a.

To calculate: The return on stockholders’ equity for Cable Corporation and Multi-Media Inc. and compute which firm has higher revenue.

Introduction:

Return on stockholders’ equity:

It is a profitability ratio that computes the capability of a company to generate profits out of the investments made by its shareholders.

a.

Answer to Problem 17P

The return on stockholders’ equity for Cable Corporation is 13.05% and that for Multi-Media Inc.is 33.1%.

Multi-Media Inc. has higher returns on stockholders’ equity than Cable Corporation.

Explanation of Solution

Calculation of the return on stockholders’ equity for Cable Corporation:

Calculation of the return on stockholders’ equity for Multi-Media Inc.:

b.

To determine: The additional ratios for both the firms.

Introduction:

The ratio of net income to sales:

It is used to compute the profit margin ratio, which shows the degree to the company makes money from its business activities.

The ratio of net income to total assets:

It is used to compute the

The ratio of sales to total assets:

It is used to compute the asset turnover ratio of the company, which shows the capability of the assets of a company to generate sales or revenue.

b.

Answer to Problem 17P

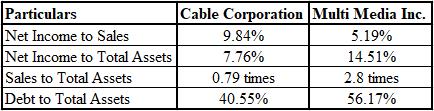

Calculation of additional ratios for Cable Corporation and Multi Media Incorporation:

Explanation of Solution

Explanatio n:

Calculation of the ratio of net income to sales for Cable Corporation:

Calculation of the ratio of net income to total assets for Cable Corporation:

Calculation of the ratio of sales to total assets for Cable Corporation:

Calculation of the ratio of debt to total assets for Cable Corporation:

Calculation of the ratio of net income to sales for Multi-Media Inc.:

Calculation of the ratio of net income to total assets for Multi-Media Inc.:

Calculation of the ratio of sales to total assets for Multi-Media Inc.:

Calculation of the ratio of debt to total assets for Multi-Media Inc.:

c.

To explain: Whether the addition or detraction of factors from part (b) in one firm gives higher return on stockholders’ equity than the value of other firm that is computed in part (a).

Introduction:

Du point analysis:

It is a structure used for examining fundamental performance by comparing the operational efficiencies of two firms. It helps in scrutinizing the strengths and weaknesses that need to be addressed.

c.

Answer to Problem 17P

The factor that leads to a higher return on total assets of Multi-Media Inc. is that the total asset turnover is more favorable for Multi-Media Inc. as compared to Cable Corporation. The total asset turnover for Multi-Media Inc. is 2.8 while that for Cable Corporation is 0.79.

The debt ratio of Multi-Media Inc. is also higher than that of Cable Corporation, which means that the total assets financed by stockholders’ equity is in a lesser percentage, which leads to higher returns on stockholders’ equity.

Explanation of Solution

The total asset turnover shows the capacity of a firm to generate revenue from its assets. The total asset turnover of Multi-Media Inc. is 2.8, which is more than the total asset turnover ratio of Cable Corporation of 0.79.

The debt ratio shows the leverage capacity of the company. Multi-Media Inc. has a higher debt ratio of 56.17% as compared to that of Cable Corporation, which is 40.55%.

Want to see more full solutions like this?

Chapter 3 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Which of the following ratios is used to measure a firms profitability? a. Liabilities Ă· Equity c. Sales Ă· Assets b. Assets Ă· Equity d. Net Income Ă· Net Salesarrow_forwardAssume the following relationships for the Caulder Corp.: Sales/Total assets Return on assets (ROA) Return on equity (ROE) Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: Debt-to-capital ratio: % % 1.9x 8.0% 13.0%arrow_forwardResolve and explain the result of the current ratio for XYZ Company and compare andexplain this result with the Industry average, where current liabilities = $581,000 andcurrent assets = $832,000. a. Resolve the current ratio for XYZ Company b.Explain the result of the current ratio for XYZ Company c.Compare and explain the result of the current ratio for XYZ Company with the Industryaverage.arrow_forward

- Use the information provided from Sapphire Ltd calculate and comment on the following ratios:1. Profit margin2. Return on equityarrow_forwardDuPont identity. For the firms in the popup window, LOADING... , find the return on equity using the three components of the DuPont identity: operating efficiency, as measured by the profit margin (net income/sales); asset management efficiency, as measured by asset turnover (sales/total assets); and financial leverage, as measured by the equity multiplier (total assets/total equity). First, find the equity of each company. The equity for PepsiCo is $nothing million. (Round to the nearest million dollars.) Help Me Solve ThisView an Example Get More Help Clear All Check Answer Financial Information ($ in millions, 2013) Company Sales Net Income Total Assets Liabilities PepsiCo $66,352 $6,769 $77,328 $53,162 Coca-Cola $46,818 $8,528 $90,042 $56,761 McDonald's $28,089 $5,826 $36,544 $20,553 PrintDonearrow_forwardAssume the following data for Cable Corporation and Multi-Media Incorporated. Net income Sales Total assets Total debt Stockholders' equity Cable Corporation $ 34,400 364,000 448,000 237,000 211,000 Cable Corporation Multi-Media, Incorporated a. 1. Compute return on stockholders' equity for both firms. Note: Input your answers as a percent rounded to 2 decimal places. Return on Stockholders' Equity Multi-Media Incorporated $ 128,000 2,700,000 % % 970,000 468,000 502,000arrow_forward

- using the table find the folloing for the four firms: Enterprise value to EBITDA Ratio Price-Earnings multiole PEG raio Cpmpany Market Value (OMR million) Net Income (OMR million) Earnings Growth Market Value of Equity (OMR million) Market Value of Debt (OMR million) Cash (OMR million) EBITDA (OMR million) Happy 117.95 22.5 4% 53.07 64.87 41.25 43.85 Smart 112.35 20.25 4.5% 59.53 52. 79 45 44.88 Kind 116.26 21 4.65% 69.76 46.5 63.95 28.20 Cheerful 120 24 5% 42 78 62.4 44.32arrow_forward4. According to the basic DuPont equation, a firm's ROE is the product of what other two ratios? a. net profit margin and the equity multiplier b. ROA and the equity multiplier C. net profit margin and return on equity d. net profit margin and total asset turnoverarrow_forwardShow the DuPont framework’s calculation of the three components of return on shareholders’ equity. Whatinformation about a company do these ratios offer?arrow_forward

- See Image for Information Compute the following performance indices for both companies: Profit margin Asset turnover Return on Capital Employed (ROCE) Current ratio Debt equity ratio Compare and analyse the performance of the two companies computed in (1) above and explain what the board of Box Limited needs to do to achieve their objective . c. Which other non-financial measures can influence the decision of the board of Box Limited?arrow_forwardPlease if you can help with these 2, better skip pls Assume the following relationships for the Caulder Corp.: Sales/Total assets 1.5× Return on assets (ROA) 8.0% Return on equity (ROE) 15.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Debt-to-capital ratio: % 2. Thomson Trucking has $9 billion in assets, and its tax rate is 25%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 5.25%. What is its times-interest-earned (TIE) ratio? Round your answer to two decimal places.arrow_forwardDefine each of the following terms: a. Liquid asset b. Liquidity ratios: current ratio; quick ratio c. Asset management ratios: inventory turnover ratio d. Debt management ratios: total debt to total capital; times-interest-earned (TIE) ratio e. Profitability ratios: profit margin; return on total assets (ROA); return on common equity (ROE); return on invested capital (ROIC); basic earning power (BEP) ratio f. Market value ratios: price/earnings (P/E) ratio; market/book (M/B) ratio; enterprise value/EBITDA ratioarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College