Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 24E

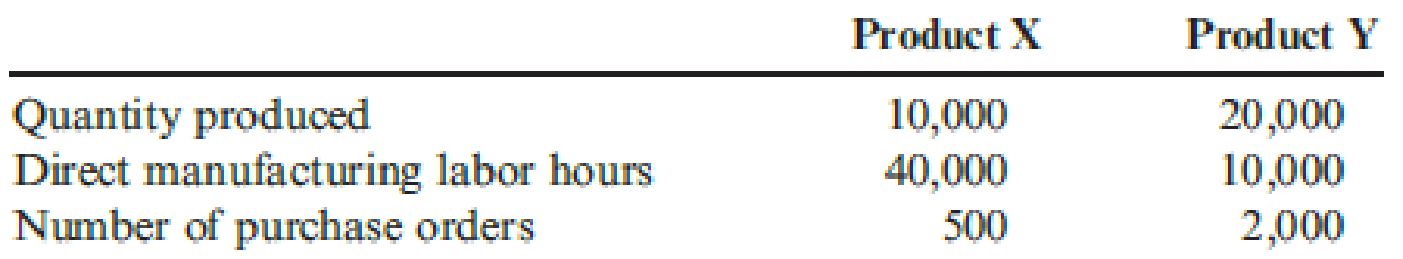

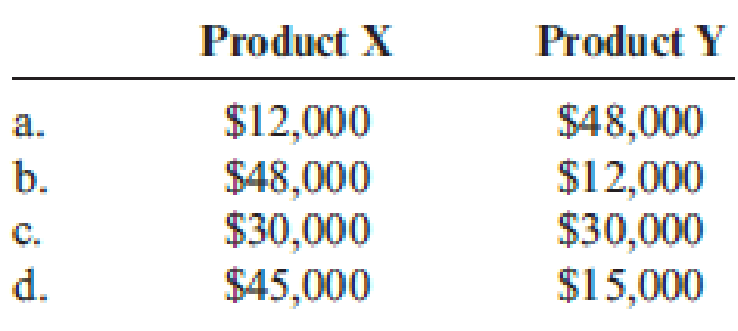

Geneva, Inc., makes two products, X and Y, that require allocation of indirect

The total cost of purchasing and receiving parts used in manufacturing is $60,000. The company uses a

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Hakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation system, product A has been assigned overhead of $24.82 per unit, while product B has been assigned $13.58 per unit. Management feels that an ABC system will provide a more accurate allocation of the overhead costs and has collected the following cost pool and cost driver information:

Cost Pools

Activity Costs

Cost Drivers

Activity Driver Consumption

Machine setup

$ 158,000

Setup hours

2,000

Materials handling

112,000

Pounds of materials

16,000

Electric power

25,000

Kilowatt-hours

25,000

The following cost information pertains to the production of A and B, just two of Hakara's many products:

A

B

Number of units produced

5,000

10,000

Direct materials cost

$ 32,000

$ 41,000

Direct labor cost

$ 41,000

$ 38,000

Number of setup hours

100

200

Pounds of materials used

1,000

1,000

Kilowatt-hours

2,000

4,000

Required:

1. Use…

Hakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation system, product A has been assigned overhead of $35.29 per unit, while product B has been assigned $8.25 per unit. Management feels that an ABC system will provide a more accurate allocation of the overhead costs and has collected the following cost pool and cost driver information:

Cost Pools

Activity Costs

Cost Drivers

Activity Driver Consumption

Machine setup

$

261,000

Setup hours

3,000

Materials handling

153,000

Pounds of materials

17,000

Electric power

38,000

Kilowatt-hours

38,000

The following cost information pertains to the production of A and B, just two of Hakara's many products:

A

B

Number of units produced

4,000

20,000

Direct materials cost

$

37,000

$

27,000

Direct labor cost

$

41,000

$

40,000

Number of setup hours

200

200

Pounds of materials used

1,000…

Hakara Company has been using direct labor costs as the basis for assigning overhead to its many products. Under this allocation

system, product A has been assigned overhead of $23.18 per unit, while product B has been assigned $9.84 per unit. Management

feels that an ABC system will provide a more accurate allocation of the overhead costs and has collected the following cost pool and

cost driver information:

Cost Pools

Activity Costs.

$426,000

Machine setup

Materials handling

171,000

54,000

Electric power

The following cost information pertains to the production of A and B, just two of Hakara's many products:

Number of units produced

Direct materials cost

Direct labor cost

Number of setup hours

Pounds of materials used

Kilowatt-hours

Product A

Product B

A

5,000

$ 37,000

$ 24,000

100

1,000

2,000

X Answer is not complete.

Cost per Unit

$

18.22 X

Cost Drivers

Setup hours

Pounds of materials.

Kilowatt-hours

Required:

1. Use activity-based costing to determine a unit cost for each product.…

Chapter 5 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 5 - What is cost measurement? Cost accumulation? What...Ch. 5 - Why is actual costing rarely used for product...Ch. 5 - Explain the differences between job-order costing...Ch. 5 - What are some differences between a manual...Ch. 5 - Prob. 5DQCh. 5 - How do firms collect job-related information on...Ch. 5 - Explain the role of activity drivers in assigning...Ch. 5 - Define the following terms: expected actual...Ch. 5 - Why would some prefer normal activity to expected...Ch. 5 - When using normal costing, how are jobs charged...

Ch. 5 - Wilson Company has a predetermined overhead rate...Ch. 5 - Why are the accounting requirements for job-order...Ch. 5 - Explain the difference between normal cost of...Ch. 5 - Amber Company produces custom framing. For one...Ch. 5 - Amber Company produces custom framing. For one...Ch. 5 - Naranjo Company designs industrial prototypes for...Ch. 5 - Naranjo Company designs industrial prototypes for...Ch. 5 - Heitger Company is a job-order costing firm that...Ch. 5 - Frieling Company installs granite countertops in...Ch. 5 - Frieling Company installs granite countertops in...Ch. 5 - Prob. 6ECh. 5 - Vince Melders, of EcoScape Company, designs and...Ch. 5 - Refer to the data in Exercise 5.7. Vince Melders,...Ch. 5 - Reggie Wilmore has just started a new...Ch. 5 - Reggie Wilmore has just started a new...Ch. 5 - During March, Aragon Company worked on three jobs....Ch. 5 - Job Cost On April 1, Sangvikar Company had the...Ch. 5 - Job Cost On April 1, Sangvikar Company had the...Ch. 5 - On August 1, Cairle Companys work-in-process...Ch. 5 - On August 1, Cairle Companys work-in-process...Ch. 5 - Ehrling Brothers Company makes jobs to customer...Ch. 5 - During August, Skyler Company worked on three...Ch. 5 - Feldspar Company uses an ABC system to apply...Ch. 5 - Kapoor Company uses job-order costing. During...Ch. 5 - Salazar Company is a job-order costing firm that...Ch. 5 - Lorrimer Company has a job-order cost system. The...Ch. 5 - CleanCom Company specializes in cleaning...Ch. 5 - Prob. 23ECh. 5 - Geneva, Inc., makes two products, X and Y, that...Ch. 5 - Prob. 25ECh. 5 - During May, the following transactions were...Ch. 5 - Firenza Company manufactures specialty tools to...Ch. 5 - Prob. 28PCh. 5 - Cherise Ortega, marketing manager for Romer...Ch. 5 - Lieu Company is a specialty print shop. Usually,...Ch. 5 - Warrens Sporting Goods Store sells a variety of...Ch. 5 - Sutton Construction Inc. is a privately held,...Ch. 5 - Dr. Alyx Hemmings is employed by Mesa Dental. Mesa...Ch. 5 - Prob. 34P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardKenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 80,000. b. Requisitioned raw materials to production, 80,000. c. Distributed direct labor costs, 10,000. d. Factory overhead costs incurred, 60,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 225,000, on account.arrow_forwardSan Mateo Optics, Inc., specializes in manufacturing lenses for large telescopes and cameras used in space exploration. As the specifications for the lenses are determined by the customer and vary considerably, the company uses a job-order costing system. Manufacturing overhead is applied to jobs on the basis of direct labor hours, utilizing the absorption- or full-costing method. San Mateos predetermined overhead rates for 20x1 and 20x2 were based on the following estimates. Jim Cimino, San Mateos controller, would like to use variable (direct) costing for internal reporting purposes as he believes statements prepared using variable costing are more appropriate for making product decisions. In order to explain the benefits of variable costing to the other members of San Mateos management team, Cimino plans to convert the companys income statement from absorption costing to variable costing. He has gathered the following information for this purpose, along with a copy of San Mateos 20x1 and 20x2 comparative income statement. San Mateo Optics, Inc. Comparative Income Statement For the Years 20x1 and 20x2 San Mateos actual manufacturing data for the two years are as follows: The companys actual inventory balances were as follows: For both years, all administrative expenses were fixed, while a portion of the selling expenses resulting from an 8 percent commission on net sales was variable. San Mateo reports any over-or underapplied overhead as an adjustment to the cost of goods sold. Required: 1. For the year ended December 31, 20x2, prepare the revised income statement for San Mateo Optics, Inc., utilizing the variable-costing method. Be sure to include the contribution margin on the revised income statement. 2. Describe two advantages of using variable costing rather than absorption costing. (CMA adapted)arrow_forward

- Larsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forwardLansing. Inc., provided the following data for its two producing departments: Machine hours are used to assign the overhead of the Molding Department, and direct labor hours are used to assign the overhead of the Polishing Department. There are 30,000 units of Form A produced and sold and 50,000 of Form B. Required: 1. Calculate the overhead rates for each department. 2. Using departmental rates, assign overhead to live two products and calculate the overhead cost per unit. How does this compare with the plantwide rate unit cost, using direct labor hours? 3. What if the machine hours in Molding were 1,200 for Form A and 3,800 for Form B and the direct labor hours used in Polishing were 5,000 and 15,000, respectively? Calculate the overhead cost per unit for each product using departmental rates, and compare with the plantwide rate unit costs calculated in Requirement 2. What can you conclude from this outcome?arrow_forwardA manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forward

- Davis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forwardEvans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forwardPatterson Company produces wafers for integrated circuits. Data for the most recent year are provided: aCalculated using number of dies as the single unit-level driver. bCalculated by multiplying the consumption ratio of each product by the cost of each activity. Required: 1. Using the five most expensive activities, calculate the overhead cost assigned to each product. Assume that the costs of the other activities are assigned in proportion to the cost of the five activities. 2. Calculate the error relative to the fully specified ABC product cost and comment on the outcome. 3. What if activities 1, 2, 5, and 8 each had a cost of 650,000 and the remaining activities had a cost of 50,000? Calculate the cost assigned to Wafer A by a fully specified ABC system and then by an approximately relevant ABC approach. Comment on the implications for the approximately relevant approach.arrow_forward

- The following data appeared in the accounting records of Craig Manufacturing Inc., which uses the weighted average cost method: Case 1All materials are added at the beginning of the process, and labor and factory overhead are added evenly throughout the process. Case 2One-half of the materials are added at the start of the manufacturing process, and the balance of the materials is added when the units are one-half completed. Labor and factory overhead are applied evenly during the process. Make the following computations for each case: a. Unit cost of materials, labor, and factory overhead for the month b. Cost of the units finished and transferred during the month c. Cost of the units in process at the end of the montharrow_forwardFreeman Furnishings has summarized its data as shown: Compute the cost of goods manufactured, assuming that the overhead is allocated based on direct labor hoursarrow_forwardFor E2-17, prepare any journal entries that would have been different if the only trigger points had been the purchase of materials and the sale of finished goods. Davis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY