Construction Accounting And Financial Management (4th Edition)

4th Edition

ISBN: 9780135232873

Author: Steven J. Peterson MBA PE

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 6P

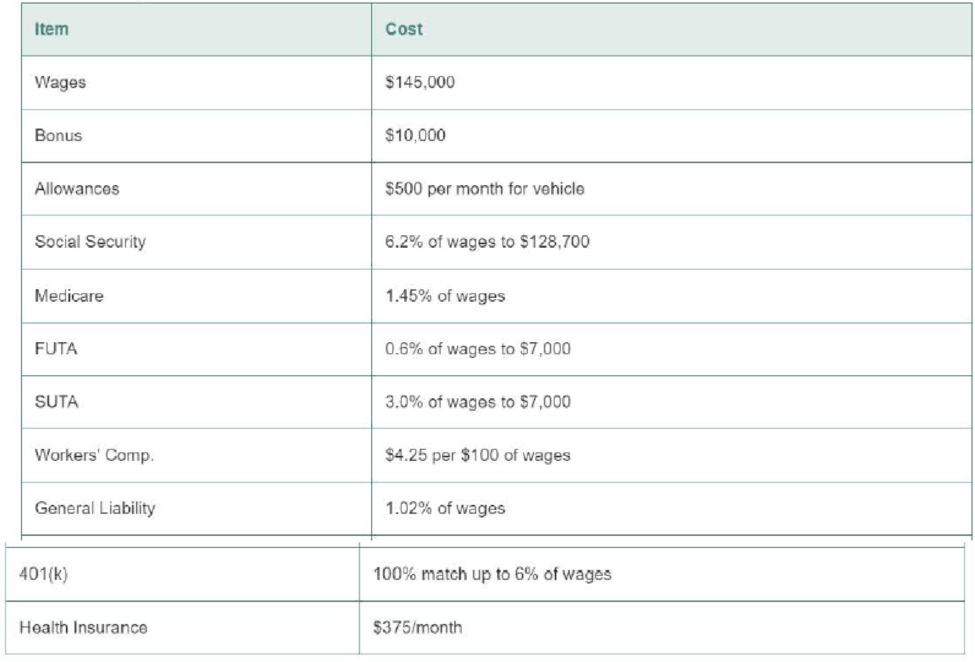

Determine the annual cost, monthly cost, and burden markup for a salaried employee given the information in Table 8-2. Assume the employee takes full advantage of the 401(k) benefit.

Table 8-2 Wage Information for Problem 6

Expert Solution & Answer

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

schedule05:53

Students have asked these similar questions

Claude Lopez is the president of Zebra Antiques. His employee, Dwight Francis, is due a raise. Dwight's current benefit analysis is as

follows:

Yearly Benefit Costs

Medical insurance

Dental insurance

Life insurance

AD&D

Short-term disability

Long-term disability

401(k)

Social Security

Medicare

Tuition reimbursement

Total yearly benefit costs (employer)

Employee's annual salary

The total value of employee's compensation

Required:

Compute the benefit analysis assuming:

Company Cost

(Current)

$ 6,400.00

145.00

228.00

114.00

45.60

22.80

1,140.00

2,287.49

534.98

2,250.00

$ 13,167.87

38,000.00

$ 51,167.87

Employee Cost

(Current)

$ 960.00

145.00

0

0

0

0

2,280.00

2,287.49

534.98

0

3 percent increase in pay.

• Dwight will increase his 401(k) contribution to 8 percent with a company match of 50 percent up to 6 percent of the employee's

annual salary.

• 15 percent increase in medical and dental insurance premiums.

Critical Thinking 6 - 2 (Algo) Kai is the president of Zebra Antiques. An

employee, Reese Francis, is due a raise. Reese's current benefit analysis is as

follows: Yearly Benefit Costs Company Cost (Current) Employee Cost (Current)

Medical insurance $ 6,800.00 $ 1,020.00 Dental insurance 165.00 165.00 Life

insurance 354.00 0 AD&D 177.00 0 Short-term disability 70.80 0 Long - term

disability 35.40 0 401(k) 885.00 1, 770.00 Social Security 3, 584.53 3, 584.53

Medicare 838.32 838.32 Tuition reimbursement 2,450.00 0 Total yearly benefit

costs (employer) $ 15,360.05 Employee's annual salary 59,000.00 The total

value of the employee's compensation $ 74,360.05 Required: Compute the

benefit analysis assuming: 3 percent increase in pay. Reese will increase the

401(k) contribution to 8 percent with a company match of 50 percent up to a 3

percent contribution by the employer. 15 percent increase in medical and

dental insurance premiums. Note: Round your answers to 2 decimal places.\

Use the combined wage bracket tables, Exhibit 9-3 and Exhibit 9-4, to solve.

Employee

MaritalStatus

WithholdingAllowances

Pay Period

GrossEarnings

CombinedWithholding

Reese, S.

M

4

Weekly

$1,211

$

Chapter 8 Solutions

Construction Accounting And Financial Management (4th Edition)

Ch. 8 - What is the difference between an allowance and a...Ch. 8 - Why are the social security and Medicare taxes...Ch. 8 - How does employee turnover affect the labor burden...Ch. 8 - What can a company do to reduce its workers'...Ch. 8 - Determine the annual cost, average hourly cost,...Ch. 8 - Determine the annual cost, monthly cost, and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Would the following companies most likely use a job order costing system or a process costing system? Paint man...

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Freeman Furnishings has summarized its data as shown. Direct labor hours will be used as the activity base to a...

Principles of Accounting Volume 2

FIFO method, spoilage, equivalent units. Refer to the information in Exercise 18-21. Suppose MacLean Manufactur...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Capitalization of Interest, Specific and General Debt, Journal Entries, IFRS. How would the solution to E11-6 c...

Intermediate Accounting (2nd Edition)

The carrying value of Bonds Payable equals a.Bonds Payable plus Discount on Bonds Payable. b.Bonds Payable minu...

Financial Accounting (12th Edition) (What's New in Accounting)

S6-2 Determining inventory costing methods

Ward Hard ware does not expect costs to change dramatically and want...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Knowledge Booster

Similar questions

- 5. The following are included in an employee benefits EXCEPT one. Vacation leave Sick leave Transportation allowance Shopping spreearrow_forwardUse (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Amount to BeWithheld Employee MaritalStatus No. of WithholdingAllowances Gross Wageor Salary PercentageMethod Wage-BracketMethod Corn, A. S 2 $675 weekly $fill in the blank 1 $fill in the blank 2 Fogge, P. S 1 1,960 weekly fill in the blank 3 Felps, S. M 6 1,775 biweekly fill in the blank 5 fill in the blank 6 Carson, W. M 4 2,480 semimonthly fill in the blank 7 fill in the blank 8 Helm, M. M 9 5,380 monthly fill in the blank 9arrow_forward22 What must an employer disclose in a defined contribution plan? The amount to be paid by the employees The basis for determining payments to fund The basis for determining benefits paid out The amount to be paid out NEXT > BOOKMARK Darrow_forward

- Determine the labor burden for an employee given the information in Table below. Assume the employee takes full advantage of the 401k benefit. Employer provides health insurance $100 a month, and employee doesn't pay for health insurance. Cost $85,000 None Item Wages Bonus Allowances Medicare Social Security FUTA None 1.45% of wages SUTA Workers' Comp. General Liability 401(k) Health Insurance 6.2% of wages to $128,700 0.6% of wages to $7,000 |2.0% of wages to $20,000 $0.85 per $100 of wages 0.65% of wages 50% match up to 6% of wages |$200/montharrow_forwardWhat is the journal entry for other post-employment benefits of the total obligation is $533,362.58? What would you do with the remainder and why?arrow_forward(see attached pic for the problem) 1. Compute the employee benefit expense for the current year.arrow_forward

- Question 1 – Which one of these lists contain ALL items that are used when computing net employment income (Division B, Subdivision a)? A) employee contributions to a registered pension plan; signing bonus on accepting employment; use of an employer-owned automobile. B) monthly automobile allowance; dental plan paid for by the employer; promotional cost incurred in selling the employer's products. C) subsidized meals in employer's facilities; life insurance paid by the employer; legal fees incurred to collect unpaid salary. D) tips and gratuities; dental insurance paid by the employer; exercise of options to purchase shares of the publicly traded employer.arrow_forwardIndicate by letter whether each of the events listed below increase (l), decreases (D), or has no effect (N) on an employer’s projected benefit obligation. Events Interest cost. ________ Amortization of prior service cost. ________ A decrease in the average life expectancy of employees. ________ An increase in the average life expectancy of employees. ________ A plan amendment that increases benefits is made retroactive to prior years. ________ An increase in the actuary’s assumed discount rate. ________ Cash contributions to the pension fund by the employer.…arrow_forwardFIGURE 13-3 40. An employee earns a gross wage represented as W. The employee's payroll deductions are shown in Figure 13-4. What is the employee's net wage? Type of Deduction Amount of Deduction Federal Income Tax 0.22W Social Security 0.076W Health and Accident Insurance 0.065W Retirement 0.05W Miscellaneous 0.042W ⒸCengage Leaming 2013arrow_forward

- Compute the net pay for each employee and answer the additional requirements that follow: Deductions Employee Basic Pay SSS Philhealth Withholding Tax Ericka Bilango 40,300.00 581.30 550.00 100.00 P 3,933.84 Alani Ching 37,600.00 581.30 517.00 100.00 3,267.09 Audrey Tan 35,500.00 581.30 488.13 100.00 2,749.31 1. How much is the total Salaries Expense? 2. How much is the total payroll deductions? 3. How much is the total credit to Cash upon payment of salaries? Is this the same as the take-home pay? Pag-IBIGarrow_forwardQuestion 2: Based on the wage-bracket method, the federal income tax withholding for an employee who files as Single, is paid weekly, completed the current Form W-4, has one job, and whose adjusted wage amount is $713 is $arrow_forward6., RST Company offers a qualified retirement plan. Each employee contributes 4 percent of his or her pretax income to the plan, and RST matches each employee's contribution. An employee's benefit at retirement is determined by his or her account balance at the time of retirement. What type of retirement plan does RST offer? a. Defined contribution plan. b. Defined benefit, flat percentage of annual earnings c. Defined benefit, unit-credit formula. d. Defined benefit, flat dollar amount for all employeesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,