Corporate Financial Accounting

15th Edition

ISBN: 9781337398169

Author: Carl Warren, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.7MAD

Analyze J. C. Penney

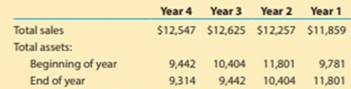

J. C. Penney Company, Inc. (JCP) is a large general merchandise retailer in the United States. The following data (in millions) were obtained from its financial statements for four recent years:

a. Compute the asset turnover ratio for each year. Round to two decimal places.

b. Plot the asset turnover ratio on a line chart with the year on the horizontal axis.

c.  Interpret the trend in this ratio over the four years.

Interpret the trend in this ratio over the four years.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Loomis, Inc. reported the following on the company’s income statement in two recent years:

Please see the image for details:

a. Determine the times interest earned ratio for the current year and the prior year. Round to one decimal place.b. Is this ratio improving or declining?

Kroger Co., a national supermarket chain, reported the following data (in millions) in its

financial statements for a recent year:

Total revenue

$108,465

Total assets at end of year

30,556

Total assets at beginning of year

29,281

a. Compute the asset turnover. Round to two decimal places.

b.

Tiffany & Co. is a large North American retailer of jewelry with an asset

turnover of 0.86. Why would Tiffany's asset turnover be lower than that of Kroger?

Select financial information for Beta Corp. for the fiscal years ending December 20X4 and 20X5 is as follows:

please find the attached image 1 and 2

5. Beta Corp. has calculated the following asset management ratios:

Asset management 20X5 20X4A/R turnover 3.3 5.1Inventory turnover 1.4 1.2

Based on the above ratios, which of the following statements is true?

a) Beta was more efficient in collecting its credit sales from customers in 20X5 than in the prior year. It was also more efficient in turning inventory into sales than in the prior year.b) Beta was less efficient in collecting its credit sales from customers in 20X5 than in the prior year. It was also less efficient in turning inventory into sales than in the prior year.c) Beta was less efficient in collecting its credit sales from customers in 20X5 than in the prior year. However, it was more efficient in turning inventory into sales than in the prior year.d) Beta was more efficient in…

Chapter 5 Solutions

Corporate Financial Accounting

Ch. 5 - Prob. 1DQCh. 5 - Prob. 2DQCh. 5 - The credit period during which the buyer of...Ch. 5 - What is the meaning of (A) 1/15, n/60; (B) n/30;...Ch. 5 - Prob. 5DQCh. 5 - Prob. 6DQCh. 5 - Who is responsible for freight when the terms of...Ch. 5 - Name three accounts that would normally appear in...Ch. 5 - Audio Outfitter Inc., which uses a perpetual...Ch. 5 - Assume that Audio Outfitter Inc. in Discussion...

Ch. 5 - Gross profit During the current year, merchandise...Ch. 5 - Purchases transactions Elkhorn Company purchased...Ch. 5 - Prob. 5.3BECh. 5 - Prob. 5.4BECh. 5 - Transactions for buyer and seller Shore Co. sold...Ch. 5 - Adjusting entries Halm Flooring Company uses a...Ch. 5 - Asset turnover ratio Financial statement data for...Ch. 5 - Determining gross profit During the current year,...Ch. 5 - Determining cost of goods sold For a recent year,...Ch. 5 - Chart of accounts Monet Paints Co. is a newly...Ch. 5 - Purchase-related transactions The Stationery...Ch. 5 - Purchase-related transactions A retailer is...Ch. 5 - Purchase-related transactions The debits and...Ch. 5 - Purchase-related transactions Stylon Co., a...Ch. 5 - Prob. 5.8EXCh. 5 - Sales-related transactions, including the use of...Ch. 5 - Customer refund Senger Company sold merchandise of...Ch. 5 - Customer return and refund On December 28, 20Y3,...Ch. 5 - Sales-related transactions After the amount due on...Ch. 5 - Sales-related transactions The debits and credits...Ch. 5 - Prob. 5.14EXCh. 5 - Determining amounts to be paid on invoices...Ch. 5 - Prob. 5.16EXCh. 5 - Purchase-related transactions Based on the data...Ch. 5 - Prob. 5.18EXCh. 5 - Prob. 5.19EXCh. 5 - Normal balances of merchandise accounts What is...Ch. 5 - Income statement and accounts for merchandiser For...Ch. 5 - Adjusting entry for inventory shrinkage Omega Tire...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Adjusting entry for customer refunds, allowances,...Ch. 5 - Income statement for merchandiser The following...Ch. 5 - Determining amounts for items omitted from income...Ch. 5 - Multiple-step income statement On March 31, 20Y9,...Ch. 5 - Multiple-step income statement The following...Ch. 5 - Single-step income statement Summary operating...Ch. 5 - Closing the accounts of a merchandiser From the...Ch. 5 - Closing entries; net income Based on the data...Ch. 5 - Closing entries On July 31, the close of the...Ch. 5 - Prob. 5.33EXCh. 5 - Prob. 5.34EXCh. 5 - Prob. 5.35EXCh. 5 - Discount taken in next fiscal year Using the data...Ch. 5 - Prob. 5.37EXCh. 5 - Rules of debit and credit for periodic inventory...Ch. 5 - Journal entries using the periodic inventory...Ch. 5 - Identify items missing in determining cost of...Ch. 5 - Appendix Cost of goods sold and related items The...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Cost of goods sold Based on the following data,...Ch. 5 - Appendix 2 Cost of goods sold Identify the errors...Ch. 5 - Closing entries using periodic inventory system...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales-related and purchase-related transactions...Ch. 5 - Sales-related and purchase-related transactions...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income statement and balance sheet...Ch. 5 - Purchase-related transactions using periodic...Ch. 5 - Appendix Sales-related and purchase-related...Ch. 5 - Prob. 5.9APRCh. 5 - Periodic inventory accounts, multiple-step income...Ch. 5 - Purchase-related transactions using perpetual...Ch. 5 - Sales-related transactions using perpetual...Ch. 5 - Sales-related and purchase-related transactions...Ch. 5 - Sales-related and purchase-related transactions...Ch. 5 - Multiple-step income statement and balance sheet...Ch. 5 - Single-step income statement and balance sheet...Ch. 5 - Prob. 5.7BPRCh. 5 - Prob. 5.8BPRCh. 5 - Prob. 5.9BPRCh. 5 - Periodic inventory accounts, multiple-step income...Ch. 5 - Comprehensive Problem 2 8. Net income: 741,455...Ch. 5 - Analyze and compare Amazon.com and Netflix...Ch. 5 - Analyze Dollar General Dollar General Corporation...Ch. 5 - Compare Dollar Tree and Dollar General The asset...Ch. 5 - Prob. 5.4MADCh. 5 - Analyze Home Depot The Home Depot (HD) reported...Ch. 5 - Prob. 5.6MADCh. 5 - Analyze J. C. Penney J. C. Penney Company, Inc....Ch. 5 - Prob. 5.1TIFCh. 5 - Prob. 5.2TIFCh. 5 - Prob. 5.5TIFCh. 5 - Prob. 5.6TIFCh. 5 - Prob. 5.7TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: 1. Calculate the return on sales. (Note: Round the percent to two decimal places.) 2. CONCEPTUAL CONNECTION Briefly explain the meaning of the return on sales ratio, and comment on whether Juroes return on sales ratio appears appropriate.arrow_forwardGrammatico Company has just completed its third year of operations. The income statement is as follows: Selected information from the balance sheet is as follows: Required: Note: Round answers to two decimal places. 1. Compute the times-interest-earned ratio. 2. Compute the debt ratio. 3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammaticos industry are as follows: How does Grammatico compare with the industrial norms? Does it have too much debt?arrow_forward

- The general merchandise retail industry has a number of segments represented by the following companies: For a recent year, the following cost of goods sold and beginning and ending inventories arc provided from corporate annual reports (in millions) for these three companies: a. Determine the inventory turnover ratio for all three companies. Round all calculations to one decimal place.b. Determine the number of days' sales in inventory for all three companies. Use 365 days and round all calculations to one decimal place. c.Interpret these results based on each company's merchandising concept.arrow_forwardAdams Company reported the following operating results for two consecutive years: Required Compute each income statement component for each of the two years as a percent of sales. Note: Percentages may not add exactly due to rounding. Round your answers to 1 decimal place. (i.e., .234 should be entered as 23.4). Sales Cost of goods sold Gross margin on sales Operating expenses Income before taxes Income taxes Net income ADAMS COMPANY Vertical Analysis of Income Statements Year 4 Percentage of Sales for Year 4 100.0 % $ $ X Answer is not complete. 999,500 549,725 449,775 129,400 320,375 81,000 239,375 % $ $ Year 3 1,081,500 598,400 483,100 152,000 331,100 80,400 250,700 Percentage of Sales for Year 3 100.0 % %arrow_forwardThe following financial data (in thousands) were taken from recent financial statements of Staples, Inc.: Please see the attachment for details: 1. Determine the times interest earned ratio for Staples in Year 3, Year 2, and Year 1? Round your answers to one decimal place.2. Evaluate this ratio for Staples.arrow_forward

- Fanning Company reported the following operating results for two consecutive years: Required Compute each income statement component for each of the two years as a percent of sales. Note: Percentages may not add exactly due to rounding. Round your answers to 1 decimal place. (i.e., .234 should be entered as 23.4). Sales Cost of goods sold Gross margin on sales Operating expenses Income before taxes Income taxes Net income FANNING COMPANY Vertical Analysis of Income Statements Percentage of Sales Year 4 Year 3 for Year 4 Percentage of Sales for Year 3 $ 1,003,000 % $ 1,080,500 % 551,650 601,200 451,350 479,300 129,500 151,800 321,850 327,500 79,600 82,600 $ 242,250 % 244,900 %arrow_forwardCompute the following the financial data for this year . 1.accountes receivable turnover 2. Average collection period 3. Inventory turnover 4. Average sale period 5. Operating cycle 6. Total asset turnoverarrow_forward10. Review the select information for Bean Superstore and Legumes Plus (industry competitors), and then complete the following. A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019. B Compute the number of days sales in receivables ratios for each company for 2018 and 2019 C. Determine which company is the better investment and why. Round answers to two decimal places.arrow_forward

- Ralph Lauren Corporation sells apparel through company-owned retail stores. Recent financial information for Ralph Lauren follows (in thousands): Please see the attachment for details: Assume that the apparel industry average return on total assets is 8.0% and the average return on stockholders’ equity is 10.0% for the year ended April 2, Year 3.a. Determine the return on total assets for Ralph Lauren for fiscal Years 2 and 3. Round percentages to one decimal place.b. Determine the return on stockholders’ equity for Ralph Lauren for fiscal Years 2 and 3. Round percentages to one decimal place.c. Evaluate the two-year trend for the profitability ratios determined in (a) and (b).d. Evaluate Ralph Lauren’s profit performance relative to the industry.arrow_forwardThe financial statements for Royale and Cavalier companies are summarized here: Cavalier Royale Company Company Balance Sheet $ 31,000 61,000 122,000 562,000 146,000 $ 51,000 22,000 37,000 172,000 52,000 Cash Accounts Receivable, Net Inventory Equipment, Net Other Assets $ 922,000 $ 334,000 $ 27,000 67,000 216,000 10,000 14,000 $ 334,000 Total Assets $ 132,000 202,000 486,000 56,000 Current Liabilities Notes Payable (long-term) Common Stock (par $20) Additional Paid-In Capital Retained Earnings 46,000 Total Liabilities and Stockholders' Equity $ 922,000 Income Statement $ 818,000 $ 298,000 156,000 101,000 Sales Revenue Cost of Goods Sold 486,000 246,000 Other Expenses $ 86,000 $ 41,000 Net Income Other Data $ 18.00 $ 15.00 Per share price at end of year Selected Data from Previous Year Accounts Receivable, Net Notes Payable (long-term) Equipment, Net Inventory Total Stockholders' Equity $ 53,000 202,000 562,000 101,000 588,000 $ 20,000 67,000 172,000 44,000 240,000 These two companies…arrow_forwardCreate an appropriate graph to show the correlation between the total revenuegenerated by Tesco and the number of its stores over the last recorded fiveyears?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License