Concept explainers

Profitability strategies

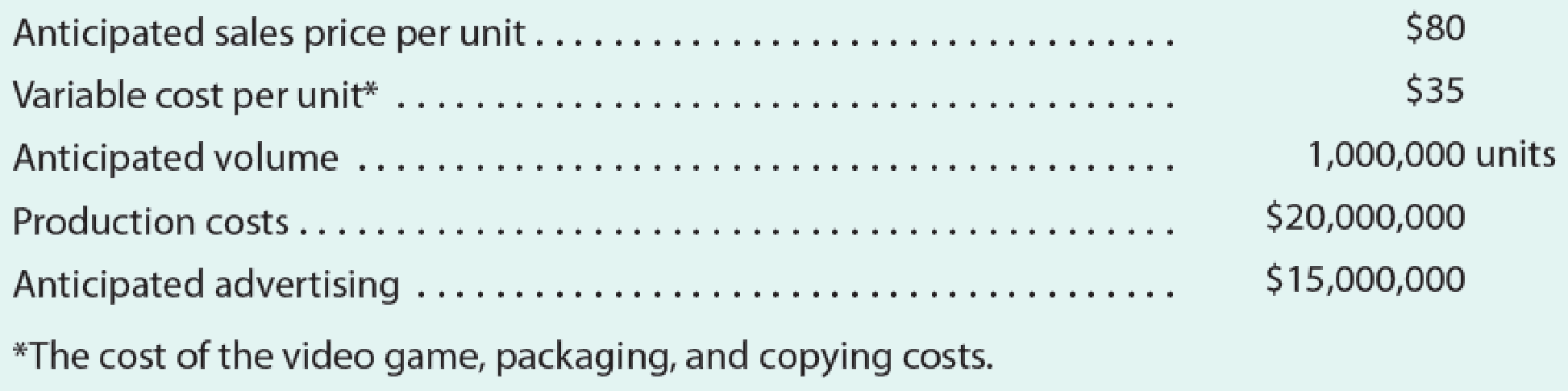

Somerset Inc. has finished a new video game, Snowboard Challenge. Management is now considering its marketing strategies. The following information is available:

Two managers, James Hamilton and Thomas Seymour, had the following discussion of ways to increase the profitability of this new offering:

Two managers, James Hamilton and Thomas Seymour, had the following discussion of ways to increase the profitability of this new offering:

James: I think we need to think of some way to increase our profitability. Do you have any ideas?

Thomas: Well, I think the best strategy would be to become aggressive on price.

James: How aggressive?

Thomas: If we drop the price to $60 per unit and maintain our advertising budget at $15,000,000, I think we will generate total sales of 2,000,000 units.

James: I think that’s the wrong way to go. You’re giving up too much on price. Instead, I think we need to follow an aggressive advertising strategy.

Thomas: How aggressive?

James: If we increase our advertising to a total of $25,000,000, we should be able to increase sales volume to 1,400,000 units without any change in price.

Thomas: I don’t think that’s reasonable. We’ll never cover the increased advertising costs.

Which strategy is best: Keep the price and advertising budget as set, follow the advice of Thomas Seymour, or follow the advice of James Hamilton?

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Financial And Managerial Accounting

- Video Tech is considering marketing one of two new video games for the coming holiday season: Battle Pacific or Space Pirates. Battle Pacific is a unique game and appears to have no competition. Estimated profits (in thousands of dollars) under high, medium, and low demand are as follows: Video Tech is optimistic about its Space Pirates game. However, the concern is that profitability will be affected by a competitor’s introduction of a video game viewed as similar to Space Pirates. Estimated profits (in thousands of dollars) with and without competition are as follows: Develop a decision tree for the Video Tech problem. For planning purposes, Video Tech believes there is a 0.6 probability that its competitor will produce a new game similar to Space Pirates. Given this probability of competition, the director of planning recommends marketing the Battle Pacific video game. Using expected value, what is your recommended decision? Show a risk profile for your recommended decision. Use sensitivity analysis to determine what the probability of competition for Space Pirates would have to be for you to change your recommended decision alternative.arrow_forwardCarizick Co manufactures gaming products. It has created a new games console called the QpBox which is about to be launched. Demand for the QpBox is anticipated to be high. The product life cycle of the QpBox is expected to be three years with 300,000 units forecast to be sold during its first year. Sales volumes are expected to decrease by 75,000 units in each subsequent year. Production volumes will be based on expected demand levels. The following costs for the QpBox have been determined: Design and development Pre-launch advertising Advertising in Year 2 Packaging Manufacturing cost $120m $0.5m $0.4m $3 per unit $80 per unit At a recent board meeting, the finance director said that Carizick Co should look to maximise the profitability of the QpBox over its life cycle. The marketing director made the comment that Carizick Co should focus on extending the maturity phase of the life cycle only as this stage is where the QpBox is most profitable. Contract with Zone Co Carizick Co has…arrow_forwardCompany XYZ is specialized in producing and selling smart watches. The company currently has two products and is planning to improve it profits in the coming years. The company is thinking of introducing a sales commission to encourage its sales people to make more sales and improve company's profitability. When designing the sales commission the company should base the sales commission on: a. The number of employees b. None of the given answers c. The contribution margin d. The selling price e. The color of the productarrow_forward

- Raider Corporation is planning to introduce a new product to its product line. 1. You are tasked with conducting a Cost - Volume - Profit (CVP) analysis for the new product. 2. Discuss the key components of CVP analysis, including the breakeven point, contribution margin, and margin of safety. 3. Additionally, explain how CVP analysis can assist Raider Corporation in making strategic decisions related to pricing, sales volume, and overall profitability for the new product. 4. Discuss any assumptions or limitations associated with CVP analysis that management should be aware of when using this tool for decision-making. 5. Finally, suggest potential strategies that Raider Corporation could employ to improve its CVP metrics and enhance the financial performance of the new product.arrow_forwardCompany XYZ is specialized in producing and selling smart watches. The company currently has two products and is planning to improve it profits in the coming years. The company is thinking of introducing a sales commission to encourage its sales people to make more sales and improve company's profitability. When designing the sales :commission the company should base the sales commission on The selling price a O The number of employees .b O The color of the product .c O The contribution margin .d O None of the given answers .e Oarrow_forwardDirections: For each situation, select one option you think will help increase profit. Put the letter of your choice in the blank. Below each answer, write your rationale. When you have finished, ask your instructor for a copy of the answer guide to verify your responses. A. Avoid extra payroll expenses. B. Get the best rates on advertising. C. Change the product you provide. D. Use resources wisely. E. Beat the competition. F. Get the best rates on supplier purchases. G. Eliminate some free services. H. Increase worker e iciency. _1. A shop that sells fine glassware offers gift wrapping at no extra cost. Rationale: 2. Two stores sell the same video game at the same price. Rationale: 3. There are 12 places to buy the yarn needed for a knitting factory. Rationale: 4. Employees at a printing company do not have a system for completing their tasks quickly and accurately. Rationale: 5. At a sign-making company, the extra metal is discarded. Rationale:arrow_forward

- Southland Corporation’s decision to produce a new line of recreational products resulted in the need to construct either a small plant or a large plant. The best selection of plant size depends on how the marketplace reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as low, medium, or high. The following payoff table shows the projected profit in millions of dollars: What is the decision to be made, and what is the chance event for Southland’s problem? Construct a decision tree. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.arrow_forwardCompany XYZ is specialized in producing and selling smart watches. The company currently has two products and is planning to improve it profits in the coming years. The company is thinking of introducing a sales commission to encourage its sales people to make more sales and improve company's profitability. When designing the sales commission the company should base the sales commission on: O a. The color of the product O b. The number of employees O c. None of the given answers O d. The contribution margin O e. The selling price on The variable cost ratio is calculated as: O a. The selling price per unit / variable cost per unit ved F1 F2 F3 E4 F5 F6 F7 F9 F10 @ 23 $4 % & 1 2 3 4 7 V 8 Q W R Y U D G Hi J K 1. C BYNÍ M { V CO ALarrow_forwardPain is Good Company manufactures a line of premium hot sauces. The company’s managers would like to increase the operating income generated from its best selling sauce Rajin’ Cajun. The product’s sales staff is doubtful that the current customer base would accept a price increase. However, they are confident that the product’s customer base can be expanded without incurring any additional costs. Management has concluded after consulting with key members of the product’s manufacturing and sales teams that all costs for the product line are currently at the lowest level possible. Given the following information for the Rajin’ Cajun line, what is management’s best option for increasing the product line’s operating income by $10,000? Sales Price . . . $5.00 Unit Fixed Cost at current sales volume . . . $0.50 Total Variable Costs at current sales volume . . . $8,750 Current Sales Volume . . . 5,000 units A. Eliminate fixed costs and decrease variable cost per…arrow_forward

- The Miramar Company is going to introduce one of three new products: a widget, a hummer, or a nimnot. The market conditions (favorable, stable, or unfavorable) will determine the profit or loss the company realizes, as shown in the following payoff table: a. Compute the expected value for each decision and select the best one. b. Develop the opportunity loss table and compute the expected opportunity loss for each product. c. Determine how much the firm would be willing to pay to a market research firm to gain better information about future market conditions.arrow_forwardHardy Limited has undertaken research into launching a new product which will take it into a new market area. Hardy feels it has expanded its existing operation to its maximum potential, and it is the market leader in its existing field. The proposed new product would offer new opportunities and, although there is strong competition in its field already, the management feel it can use its existing brand name to break into this product line. The new product is in car cleaning accessories, but will offer items in a single package not currently available. The management believe that,although the proposed product may be relatively short lived, the penetration of new markets is worthwhile as long as the product does not make a loss. Details of the project are as follows: • Market research costs incurred to date amount to £250,000 • Investment in plant at the start: £2,900,000. At the end of the product's life the plant will have a disposal value of £80,000 . The project is estimated to have…arrow_forward. Dawson Electronics is a manufacturer of high-tech control modules for lawn sprinkler systems. Denise, the CEO, is trying to decide if the company should develop one of two potential new products, the Water Saver 1000 or the Greener Grass 5000. With each product, Dawson can capture a bigger market share if it chooses to expand capacity by buying additional machines. Given different demand scenarios, their probabilities of occurrence, and capacity expansion versus no change in capacity, the potential sales of each product are summarized in Table 5.50. Table 5.5 Demand and Sales Information for Dawson Electronics Low Demand. Medium Demand High Demand Low Demand Medium Demand High Demand Water Saver 1000 Dollar Sales ($1,000) With Capacity Expansion 1,000 2,000 3,000 700 Greener Grass 5000 Dollar Sales ($1,000) 1,000 2,000 2,500 Without Capacity Expansion 3,000 5,000 1,000 2,000 3,000 Probability of Occurrence 0.25 0.50 0.25 0.25 0.50 0.25 a. What is the expected payoff for Water Saver…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning