Concept explainers

(a)

T- Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

To Enter: The beginning balancesin the general ledger as of April 30, 2017.

(a)

Explanation of Solution

The beginning balancesare entered in the general ledger using T- Accounts as on April 30, 2017 as follows:

| Cash | |||

| Apr. 30 | $5,000 | ||

| Bal. | $ 5,000 | ||

Table (1)

| Supplies | |||

| Apr. 30 | $ 500 | ||

| Bal. | $ 500 | ||

Table (2)

| Equipment | |||

| Apr. 30 | $ 24,000 | ||

| Bal. | $ 24,000 | ||

Table (3)

| Accounts Payable | |||

| Apr. 30 | $2,100 | ||

| Bal. | $ 2,100 | ||

Table (4)

| Notes Payable | |||

| Apr. 30 | $10,000 | ||

| Bal. | $10,000 | ||

Table (5)

| Unearned Service Revenue | |||

| Apr. 30 | $ 1,000 | ||

| Bal. | $ 1,000 | ||

Table (6)

| Common Stock | |||

| Apr. 30 | $ 5,000 | ||

| Bal. | $ 5,000 | ||

Table (7)

| Retained earnings | |||

| Apr. 30 | $11,400 | ||

| Bal. | $11,400 | ||

Table (8)

(b)

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

To journalize: The business transactions as given for Incorporation P.

(b)

Explanation of Solution

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| May 1 | Rent Expenses | 1,000 | |

| Cash | 1,000 | ||

| (To record the payment of rent) | |||

| May 4 | Accounts Payable | 1,100 | |

| Cash | 1,100 | ||

| (To record the payment of account payable at April 30) | |||

| May 7 | Cash | 1,500 | |

| Unearned Service revenue | 1,500 | ||

| (To record the cash received in advance for the services yet to be provided) | |||

| May 8 | Cash | 1,200 | |

| Service Revenue | 1,200 | ||

| (To record the cash received for the services performed) | |||

| May 14 | Salaries Expenses | 1,200 | |

| Cash | 1,200 | ||

| (To record the payment of salaries to employees) | |||

| May 15 | Cash | 800 | |

| Service Revenue | 800 | ||

| (To record the collection of cash for the services performed) | |||

| May 15 | Unearned Service revenue | 700 | |

| Service Revenue | 700 | ||

| (To record the recognition of service revenue from the unearned service revenue account) | |||

| May 21 | Accounts Payable | 1,000 | |

| Cash | 1,000 | ||

| (To record the payment of cash on account from the remaining balance due on April 30) | |||

| May 22 | Cash | 1,000 | |

| Service Revenue | 1,000 | ||

| (To record the cash received for the services performed) | |||

| May 22 | Supplies | 700 | |

| Accounts Payable | 700 | ||

| (To record the purchase of supplies on account) | |||

| May 25 | Advertising Expenses | 500 | |

| Accounts Payable | 500 | ||

| (To record the advertising expenses, due to be paid on June 13) | |||

| May 25 | Utilities Expenses | 400 | |

| Cash | 400 | ||

| (To record the payment of utilities expenses) | |||

| May 29 | Cash | 1,700 | |

| Service Revenue | 1,700 | ||

| (To record the cash received for the services performed) | |||

| May 29 | Unearned Service revenue | 600 | |

| Service Revenue | 600 | ||

| ( To record the recognition of service revenue from the unearned service revenue account) | |||

| May 31 | Interest Expenses | 50 | |

| Cash | 50 | ||

| (To record the payment of interest on notes payable) | |||

| May 31 | Salaries Expenses | 1,200 | |

| Cash | 1,200 | ||

| (To record the salaries paid to the employees) | |||

| May 31 | Income Tax Expenses | 150 | |

| Cash | 150 | ||

| (To record the payment of income tax) |

Table(1)

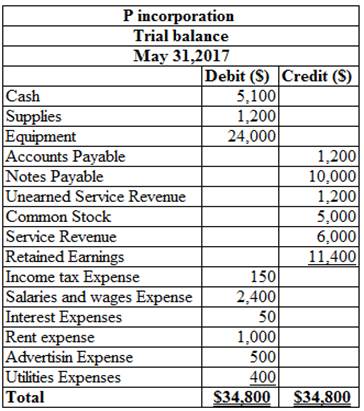

(c)

A trial balance is the summary of all the ledger accounts. The trial balance is prepared to check the total balance of the debit with the total of the balance of the credit column, which must be equal. The trial balance is usually prepared to check accuracy of ledger balances. In trial balance the debit balances are listed in the left column, and credit balances are listed in the right column.

To

(c)

Explanation of Solution

| Cash | |||

| Apr. 30 | $ 5,000 | May. 1 | $1,000 |

| May. 7 | $ 1,500 | 4 | $1,100 |

| 8 | $ 1,200 | 14 | $1,200 |

| 15 | $ 800 | 21 | $1,000 |

| 22 | $ 1,000 | 25 | $ 400 |

| 29 | $ 1,700 | 31 | $ 50 |

| 31 | $1,200 | ||

| 31 | $ 150 | ||

| Total | 11,200 | Total | 6,100 |

| Bal. | $ 5,100 | ||

Table (1)

| Supplies | |||

| Apr. 30 | $ 500 | ||

| Bal. | $ 500 | ||

Table (2)

| Equipment | |||

| Apr. 30 | $24,000 | ||

| Bal. | $24,000 | ||

Table (3)

| Accounts Payable | |||

| Apr. 30 | $2,100 | ||

| May 4 | $1,100 | May 22 | $ 700 |

| May 21 | $1,000 | 25 | $ 500 |

| Total | $2,100 | Total | $3,300 |

| Bal. | $1,200 | ||

Table (4)

| Notes Payable | |||

| Apr. 30 | $10,000 | ||

| Bal. | $10,000 | ||

Table (5)

| Unearned Service Revenue | |||

| Apr. 30 | $ 1,000 | ||

| May 15 | $ 700 | May 7 | $ 1,500 |

| May 29 | $ 600 | ||

| Total | $ 1,300 | Total | $2,500 |

| Bal. | $1,200 | ||

Table (6)

| Common Stock | |||

| Apr. 30 | $ 5,000 | ||

| Bal. | $ 5,000 | ||

Table (7)

| Retained earnings | |||

| Apr. 30 | $11,400 | ||

| Bal. | $11,400 | ||

Table (8)

| Service Revenue | |||

| May. 8 | $1,200 | ||

| 15 | $ 800 | ||

| 15 | $ 700 | ||

| 22 | $1,000 | ||

| 29 | $1,700 | ||

| 29 | $ 600 | ||

| Bal. | $6,000 | ||

Table (9)

| Salaries and wages expenses | |||

| May 14 | $ 1,200 | ||

| May 31 | $ 1,200 | ||

| Bal. | $ 2,400 | ||

Table (10)

| Rent Expense | |||

| May. 1 | $1,000 | ||

| Bal. | $1,000 | ||

Table (11)

| Supplies Expense | |||

| May. 22 | $ 700 | ||

| Bal. | $ 700 | ||

Table (12)

| Advertising Expense | |||

| May. 25 | $ 500 | ||

| Bal. | $ 500 | ||

Table (13)

| Utilities Expense | |||

| May. 25 | $ 400 | ||

| Bal. | $ 400 | ||

Table (14)

| Interest Expense | |||

| May. 31 | $ 50 | ||

| Bal. | $ 50 | ||

Table (15)

| Income tax Expense | |||

| May. 31 | $ 150 | ||

| Bal. | $ 150 | ||

Table (16)

(d)

To Prepare: The trial balance of Incorporation P as on May 31, 2017.

(d)

Explanation of Solution

Table-1

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

- Marx Corporation has accounts receivable of $96,000 at March 31, 2018. An analysis of the accounts shows these amounts. Balance, March 31 Month of Sale 2018 2017 March (current) $65,500 $76,100 February (1 – 30 days past due) 13,100 7,200 December and January (31 – 90 days past due) 9,500 2,500 (over 90 days past due) 7,900 1,200 $96,000 $87,000 Credit terms are 2/10, n/30. At March 31, 2018, there is an unadjusted $2,400 credit balance in Allowance for Doubtful Accounts. The company uses the percentage of receivables by age category for estimating uncollectible accounts Marx’s estimates of bad debts are as shown below. Age of Accounts Estimated PercentageUncollectible Current 2% 1–30 days past due 6% 31–90 days past due 30% Over 90 days past due 50% Prepare an aging schedule to determine the total estimated uncollectibles at March 31, 2018. Accounts Receivable…arrow_forwardMarx Corporation has accounts receivable of $96,000 at March 31, 2018. An analysis of the accounts shows these amounts. Balance, March 31 Month of Sale 2018 2017 March (current) $65,500 $76,100 February (1 – 30 days past due) 13,100 7,200 December and January (31 – 90 days past due) 9,500 2,500 (over 90 days past due) 7,900 1,200 $96,000 $87,000 Credit terms are 2/10, n/30. At March 31, 2018, there is an unadjusted $2,400 credit balance in Allowance for Doubtful Accounts. The company uses the percentage of receivables by age category for estimating uncollectible accounts Marx’s estimates of bad debts are as shown below. Age of Accounts Estimated PercentageUncollectible Current 2% 1–30 days past due 6% 31–90 days past due 30% Over 90 days past due 50% Prepare the adjusting entry at March 31, 2018, to record bad debts expense. (Credit account titles are automatically indented when amount is…arrow_forwardMarx Corporation has accounts receivable of $96,000 at March 31, 2018. An analysis of the accounts shows these amounts. Balance, March 31 Month of Sale 2018 2017 March (current) $65,900 $76,200 February (1 – 30 days past due) 12,900 7,900 December and January (31 – 90 days past due) 10,100 2,100 (over 90 days past due) 7,100 1,200 $96,000 $87,400 Credit terms are 2/10, n/30. At March 31, 2018, there is an unadjusted $2,300 credit balance in Allowance for Doubtful Accounts. The company uses the percentage of receivables by age category for estimating uncollectible accounts Marx’s estimates of bad debts are as shown below. Age of Accounts Estimated PercentageUncollectible Current 3% 1–30 days past due 6% 31–90 days past due 30% Over 90 days past due 50% Prepare the adjusting entry at March 31, 2018, to record bad debts expense.arrow_forward

- Marx Corporation has accounts receivable of $96,000 at March 31, 2018. An analysis of the accounts shows these amounts. Balance, March 31 Month of Sale 2018 2017 March (current) $65,900 $76,200 February (1 – 30 days past due) 12,900 7,900 December and January (31 – 90 days past due) 10,100 2,100 (over 90 days past due) 7,100 1,200 $96,000 $87,400 Credit terms are 2/10, n/30. At March 31, 2018, there is an unadjusted $2,300 credit balance in Allowance for Doubtful Accounts. The company uses the percentage of receivables by age category for estimating uncollectible accounts Marx’s estimates of bad debts are as shown below. Age of Accounts Estimated PercentageUncollectible Current 3% 1–30 days past due 6% 31–90 days past due 30% Over 90 days past due 50% Prepare an aging schedule to determine the total estimated uncollectibles at March 31, 2018.arrow_forwardYeah Corporation has accounts receivable of $96,000 at March 31, 2018. An analysis of the accounts shows these amounts. Balance, March 31 Month of Sale 2018 2017 March (current) $65,900 $76,200 February (1 – 30 days past due) 12,900 7,900 December and January (31 – 90 days past due) 10,100 2,100 (over 90 days past due) 7,100 1,200 $96,000 $87,400 Credit terms are 2/10, n/30. At March 31, 2018, there is an unadjusted $2,300 credit balance in Allowance for Doubtful Accounts. The company uses the percentage of receivables by age category for estimating uncollectible accounts Yeah's estimates of bad debts are as shown below. Age of Accounts Estimated PercentageUncollectible Current 3% 1–30 days past due 6% 31–90 days past due 30% Over 90 days past due 50% Prepare an aging schedule to determine the total estimated uncollectibles at March 31, 2018. Accounts Receivable…arrow_forwardAt the beginning of 2009, Pental Company had the following balances: A/R = $122,000 Allowance for Uncollectible Accounts = $7,900 During 2009, their credit sales were $1,173,000 and collections on A/R were $1,150,000. The following additional transactions occurred during the year: Feb 17, wrote off XXX Account, $3.600 May 28, wrote off YYY Account, $2,400 Dec 15, wrote off ZZZ Account, $900 Dec 31, recorded bad debts expense assuming that Penman's policy is to record bad debts expense at 0.8% of credit sales (Hint: The allowance account is increased by 0.8% of credit sales regardless of write-offs.) Compute the ending balance in A/R and the allowance for uncollectible accounts. Show how Pental's Dec 31, 2009 balance sheet reports the two accounts.arrow_forward

- The following information is available for Reigen Company relating to 2019 operations: Accounts Receivable, January 1 4,000,000 Accounts receivable collected 8,400,000 Cash sales 2,000,000 Inventory, Jan. 1 4,800,000 Inventory, Dec. 31 4,400,000 Purchases 8,000,000 Gross Margin on Sales 4,200,000 What is the balance of accounts receivable on December 31, 2019?arrow_forwardDuring the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $120,000, of which $60,000 was on credit. At the start of 2021, Accounts Receivable showed a $12,000 debit balance and the Allowance for Doubtful Accounts showed a $500 credit balance. Collections of accounts receivable during 2021 amounted to $58,000. Data during 2021 follow: a. On December 10, a customer balance of $1,000 from a prior year was determined to be uncollectible, so it was written off. b. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Required: 1. Give the required journal entries for the two events in December. 2-a. Show how the amounts related to Bad Debt Expense would be reported on the income statement. 2-b. Show how the amounts related to Accounts Receivable would be reported on the balance sheet. 3. On the basis of the data available, does the 2 percent rate appear to be reasonable?arrow_forwardA Plus Services has the following transactions during January: Credit sales of $110,000, collections of credit sales of $87,000, and write-offs of $19,000. A Plus Services uses the direct write-off method. At the end of January, the balance of Accounts Receivable is ________.arrow_forward

- Nonnas Re-Appliance Store collects 55% of its accounts receivable in the month of sale and 40% in the month after the sale. Given the following sales, how much cash will be collected in February?arrow_forwardCatherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardFitbands estimated sales are: What are the balances in accounts receivable for January, February, and March if 65% of sales is collected in the month of sale, 25% is collected the month after the sale, and 10% is second month after the sale?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning - Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College