Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 3PB

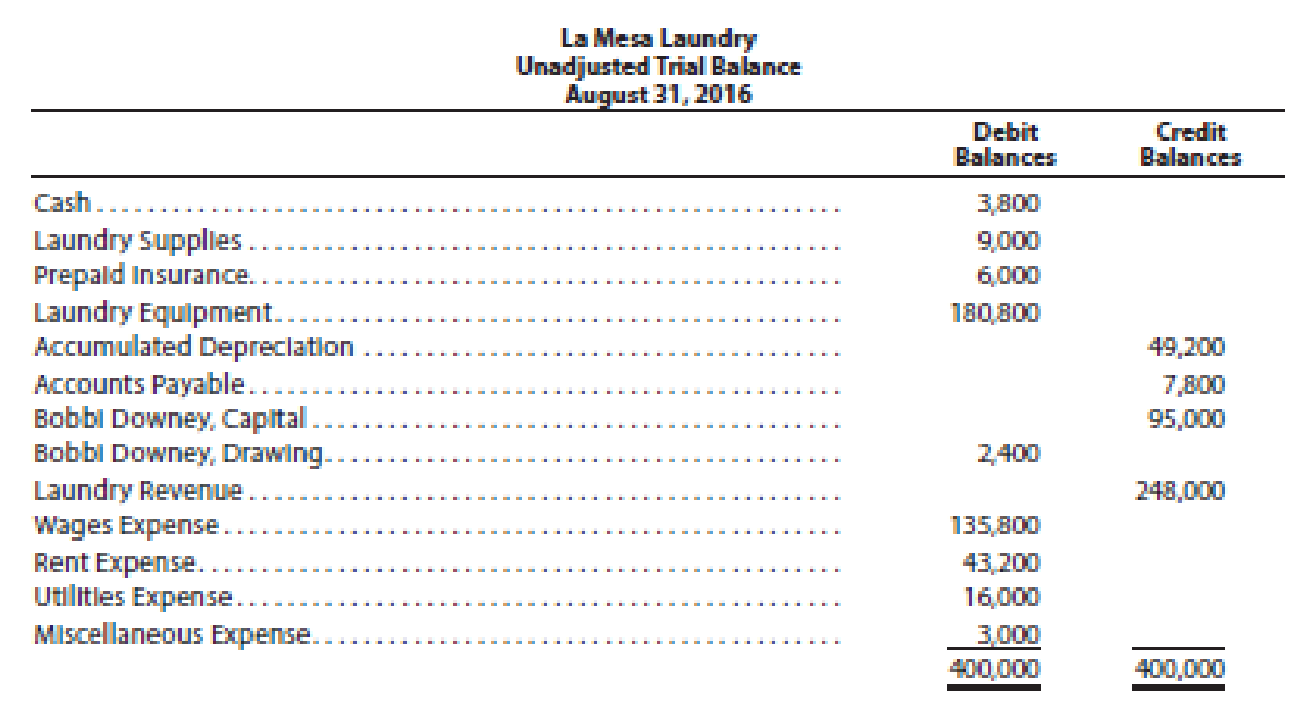

The unadjusted

The data needed to determine year-end adjustments are as follows:

- a. Wages accrued but not paid at August 31 are $2,200.

- b.

Depreciation of equipment during the year is $8,150. - c. Laundry supplies on hand at August 31 are $2,000.

- d. Insurance premiums expired during the year are $5,300.

Instructions

- 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as “Aug. 31 Bal.” In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.

- 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

- 3. Journalize and post the

adjusting entries . Identify the adjustments by “Adj.” and the new balances as “Adj. Bal.” - 4. Prepare an adjusted trial balance.

- 5. Prepare an income statement, a statement of owner’s equity (no additional investments were made during the year), and a

balance sheet . - 6. Journalize and

post the closing entries. Identify the closing entries by “Clos.” - 7. Prepare a post-closing trial balance.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Unadjusted account balances at December 31, 2019, for Rapisarda Company are as follows: The following data are not yet recorded:a. Depreciation on the equipment is $18,350.b. Unrecorded wages owed at December 31, 2019: $4,680.c. Prepaid rent at December 31, 2019: $9,240.d. Income taxes expense: $5,463.Required:Prepare a completed worksheet for Rapisarda Company.

The unadjusted trial balance of Epicenter Laundry at June 30, 2019, the end of the fiscal year, follows:

The data needed to determine year-end adjustments are as follows:a. Laundry supplies on hand at June 30 are $3,600.b. Insurance premiums expired during the year are $5,700.c. Depreciation of laundry equipment during the year is $6,500.d. Wages accrued but not paid at June 30 are $1,100.Instructions1. For each account listed in the unadjusted trial balance, enter the balance in a Taccount. Identify the balance as “June 30 Bal.” In addition, add T accounts for WagesPayable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense.2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.3. Journalize and post the adjusting entries. Identify the adjustments as “Adj.” and the new balances as “Adj. Bal.”4. Prepare an adjusted trial balance.5. Prepare an income statement, a…

The information necessary for preparing the 2021 year-end adjusting entries for Winter Storage appears below. Winter's fiscal year-end is December 31.Depreciation on the equipment for the year is $7,000.Salaries earned by employees (but not paid to them) from December 16 through December 31, 2021, are $3,400.On March 1, 2021, Winter lends an employee $12,000 and a note is signed requiring principal and interest at 6% to be paid on February 28, 2022.On April 1, 2021, Winter pays an insurance company $15,000 for a one-year fire insurance policy. The entire $15,000 is debited to prepaid insurance at the time of the purchase.$1,500 of supplies are used in 2021.A customer pays Winter $4,200 on October 31, 2021, for six months of storage to begin November 1, 2021. Winter credits deferred revenue at the time of cash receipt.On December 1, 2021, $4,000 rent is paid to a local storage facility. The payment represents storage for December 2021 through March 2022, at $1,000 per month. Prepaid…

Chapter 4 Solutions

Financial Accounting

Ch. 4 - Prob. 1DQCh. 4 - Describe the nature of the assets that compose the...Ch. 4 - Prob. 3DQCh. 4 - Prob. 4DQCh. 4 - Why are closing entries required at the end of an...Ch. 4 - Prob. 6DQCh. 4 - What is the purpose of the post-closing trial...Ch. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - Recent fiscal years for several well-known...

Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - Marcie Davies owns and operates Gemini Advertising...Ch. 4 - Prob. 2PEBCh. 4 - The following accounts appear in an adjusted trial...Ch. 4 - The following accounts appear in an adjusted trial...Ch. 4 - After the accounts have been adjusted at October...Ch. 4 - After the accounts have been adjusted at April 30,...Ch. 4 - From the following list of steps in the accounting...Ch. 4 - From the following list of steps in the accounting...Ch. 4 - Balance sheet data for HQ Properties Company...Ch. 4 - Balance sheet data for Brimstone Company follows:...Ch. 4 - The balances for the accounts that follow appear...Ch. 4 - Prob. 2ECh. 4 - Bamboo Consulting is a consulting firm owned and...Ch. 4 - Elliptical Consulting is a consulting firm owned...Ch. 4 - The following account balances were taken from the...Ch. 4 - The following revenue and expense account balances...Ch. 4 - FedEx Corporation had the following revenue and...Ch. 4 - Apex Systems Co. offers its services to residents...Ch. 4 - Selected accounts from the ledger of Restoration...Ch. 4 - Prob. 10ECh. 4 - At the balance sheet date, a business owes a...Ch. 4 - Prob. 12ECh. 4 - List the errors you find in the following balance...Ch. 4 - Prob. 14ECh. 4 - Prior to its closing, Income Summary had total...Ch. 4 - After all revenue and expense accounts have been...Ch. 4 - Prob. 17ECh. 4 - Prob. 18ECh. 4 - An accountant prepared the following post-closing...Ch. 4 - Rearrange the following steps in the accounting...Ch. 4 - The following data (in thousands) were taken from...Ch. 4 - Prob. 22ECh. 4 - Prob. 23ECh. 4 - Alert Security Services Co. offers security...Ch. 4 - Alert Security Services Co. offers security...Ch. 4 - Prob. 26ECh. 4 - Based on the data in Exercise 4-24, prepare the...Ch. 4 - Based on the data in Exercise 4-25, prepare the...Ch. 4 - Prob. 1PACh. 4 - Finders Investigative Services is an investigative...Ch. 4 - The unadjusted trial balance of Epicenter Laundry...Ch. 4 - The unadjusted trial balance of Lakota Freight Co....Ch. 4 - For the past several years, Steffy Lopez has...Ch. 4 - Last Chance Company offers legal consulting advice...Ch. 4 - The Gorman Group is a financial planning services...Ch. 4 - The unadjusted trial balance of La Mesa Laundry at...Ch. 4 - The unadjusted trial balance of Recessive...Ch. 4 - For the past several years, Jeff Horton has...Ch. 4 - The unadjusted trial balance of PS Music as of...Ch. 4 - Kelly Pitney began her consulting business, Kelly...Ch. 4 - Picasso Graphics is a graphics arts design...Ch. 4 - The following is an excerpt from a telephone...Ch. 4 - Prob. 3CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31, 2017. Unrecorded depreciation on the trucks at the end of the year is $9,602. The total amount of accrued interest expense at year-end is $8,000. The cost of unused office supplies still available at year-end is $1,200. 1. Use the above information about the company’s adjustments to complete a 10-column work sheet.2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31, 2017.2b. Determine the capital amount to be reported on the December 31, 2017 balance sheet.arrow_forwardThe following additional accounts from Recessive Interiors' chart of accounts should be used: Wages Payable, 22; Income Summary, 33; Depreciation Expense-Equipment, 54; Supplies Expense, 55; Depreciation Expense-Trucks, 56; Insurance Expense, 57. The data needed to determine year-end adjustments are as follows: Supplies on hand at January 31 are $2,850. Insurance premiums expired during the year are $3,150. Depreciation of equipment during the year is $5,250. Depreciation of trucks during the year is $4,000. Wages accrued but not paid at January 31 are $900. Required: 1. Journalize the adjusting entries on of the journal. 2. Prepare an adjusted trial balance. 3. Prepare a post-closing trial balance.arrow_forwardThe following additional accounts from Recessive Interiors' chart of accounts should be used: Wages Payable, 22; Income Summary, 33; Depreciation Expense-Equipment, 54; Supplies Expense, 55; Depreciation Expense-Trucks, 56; Insurance Expense, 57. The data needed to determine year-end adjustments are as follows: Supplies on hand at January 31 are $2,850. Insurance premiums expired during the year are $3,150. Depreciation of equipment during the year is $5,250. Depreciation of trucks during the year is $4,000. Wages accrued but not paid at January 31 are $900. Required: 1. Journalize the closing entries on of the journal. Then post to the general ledger in the attached spreadsheet. For a compound transaction, if an amount box does not require an entry, leave it blank.arrow_forward

- The following additional accounts from Recessive Interiors' chart of accounts should be used: Wages Payable, 22; Income Summary, 33; Depreciation Expense-Equipment, 54; Supplies Expense, 55; Depreciation Expense-Trucks, 56; Insurance Expense, 57. The data needed to determine year-end adjustments are as follows: Supplies on hand at January 31 are $2,850. Insurance premiums expired during the year are $3,150. Depreciation of equipment during the year is $5,250. Depreciation of trucks during the year is $4,000. Wages accrued but not paid at January 31 are $900. Required: 1. Prepare an income statement. 2. Prepare a Statement of Owner's Equity (no additional investments were made during the year.) 3. Prepare a balance sheet.arrow_forwardCedar Valley is a national restoration contractor licensed in roofing, siding, gutters and windows. Cedar Valley's balance of Allowance for Uncollectible Accounts is $2,300 (debit before adjustment at the end of the year. The company estimates future uncollectible accounts to be $11,500. What is the adjustment Cedar Valley would record for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjusting entry for Allowance for Uncollectible Accounts. Note: Enter debits before credits. Transaction General Jounal Debit Credit Record entry Clear entry View general journalarrow_forwardQueenan Company computes depreciation on delivery equipment at $1,000 for the month of June. The adjusting entry to record this depreciation should be reflected as:arrow_forward

- Required 1. Prepare and complete a 10-column work sheet for fiscal year 2019, starting with the unadjusted trial balance and including adjustments based on these additional facts. a. The supplies available at the end of fiscal year 2019 had a cost of $7,900. b. The cost of expired insurance for the fiscal year is $10,600. c. Annual depreciation on equipment is $7,000. d. The April utilities expense of $800 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $800 amount owed needs to be recorded. e. The company’s employees have earned $2,000 of accrued and unpaid wages at fiscal year-end. f. The rent expense incurred and not yet paid or recorded at fiscal year-end is $3,000. g. Additional property taxes of $550 have been assessed for this fiscal year but have not been paid or recorded in the accounts. h. The $300 accrued interest for April on the long-term notes payable has not yet been paid or recorded. 2. Using information…arrow_forwardAfter completing the adjusting entries but before closing the nominal accounts as of December 31, 2020, the following errors were discovered in the records of Winston Corporation: 1) Depreciation computed on the building for the years 2018, 2019 and 2020 were overstated by P10,000 per year. 2) Cost of the minor repair on the machinery of P1,200, made on June 30, 2019, was charged to Machinery account. Machinery balance is depreciated at an annual rate of 10%. 3) Unused office supplies as of December 31, 2019 of P1,250 were overlooked. The company debits Office supplies expense upon purchase of supplies. 4) 3-year insurance premium of P12,000 was paid on October 1, 2018. The amount was charged to Insurance expense account and no adjustment for the unexpired premium was taken up. 5) Merchandise purchased on 2019 of P32,000, term: FOB shipping point, was taken up in the books when the goods were received in January 2020. These items were not included in the inventory count made on…arrow_forwardOlney Cleaning Company had the following items that require adjustment at year end. For one cleaning contract, $11,100 cash was received in advance. The cash was credited to Unearned Service Revenue upon receipt. At year end, $260 of the service revenue was still unearned. For another cleaning contract, $8,700 cash was received in advance and credited to Unearned Service Revenue upon receipt. At year end, $3,000 of the services had been provided. Required: 1. Prepare the adjusting journal entries needed at December 31. If an amount box does not require an entry, leave it blank. Dec. 31 Unearned Service Revenue fill in the blank 02e1a8f7d03afe9_2 fill in the blank 02e1a8f7d03afe9_3 Service Revenue fill in the blank 02e1a8f7d03afe9_5 fill in the blank 02e1a8f7d03afe9_6 Dec. 31 Unearned Service Revenue fill in the blank 02e1a8f7d03afe9_8 fill in the blank 02e1a8f7d03afe9_9 Service Revenue fill in the blank 02e1a8f7d03afe9_11 fill in the blank 02e1a8f7d03afe9_12…arrow_forward

- The following information is available for Drake Company, which adjusts and closes its accounts every December 31: 1. Salaries accrued but unpaid total $2,840 on December 31. 2. The $247 December utility bill arrived on December 31 and has not been paid or recorded. 3. Buildings with a cost of $78,000, 25-year life, and $9,000 residual value are to be depreciated; equipment with a cost of $44,000, 8-year life, and $2,000 residual value is also to be depreciated. The straight-line method is to be used. 4. A count of supplies indicates that the Store Supplies account should be reduced by $128 and the Office Supplies account reduced by $397 for supplies used during the year. 5. The company holds a $6,000, 12% (annual rate), 6-month note receivable dated September 30, from a customer. The interest is to be collected on the maturity date. 6. Bad debts expense is estimated to be 1% of annual sales. Sales total $65,000. 7. An analysis of the company insurance policies…arrow_forwardThe Sea Gull Company opened for business on January 1, 2018. Its trial balance before adjustment on December 31 is as follows: Other data:1. Annual depreciation is TK. 20,000 on the buildings.2. TK. 6,000 of supplies are used during the year.3. Services are performed for Tk. 5,000 but not received and recorded yet.4. Interest rate is 12%. Mortgage was taken on July 1. Required: Prepare a complete worksheet.arrow_forwardYour examination of Sullivan Company’s records provides the following information for the December 31, year-end adjustments: 1. Bad debts are to be recorded at 2% of sales. Sales made on credit totaled $25,000 for the year. 2. Salaries at year-end that have accumulated but have not been paid total $1,400. 3. Annual straight-line depreciation for the company’s equipment is based on a cost of $30,000, an estimated life of 8 years, and an estimated residual value of $2,000. 4. Prepaid insurance in the amount of $800 has expired. 5. Interest that has been earned but not collected totals $500. 6. The company has satisfied performance obligations entitling it to rent…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License