Concept explainers

Healthy Foods Inc. sells 50-pound bags of grapes to the military for

a. What is the break-even point in bags?

b. Calculate the profit or loss on 12,000 bags and on 25,000 bags.

c. What is the degree of operating leverage at 20,000 bags and at 25,000 bags? Why does the degree of operating leverage change as the quantity sold increases?

d. If Healthy Foods has an annual interest expense of

e. What is the degree of combined leverage at both sales levels?

a.

To calculate: The break-even point (BEP) of Healthy Foods Inc.

Introduction:

Break-even point (BEP):

It is a point of sale at which a company is in a no profit and no loss situation. The value of BEP is derived by dividing total fixed cost by the difference of revenue per unit and variable cost per unit.

Answer to Problem 12P

The BEP of Healthy Foods Inc. is 16,000 bags.

Explanation of Solution

Calculation of BEP of Healthy Foods Inc.:

b.

To calculate: The profit or loss for Healthy Foods Inc. on 12,000 as well as 25,000 bags.

Introduction:

Profit or Loss:

It refers to the gain or loss arising from the commercial transactions during a specified period of time and is used to assess the company’s financial performance.

Answer to Problem 12P

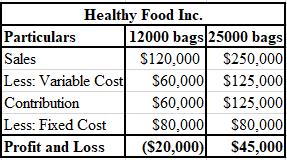

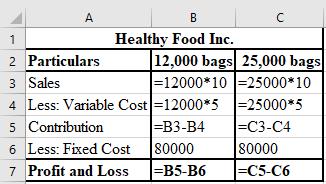

Calculation of profit or loss on 12,000 bags and 25,000 bags for Healthy Foods Inc:

Explanation of Solution

The formulae used for the computation of profit or loss of 12,000 bags and 25,000 bags:

c.

To calculate: The DOL for 20,000 and 25,000 bags of Healthy Foods Inc. and also explain the reason behind the change of DOL with the increase in the quantity sold.

Introduction:

Degree of operating leverage (DOL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 12P

The DOL for Healthy Foods Inc. for 20,000 bags is 5 times and for 25,000 bags is 2.78 times.

The reason behind this change of DOL is that the leverage has gone down and is far away from BEP. Hence, we can say that the leverage has decreased and the organisation is operating on a greater profit base.

Explanation of Solution

Calculation of DOL for 20,000 bags:

Calculation of DOL for 25,000 bags:

d.

To calculate: The DFL of Healthy Foods Inc.for 20,000 bags as well as 25,000 bags.

Introduction:

Degree of financial leverage(DFL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 12P

DFL for the company Healthy Foods Inc. for 20,000 bags is 2 times and for 25,000 bags is 1.29 times.

Explanation of Solution

Calculation of DFL for 20,000 bags:

Calculation of DFL for 25,000 bags:

Working note:

Calculation of EBIT on 20,000 bags:

Calculation of EBIT on 25,000 bags:

e.

To calculate: The DCL of Healthy foods Inc. at 20,000 and 25,000 bags, respectively.

Introduction:

Degree of combined leverage (DCL):

It is a multiple measurement ratio which determines the quantity of change in operating income of the company with the change in sales value.

Answer to Problem 12P

DCL for the company Healthy Foods Inc. for 20,000 bags is 10 times and for 25,000 bags is 3.57 times.

Explanation of Solution

Explanation:

Calculation of DCL on 20,000 bags:

Calculation of DCL on 25,000 bags:

Want to see more full solutions like this?

Chapter 5 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Super Sales Company is the exclusive distributor for a high-quality knapsack. The product sells for $60 per unit and has a CM ratio of 40%. The company’s fixed expenses are $540,000 per year. The company plans to sell 26,000 knapsacks this year. Required: What are the variable expenses per unit? Use the equation method for the following: What is the break-even point in units and in sales dollars? What sales level in units and in sales dollars is required to earn an annual profit of $108,000? What sales level in units is required to earn an annual after-tax profit of $108,000 if the tax rate is 20%? Assume that through negotiation with the manufacturer, Super Sales Company is able to reduce its variable expenses by $3 per unit. What is the company’s new break-even point in units and in sales dollars? (Do not round intermediate calculations. Round your final answers to the nearest whole number.)arrow_forwardSuper Sales Company is the exclusive distributor for a high-quality knapsack. The product sells for $60 per unit and has a CM ratio of 40%. The company’s fixed expenses are $540,000 per year. The company plans to sell 26,000 knapsacks this year. Required: 1. What are the variable expenses per unit? 2. Use the equation method for the following: a. What is the break-even point in units and in sales dollars? b. What sales level in units and in sales dollars is required to earn an annual profit of $108,000? c. What sales level in units is required to earn an annual after-tax profit of $108,000 if the tax rate is 20%? d. Assume that through negotiation with the manufacturer, Super Sales Company is able to reduce its variable expenses by $3 per unit. What is the company’s new break-even point in units and in sales dollars? (Do not round intermediate calculations. Round your final answers to the nearest whole number.)arrow_forward[The following information applies to the questions displayed below.] Charlevoix Cases makes mobile phone cases. The company has collected the following price and cost characteristics: Sales price Variable costs Fixed costs $ 12.00 per case 5.50 per case 391,950 per year Assume that the company plans to sell 75,300 units annually. Consider requirements (b), (c), and (d) independently of each other. Required: a. What will be the operating profit? b. What is the impact on operating profit if the sales price decreases by 20 percent? Increases by 10 percent? Note: Do not round intermediate calculations. c. What is the impact on operating profit if variable costs per unit decrease by 20 percent? Increase by 10 percent? Note: Do not round intermediate calculations. d. Suppose that fixed costs for the year are 20 percent lower than projected and variable costs per unit are 20 percent higher tha projected. What impact will these cost changes have on operating profit for the year? Will profit…arrow_forward

- The Poseidon Swim Company produces swim trunks. The average selling price for one of their swim trunks is $64.63. The variable cost per unit is $21.75, Poseidon Swim has average fixed costs per year of $7,993. Assume that current level of sales is 314 units. What will be the resulting percentage change in EBIT if they expect units sold to changes by -4.2 percent? (You should calculate the degree of operating leverage first). (Write the percentage sign in the "units" box). Round the answer to two decimal places.arrow_forwardSuper Sales Company is the exclusive distributor for a high-quality knapsack. The product sells for $80 per unit and has a CM ratio of 40%. The company's fixed expenses are $360,000 per year. The company plans to sell 13,000 knapsacks this year. Required: 1. What are the variable expenses per unit? Variable expenses per unit 2. Use the equation method for the following: a. What is the break-even point in units and in sales dollars? Break-even point in units Break-even point in sales dollarsarrow_forwardCobb Co. can further process Product X to produce Product Y. Product X is currently selling for $30 per pound and costs $28 per pound to produce. Product Y would sell for $60 per pound and would require an additional cost of $24 per pound to produce. What is the net differential income from producing Product Y? (a)$6 per pound (b)a$8 per pound (c)$2 per pound (d)$30 per pound Aarrow_forward

- Samsung manufacturers USB charging cables for mobile devices. It sells these cables to distributors for $2.6000000000 each, while their variable costs are 72e per cable, and they have a fixed cost of $43000 to manufacture the cables. 1. What is the Contribution margin (in dollars)? 2. What is the profit function (without units using x as the number of cables sold)? 3. What is their projected profit or loss next month (in dollars), for which Samsung forecasts sales of 23241 cables? 4. What is the break even volume (without units)? For parts 1, 2, and 3, answer to the nearest cent. For part 4, answer to one decimal place (don't round up to the nearest whole unit). Answer: 1. Contribution margin = 2. Profit function: Profit= 3. Profit or loss = 4. Break even volume =arrow_forwardFlorida Citrus produced 40,000 boxes of fruit that sold for Rs. 3 per box. The total variable costs for the 40,000 boxes were Rs. 60,000, and the fixed costs were Rs.75,000. (a) How much profit (or loss) resulted? (b) What was the break-even quantity? (c) Assuming that fixed costs remain constant, how many additional boxes will be required for the company to increase profit by Rs. 22500.arrow_forward1. An ice cream producer has fixed costs of $70,000 per month, and it can produce up to 15,000 ice cream tubs per month. Each tub costs $10 in the market while the producer faces variable costs of $3 per tub. (a) What is the economic breakeven level of production? (b) Calculate the ice cream producer's monthly profits at full capacity. What would happen to the monthly profits if another ice cream producer entered the market, driving the price of the ice cream tubs down to $7 per unit? Support your calculations graphically.arrow_forward

- XYZ Company sells a product for $250. The variable cost is $150 per unit. The fixed costs are $300,000. The company wants to have a profit of $400,000. How many units do they have to sell to achieve this goal?arrow_forwardLindon Company is the exclusive distributor for an automotive product. The product sells $40 per unit and has a CM ratio of 30%. The company's fixed expenses are $180,000 per year. Required: 1. What are the variable expenses per unit? 2. Using the equation method: a. What is the break-even point in units and sales dollars? b. What sales level in units and in sales dollars is required to earn an annual profit of $60,000? c. Assume that by using a more efficient shipper, the company is able to reduce its variable expenses by $4 per unit. What is the Company's new break-even point in units and in sales dollars? 3. Repeat (2) above using the unit contribution method.arrow_forwardPimpton Plows sells its product for $50. Its variable cost per unit is $19.00. Fixed costs total $434,000.How many units does the company need to sell to breakeven?What are the total sales in dollars at the breakeven point?How many units does the company need to sell to earn a profit of $155,000?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education