College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 1CP

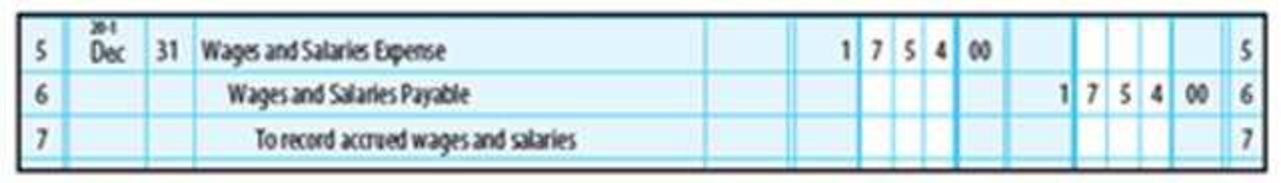

Irina Company pays its employees weekly. The last pay period for 20-1 was on December 28. From December 28 through December 31, the employees earned $1,754, so the following

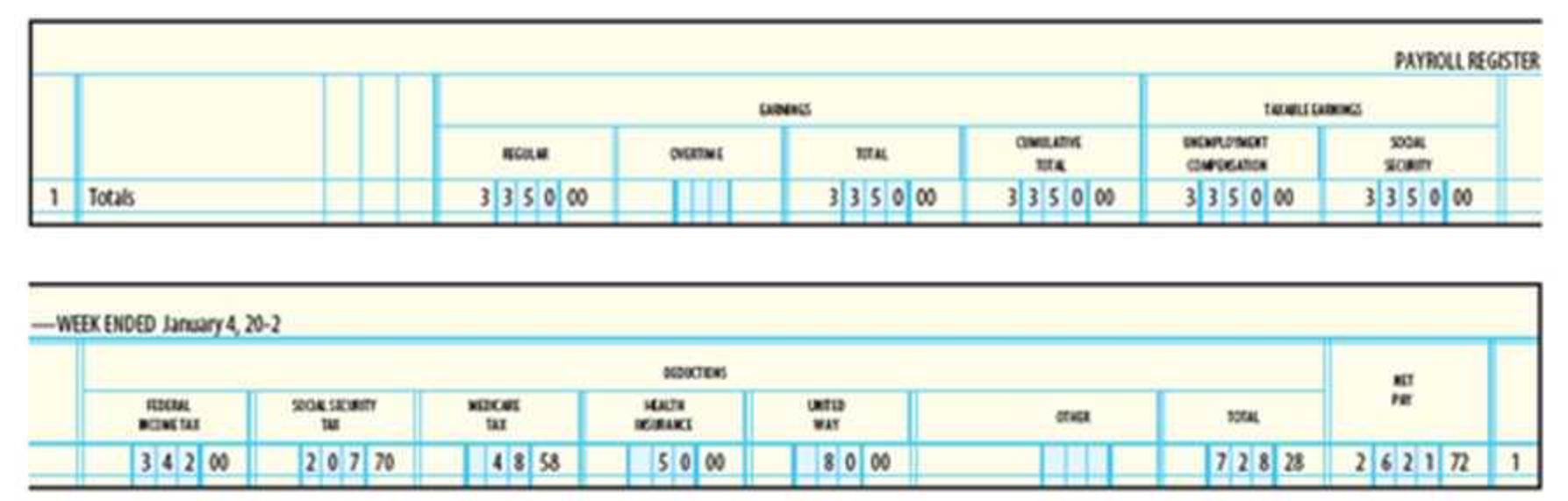

The first pay period in 20-2 was on Januar)-4. The totals line from Irina Company’s payroll register for the week ended Januar)-4, 20-2, was as follows:

REQUIRED

- 1. Prepare the

journal entry for the payment of the payroll on January 4, 20-2. - 2. Prepare T accounts for Wages and Salaries Expense and Wages and Salaries Payable showing the beginning balance, January 4, 20-2, entry, and aiding balance as of January 4, 20-2.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Irina Company pays its employees weekly. The last pay period for 20-1 was on December 28. From December 28 through December 31, the employees earned $1,754, so the following adjusting entry was made:

The first pay period in 20-2 was on January 4. The totals line from IrinaCompany’s payroll register for the week ended January 4, 20-2, was as follows:

Required1. Prepare the journal entry for the payment of the payroll on January 4, 20-2.2. Prepare T accounts for Wages and Salaries Expense and Wages and Salaries Payable showing the beginning balance, January 4, 20-2, entry, and ending balance as of January 4, 20-2.

Specialty Manufacturing estimated that its total payroll for the coming year would be $482,500. The workers' compensation insurance premium rate is 0.2%.

Required:

1. Calculate the estimated workers' compensation insurance premium.$

Prepare the journal entry for the payment as of January 2, 20--.

If an amount box does not require an entry, leave it blank.

Page:

DATE

ACCOUNT TITLE

DOC.NO.

POST.REF.

DEBIT

CREDIT

1

20-- Jan. 2

1

2

2

3

3

2. Assume that Specialty Manufacturing's actual payroll for the year is $487,000. Calculate the total insurance premium owed.$

Prepare a journal entry as of December 31, 20--, to record the adjustment for the underpayment. The actual payment of the additional premium will take place in January of the next year.

If an amount box does not require an entry, leave it blank.

Page:

DATE

ACCOUNT TITLE

DOC.NO.

POST.REF.

DEBIT

CREDIT

1

20-- Dec. 31

1

2…

The following information about the payroll for the week ended December 30 was obtained from the records of Boltz Co.:Required:1. Assuming that the payroll for the last week of the year is to be paid on December 31, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles):a. December 30, to record the payroll.b. December 30, to record the employer’s payroll taxes on the payroll to be paid on December 31. Of the total payroll for the last week of the year, $44,000 is subject to unemployment compensation taxes.2. Assuming that the payroll for the last week of the year is to be paid on January 5 of the following fiscal year, journalize the following entries (refer to the Chart of Accounts for exact wording of account titles):a. On page 11 of the journal: December 30, to record the payroll.b. On page 12 of the journal: January 5, to record the employer's payroll taxes on the payroll to be paid on January 5. Since it is a new fiscal year, all…

Chapter 8 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 8 - Prob. 1TFCh. 8 - Prob. 2TFCh. 8 - Prob. 3TFCh. 8 - Prob. 4TFCh. 8 - A payroll register is a multi-column form used to...Ch. 8 - Prob. 1MCCh. 8 - Prob. 2MCCh. 8 - Prob. 3MCCh. 8 - Prob. 4MCCh. 8 - Social Security Tax Payable and Medicare Tax...

Ch. 8 - Prob. 1CECh. 8 - Prob. 2CECh. 8 - Prob. 1RQCh. 8 - Prob. 2RQCh. 8 - Identify the four factors that determine the...Ch. 8 - Prob. 4RQCh. 8 - Prob. 5RQCh. 8 - Prob. 6RQCh. 8 - Prob. 7RQCh. 8 - Prob. 8RQCh. 8 - Prob. 9RQCh. 8 - Prob. 10RQCh. 8 - Prob. 1SEACh. 8 - COMPUTING OVERTI ME RATE OF PAY AND GROSS WEEKLY...Ch. 8 - Prob. 3SEACh. 8 - CALCUL ATING SOCIAL SECURITY AND MEDICARE TAXES...Ch. 8 - Prob. 5SEACh. 8 - JOURNALIZING PAYROLL TRANSACTIONS On December 31,...Ch. 8 - PAYROLL JOURNAL ENTRY Journalize the following...Ch. 8 - Prob. 8SPACh. 8 - PAYROLL REGISTER AND PAYROLL JOURNAL ENTRY Mary...Ch. 8 - EMPLOYEE EARNINGS RECORD Marys Luxury Travel in...Ch. 8 - COMPUTING WEEKLY GROSS PAY Manuel Sotos regular...Ch. 8 - Prob. 2SEBCh. 8 - Prob. 3SEBCh. 8 - CALCULATING SOCIAL SECURITY AND MEDICARE TAXES...Ch. 8 - Prob. 5SEBCh. 8 - JOURNALIZING PAYROLL TRANSACTIONS On November 30,...Ch. 8 - PAYROLL JOURN AL ENTRY Journalize the following...Ch. 8 - Prob. 8SPBCh. 8 - Prob. 9SPBCh. 8 - Prob. 10SPBCh. 8 - Prob. 1MYWCh. 8 - Prob. 1ECCh. 8 - Prob. 1MPCh. 8 - Irina Company pays its employees weekly. The last...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Reviewing payroll records indicates that one-fifth of employee salaries that are due to be paid on the first payday in January, totaling $15,000, are actually for hours worked in December. There was no previous balance in the Salaries Payable account at that time. Based on the information provided, make the December 31 adjusting journal entry to bring the balances to correct.arrow_forwardReviewing payroll records indicates that employee salaries that are due to be paid on January 3 include $3,575 in wages for the last week of December. There was no previous balance in the Salaries Payable account at that time. Based on the information provided, make the December 31 adjusting journal entry to bring the balances to correct.arrow_forwardThe totals from the payroll register of Olt Company for the week of January 25 show: Journalize the entry to record the payroll of January 25.arrow_forward

- The totals line from Nix Companys payroll register for the week ended March 31, 20--, is as follows: Payroll taxes are imposed as follows: Social Security tax, 6.2%; Medicare tax, 1.45%; FUTA tax, 0.6%; and SUTA tax, 5.4%. REQUIRED 1. a. Prepare the journal entry for payment of this payroll on March 31, 20--. b. Prepare the journal entry for the employers payroll taxes for the period ended March 31, 20--. 2. Nix Company had the following balances in its general ledger before the entries for requirement ( 1 ) were made: a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--. b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--. c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.arrow_forwardYou have been asked to record the November payroll information using a payroll register and a general journal. Review the printout of the worksheet PR, a computerized payroll register, that follows these requirements. The columns will automatically retotal as new entries are made. Entries in column B indicate whether or not employees are union members. Assume Joness cumulative gross pay at October 31 could be 85,000, or 105,000, or 125,000.arrow_forwardIn the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problem, you are to record the payroll transactions for the last quarter of the firms fiscal year. The last quarter begins on April 1, 20--. Refer to the Illustrative Case on pages 6-27 to 6-33 and proceed as follows: a. Analyze and journalize the transactions described in the following narrative. Use the two-column journal paper provided on pages 6-73 to 6-77. Omit the writing of explanations in the journal entries. b. Post the journal entries to the general ledger accounts on pages 6-78 to 6-83. Narrative of Transactions: c. Answer the following questions: 1. The total amount of the liability for FICA taxes and federal income taxes withheld as of June 30 is................................................................................ ________ 2. The total amount of the liability for state income taxes withheld as of June 30 is................................................................................................................ ________ 3. The amount of FUTA taxes that must be paid to the federal government on or before August 1 (assume July 31 is a Sunday) is........................................ ________ 4. The amount of contributions that must be paid into the state unemployment compensation fund on or before August 1 is.................................................. ________ 5. The total amount due the treasurer of the union is........................................ ________ 6. The total amount of wages and salaries expense since the beginning of the fiscal year is ................................................................................................... ________ 7. The total amount of payroll taxes expense since the beginning of the fiscal year is ............................................................................................................ ________ 8. Using the partial journal below, journalize the entry to record the vacation accrual at the end of the companys fiscal year. The amount of Brookins Companys vacation accrual for the fiscal year is 15,000.arrow_forward

- A weekly payroll summary made from labor time records shows the following data for Pima Company: Overtime is payable at one-and-a-half times the regular rate of pay and is distributed to all jobs worked on during the period. a. Determine the net pay of each employee. The income taxes withheld for each employee amount to 15% of the gross wages. b. Prepare journal entries for the following: 1. Recording the payroll. 2. Paying the payroll. 3. Distributing the payroll. (Assume that the overtime premium will be charged to all jobs worked on during the period.) 4. The employers payroll taxes. (Assume that none of the employees has achieved the maximum wage bases for FICA and unemployment taxes.)arrow_forwardVaughn Company has the following data for the weekly payroll ending January 31. Employee M T L. Helton R. Kenseth D. Tavaras 9 (a) 7 7 9 10 10 Hours W T 9 7 F 10 S 2 7 7 8 5 8 8 8 0 Hourly Rate $12 14 15 Federal Income Tax Withholding $32 39 54 Health Insurance $10 27 Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) 26 Cumulative Earnings (Jan. 1- 24) $1,440 1,722 Employees are paid 1½ times the regular hourly rate for all hours worked in excess of 40 hours per week. The 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages. 1,800arrow_forwardThis problem challenges you to apply your cumulative accounting knowledge to move a step beyond the material in the chapter. Irina Company pays its employees weekly.The last pay period for 20-1 was on December 28.From December 28 through December 31, the employees earned $1,754, so the following adjusting entry was made: The first pay period in 20-2 was on January 4.The totals line from Irina Company's payroll register for the week ended January 4, 20-2,was as follows: REQUIRED a.Prepare thejournal entry for the payment of the payroll on January 4, 20-2. b.Prepare T accounts for Wages and Salaries Ex. pense and Wages and Salaries Payable showing the beginning balance, January 4, 20-2.entry, and ending balance as of January 4, 20-2.arrow_forward

- In the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problem, you are to record the payroll transactions for the last quarter of the firm's fiscal year. The last quarter begins on April 1, 20--. Narrative of Transactions: Apr. 1. Paid the treasurer of the union the amount of union dues withheld from workers' earnings during March. 15. Payroll: $6,105. All wages and salaries taxable. Withheld $565 for federal income taxes, $107.32 for state income taxes, and $50 for union dues. 15. Paid the treasurer of the state the amount of state income taxes withheld from workers' earnings during the first quarter. 15. Electronically transferred funds to remove the liability for FICA taxes and employees' federal income taxes withheld on the March payrolls. 29. Payroll: $5,850. All wages and salaries taxable. Withheld $509 for federal income taxes,…arrow_forwardIn the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problem, you are to record the payroll transactions for the last quarter of the firm's fiscal year. The last quarter begins on April 1, 20--. Narrative of Transactions: Apr. 1. Paid the treasurer of the union the amount of union dues withheld from workers' earnings during March. 15. Payroll: $6,105. All wages and salaries taxable. Withheld $565 for federal income taxes, $107.32 for state income taxes, and $50 for union dues. 15. Paid the treasurer of the state the amount of state income taxes withheld from workers' earnings during the first quarter. 15. Electronically transferred funds to remove the liability for FICA taxes and employees' federal income taxes withheld on the March payrolls. 29. Payroll: $5,850. All wages and salaries taxable. Withheld $509 for federal income taxes,…arrow_forwardSarasota Corp.s gross payroll for April is $50,300. The company deducted $2,217 for CPP, $1,073 for El, and $9,061 for income taxes from the employees' cheques. Employees are paid monthly at the end of each month. Prepare a journal entry for Sarasota on April 30 to record the payment of the April payroll to employees. (Credit account titles are automatlcally Indented when the amount Is entered. Do not Indent manually. If no entry Is requlred, select "No Entry" for the account titles and enter O for the amounts.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License