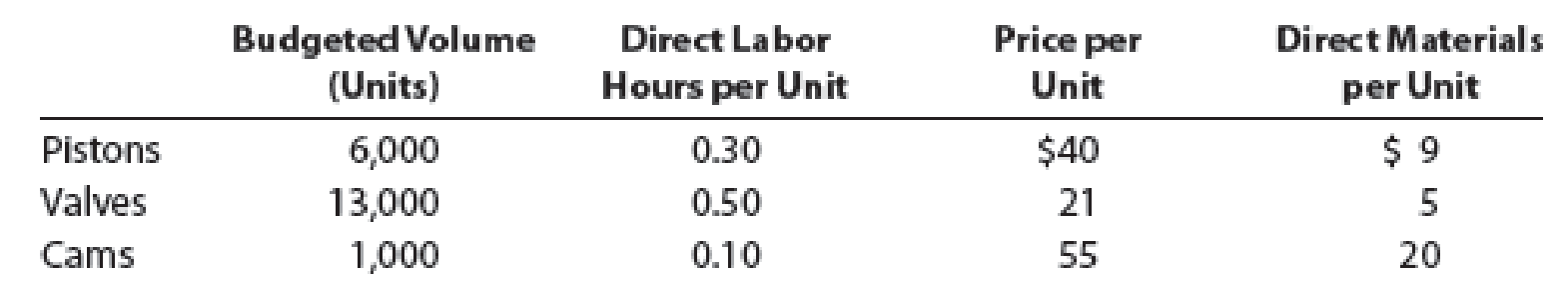

Isaac Engines Inc. produces three products—pistons, valves, and cams—for the heavy equipment industry. Isaac Engines has a very simple production process and product line and uses a single plantwide factory overhead rate to allocate overhead to the three products. The factory overhead rate is based on direct labor hours. Information about the three products for 20Y2 is as follows:

The estimated direct labor rate is $20 per direct labor hour. Beginning and ending inventories are negligible and are, thus, assumed to be zero. The budgeted factory overhead for Isaac Engines is $235,200.

a. Determine the plantwide factory overhead rate.

b. Determine the factory overhead and direct labor cost per unit for each product.

c. Use the information provided to construct a budgeted gross profit report by product line for the year ended December 31, 20Y2. Include the gross profit as a percent of sales in the last line of your report, rounded to one decimal place.

d. What does the report in (c) indicate to you?

a.

Compute the plant-wide overhead rate using direct labor hours (DLH) as the allocation base.

Explanation of Solution

Single plant-wide factory overhead rate: The rate at which the factory or manufacturing overheads are allocated to products is referred to as single plant-wide factory overhead rate.

Formula to compute single plant-wide overhead rate:

Compute single plant-wide overhead rate using DLH as the allocation base.

Working note (1):

Compute the total number of direct labor hours (DLH) budgeted.

| Types of Products | Number of Budgeted Units | × | Number of DLH Per Unit | = | Total Number of Budgeted DLH |

| Pistons | 6,000 units | × | 0.30 DLH | = | 1,800 DLH |

| Valves | 13,000 units | × | 0.50 DLH | = | 6,500 DLH |

| Cams | 1,000 units | × | 0.10 DLH | = | 100 DLH |

| Total number of budgeted DLH | 8,400 DLH | ||||

Table (1)

b.

Calculate the factory overhead allocated per unit of each product, and direct labor cost per unit.

Explanation of Solution

Compute the factory overhead allocated per unit for each product.

| Types of Products | Single Plant-Wide Overhead Rate | × | Number of DLH Per Unit of Each Product | = | Factory Overhead Per Unit |

| Pistons | $28 per DLH | × | 0.30 DLH | = | $8.40 per unit |

| Valves | $28 per DLH | × | 0.50 DLH | = | $14.00 per unit |

| Cams | $28 per DLH | × | 0.10 DLH | = | $2.80 per unit |

Table (2)

Compute direct labor cost per unit for each product.

| Types of Products | Estimated Direct Labor Rate | × | Number of DLH Per Unit of Each Product | = | Direct Labor Cost Per Unit |

| Pistons | $20 per DLH | × | 0.30 DLH | = | $6 per unit |

| Valves | $20 per DLH | × | 0.50 DLH | = | $10 per unit |

| Cams | $20 per DLH | × | 0.10 DLH | = | $2 per unit |

Table (3)

c.

Prepare a budgeted gross profit report of Company I for the year ended December 31, 20Y2.

Explanation of Solution

Prepare a budgeted gross profit report of Company I, by product line, for the year ended December 31, 20Y2.

| Company I | |||

| Budgeted Gross Profit Report | |||

| December 31, 20Y2 | |||

| Pistons | Valves | Cams | |

| Revenues (2) | $240,000 | $273,000 | $55,000 |

| Direct materials cost (3) | (54,000) | (65,000) | (20,000) |

| Direct labor cost (4) | (36,000) | (130,000) | (2,000) |

| Factory overhead (5) | (50,400) | (182,000) | (2,800) |

| Gross profit | $99,600 | $(104,000) | $30,200 |

| Gross profit as a percent of sales (6) | 41.5% | (38.1)% | 54.9% |

Table (4)

Working note (2):

Compute the sales revenues for each product.

| Types of Products | Number of Budgeted Units | × | Price Per Unit | = | Sales Revenue |

| Pistons | 6,000 units | × | $40 | = | $240,000 |

| Valves | 13,000 units | × | 21 | = | 273,000 |

| Cams | 1,000 units | × | 55 | = | 55,000 |

Table (5)

Working note (3):

Compute the direct material cost for each product.

| Types of Products | Number of Budgeted Units | × | Cost Per Unit | = | Direct material Cost |

| Pistons | 6,000 units | × | $9.00 | = | $54,000 |

| Valves | 13,000 units | × | 5.00 | = | 65,000 |

| Cams | 1,000 units | × | 20.00 | = | 20,000 |

Table (6)

Working note (4):

Compute the direct labor cost for each product.

| Types of Products | Number of Budgeted Units | × | Cost Per Unit | = | Direct labor Cost |

| Pistons | 6,000 units | × | $6.00 | = | $36,000 |

| Valves | 13,000 units | × | 10.00 | = | 130,000 |

| Cams | 1,000 units | × | 2.00 | = | 2,000 |

Table (7)

Working note (5):

Compute the total factory overhead allocated for each product.

| Types of Products | Number of Budgeted Units | × | Factory Overhead Per Unit | = | Total Factory Overhead |

| Pistons | 6,000 units | × | $8.40 per unit | = | $50,400 |

| Valves | 13,000 units | × | 14.00 per unit | = | 182,000 |

| Cams | 1,000 units | × | 2.80 per unit | = | 2,800 |

Table (8)

Note: Refer to table (2) for value and computation of factory overhead per unit.

Working note (6):

Compute the gross profit as a percent of sales for each product.

| Types of Products |

Gross Profit (A) |

Sales Revenues (B) |

Gross Profit Percentage |

| Pistons | $99,600 | $240,000 | 41.5% |

| Valves | (104,000) | 273,000 | (38.1)% |

| Cams | 30,200 | 55,000 | 54.9% |

Table (9)

Note: Refer to Table (4) for value and computation of sales revenues.

d.

Discuss the interpretations from the gross profit report.

Explanation of Solution

Of the three products, cams are highly profitable, and pistons are also profitable as well. But valves are at loss. The sales price per unit should be increased or the cost price should be cut down to increase the profitability of valves.

Want to see more full solutions like this?

Chapter 4 Solutions

Managerial Accounting

- Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for 66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Prior to making a decision, the companys CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups1,160 each (The setups would be avoided, and total spending could be reduced by 1,160 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is 12,300 and could be totally avoided if the part were purchased. Engineering work: 470 hours, 45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at 30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. 2. Now, using the special study data, repeat the analysis. 3. Discuss the qualitative factors that would affect the decision, including strategic implications. 4. After reviewing the special study, the controller made the following remark: This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs? Is the controller right?arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardEvans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forward

- Green Co. uses 6 machine hours and 2 direct labor hours to produce Product A. It uses 8 machine hours and 16 direct labor hours to produce Product B. Green's Assembly and Finishing departments have factory overhead rates of $240 per machine hour and $160 per direct labor hour, respectively. How much total factory overhead will be allocated to a unit of each of the two products?-arrow_forwardQriole Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign to each product line, the controller, William Brown, has developed the following information: Estimated wheels produced Direct labour hours per wheel Car Car wheels $ Truck 45,000 11,000 4 Total estimated overhead costs for the two product lines are $1,340,000. Calculate the overhead cost assigned to the car wheels and truck wheels, assuming that direct labour hours are used to allocate overhead costs. 8 180,000arrow_forwardSchell Company manufactures automobile floor mats. It currently has two product lines, the Standard and the Deluxe. Schell has a total of $39,060 in overhead. It currently uses a traditional cost system with overhead applied to the product on the basis of either labor hours or machine hours. Schell has compiled the following information about possible cost drivers and its two product lines: Schell Company Total 600 labor hours 7,150 machine hours Quantity or Amount Consumed Quantity or Amount Consumed by Standard Floor Mat Line by Deluxe Floor Mat Line 400 labor hours 200 labor hours 3,000 machine hours 4,150 machine hours Required: 1. Suppose Schell uses a traditional costing system with direct labor hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Suppose Schell uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line.arrow_forward

- Rondeau, Incorporated, manufactures and sells two products: Product V9 and Product M6. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product V9 Product M6 Total direct labor-hours Product V9 Product M6 Direct Materials Cost per Unit $ 287.60 $ 180.80 The direct labor rate is $26.60 per DLH. The direct materials cost per unit for each product is given below: Activity Cost Pools Labor-related Product testing Order size Expected Production 580 680 The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Traditional unit product cost ABC unit product cost Difference Direct Labor-Hours Per Unit DLHS Tests MHS 11.8 8.8 Activity Estimated Overhead Measures Product V9 Product M6 Total Direct Labor-Hours 6,844 5,984 12,828 Cost $ 101,656 75,208 398,000 $ 574,864 Product V9 6,844 1,020 5,300 Expected…arrow_forwardNole, Incorporated, manufactures and sells two products: Product W8 and Product NO. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product W8 Product NO Total direct labor-hours Total Direct Labor-Hours 900 11,000 11,900 The direct labor rate is $17.40 per DLH. The direct materials cost per unit for each product is given below: Direct Materials Cost per Unit $ 176.40 $ 280.50 Product W8 Product NØ Expected Production 100 1,000 Activity Cost Pools Labor-related Machine setups Order size Direct Labor- Hours Per Unit 9.0 11.0 The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Expect Activity Product NO 11,000 400 4,200 Multiple Choice Activity Measures DLHS setups MHS Estimated Overhead Cost $461,720 25,865 796,220 $ 1,283,805 The overhead applied to each unit of Product W8 under…arrow_forwardRondeau, Incorporated, manufactures and sells two products: Product V9 and Product M6. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product V9 Product M6 Total direct labor-hours Product V9 Product M6 The direct labor rate is $24.20 per DLH. The direct materials cost per unit for each product is given below: Direct Materials Cost per Unit $275.60 $ 168.80 Activity Cost Pools Labor-related Product testing Order size The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Required: Calculate the difference betwee the unit Expected Production 340 440 Traditional unit product cost ABC unit product cost Difference $ DLHs Tests MHS Product V9 Activity Measures Estimated Overhead Cost Direct Labor-Hours Per Unit 9.4 6.4 Product M6 0.00 $ Total Direct Labor-Hours 3,196 2,816 6,012 0.00 $ 95,656…arrow_forward

- XYZ Ltd. is a manufacturing company that follows the cost allocation approach for overhead allocation. The company uses three cost pools for allocating overhead costs: Material Handling, Machine Maintenance, and Factory Utilities. Each cost pool has its own cost driver. For the current accounting period, the company incurred the following costs and activity levels: Material Handling Costs: $150,000 Cost Driver: Number of Material Orders - 2,500 orders Machine Maintenance Costs: $250,000 Cost Driver: Machine Hours - 10,000 hours Factory Utilities Costs: $200,000 Cost Driver: Direct Labor Hours - 5,000 hours Calculate the overhead allocation rate for each cost pool based on the given information. A) Material Handling: $60 per order, Machine Maintenance: $25 per hour, Factory Utilities: $40 per direct labor hour. B) Material Handling: $30 per order, Machine Maintenance: $25 per hour, Factory Utilities: $40 per direct labor hour. C) Material Handling: $60 per order, Machine…arrow_forwardGigabyte, Inc. manufactures three products for the computer industry: Gismos (product G): annual sales, 8,000 units Thingamajigs (product T): annual sales, 15,000 units Whatchamacallits (product W): annual sales, 4,000 units The company uses a traditional, volume-based product-costing system with manufacturing over-head applied on the basis of direct-labor dollars. The product costs have been computed as follows: Product G Product T Product W Raw material ..........................$ 35.00 $52.50 $17.50 Direct labor 16(.8 hr.at $20) 12(.6 hr at $20) 8(.4 hr at $20) Manufacturing overhead* ......140.00 105.00 70.00 Total product cost ..................$191.00 $169.50 $95.50 *Calculation of predetermined overhead rate: Manufacturing overhead budget: Machine setup...................................................................................$…arrow_forwardEllis Equipment (EE), manufactures three models of lawn tractor: EE-1000, EE-1800, and EE-2800. Because of the different materials used, production processes for each model differ significantly in terms of machine types and time requirements. Once parts are produced, however, assembly time per unit required for each type of tractor is similar. For this reason, EE allocates overhead on the basis of machine-hours. Last quarter, the company shipped 8,000 EE-1000s, 3,200 EE-1800s, and 800 EE-2800s. The revenues and expenses for the last quarter were as follows: ELLIS EQUIPMENT Income Statement For the Quarter Ended June 30 EE-1000 EE-1800 EE-2800 Total Sales revenue $ 12,800,000 $ 8,000,000 $ 3,520,000 $ 24,320,000 Direct costs Direct materials 4,800,000 3,200,000 1,120,000 9,120,000 Direct labor 1,680,000 768,000 230,400 2,678,400 Variable overhead Setting up machines 1,400,000 Quality testing 1,800,000 Painting 780,000…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College