Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 9E

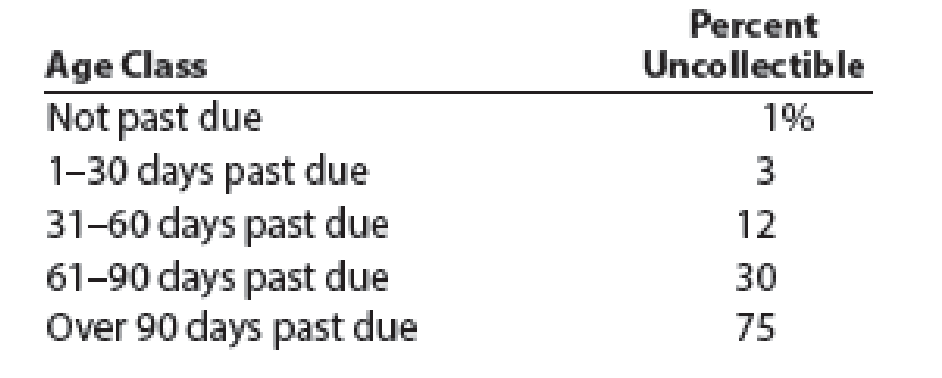

Estimating allowance for doubtful accounts

Evers Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 8-8.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Kirchhoff Industries has a past history of uncollectible accounts, as shown below.

Age Class

PercentUncollectible

Not past due

2%

1-30 days past due

6

31-60 days past due

25

61-90 days past due

35

Over 90 days past due

50

Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below.

Kirchhoff IndustriesAging of Receivables Schedule

Customer

Balance

Not PastDue

1-30 DaysPast Due

31-60 DaysPast Due

61-90 DaysPast Due

Over 90 DaysPast Due

Subtotals

553,700

326,700

121,800

49,800

27,700

27,700

Conover Industries

18,900

18,900

Keystone Company

22,000

22,000

Moxie Creek Inc.

4,800

4,800

Rainbow Company

12,000

12,000

Swanson Company

27,700

27,700

Total receivables

639,100

354,400

133,800

54,600

49,700

46,600

Percentage uncollectible

2%

6%

25%

35%

50%

Allowance for Doubtful Accounts

fill in the blank 1

fill in the blank 2

fill in the blank 3…

An aging of a company's accounts receivable indicates the estimate of uncollectible receivables totals $7,900. If Allowance for Doubtful Accounts has a $700 credit balance, the adjustment to record the bad debt expense for the period will require a

Estimating Allowance for Doubtful Accounts

Kirchhoff Industries has a past history of uncollectible accounts, as follows.

Age Class

PercentUncollectible

Not past due

2%

1-30 days past due

4

31-60 days past due

18

61-90 days past due

40

Over 90 days past due

75

Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below.

Kirchhoff Industries

Estimate the Allowance for Doubtful Accounts

Balance

Not PastDue

Days PastDue 1-30

Days PastDue 31-60

Days PastDue 61-90

Days PastDue Over 90

Subtotals

$1,050,000

$600,000

$220,000

$115,000

$85,000

$30,000

Conover Industries

30,000

30,000

Keystone Company

18,000

18,000

Moxie Creek Inc.

9,000

9,000

Rainbow Company

26,400

26,400

Swanson Company

46,600

46,600

Total receivables

1,180,000

626,400

266,600

124,000

103,000

60,000

Percentage uncollectible

2%

4%

18%

40%

75%…

Chapter 8 Solutions

Financial And Managerial Accounting

Ch. 8 - What are the three classifications of receivables?Ch. 8 - Dans Hardware is a small hardware store in the...Ch. 8 - What kind of an account (asset, liability, etc.)...Ch. 8 - After the accounts are adjusted and closed at the...Ch. 8 - A firm has consistently adjusted its allowance...Ch. 8 - Which of the two methods of estimating...Ch. 8 - Neptune Company issued a note receivable to...Ch. 8 - If a note provides for payment of principal of...Ch. 8 - Prob. 9DQCh. 8 - Prob. 10DQ

Ch. 8 - Direct write-off method Journalize the following...Ch. 8 - Allowance method Journalize the following...Ch. 8 - Percent of sales method At the end of the current...Ch. 8 - Analysis of receivables method At the end of the...Ch. 8 - Note receivable Prefix Supply Company received a...Ch. 8 - Accounts receivable turnover and days sales in...Ch. 8 - Prob. 1ECh. 8 - Prob. 2ECh. 8 - Entries for uncollectible accounts, using direct...Ch. 8 - Entries for uncollectible receivables, using...Ch. 8 - Entries to write off accounts receivable Creative...Ch. 8 - Providing for doubtful accounts At the end of the...Ch. 8 - Number of days past due Toot Auto Supply...Ch. 8 - Aging of receivables schedule The accounts...Ch. 8 - Estimating allowance for doubtful accounts Evers...Ch. 8 - Adjustment for uncollectible accounts Using data...Ch. 8 - Estimating doubtful accounts Outlaw Bike Co. is a...Ch. 8 - Entry for uncollectible accounts Using the data in...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Effect of doubtful accounts on net income During...Ch. 8 - Effect of doubtful accounts on net income Using...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Determine due date and interest on notes Determine...Ch. 8 - Entries for notes receivable Valley Designs issued...Ch. 8 - Entries for notes receivable The series of five...Ch. 8 - Entries for notes receivable, including year-end...Ch. 8 - Entries for receipt and dishonor of note...Ch. 8 - Entries for receipt and dishonor of notes...Ch. 8 - Prob. 25ECh. 8 - Allowance method entries The following...Ch. 8 - Aging of receivables; estimating allowance for...Ch. 8 - Compare two methods of accounting for...Ch. 8 - Details of notes receivable and related entries...Ch. 8 - Notes receivable entries The following data relate...Ch. 8 - Sales and notes receivable transactions The...Ch. 8 - Allowance method entries The following...Ch. 8 - Aging of receivables; estimating allowance for...Ch. 8 - Compare two methods of accounting for...Ch. 8 - Prob. 4PBCh. 8 - Prob. 5PBCh. 8 - Prob. 6PBCh. 8 - Prob. 1MADCh. 8 - Analyze Ralph Lauren Ralph Lauren Corporation (RL)...Ch. 8 - Analyze L Brands L Brands, Inc. (LB) sells womens...Ch. 8 - Compare Ralph Lauren and L Brands Use the data in...Ch. 8 - Prob. 5MADCh. 8 - Prob. 1TIFCh. 8 - Interest computations Bev Wynn, vice president of...Ch. 8 - Prob. 4TIFCh. 8 - Allowance for doubtful accounts For several years,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using data in Exercise 9-9, assume that the allowance for doubtful accounts for Waddell Industries has a credit balance of 6,350 before adjustment on August 31. Journalize the adjusting entry for uncollectible accounts as of August 31. Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardKirchhoff Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8.arrow_forwardWaddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forward

- Background imformation: The Lake Lucerne Company uses the allowance method of estimating bad debts expense. An aging schedule is prepared in order to calculate the balance in the allowance account. The percentage uncollectible is calculated as followed: 1-30 days= 1.5% 31-60 days= 3.5% 61-90 days= 12% 91-365 days= 70% Calculate the number of days each receivable is outstanding and Complete the Schedule of Accounts Receivable. Both are showed in the images attached for context and data. Make sure to show all work and formulas.arrow_forwardEstimating Allowance for Doubtful Accounts Kirchhoff Industries has a past history of uncollectible accounts, as shown below. Age Class Not past due 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due Customer Subtotals Conover Industries Keystone Company Moxie Creek Inc. Rainbow Company Swanson Company Total receivables Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below. Kirchhoff Industries Aging of Receivables Schedule Percentage uncollectible Percent Uncollectible Allowance for Doubtful Accounts 2% 6 20 Balance 30 45 Not Past 1-30 Days 31-60 Days 61-90 Days Over 90 Days Due Past Due Past Due 798,900 471,400 175,800 Past Due Past Due 71,900 17,900 20,700 6,700 9,500 26,300 26,300 880,000 497,700 185,300 2% 6% 9,500 6,700 78,600 20% 39,900 20,700 60,600 30% 39,900 17,900 57,800 45%arrow_forwardNet Zero Products, a wholesaler of sustainable raw materials, prepares the following aging of receivables analysis. (1) Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method. (2) Prepare the adjusting entry to record bad debts expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is a $1,000 credit.arrow_forward

- Estimating Allowance for Doubtful Accounts Evers Industries has a past history of uncollectible accounts, as follows. Age Class Percent Uncollectible Not past due 1 % 1-30 days past due 3 31-60 days past due 12 61-90 days past due 30 Over 90 days past due 75 Estimate the allowance for doubtful accounts, based on the aging of receivables information provided in the chart below. Evers Industries Estimate of Allowance for Doubtful Accounts Balance Not PastDue Days PastDue 1-30 Days PastDue 31-60 Days PastDue 61-90 Days PastDue Over 90 Total receivables 1,124,500 607,400 233,000 121,600 96,500 66,000 Percentage uncollectible 1% 3% 12% 30% 75% Allowance for doubtful accountsarrow_forwardAn aging of a company's accounts receivable indicates that $5,539 are estimated to be uncollectible. If Allowance for Doubtful Accounts has a $900 credit balance, the adjustment to record bad debts for the period will require a credit to the Allowance for Doubtful Accounts of:arrow_forwardAn aging of a company's accounts receivable indicates that the estimate of the uncollectible accounts totals $4,549. If Allowance for Doubtful Accounts has a $1,328 credit balance, the adjustment to record the bad debt expense for the period will require a Select the correct answer. credit to Allowance for Doubtful for $4,549. debit to Allowance for Doubtful Accounts for $3,221. debit to Allowance for Doubtful Accounts for $4,549 debit to Bad Debt Expense for $3,221.arrow_forward

- Estimating Allowance for Doubtful Accounts Kirchhoff Industries has a past history of uncollectible accounts, as shown below. Age Class Percent Uncollectible Not past due 2% 1-30 days past due 5 31-60 days past due 20 61-90 days past due 30 Over 90 days past due 45 Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below. Kirchhoff Industries Aging of Receivables Schedule Customer Balance Not Past Due 1-30 Days Past Due 31-60 Days Past Due 61-90 Days Past Due Over 90 Days Past Due Subtotals 665,900 392,900 146,500 59,900 33,300 33,300 Conover Industries 13,900 13,900 Keystone Company 17,100 17,100 Moxie Creek Inc. 6,400 6,400 Rainbow Company 9,600 9,600 Swanson Company 30,000 30,000 Totals 742,900 422,900 156,100 66,300 50,400 47,200 Percentage uncollectible 2% 5% 20% 30% 45% Allowance for Doubtful Accounts fill in the blank 1 fill in the blank 2…arrow_forwardEstimating Allowance for Doubtful Accounts Kirchhoff Industries has a past history of uncollectible accounts, as shown below. Age Class Percent Uncollectible Not past due 2% 1-30 days past due 5 31-60 days past due 20 61-90 days past due 30 Over 90 days past due 45 Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below. Kirchhoff Industries Aging of Receivables Schedule Customer Balance Not Past Due 1-30 Days Past Due 31-60 Days Past Due 61-90 Days Past Due Over 90 Days Past Due Subtotals 732,800 432,400 161,200 66,000 36,600 36,600 Conover Industries 15,700 15,700 Keystone Company 18,300 18,300 Moxie Creek Inc. 4,500 4,500 Rainbow Company 11,700 11,700 Swanson Company 23,000 23,000 Totals 806,000 455,400 172,900 70,500 54,900 52,300 Percentage uncollectible 2% 5% 20% 30% 45% Allowance for Doubtful Accounts fill in the blank 1 fill in the blank 2…arrow_forwardAn aging of a company's accounts receivable indicates the estimate of uncollectible receivables totals $5,249. If Allowance for Doubtful Accounts has a $1,383 credit balance, the adjustment to record the bad debt expense for the period will require a Oa. debit to Bad Debt Expense for $3,866. Ob. credit to Allowance for Doubtful Accounts for $5,249. Oc. debit to Bad Debt Expense for $1.383. Od. debit to Bad Debt Expense for $5,249. Dasarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License