Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 4.31E

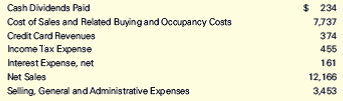

Closing Entries for Nordstrom

The following accounts appear on Nordstrom’s 2013 financial statements as reported in its Form 10-K for the fiscal year ended February 1, 2014. The accounts are listed in alphabetical order, and the balance in each account is the normal balance for that account. All amounts are in millions of dollars. Prepare closing entries for Nordstrom for 2013.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

If necessary, record year-end adjusting entries for uncollectible accounts.Prepare the aging schedule for the following accounts receivable:

Ageing classification (numbers of due days)

Balance sheet as at 31 December

Estimate of the percentage of the account that is uncollectible

0-30 days

$120,000

1%

31-60 days

80,100

2 %

61-90 days

21,000

11%

91- 120 days

9,000

23%

Más de 120 days

15,300

65%

Total accounts receivable

$245,400

Johnson company’s financial year ended on December 31, 2010. All thetransactions related to the company’s uncollectible accounts are can be found below:

The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200.Required:1. Prepare journal entries for each transaction.2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account.3. Prepare the balance sheet extract as at Dec 31 to show the net realizable value for the Accounts Receivable.

4. Assume that the aging of accounts receivable method was used by the company and that $7,050 of the accounts receivable as of December 31 were estimated to be uncollectible. You are now required to:a. Determine the amount to be charged to uncollectible expense (show your workings for the computation of this figure).b. Prepare the balance sheet extract to show the net realizable value of the…

Johnson company’s financial year ended on December 31, 2010. All the transactions related to the company’s uncollectible accounts are can be found below:

The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200.

Prepare journal entries for each transaction.

Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account.

Chapter 4 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 4 - Read each definition below and write the number of...Ch. 4 - Prob. 4.1ECh. 4 - Comparing the Income Statement and the Statement...Ch. 4 - Prob. 4.3ECh. 4 - Accruals and Deferrals For the following...Ch. 4 - Office Supplies Somerville Corp. purchases office...Ch. 4 - Prepaid Rent—Quarterly Adjustments On September...Ch. 4 - Prob. 4.7ECh. 4 - Depreciation On July 1, 2016, Dexter Corp. buys a...Ch. 4 - Working Backward: Depreciation Polk Corp....

Ch. 4 - Prob. 4.10ECh. 4 - Subscriptions Horse Country Living publishes a...Ch. 4 - Customer Deposits Wolfe $ Wolfe collected $9,000...Ch. 4 - Concert Tickets Sold in Advance Rock N Roll...Ch. 4 - Prob. 4.14ECh. 4 - Wages Payable Denton Corporation employs 50...Ch. 4 - Prob. 4.16ECh. 4 - Prob. 4.17ECh. 4 - Interest Payable—Quarterly Adjustments Glendive...Ch. 4 - Prob. 4.19ECh. 4 - Interest Receivable On June 1, 2016, MicroTel...Ch. 4 - Rent Receivable Hudson Corp. has extra space in...Ch. 4 - Working Backward: Rent Receivable Randys Rentals...Ch. 4 - The Effect of Ignoring Adjusting Entries on Net...Ch. 4 - The Effect of Adjusting Entries on the Accounting...Ch. 4 - Reconstruction of Adjusting Entries from...Ch. 4 - The Accounting Cycle The steps in the accounting...Ch. 4 - Trial Balance The following account titles,...Ch. 4 - Prob. 4.28ECh. 4 - Preparation of a Statement of Retained Earnings...Ch. 4 - Reconstruction of Closing Entries The following T...Ch. 4 - Closing Entries for Nordstrom The following...Ch. 4 - Prob. 4.32ECh. 4 - Prob. 4.33ECh. 4 - Prob. 4.34ECh. 4 - Revenue Recognition, Cash and Accrual Bases...Ch. 4 - Depreciation Expense During 2016, Carter Company...Ch. 4 - Prob. 4.37MCECh. 4 - Adjusting Entries Kretz Corporation prepares...Ch. 4 - Prob. 4.2PCh. 4 - Prob. 4.3PCh. 4 - Recurring and Adjusting Entries Following are...Ch. 4 - Prob. 4.5PCh. 4 - Prob. 4.6PCh. 4 - Prob. 4.7PCh. 4 - Prob. 4.8PCh. 4 - Prob. 4.9PCh. 4 - Prob. 4.10PCh. 4 - Prob. 4.1IPCh. 4 - Prob. 4.2APCh. 4 - Prob. 4.3APCh. 4 - Prob. 4.7APCh. 4 - Prob. 4.9APCh. 4 - Prob. 4.10APCh. 4 - Prob. 4.11MCPCh. 4 - Prob. 4.12MCPCh. 4 - Prob. 4.13MCPCh. 4 - Prob. 4.11AMCPCh. 4 - Prob. 4.12AMCPCh. 4 - Prob. 4.13AMCPCh. 4 - Prob. 4.1APCh. 4 - Prob. 4.4APCh. 4 - Prob. 4.5APCh. 4 - Prob. 4.6APCh. 4 - Prob. 4.8APCh. 4 - Prob. 4.1DCCh. 4 - Prob. 4.2DCCh. 4 - Prob. 4.3DCCh. 4 - Prob. 4.4DCCh. 4 - Depreciation Jensen Inc., a graphic arts studio,...Ch. 4 - Prob. 4.6DCCh. 4 - Prob. 4.7DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Johnson company’s financial year ended on December 31, 2010. All thetransactions related to the company’s uncollectible accounts are can be found below: The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200. Required:1. Prepare journal entries for each transaction.2. Prepare the Allowance for Uncollectible and the Accounts Receivable accounts based on the information presented and balance off each account.arrow_forwardOn September 30, 2013, the general ledger of Leons Golf Shop, which uses the calendar year as its accounting period, showed the following year-to-date account balances: The merchandise inventory account had a 48,000 balance on January 1, 2013. The historical gross profit percentage is 40%. Leon prepares quarterly financial statements and takes physical inventory once a yearat the end of the accounting period. In order to prepare the financial statements for the third quarter, the store needs to have an estimate of ending inventory. You have been asked to use the gross profit method to estimate the ending inventory. Review the worksheet called GP. Study it carefully because it may have a solution format somewhat different from the one shown in your textbook.arrow_forwardRefer to RE6-8. On April 23, 2020, McKinncy Co. receives a check, from Mangold Corporation for 8,500. Prepare the journal entry for McKinncy to record the collection of the account previously written off.arrow_forward

- On June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2019. The merchandise inventory as of June 30, 2019, was 508,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 33,000. 3. Prepare the closing entries for Simkins Company as of June 30, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forwardThe following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.arrow_forwardJournalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of $18,330 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable: Aging Class (Numberof Days Past Due) Receivables Balanceon December 31 Estimated Percent ofUncollectible Accounts 0-30 days $293,000 1 % 31-60 days 110,000 8 61-90 days 35,000 20 91-120 days 13,000 55 More than 120 days 18,000 80 Total receivables $469,000arrow_forward

- Use the following to answer questions 20 – 22 At the beginning of the year; MB, Inc.'s allowance for uncollectible accounts had a beginning balance of $6,500. On January 22nd, MB wrote off the A/R from customer C for $340 20. Record the entry for write-off 2$ 31st); total accounts written off were $5,540 (including the write off for customer C). What is the balance in the allowance for uncollectible accounts after all the write-offs? 21. By the end of the year (December 22. $ How much did bad debt expense change when the company wrote off the accounts receivables?arrow_forwardCurrent Attempt in Progress The ledger of Cullumber Company at the end of the current year shows Accounts Receivable $68,000, Credit Sales $810,000, and Sales Returns and Allowances $38,000. Prepare journal entries for each separate scenario below. If Cullumber Company uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Cullumber Company determines that Matisse's $500 balance is uncollectible. (a) If Allowance for Doubtful Accounts has a credit balance of $900 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 8% of accounts receivable. (b) If Allowance for Doubtful Accounts has a debit balance of $490 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 7% of accounts receivable. (c) (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles…arrow_forwardAdams Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31, 2019: Amount 10,000 Customer Billy Adams Stan Fry 8,000 Tammy Imes Shana Wagner 5,000 1,700 Total 24,700 a. Journalize the write-offs for 2019 under the direct write-off method. b. Journalize the write-offs for 2019 under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded $2,600,000 of credit sales during 2019. Based on past history and industry averages, 1.75% of credit sales are expected to be uncollectible. c. How much higher or lower would Adams Company's 2019 net income have been under the direct write-off method than under the allowance method? %24arrow_forward

- A. More Review Show (MRS) prepares quarterly statements. Thebookkeeper presented to you the records and you found out the following account balancesbefore adjustments for the quarter ended March 31, 200B:1. The notes receivable balance of P180,000 as of March 31, 200B consisted of a 60-day 12% note for P120,000 dated February 14, 200B and a 30-day 6% note for P60,000 dated March 16, 200B2. The balance of the prepaid insurance account of P22,000 represents a one-year policycontracted last November 1, 200A for P10,000 and a two-year policy contracted last July 1, 200A for P12,0003. The balance of the prepaid rent account of P50,000 pertains to advance rent paid lastDecember 1, 200A six months effective on the same date.4. The rate per day for each of the four shop workers is P350. MRS pays the weekly salaries of its workers every Monday of the following week ( a week consisting of five days from Monday to Friday). March 31, 200B falls on Thursday.5. Mortgage notes payable had a credit…arrow_forwardMore Review Show (MRS) prepares quarterly statements. The bookkeeper presented to you the records and you found out the following account balances before adjustments for the quarter ended March 31, 200B: The notes receivable balance of P180,000 as of March 31, 200B consisted of a 60-day 12% note for P120,000 dated February 14, 200B and a 30-day 6% note for P60,000 dated March 16, 200B Required: Prepare adjusting entryarrow_forwardDuring its first year of operation in 2014, Browne Sales Corporation made most of its sales on credit. At the end of the year, accounts receivable amounted to $199,000. On December 31, 2014, management reviewed the collectible status of the accounts receivable. Approximately $16,500 of the $199,000 of accounts receivable were estimated to be uncollectible. What adjusting entry would be made December 31, 2014?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY