Concept explainers

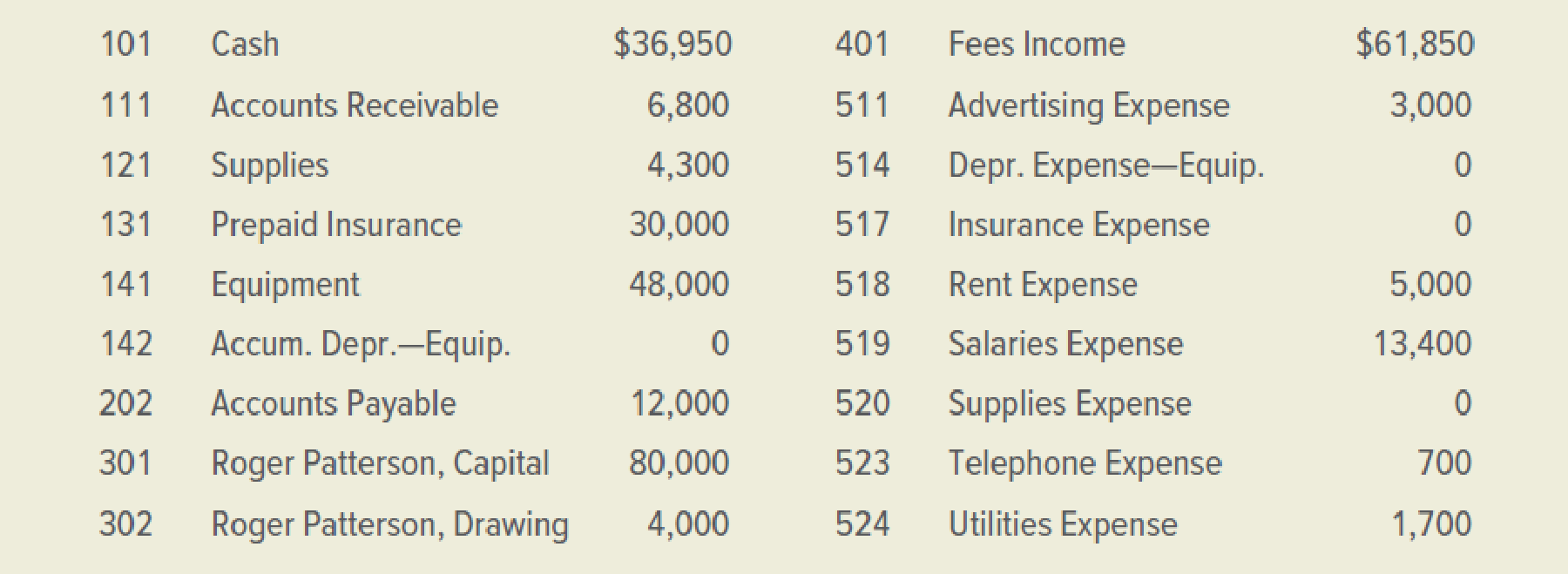

The account balances for the Patterson International Company on January 31. 2019, follow. The balances shown are after the first month of operations.

INSTRUCTIONS

- 1. Prepare the

Trial Balance section of the worksheet. - 2. Record the following adjustments in the Adjustments section of the worksheet:

- a. Supplies used during the month amounted to $2,100.

- b. The amount in the Prepaid Insurance account represents a payment made on January 1. 2019, for six months of insurance coverage.

- c. The equipment, purchased on January 1.2019, has an estimated useful life of 10 years with no salvage value. The firm uses the straight-line method of

depreciation.

- 3. Complete the worksheet.

- 4. Prepare an income statement, statement of owner’s equity, and

balance sheet (use the report form). - 5. Record the balances in the general ledger accounts, then journalize and

post the adjusting entries. Use 3 for the journal page number.

Analyze: If the useful life of the equipment had been 12 years instead of 10 years, how would net income have been affected?

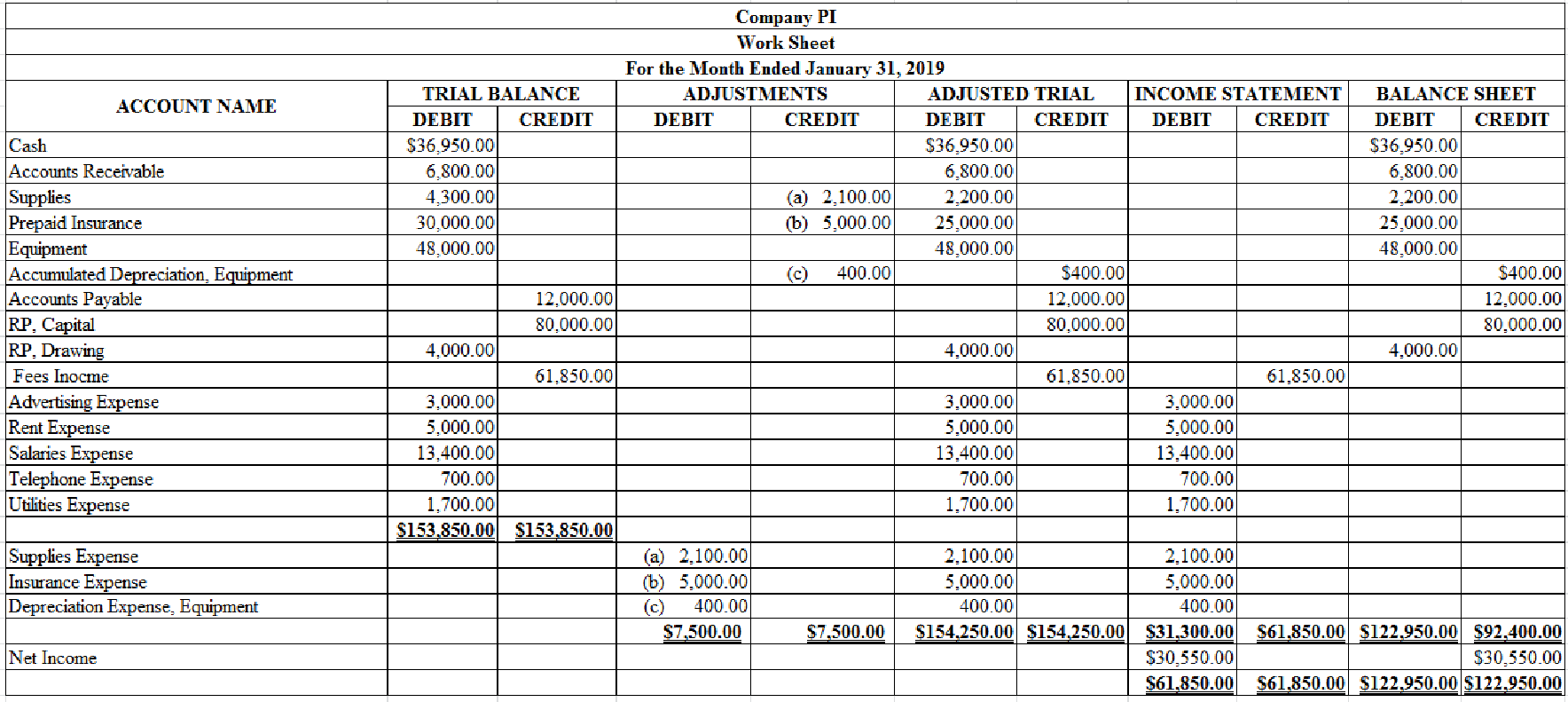

1, 2 and 3.

Prepare trial balance section, indicate the given adjustments, and complete the worksheet for Company PI for the month ended January 31, 2019.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that helps accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where trial balance, adjustments, adjusted trial balance, income statement, and balance sheet are presented.

Prepare trial balance section, indicate the given adjustments, and complete the worksheet for Company PI for the month ended January 31, 2019.

Table (1)

4.

Prepare income statement, statement of owners’ equity, and balance sheet for Company PI for the month of January, 2019.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operation and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for Company PI for the month ended January 31, 2019.

| Company PI | ||

| Income Statement | ||

| For the Month Ended January 31, 2019 | ||

| Revenues: | ||

| Fees Income | 61,850 | |

| Expenses: | ||

| Advertising Expense | $3,000 | |

| Depreciation Expense, Equipment | 400 | |

| Rent Expense | 5,000 | |

| Salaries Expense | 13,400 | |

| Supplies Expense | 2,100 | |

| Insurance Expense | 5,000 | |

| Utilities Expense | 1,700 | |

| Telephone Expense | 700 | |

| Total expenses | 31,300 | |

| Net income | $30,550 | |

Table (2)

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings are deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement for Company PI for the month ended January 31, 2019.

| Company PI | ||

| Statement of Owners’ Equity | ||

| For the Month Ended January 31, 2019 | ||

| RP, Capital, January 1, 2019 | $80,000 | |

| Net income for January | 30,550 | |

| Less: Withdrawals for January | 4,000 | |

| Increase in capital | 26,550 | |

| RP, Capital, January 31, 2019 | $106,550 | |

Table (3)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet Company PI as at January 31, 2019.

| Company PI | ||

| Balance Sheet | ||

| January 31, 2019 | ||

| Assets | ||

| Cash | $36,950 | |

| Accounts Receivable | 6,800 | |

| Supplies | 2,200 | |

| Prepaid Insurance | 25,000 | |

| Equipment | $48,000 | |

| Less: Accumulated Depreciation | 400 | 47,600 |

| Total Assets | $118,550 | |

| Liabilities and owner’s equity | ||

| Liabilities | ||

| Accounts Payable | 12,000 | |

| Owners’ Equity | ||

| RP, Capital | 106,550 | |

| Total Liabilities and Owners’ Equity | $118,550 | |

Table (4)

5.

Prepare adjusting entry and post the transactions in general ledger.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and owners’ or stockholders’ equity) to maintain the records according to accrual basis principle and matching concept.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting entry for supplies.

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Supplies expense | 520 | 2,100 | |

| Supplies | 121 | 2,100 | ||

| (to record supplies used) | ||||

Table (5)

Description:

- Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Prepare adjusting entry for insurance expense:

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Insurance expense | 517 | 5,000 | |

| Prepaid insurance | 131 | 5,000 | ||

| (to record part of prepaid insurance expired) | ||||

Table (6)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Prepare adjusting entry for depreciation expense-equipment:

| GENERAL JOURNAL | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 2019 | Depreciation expense-Equipment | 514 | 400 | |

| Accumulated depreciation-Equipment | 142 | 400 | ||

| (to record depreciation expense) | ||||

Table (7)

Description:

- Depreciation Expense, Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Post the above transactions in the general ledger.

| ACCOUNT Supplies ACCOUNT NO. 121 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 4,300 | 4,300 | |||

| 31 | Adjusting | 3 | 2,100 | 2,200 | |||

Table (8)

| ACCOUNT Prepaid Insurance ACCOUNT NO. 131 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 30,000 | 30,000 | |||

| 31 | Adjusting | 3 | 5,000 | 25,000 | |||

Table (9)

| ACCOUNT Accumulated Depreciation - Equipment ACCOUNT NO. 142 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 400 | 400 | |||

Table (10)

| ACCOUNT Depreciation Expense - Equipment ACCOUNT NO. 514 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 400 | 400 | |||

Table (11)

| ACCOUNT Insurance Expense ACCOUNT NO. 517 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 5,000 | 5,000 | |||

Table (12)

| ACCOUNT Supplies Expense ACCOUNT NO. 520 | |||||||

| Date | Description | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| January | 1 | Balance | 0 | 0 | |||

| 31 | Adjusting | 3 | 2,100 | 2,100 | |||

Table (13)

Analyze: If the useful life of the equipment is 12 years instead of 10 years, then the depreciation expense for the month would be $334 rather than $400. As a result, the net income would increase by $66.

Want to see more full solutions like this?

Chapter 5 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Comprehensive Selected transactions of Shadrach Computer Corporation during November and December of 2019 are as follows: Required: Prepare journal entries to record the preceding transactions of Shadrach Computer Corporation for 2019. Include year-end accruals. Round all calculations to the nearest dollar.arrow_forwardRefer to RE6-8. On April 23, 2020, McKinncy Co. receives a check, from Mangold Corporation for 8,500. Prepare the journal entry for McKinncy to record the collection of the account previously written off.arrow_forwardc. On September 1, 2019, North Dakota Manufacturing paid a premium of $13,560 in cash for a one-year insurance policy. On December 31, 2019, an examination of the insurance records showed that coverage for a period of four months had expired. Record the adjustment for insurance expired. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019arrow_forward

- Journalize the adjusting entry for each of the following accrued expenses at the end of the current year:a. Product warranty cost, $26,800.b. Interest on the 19 remaining notes owed to Gallardo Co.arrow_forwardThe balance in the Prepaid Insurance account before adjustment at the end of the year is P7,200, which represents twelve months’ Insurance purchased on December 1. The adjusting entry required on Dec. 31, 2018 is a. debit Prepaid Insurance, P7,200; credit Insurance Expense, P7,200 b. debit Insurance Expense, P600; credit Insurance Payable, P600 c. debit Insurance Expense, P6,600; credit Prepaid Insurance, P6,600 d. debit Prepaid Insurance, P600; credit Insurance Expense, P600 e. debit, Insurance Expense, P600; credit Prepaid Insurance, P600arrow_forwardOn November 30, 2019, Davis Company and the following account balances: 1. Prepare general journal entries to record preceding transactions. 2. Post to general ledger T-accou11ts. 3. Prepare a year-end trial balance on a worksheet and complete the worksheet using the following information: (a) accrued salaries at year-end total $1,200; (b ) for simplicity, the building and equipment are being depreciated using the stright-line method over an estimated life of 20 years with no residual all c) supplies on hand at the end of the year total $630; (d ) bad debts expense for the year totals $830; and (e ) the income tax rate is 30%; income taxes are payable in the first quarter of 2020. 4. Prepare company's financial statements for 2019 . 5. Prepare 2019 (a) adjusting and (b) closing entries in the general journal.arrow_forward

- On July 1, a six-month liability insurance policy was purchased for $750. Required: Analyze the required adjustment as of July 31 using T accounts, and then formally enter this adjustment in the general journal. (Trial balance is abbreviated TB.)arrow_forwardOn December 1, 2019, an advance rent payment of $25,800, representing a three-month prepayment for the months of December, January, and February, was received in cash from the company’s tenant. Required: Use the horizontal model (or write the journal entries) to record the effects of the following items: a. The three months of rent collected in advance on December 1, 2019. b. The adjustment that will be made at the end of each month to show the amount of rent “earned” during the month.arrow_forwardPrepare a General Journal entry for the following transaction: On December 17, On Your Mark paid $1,500 to Keystone Insurance Company toward the premium for a six-month insurance policy, check No. 1001.arrow_forward

- The balance in the Prepaid Insurance account before adjustment at the end of the year is P7,200 which represents twelve months insurance purchased on December 1. What is the adjusting entry required on Dec. 31, 2021? debit Prepaid Insurance, P600; credit Insurance Expense, P600. debit Insurance Expense, P600; credit Prepaid Insurance, P600. debit Insurance Expense, P600; credit Insurance Payable, P600. debit Insurance Expense, P6,600; credit Prepaid Insurance, P6,600. debit Prepaid Insurance, P7,200; credit Insurance Expense, P7,200.arrow_forwardThe company determines that the interest expense on a note payable for the period ending December 31 is $630. This amount is payable on January 1. Prepare the journal entries required on December 31 and January 1. If an amount box does not require an entry, leave it blank. Dec. 31 Jan. 1arrow_forwardMarcellus Purse conduct cleaning business on the credit basis. He provides the collects the sccount receivable in 60 days. The Allowance October 2019 is $3,993. The following information is available Douchd D 1. The business uses aging of account receivable method to count the bad de 2. The accountant is required to update the balance of allowance of dosud des OURE at the end of each month 3. On 5 October 2019 a total of $1.997 ewed by Lucy Frone has been deemed w uncollectable and therefore written off 4. The total sales recorded during 1 October 2019 to 31 October 2019 is $812577 The balance in the Account receivable on 31 October 2019 is $198.300 5. 6. On 31 October 2019 the accountant estimates that 3% of the account receivable is estimated as doubtful. Q3 Required (a) Prepare the Accounting Entries for the transactions or events relating to bad debt for the month ended 31 October 2019, ignore GST ( (b) Prepare and balance the T-account for Allowance for Doubtful Debts accounts as…arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning - Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College