_forwardThe sales revenue of Business Strategy Limited for 2019 is $100 million. The CEO told the sales director in December of 2019 that the board had set a target of $145 million in sales revenue for 2022 and expected that there should be stable annual growth of sales over the 3 years. The board expects the growth rate will be maintained continuously in future years. The market has the same expectation of the board. Business Strategy Limited is expected to pay dividend of $20 per common stock at the end of the year 2020. The market price of the common stock at the beginning of 2020 is $1,000.What is the required rate of return on Business Strategy Limited’s common stock?arrow_forward

- Quantitative Problem 1: Beasley Industries' sales are expected to increase from $4 million in 2019 to $5 million in 2020, or by 25%. Its assets totaled $3 million at the end of 2019. Beasley is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current liabilities are $760,000, consisting of $170,000 of accounts payable, $500,000 of notes payable, and $90,000 of accrued liabilities. Its profit margin is forecasted to be 4%, and its dividend payout ratio is 50%. Using the AFN equation, forecast the additional funds Beasley will need for the coming year. Do not round intermediate calculations. Round your answer to the nearest dollar. $ The AFN equation assumes that ratios remain constant. However, firms are not always operating at full capacity so adjustments need to be made to the existing asset forecast. Excess capacity adjustments are changes made to the existing asset forecast because the firm is not operating at full capacity. For…arrow_forwardKestus Corporation's sales are expected to increase from $5 million in 2019 to $6 million in 2020, or by 20%. Its assets totaled $5 million at the end of 2019. Kestus is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current liabilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 6%, and the forecasted retention ratio is 25%. Use the AFN equation to forecast Kestus additional funds needed for the coming year. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. Now assume the company's assets totaled $3 million at the end of 2019. Is the company's "capital intensity" the same or different comparing to initial situation?arrow_forwardCarston Corporation's sales are expected to increase from $5 million in 2019 to $6 million in 2020, or by 20%. Its assets totaled $4 million at the end of 2019. Carston is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current liabilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 5%, and the forecasted retention ratio is 40%. Use the AFN equation to forecast the additional funds Carston will need for the coming year. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar.arrow_forward

- Supposing that the 2022 sales are projected to increase by 25% over the year 2021 sales and that there is proportional relationship between sales to operating costs, interest expenses, current assets and spontaneous liabilities. The company has been operating at full capacity and planned to maintain the dividend ratio and profit margin position of the previous year.Required i. Using the Percentage of Sales proforma method, compute the additional funds needed (AFN), assuming that the company was operating at full capacity in the year 2021. ii. Using the Formula method, compute the additional funds needed, assuming that the company was operating at full capacity in the year 2021.arrow_forwardGiven the following information, if the firm wants to grow sales by 70% next year, and it is operating at 80% capacity, what is the additional funds using the AFN equation? Liabilities and Equity Assets 2023 Cash & sec. 100 Accounts payable & accruals Accounts rec. 300 Notes payable 2023 250 200 Inventories 500 Total CA 900 Total CL 450 L-T debt 600 Common stock 300 Net fixed Assets 700 Retained Earnings 250 Total assets 1600 Total claims 1600 Income Statement 2023 Sales 3000 Less: COGS (60%) 1800 SGA costs (20%) 600 EBIT 600 Interest (at 10%) 80 EBT 520 Taxes (40%) 208 Net income 312 Dividends (20%) 62 Add'n to RE 250 POR 20%arrow_forwardAssume today is December 31, 2019. Barrington Industries expects that its 2020 after-tax operating income [EBIT(1 – T)] will be $420 million and its 2020 depreciation expense will be $70 million. Barrington's 2020 gross capital expenditures are expected to be $100 million and the change in its net operating working capital for 2020 will be $30 million. The firm's free cash flow is expected to grow at a constant rate of 5% annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of capital is 8.8%; the market value of the company's debt is $2.15 billion; and the company has 190 million shares of common stock outstanding. The firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects. Also, the firm has zero non-operating assets. Using the corporate valuation model, what should be the company's stock price today (December 31, 2019)? Do not round intermediate calculations. Round your…arrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning