Horngren's Accounting (11th Edition)

11th Edition

ISBN: 9780133856781

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem E6.24E

Correcting an inventory error-two years

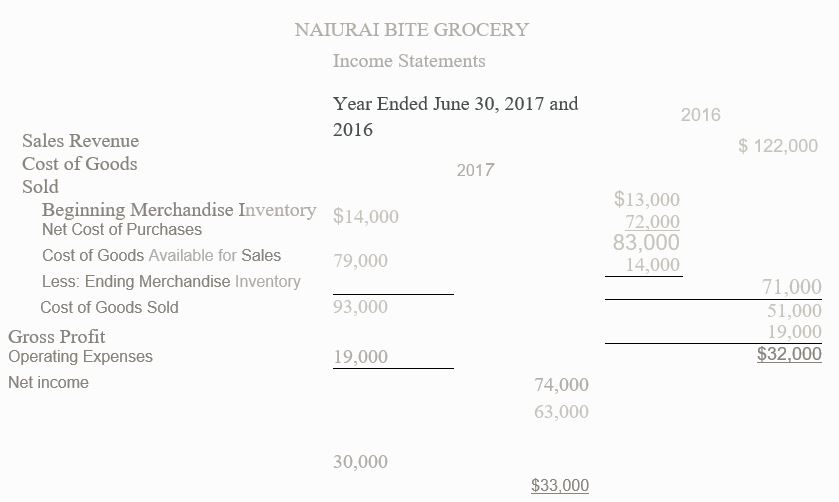

Natural Bile Grocery reported the following comparative income statements for the years ended June 30, 2017 and 2016:

During 2017, Natural Bite discovered that ending 2016 merchandise inventory was overstated by 55,000.

Requirements

- Prepare corrected income statements for the two years.

- State whether each year’s net income-before your corrections-is understated or overstated, and indicate the amount of the understatement or overstatement.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

2. Tretorn Company began operations in 2018. During the first two years of operations, Tretorn made undiscovered errors in taking its year-end inventories that understated 2018 ending inventory by P40,000 and overstated 2019 ending inventory by P50,000. The combined effect of these errors on reported income for the year 2018, 2019 and 2020 respectively is

choices:

P40,000 understated; P90,000 overstated and P50,000 understated

P40,000 understated; P50,000 overstated and not affected

P40,000 understated; P10,000 overstated and not affected

P40,000 overstated; P50,000 understated and P10,000 overstated

3. Hardy Company is a wholesale electronics distributor. On December 31, 2020, it prepared the following partial income statement: Inventory, January 1 P 200,000; Net Purchases 300,000; Net Sales 600,000.Given this information, if Hardy Company's gross margin is 30 percent of net sales, what is the correct ending inventory balance?

choices:…

For all exercises, assume the perpetual inventory system is used unless stated otherwise.

Correcting an inventory error—two years

Nature Foods Grocery.1 reported the following comparative income statements for the year ended June 30, 2019 and 2018:

During 2019, Nature Foods Grocery discovered that ending 2018 merchandise inventory was overstated by $5,500.

Requirements

Prepare corrected income statements for the two years.

State whether each year’s net income—before your corrections—is understated or overstated, and indicate the amount of the understatement or overstatement.

2. Tretorn Company began operations in 2018. During the first two years of operations, Tretorn made undiscovered errors in taking its year-end inventories that overstated 2018 ending inventory by P50,000 and understated 2019 ending inventory by P40,000. The combined effect of these errors on reported income for the year 2018, 2019 and 2020 respectively is

choices:

P50,000 understated; P90,000 overstated and P40,000 understated

P50,000 overstated; P90,000 understated and P40,000 overstated

P50,000 overstated; P40,000 understated and not affected

P50,000 overstated; P90,000 understated and not affected

3. Golden Company maintains a markup of 60 percent based on cost. The company's selling and administrative expenses average 30 percent of sales. Annual sales were P1,440,000. Golden's operating profit for the year is

choices:

P144,000

P432,000

P108,000

Chapter 6 Solutions

Horngren's Accounting (11th Edition)

Ch. 6 - Which principle or concept states that business...Ch. 6 - Which inventory costing method assigns to ending...Ch. 6 - Assume Nile.com began April with 14 units of...Ch. 6 - Suppose Nile.com used the weighted-average...Ch. 6 - Which inventory costing method results in the...Ch. 6 - Which of the following is most closely linked to...Ch. 6 - At December 31, 2018, Stevenson Company overstated...Ch. 6 - Suppose Maestro’s had cost of goods sold during...Ch. 6 - Suppose used the LIFO inventory costing method and...Ch. 6 - Prob. 1RQ

Ch. 6 - Prob. 2RQCh. 6 - Prob. 3RQCh. 6 - Prob. 4RQCh. 6 - Discuss some measures that should be taken to...Ch. 6 - Under a perpetual inventory system, what are the...Ch. 6 - When using a perpetual inventory system and the...Ch. 6 - During periods of rising costs, which inventory...Ch. 6 - What does the lower-of-cost-or market (LCM) rule...Ch. 6 - What account is debited when recording the...Ch. 6 - What is the effect on cost of goods sold, gross...Ch. 6 - When does an inventory error cancel out, and why?Ch. 6 - How is inventory turnover calculated, and what it...Ch. 6 - How is days’ sales inventory calculated, and what...Ch. 6 - When using the periodic inventory system, which...Ch. 6 - When using periodic inventory system and...Ch. 6 - Determining inventory accounting principles...Ch. 6 - Determining inventory costing methods Learning...Ch. 6 - Prob. S6.3SECh. 6 - Prob. S6.4SECh. 6 - Prob. S6.5SECh. 6 - Prob. S6.6SECh. 6 - Prob. S6.7SECh. 6 - Prob. S6.8SECh. 6 - Prob. S6.9SECh. 6 - Prob. S6.10SECh. 6 - Prob. S6A.11SECh. 6 - Prob. S6A.12SECh. 6 - Prob. S6A.13SECh. 6 - Using accounting vocabulary Learning Objective 1,...Ch. 6 - Prob. E6.15ECh. 6 - Prob. E6.16ECh. 6 - Prob. E6.17ECh. 6 - Prob. E6.18ECh. 6 - Prob. E6.19ECh. 6 - Prob. E6.20ECh. 6 - Prob. E6.21ECh. 6 - Prob. E6.22ECh. 6 - Prob. E6.23ECh. 6 - Correcting an inventory error-two years Natural...Ch. 6 - Prob. E6.25ECh. 6 - Prob. E6A.26ECh. 6 - Prob. E6A.27ECh. 6 - Prob. P6.28APGACh. 6 - Prob. P6.29APGACh. 6 - Prob. P6.30APGACh. 6 - Objectives 5, 6 overstated $7,000 P6-31A...Ch. 6 -

Jepson Electronic Center began cost $70...Ch. 6 - Prob. P6.33BPGBCh. 6 - Prob. P6.34BPGBCh. 6 - Accounting principles for inventory and applying...Ch. 6 - Prob. P6.36BPGBCh. 6 - Prob. P6A.37BPGBCh. 6 - Prob. P6.38CPCh. 6 - Prob. P6.39PSCh. 6 - Prob. 6.1DCCh. 6 - > Fraud Case 6-1 Ever since he was a kid, Carl...Ch. 6 - Prob. 6.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Effects of an Inventory Error The income statements for Graul Corporation for the 3 years ending in 2019 appear below. During 2019, Graul discovered that the 2017 ending inventory had been misstated due to the following two transactions being recorded incorrectly. a. A purchase return of inventory costing $42,000 was recorded twice. b. A credit purchase of inventory' made on December 20 for $28,500 was not recorded. The goods were shipped F.O.B. shipping point and were shipped on December 22, 2017. Required: 1. Was ending inventory for 2017 overstated or understated? By how much? 2. Prepare correct income statements for all 3 years. 3. CONCEPTUAL CONNECTION Did the error in 2017 affect cumulative net income for the 3-year period? Explain your response. 4. CONCEPTUAL CONNECTION Why was the 2019 net income unaffected?arrow_forwardDollar-Value LIFO Kwestel Company adopted the dollar-value LIFO method for inventory valuation at the beginning of 2015. The following information about the inventory at the end of each year is available from Kwestels records: Required: Calculate the dollar-value LIFO inventory at the end of each year. Round to the nearest dollar.arrow_forwardOlson Company adopted the dollar-value LIFO method for inventory valuation at the beginning of 2015. The following information about the inventory at the end of each year is available from Olsons records: Required: 1. Calculate the dollar-value LIFO inventory at the end of each year. 2. Prepare the appropriate disclosures for the 2021 annual report if Olson uses current cost internally and LIFO for financial reporting.arrow_forward

- Inventory Analysis The following account balances are taken from the records of Lewis Inc., a wholesaler of fresh fruits and vegetables: Required Compute Lewiss inventory turnover ratio for 2016 and 2015. Compute the number of days sales in inventory for 2016 and 2015. Assume 360 days in a year. Comment on your answers in parts (1) and (2) relative to the companys management of inventory over the two years. What problems do you see in its inventory management?arrow_forwardDuring 2016, WMC Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: 2014 understated by $120,000 2015 overstated by 150,000 WMC uses the periodic inventory system and the FIFO cost method. Required: 1. Determine the effect of these errors on retained earnings at January 1, 2016, before any adjustments. Explain your answer. (Ignore income taxes.) 2. Prepare a journal entry to correct the error. 3. What other step(s) would be taken in connection with the error?arrow_forwardCambi Company began operations on January 1, 2016. In the second quarter of 2017, it adopted the FIFO method of inventory valuation. In the past, it used the LIFO method. The company’s interim income statements as originally reported under the LIFO method follow:If the FIFO method had been used since the company began operations, cost of goods sold in each of the previous quarters would have been as follows:Sales for the second quarter of 2017 are $20,000, cost of goods sold under the FIFO method is $9,000, and operating expenses are $3,400. The effective tax rate remains 40 percent. Cambi Company has 1,000 shares of common stock outstanding.Prepare a schedule showing the calculation of net income and earnings per share that Cambi reports for the three-month period and the six-month period ended June 30, 2017.arrow_forward

- During 2016, WMC Corporation discovered that its ending inventories reported in its financial statements were misstated by the following material amounts: 2014 understated by $120,000 2015 overstated by 150,000 WMC uses a periodic inventory system and the FIFO cost method. Required: 1. Determine the effect of these errors on retained earnings at January 1, 2016, before any adjustments. Explain your answer. (Ignore income taxes.) 2. Prepare a journal entry to correct the errors. 3. What other step(s) would be taken in connection with the correction of the errors?arrow_forwardFor each of the following independent scenarios, indicate the effect of the error (if any) on: i. 2019 net income; ii. 2020 net income; and iii. 2020 closing retained earnings. company uses the periodic system of inventory and its fiscal year-end is December 31. Ignore income tax effects. Consider each of the following independent The scenarios: a. Your analysis of inventory indicates that inventory at the end of 2019 was overstated by $27,000 due to an inventory count error. Inventory at the end of 20 13 was correctly stated. b. Invoices in the amount of $107,000 for inventory received in December 2019 were not entered on the books in 2019. They were recorded as purchases in January 2020 when they were paid. The goods were counted in the 2019 inventory count and included in ending inventory on the 2019 financial statements. c. Goods received on consignment amounting to $89,000 were included in the physical count of goods at the end of 2020 and included in ending inventory on the 2020…arrow_forwardSunflower Co. reported net income of P150,000, P180,000, and P220,000 for the years 2017, 2018, and 2019. However, the following errors were detected and were not yet corrected:· 2017 ending inventory is overstated by P6000.· 2018 beginning inventory is overstated by P6000.· A prepayment for rent for three years amounting to P9000 was expensed in full in 2018.How much is the correct 2019 net income?arrow_forward

- The income statement of TINKER CORP. shows a net income of P175,000 for the year ended December 31, 2014. Adjustments were made for the following errors: 1 December 31, 2013, inventory overstated by P22,500. 2 December 31, 2014, inventory understated by P37,500. 3 A P10,000 customer's deposit received in December 2014, was credited to sales in 2014. The goods were actually shipped in January 2015. What is the unadjusted net income of Uruguay Co. for the year ended December 31, 2014? А. P234,000 C. P170,000 P125,000 D. P200,000 B.arrow_forwardHeadlands Industries reports net income of $86,320 in 2017. However, ending inventory was understated by $6,990. What is the correct net income for 2017? The correct net income List of Accounts What effect, if any, will this error have on total assets as reported in the balance sheet at December 31, 2017? in the balance sheet will be v by the amount that ending inventory is $ List of Accounts %24arrow_forwardThe following inventory valuation errors have been discovered for Knox Corporation: The 2015 year-end inventory was overstated by $23,000 The 2016 year-end inventory was understated by $61,000 The 2017 year-end inventory was understated by $17,000 The reported income before taxes for Knox was: Year: Income before Taxes: 2015 $138,000 2016 $254,000 2017 $168,000 Required: 1. Compute what income before taxes for 2015, 2016, and 2017 should have been after correcting for the errors.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License