Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 58P

Cost of Goods Manufactured, Income Statement

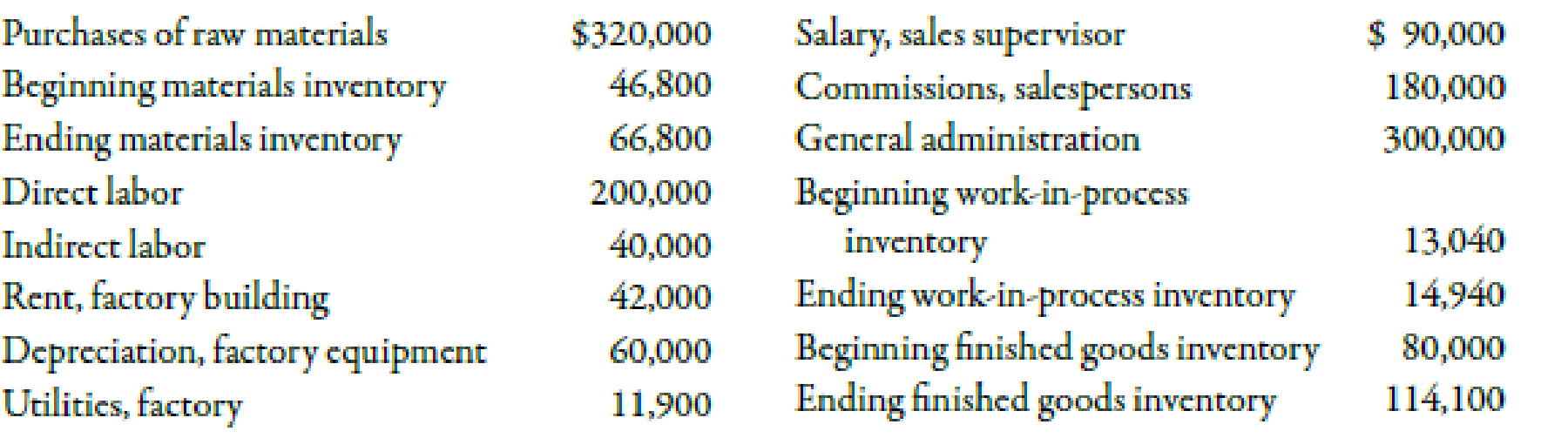

W. W. Phillips Company produced 4,000 leather recliners during the year. These recliners sell for $400 each. Phillips had 500 recliners in finished goods inventory at the beginning of the year. At the end of the year, there were 700 recliners in finished goods inventory. Phillips’ accounting records provide the following information:

Required:

- 1. Prepare a statement of cost of goods manufactured.

- 2. Compute the average cost of producing one unit of product in the year.

- 3. Prepare an income statement for external users.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The following income statement was drawn from the records of Adams Company, a merchandising firm:

ADAMS COMPANY

Income Statement

For the Year Ended December 31, Year 1

Sales revenue (7,500 units x $167)

Cost of goods sold (7,500 units x $82)

Gross margin

Sales commissions (5% of sales)

Administrative salaries expense

Advertising expense

Depreciation expense

Shipping and handling expenses (7,500 units x $5)

Net income

Required

$1,252,500

(615,000)

637,500

(62,625)

(88,000)

(40,000)

(49,000)

(37,500)

$360,375

a. Reconstruct the income statement using the contribution margin format.

b. Calculate the magnitude of operating leverage.

c. Use the measure of operating leverage to determine the amount of net income Adams will earn if sales increase by 20 per

Complete this question by entering your answers in the tabs below.

Req A

Req B and C

Reconstruct the income statement using the contribution margin format.

ADAMS COMPANY

Income Statement

For the Year Ended December 31, Year 1

Cost of Goods Sold, Profit margin, and Net Income for a Manufacturing Company

The following information is available for Bandera Manufacturing Company for the month ending January 31:

Cost of goods manufactured

$165,390

Selling expenses

55,250

Administrative expenses

29,210

Sales

351,890

Finished goods inventory, January 1

39,760

Finished goods inventory, January 31

36,240

a. For the month ended January 31, determine Bandera Manufacturing’s cost of goods sold.

Bandera Manufacturing Company

Cost of Goods Sold

January 31

$

$

$

b. For the month ended January 31, determine Bandera Manufacturing’s gross profit.

Bandera Manufacturing Company

Gross Profit

January 31

$

$

c. For the month ended January 31, determine Bandera Manufacturing’s net income.

Bandera Manufacturing Company

Net Income

January 31

$

Operating expenses:

$

Total operating expenses…

Cost of Goods Sold, Profit margin, and Net Income for a Manufacturing Company

The following information is available for Aricanly Manufacturing Company for the month ending January 31:

Cost of goods manufactured

$292,550

Selling expenses

97,720

Administrative expenses

51,660

Sales

622,440

Finished goods inventory, January 1

70,340

Finished goods inventory, January 31

64,110

a. For the month ended January 31, determine Aricanly's cost of goods sold.

Aricanly Manufacturing

Company

Cost of Goods Sold

January 31

Chapter 2 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 2 - Explain the difference between cost and expense.Ch. 2 - What is the difference between accumulating costs...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - What is a direct cost? An indirect cost? Can the...Ch. 2 - What is allocation?Ch. 2 - What is the difference between a product and a...Ch. 2 - Define manufacturing overhead.Ch. 2 - Explain the difference between direct materials...Ch. 2 - Define prime cost and conversion cost. Why cant...Ch. 2 - How does a period cost differ from a product cost?

Ch. 2 - Define selling cost. Give five examples of selling...Ch. 2 - What is the cost of goods manufactured?Ch. 2 - What is the difference between cost of goods...Ch. 2 - What is the difference between the income...Ch. 2 - Why do firms like to calculate a percentage column...Ch. 2 - Accumulating costs means that a. costs must be...Ch. 2 - Product (or manufacturing) costs consist of a....Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Prob. 4MCQCh. 2 - The accountant in a factory that produces biscuits...Ch. 2 - Which of the following is an indirect cost? a. The...Ch. 2 - Prob. 7MCQCh. 2 - Kelloggs makes a variety of breakfast cereals....Ch. 2 - Prob. 9MCQCh. 2 - Stone Inc. is a company that purchases goods...Ch. 2 - JackMan Company produces die-cast metal bulldozers...Ch. 2 - Prob. 12MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple-Choice...Ch. 2 - Use the following information for Multiple- Choice...Ch. 2 - Prob. 16MCQCh. 2 - Use the following information for Multiple-Choice...Ch. 2 - 2-18 Use the following information for Multiple-...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Direct Materials Used in Production Slapshot...Ch. 2 - Cost of Goods Manufactured Slapshot Company makes...Ch. 2 - Cost of Goods Sold Slapshot Company makes ice...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Prob. 26BEACh. 2 - Prob. 27BEBCh. 2 - Prob. 28BEBCh. 2 - Direct Materials Used in Production Morning Smiles...Ch. 2 - 2-30 Cost of Goods Manufactured Morning Smiles...Ch. 2 - Cost of Goods Sold Morning Smiles Coffee Company...Ch. 2 - Use the following information for Brief Exercises...Ch. 2 - Use the following information for Brief Exercise:...Ch. 2 - Service Organization Income Statement Healing...Ch. 2 - Prob. 35ECh. 2 - Products versus Services, Cost Assignment Holmes...Ch. 2 - Assigning Costs to a Cost Object, Direct and...Ch. 2 - Total and Unit Product Cost Martinez Manufacturing...Ch. 2 - Cost Classification Loring Company incurred the...Ch. 2 - Classifying Cost of Production A factory...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Use the following information for Exercises 2-41...Ch. 2 - Direct Materials Used Hannah Banana Bakers makes...Ch. 2 - Cost of Goods Sold Allyson Ashley makes jet skis....Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-45...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Use the following information for Exercises 2-47...Ch. 2 - Understanding the Relationship between Cost Flows,...Ch. 2 - Manufacturing, Cost Classification, Product Costs...Ch. 2 - Cost Assignment, Direct Costs Harry Whipple, owner...Ch. 2 - Cost of Direct Materials, Cost of Goods...Ch. 2 - Preparation of Income Statement: Manufacturing...Ch. 2 - Cost of Goods Manufactured, Cost of Goods Sold...Ch. 2 - Cost Identification Following is a list of cost...Ch. 2 - Income Statement, Cost of Services Provided,...Ch. 2 - Cost of Goods Manufactured, Income Statement W. W....Ch. 2 - Cost Definitions Luisa Giovanni is a student at...Ch. 2 - Cost Identification and Analysis, Cost Assignment,...Ch. 2 - Cost Analysis, Income Statement Five to six times...Ch. 2 - Cost Classification, Income Statement Gateway...Ch. 2 - Cost Information and Ethical Behavior, Service...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardSalespersons report and analysis Walthman Industries Inc. employs seven salespersons to sell and distribute its product throughout the state. Data taken from reports received from the salespersons during the year ended December 31 are as follows: Instructions 1. Prepare a table indicating contribution margin, variable cost of goods sold as a percent of sales, variable selling expenses as a percent of sales, and contribution margin ratio by salesperson. (Round whole percent to one digit after decimal point.) 2. Which salesperson generated the highest contribution margin ratio for the year and why? 3. Briefly list factors other than contribution margin that should be considered in evaluating the performance of salespersons.arrow_forwardCost of goods sold, profit margin, and net income for a manufacturing company The following information is available for Bandera Manufacturing Company for the month ending January 31: For the month ended January 31, determine Bandera Manufacturings (A) cost of goods sold, (B) gross profit, and (C) net income.arrow_forward

- Reese Manufacturing Company manufactures and sells a limited line of products made to customer order. The company uses a perpetual inventory system and keeps its accounts on a calendar year basis. A 6-column spreadsheet is presented on page 1100. Additional information needed to prepare the income statement and schedule of cost of goods manufactured is as follows: REQUIRED 1. Prepare an income statement and schedule of cost of goods manufactured for the year ended December 31,20--. 2. Prepare a statement of retained earnings for the year ended December 31,20--. 3. Prepare a balance sheet as of December 31, 20--. 4. Prepare the adjusting, closing, and reversing entries.arrow_forwardThe following data are taken from the general ledger and other records of Coral Park Production Co. on January 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forwardThe following data are taken from the general ledger and other records of Phoenix Products Co. on October 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forward

- Cost Classification Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, 216,000. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost?arrow_forwardLangstons purchased $3,100 of merchandise during the month, and its monthly income statement shows a cost of goods sold of $3,000. What was the beginning inventory if the ending inventory was $1,250?arrow_forwardClick the Chart sheet tab. On the screen is a column chart showing ending inventory costs. During a deflationary period, which bar (A, B, or C) represents FIFO costing, which represents LIFO costing, and which represents weighted average? Explain your reasoning. On January 4 following year-end, Rio Enterprises received a shipment of 60 units of product costing 580 each. These units had been ordered by Del in December and had been shipped to him on December 27. They were shipped FOB shipping point. Revise the FIFOLIFO3 worksheet to include this shipment. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as FIFOLIFOT. Using the FIFOLIFO3 file, prepare a 3-D bar (stacked) chart showing the cost of goods sold and ending inventory under each of the four inventory cost flow assumptions. No Chart Data Table is needed. Use the values in the Calculations Section of the worksheet for your chart. Enter your name somewhere on the chart. Save the file again as FIFOLIFO3. Print the chart.arrow_forward

- Cost of Goods Sold, Profit margin, and Net Income for a Manufacturing Company The following information is available for Aricanly Manufacturing Company for the month ending January 31: Cost of goods manufactured $198,240 Selling expenses 66,220 Administrative expenses 35,010 Sales 421,790 099 43,440 Finished goods inventory, January 1 Finished goods inventory, January 31 a. For the month ended January 31, determine Aricanly's cost of goods sold. Aricanly Manufacturing Company Cost of Goods Sold January 31 Finished goods inventory, January 1 Cost of goods manufactured Cost of finished goods available for sale Less finished goods inventory, January 31 PIOS spoob jo 150) Feedback Show all 12:43 AM a (中岁。 11/3/2021 直0 su prt sc delete 114 1AA backspace 00 pause home ctriarrow_forwardThe following Income statement was drawn from the records of Fanning Company, a merchandising firm: Sales revenue (7,000 units x $160) Cost of goods sold (7,000 units * $87) Gross margin Sales commissions (5% of sales) Administrative salaries expense Required For the Year Ended December 31, Year 1 Advertising expense Depreciation expense Shipping and handling expenses (7,000 units * $1) Net income FANNING COMPANY Income Statement Req A a. Reconstruct the Income statement using the contribution margin format. b. Calculate the magnitude of operating leverage. c. Use the measure of operating leverage to determine the amount of net Income Fanning will earn If sales Increase by 20 percent. Complete this question by entering your answers in the tabs below. Reg B and C FANNING COMPANY Income Statement For the Year Ended December 31, Year 1 Less: Variable costs Reconstruct the income statement using the contribution margin format. Less: Fixed costs $1,120,088 (609,000) 511,000 (56,000)…arrow_forwardThe following Income statement was drawn from the records of Campbell Company, a merchandising firm: CAMPBELL COMPANY Income Statement For the Year Ended December 31, Year 1 Sales revenue (7,000 units × $165) Cost of goods sold (7,000 units x $87) Gross margin Sales commissions (10% of sales) Administrative salaries expense Advertising expense Depreciation expense Shipping and handling expenses (7,000 units × $2) Net income Required Req A a. Reconstruct the income statement using the contribution margin format. b. Calculate the magnitude of operating leverage. c. Use the measure of operating leverage to determine the amount of net Income Campbell will earn if sales Increase by 20 percent. Complete this question by entering your answers in the tabs below. Req B and C Less: Variable costs Less: Fixed costs Reconstruct the income statement using the contribution margin format. CAMPBELL COMPANY Income Statement For the Year Ended December 31, Year 1 $ $1,155,000 (609,000) 546,000 (115,500)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License