Concept explainers

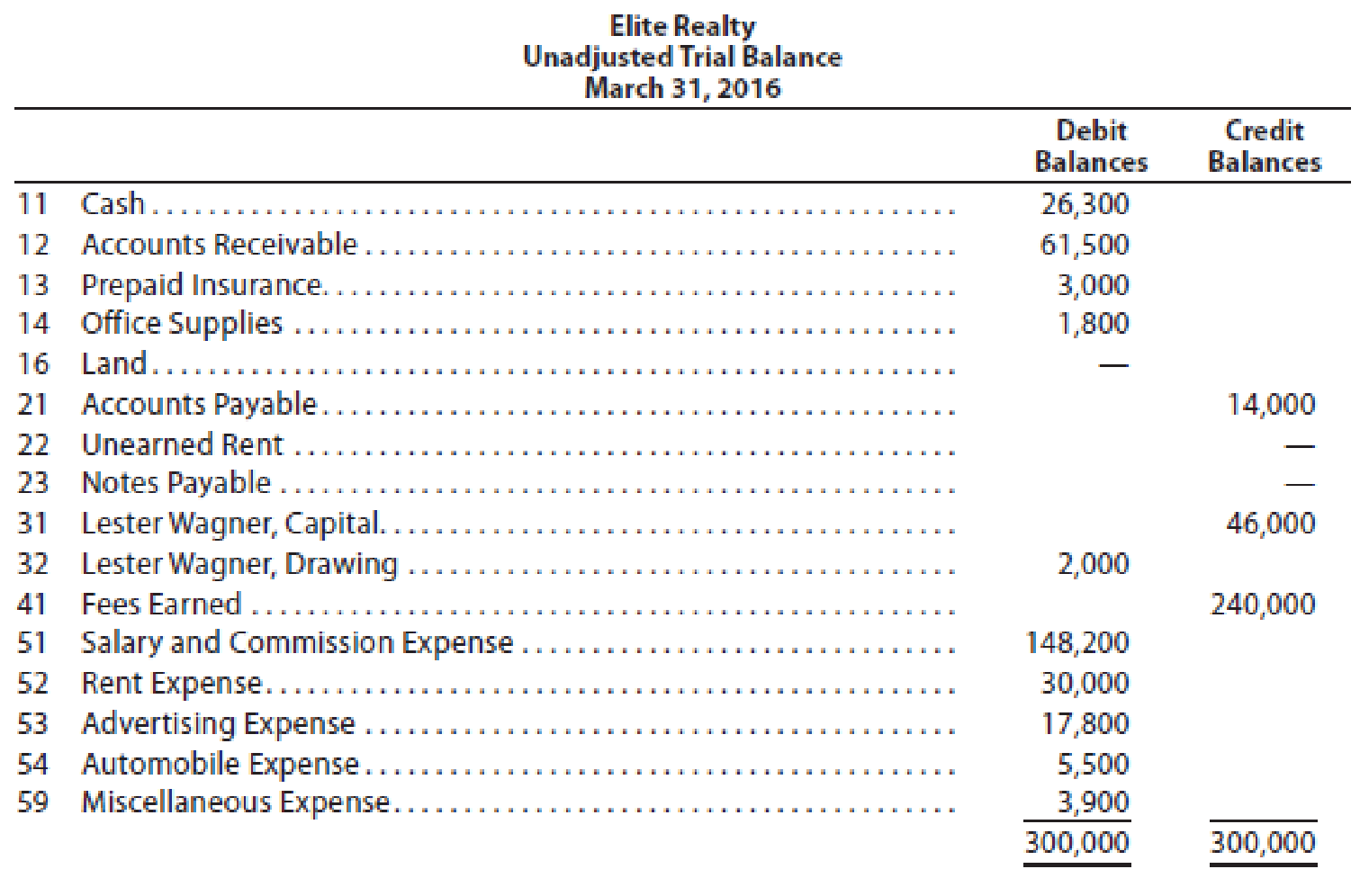

Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted

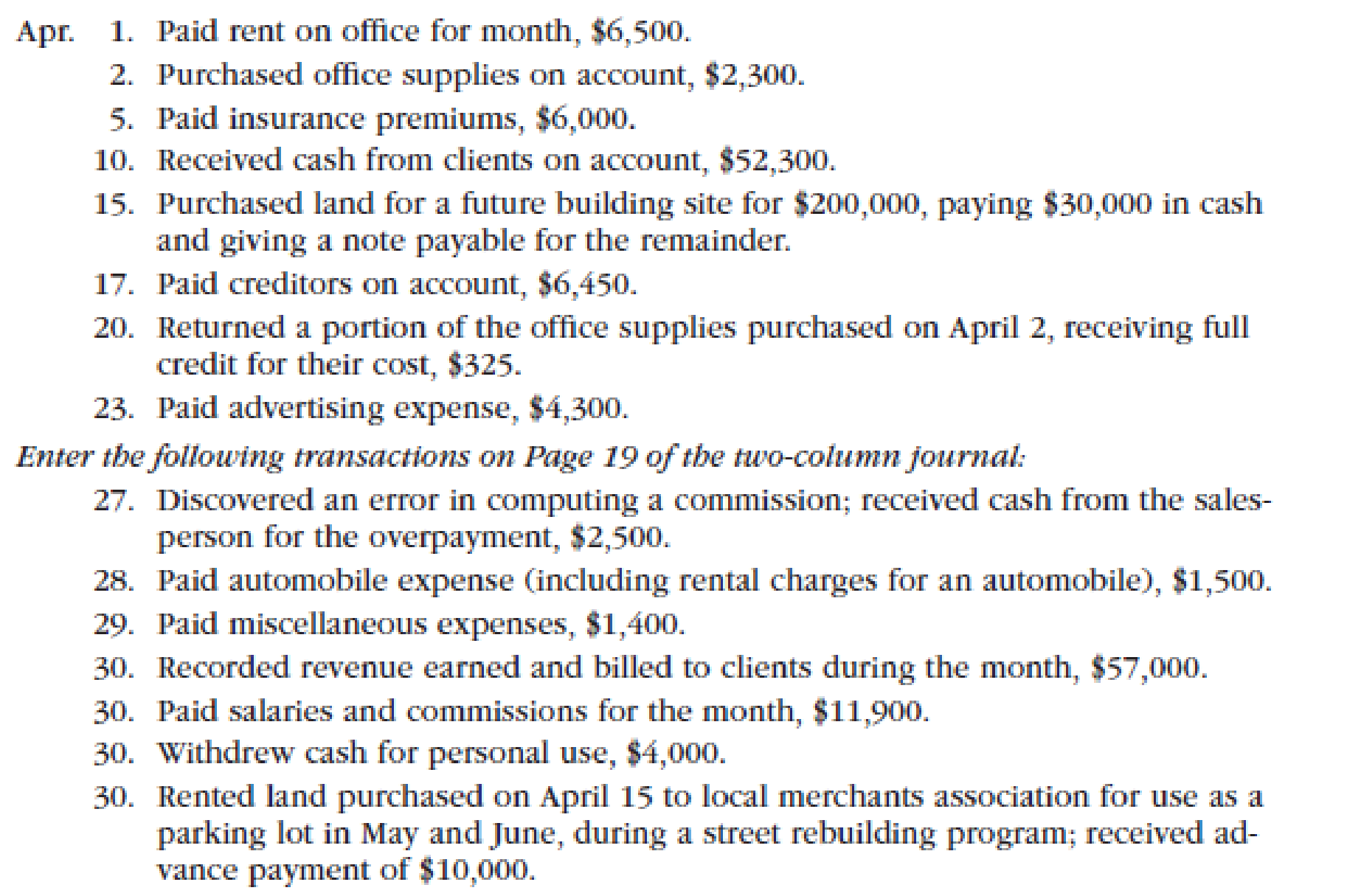

The following business transactions were completed by Elite Realty during April 2016:

Instructions

- 1. Record the April 1, 2016, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark (✔) in the Posting Reference column.

- 2. Journalize the transactions for April in a two-column journal beginning on Page 18.

Journal entry explanations may be omitted. - 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting.

- 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2016.

- 5. Assume that the April 30 transaction for salaries and commissions should have been $19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?

2 and 3:

Journalize the transactions of April in a two column journal beginning on page 18.

Explanation of Solution

Journal: Journal is the book of original entry. Journal consists of the day today financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

Rules of debit and credit:

“An increase in an asset account, an increase in an expense account, a decrease in liability account, and a decrease in a revenue account should be debited.

Similarly, an increase in liability account, an increase in a revenue account and a decrease in an asset account, a decrease in an expenses account should be credited”.

Journalize the transactions of April in a two column journal beginning on page 18.

| Journal Page 18 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2016 | Rent expense | 52 | 6,500 | ||

| April | 1 | Cash | 11 | 6,500 | |

| (To record the payment of rent) | |||||

| 2 | Office supplies | 14 | 2,300 | ||

| Accounts payable | 21 | 2,300 | |||

| (To record the purchase of supplies of account) | |||||

| 5 | Prepaid insurance | 13 | 6,000 | ||

| Cash | 11 | 6,000 | |||

| (To record the payment of insurance premium) | |||||

| 10 | Cash | 11 | 52,300 | ||

| Accounts receivable | 12 | 52,300 | |||

| (To record the receipt of cash from clients) | |||||

| 15 | Land | 16 | 200,000 | ||

| Cash | 11 | 30,000 | |||

| Notes payable | 23 | 170,000 | |||

| (To record the purchase of land party for cash and party on signing a note) | |||||

| 17 | Accounts payable | 21 | 6,450 | ||

| Cash | 11 | 6,450 | |||

| (To record the payment made to creditors on account) | |||||

| 20 | Accounts payable | 21 | 325 | ||

| Office supplies | 14 | 325 | |||

| (To record the payment made to creditors on account) | |||||

| 23 | Advertising expense | 53 | 4,300 | ||

| Cash | 11 | 4,300 | |||

| (To record the payment of advertising expense) | |||||

Table (1)

| Journal Page 19 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2016 | Cash | 11 | 2,500 | ||

| April | 27 | Salary and commission expense | 51 | 2,500 | |

| (To record the receipt of cash) | |||||

| 28 | Automobile expense | 54 | 1,500 | ||

| Cash | 11 | 1,500 | |||

| (To record the payment made for automobile expense) | |||||

| 29 | Miscellaneous expense | 59 | 1,400 | ||

| Cash | 11 | 1,400 | |||

| (To record the payment made for Miscellaneous expense) | |||||

| 30 | Accounts receivable | 12 | 57,000 | ||

| Fees earned | 41 | 57,000 | |||

| (To record the revenue earned and billed) | |||||

| 30 | Salary and commission expense | 51 | 11,900 | ||

| Cash | 11 | 11,900 | |||

| (To record the payment made for salary and commission expense) | |||||

| 30 | Person L’s Drawing | 32 | 4,000 | ||

| Cash | 11 | 4,000 | |||

| (To record the drawing made for personal use) | |||||

| 30 | Cash | 11 | 10,000 | ||

| Unearned rent | 22 | 10,000 | |||

| (To record the cash received for the service yet to be provide) | |||||

Table (2)

1 and 3:

Record the balance of each account in the appropriate balance column of a four-column account and post them to the ledger.

Explanation of Solution

T-account: An account is referred to as a T-account, because the alignment of the components of the account resembles the capital letter ‘T’. An account consists of the three main components which are as follows:

- The title of the account

- The left or debit side

- The right or credit side

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 26,300 | |||

| 1 | 18 | 6,500 | 19,800 | ||||

| 5 | 18 | 6,000 | 13,800 | ||||

| 10 | 18 | 52,300 | 66,100 | ||||

| 15 | 18 | 30,000 | 36,100 | ||||

| 17 | 18 | 6,450 | 29,650 | ||||

| 23 | 18 | 4,300 | 25,350 | ||||

| 27 | 19 | 2,500 | 27,850 | ||||

| 28 | 19 | 1,500 | 26,350 | ||||

| 29 | 19 | 1,400 | 24,950 | ||||

| 30 | 19 | 11,900 | 13,050 | ||||

| 30 | 19 | 4,000 | 9,050 | ||||

| 30 | 19 | 10,000 | 19,050 | ||||

Table (3)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 61,500 | |||

| 10 | 18 | 52,300 | 9,200 | ||||

| 30 | 19 | 57,000 | 66,200 | ||||

Table (4)

| Account: Prepaid Insurance Account no. 13 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 3,000 | |||

| 5 | 18 | 6,000 | 9,000 | ||||

Table (5)

| Account: Office Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 1,800 | |||

| 2 | 18 | 2,300 | 4,100 | ||||

| 20 | 18 | 325 | 3,775 | ||||

Table (6)

| Account: Land Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 15 | 18 | 200,000 | 200,000 | |||

Table (7)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 14,000 | |||

| 2 | 18 | 2,300 | 16,300 | ||||

| 17 | 18 | 6,450 | 9,850 | ||||

| 20 | 18 | 325 | 9,525 | ||||

Table (8)

| Account: Unearned Rent Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 30 | 19 | 10,000 | 10,000 | |||

Table (9)

| Account: Notes Payable Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 15 | 18 | 170,000 | 170,000 | |||

Table (10)

| Account: Person L’s Capital Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 46,000 | |||

Table (11)

| Account: Person L’s Drawing Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 2,000 | |||

| 30 | 19 | 4,000 | 6,000 | ||||

Table (12)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 240,000 | |||

| 30 | 19 | 57,000 | 297,000 | ||||

Table (13)

| Account: Salary and commission expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 148,200 | |||

| 27 | 19 | 2,500 | 145,700 | ||||

| 30 | 19 | 11,900 | 157,600 | ||||

Table (14)

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 30,000 | |||

| 1 | 18 | 6,500 | 36,500 | ||||

Table (15)

| Account: Advertising expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 17,800 | |||

| 23 | 18 | 4,300 | 22,100 | ||||

Table (17)

| Account: Automobile expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 5,500 | |||

| 28 | 19 | 1,500 | 7,000 | ||||

Table (18)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 1 | Balance | ✓ | 3,900 | |||

| 29 | 19 | 1,400 | 5,300 | ||||

Table (19)

4.

Prepare an unadjusted trial balance of E Realty at April 30, 2016.

Explanation of Solution

Unadjusted trial balance: The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Prepare an unadjusted trial balance of E Realty at April 30, 2016 as follows:

|

E Realty Unadjusted Trial Balance April 30, 2016 | |||

| Particulars |

Account No. | Debit $ | Credit $ |

| Cash | 11 | 19,050 | |

| Accounts receivable | 12 | 66,200 | |

| Prepaid insurance | 13 | 9,000 | |

| Office supplies | 14 | 3,775 | |

| Land | 16 | 200,000 | |

| Accounts payable | 21 | 9,525 | |

| Unearned rent | 22 | 10,000 | |

| Notes payable | 23 | 170,000 | |

| Person L’s Capital | 31 | 46,000 | |

| Person L’s Drawings | 32 | 6,000 | |

| Fees earned | 41 | 297,000 | |

| Salaries and commission expense | 51 | 157,600 | |

| Rent expense | 52 | 36,500 | |

| Advertising expense | 53 | 22,100 | |

| Automobile expense | 54 | 7,000 | |

| Miscellaneous expense | 59 | 5,3000 | |

| Total | 532,525 | 532,525 | |

Table (20)

5. (a)

Explain the reason behind the unadjusted trial balance in (4) balance.

Explanation of Solution

The unadjusted trial balance in (4) would still balance, since all the debits are equalized with the credit in the original journal entry.

(b)

Journalize the correcting entry.

Explanation of Solution

The Correcting entry is as follows:

| Journal Page 19 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2016 | Salary and commission expense | 51 | 7,200 | ||

| April | 30 | Cash | 11 | 7,200 | |

| (To record the correcting entry) | |||||

Working notes:

(c)

Identify whether the error made is a slide or transposition.

Explanation of Solution

Transposition error: At the time of posting a transaction when two digits of numbers are transposed, in such case the transposition error occurs.

Slide error: A slide error occurs, when the decimal point of an amount has been misplaced.

The account balance recorded as $11,900 instead of $19,100 is a transposition error because the two digits of the numbers are transposed.

Want to see more full solutions like this?

Chapter 2 Solutions

Financial Accounting

- The transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardMaddie Inc. has the following transactions for its first month of business. A. What are the individual account balances, and the total balance, in the accounts receivable subsidiary ledger? B. What is the balance in the accounts receivable general ledger (control) account?arrow_forwardPiedmont Inc. has the following transactions for its first month of business: A. What are the individual account balances, and the total balance, in the accounts payable subsidiary ledger? B. What is the balance in the Accounts Payable general ledger account?arrow_forward

- Sage Learning Centers was established on July 20, 2016, to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger, and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forwardThe transactions completed by Revere Courier Company during December 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of December 1: 2. Journalize the transactions for December 2016, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single-column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardPresented below are selected transactions of Headland Restaurant for the month ending August 31, 2025. a. b. Date Prepare entries for the Headland transactions. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement. List all debit entries before credit entries. Round intermediate calculations to 2 decimal places, e.g. 15.25% and final answers to O decimal places, e.g. 5,125.) st 2025 st 2025 Headland sells 84 gift cards at $72 per gift card and 52 of the gift cards are redeemed by year end. It is estimated that 10 of the gift cards will not be redeemed. st 2025 Headland accepted a reservation for its private dining room for a rehearsal dinner in September. It received a security deposit of $300, which will be returned after the dinner is held. Account Titles and Explanation Cash Unearned…arrow_forward

- II. The following information is obtained from a review of the record keeping process. Analyze the given information and prepare a modified trial balance. Show your solutions. (** Ricanor Accounting Services Trial Balance Dec. 31, 2021 Debit Credit Cash P189,000 284,600 66,400 40.000 Accounts Receivable Supplies Prepaid Insurance Office Equipment Notes Payable Accounts Payable Ricanor. Capital Ricanor. Withdrawals Service Income Salaries Expense Advertising Expense 526,800 P130,000 195,400 297,200 100,000 821,400 348,700 12.200 P1.467.700 Totals P1.544.000 a. An account receivable for P 24,300 was incorrectly added as P 23,400 when computing the balance of the Accounts Receivable account. b. A debit posting from the journal for P5,200 is missing from the Salaries Expense account. C.A debit posting of P15.000 to Notes Payable should have been made to Accounts Payable. d. A debit posting of P25,000 to Supplies was incorrectly posted as P2,500. Carrow_forwardRequirements: 1. Journalize each transaction including explanations. 2. The accounts listed in the trial balance, together with their balances as of March 31,2024, have been opened for you in T-account form. Post the journal entries to the ledger (use T-account format). 3. Prepare the trial balance of Harper Service Center as of April 30, 2024. More info Apr. 2 Borrowed $45,000 from the bank and signed a note payable in the name of the business. Apr. 4 Paid cash of $40,000 to acquire land. Apr. 9 Performed services for a customer and received cash of $5,000. Apr. 13 Purchased office supplies on account, $300. Apr. 15 Performed services for a customer on account, $2,600. Apr. 18 Paid $1,200 on account. Apr. 21 Paid the following cash expenses: salaries, $3,000; rent, $1,500; and interest, $400. Apr. 25 Received $3,100 from a customer on account. Apr. 27 Received a $200 utility bill that will be paid next month. Apr. 29 Received $1,500 for services to be…arrow_forwardd. journal. Include an exp b. Prepare a four-column account for Supplies. Entel January 1, 2016. Place a check mark (✓) in the Posting Reference column. c. Prepare a four-column account for Accounts Payable. Enter a credit balance of $18,430 as of January 1, 2016. Place a check mark (✓) in the Posting Reference column. dad. Post the January 7, 2016, transaction to the accounts. e. Do the rules of debit and credit apply to all companies? OBJ. 2,3 EX 2-9 Transactions and T accounts dinom odiginu lali The following selected transactions were completed during August of the current year: oms 1. Billed customers for fees earned, $73,900. vino asittho a. 2. Purchased supplies on account, $1,960. 3. Received cash from customers on account, $62,770. 4. Paid creditors on account, $820. a. Journalize these transactions in a two-column journal, using the appropriate number to identify the transactions. Journal entry explanations may be omitted. b. Post the entries prepared in (a) to the following…arrow_forward

- DETERMINE THE BALANCES OF THE FOLLOWING ACCOUNTS AS OF SEPTEMBER 30, 2017. (FORMAT ANSWERl: 1,000,000) Entity A began operation to provide credit collection services on September 2020. The Unadjusted Trial Balance as of September 30, 2020 is as shown below: Entity A Trial Balance September 30, 2020 Cash and Cash Equivalent 174,000 Accounts Receivable 96,200 Office Supplies 10,500 Prepaid Insurance 24,000 Equipment 300,000 Notes Payable 100,000 Accounts Payable 123,500 Unearned Service Income 50,000 A, Capital 200,000 A, Drawings 6,000 Service Income 176,200 Salaries Expense 12,000 Transportation Expense 13,000 Rent Expense 12,000 MIscellaneous Expenses 2,000 649,700 649,700 Additional Data 1. Unused supplies on September 30, 2020 is P7,500 2. The equipment was acquired on September 1, 2017 with useful life of 5 years and with estimated salvage value of P30,000 3. Interest on the notes payable is 18%. The note was issued on September 1, 2020. 4. The prepaid insurance is for the period…arrow_forwardDETERMINE THE BALANCES OF THE FOLLOWING ACCOUNTS AS OF SEPTEMBER 30, 2017. (FORMAT ANSWERl: 1,000,000) Entity A began operation to provide credit collection services on September 2020. The Unadjusted Trial Balance as of September 30, 2020 is as shown below: Entity A Trial Balance September 30, 2020 Cash and Cash Equivalent 174,000 Accounts Receivable 96,200 Office Supplies 10,500 Prepaid Insurance 24,000 Equipment 300,000 Notes Payable 100,000 Accounts Payable 123,500 Unearned Service Income 50,000 A, Capital 200,000 A, Drawings 6,000 Service Income 176,200 Salaries Expense 12,000 Transportation Expense 13,000 Rent Expense 12,000 MIscellaneous Expenses 2,000 649,700 649,700 Additional Data 1. Unused supplies on September 30, 2020 is P7,500 2. The equipment was acquired on September 1, 2017 with useful life of 5 years and with estimated salvage value of P30,000 3. Interest on the notes payable is 18%. The note was issued on September 1, 2020. 4. The prepaid insurance is for the period…arrow_forwardDETERMINE THE BALANCES OF THE FOLLOWING ACCOUNTS AS OF SEPTEMBER 30, 2017. (FORMAT ANSWERl: 1,000,000) Entity A began operation to provide credit collection services on September 2020. The Unadjusted Trial Balance as of September 30, 2020 is as shown below: Entity A Trial Balance September 30, 2020 Cash and Cash Equivalent 174,000 Accounts Receivable 96,200 Office Supplies 10,500 Prepaid Insurance 24,000 Equipment 300,000 Notes Payable 100,000 Accounts Payable 123,500 Unearned Service Income 50,000 A, Capital 200,000 A, Drawings 6,000 Service Income 176,200 Salaries Expense 12,000 Transportation Expense 13,000 Rent Expense 12,000 MIscellaneous Expenses 2,000 649,700 649,700 Additional Data 1. Unused supplies on September 30, 2020 is P7,500 2. The equipment was acquired on September 1, 2017 with useful life of 5 years and with estimated salvage value of P30,000 3. Interest on the notes payable is 18%. The note was issued on September 1, 2020. 4. The prepaid insurance is for the period…arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College