Advanced Financial Accounting

12th Edition

ISBN: 9781259916977

Author: Christensen, Theodore E., COTTRELL, David M., Budd, Cassy

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 2.5E

Acquisition Price

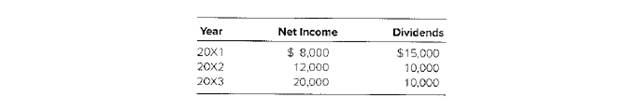

Phillips Company bought 40 percent ownership in Jones Bag Company on January 1, 20X1, at underlying book value. During the period of January 1, 20X1. through December 31. 20X3, themarket value of Phillips’ investment in Jones’ stock increased by $2,000 each year. In 20X1, 20X2, and 20X3, Jones Bag reported the following:

The balance in Phillips Company’s investment account on December 31, 20X3, was $54,000.

Required

In each of the following independent cases, determine the amount that Phillips paid for its investment in Jones Bag stock assuming that Phillips accounted for its investment by (a) carrying the investment it fair value, or (b) using the equity method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

On January 1, 20x1, ABC Co. acquired 80% interest in XYZ, Inc. by issuing 5,000 shares with fair value of P30 per share and par value of P20 per share. The financial statements of ABC Co. and XYZ, Inc. immediately after the acquisition are shown below:

Jan. 1, 20x1ABC Co. XYZ, Inc.Cash 20,000 10,000Accounts receivable 60,000 24,000Inventory 80,000 46,000Investment in subsidiary 150,000 Equipment 400,000 100,000Accumulated depreciation (40,000) (20,000)Total assets 670,000 160,000Accounts payable 40,000 12,000Bonds payable 60,000 -Share capital 340,000 100,000Share premium 130,000 -Retained earnings 100,000 48,000Total liabilities and equity 670,000 160,000

On January 1, 20x1, the fair value of the assets and liabilities of XYZ, Inc. were determined by appraisal, as follows:XYZ, Inc. Carrying amounts Fair values Fair value incrementCash 10,000 10,000 -Accounts receivable 24,000 24,000 -Inventory 46,000 62,000 16,000Equipment 100,000 120,000 20,000Accumulated depreciation (20,000)…

On-Ju Company acquired 90% interest in Southwest Company on December 31, 20x4 for P320,000. During 20x5 Southwest had a net income of P22,000 and paid a cash dividend of P7,000. Applying the cost method would give a debit balance in the Investment in Southwest Company account at the end of 20x5 of:

P335,000

P333,500

P313,700

P320,000

on January 1, 20x1 entitiy A acquires 30% interest in Entity B for 600,000. Entity B reports profit of 200,000 and declares dividends of 50,000 in 20x1. How much is the carrying amount of the investment in associate on Dec31, 20x1

Chapter 2 Solutions

Advanced Financial Accounting

Ch. 2 - What types of investments in common stock normally...Ch. 2 - Prob. 2.2QCh. 2 - Describe an investor’s treatment of an investment...Ch. 2 - How is the receipt of a dividend recorded under...Ch. 2 - How does carrying securities at fair value...Ch. 2 - Prob. 2.6QCh. 2 - Prob. 2.7QCh. 2 - Prob. 2.8QCh. 2 - Prob. 2.9QCh. 2 - Prob. 2.10Q

Ch. 2 - How are a subsidiary’s dividend declarations...Ch. 2 - Prob. 2.12QCh. 2 - Give a definition of consolidated retained...Ch. 2 - Prob. 2.14QCh. 2 - Prob. 2.15QCh. 2 - Prob. 2.16AQCh. 2 - When is equity method reporting considered...Ch. 2 - How does the fully adjusted equity method differ...Ch. 2 - What is the modified equity method? When might a...Ch. 2 - Choice of Accounting Method Slanted Building...Ch. 2 - Prob. 2.2CCh. 2 - Prob. 2.3CCh. 2 - Prob. 2.4CCh. 2 - Prob. 2.5CCh. 2 - Prob. 2.6CCh. 2 - Prob. 2.1.1ECh. 2 - Multiple-Choice Questions on Accounting for Equity...Ch. 2 - Prob. 2.1.3ECh. 2 - Prob. 2.1.4ECh. 2 - Multiple-Choice Questions on Intercorporate...Ch. 2 - Prob. 2.2.2ECh. 2 - Prob. 2.3.1ECh. 2 - Prob. 2.3.2ECh. 2 - Prob. 2.3.3ECh. 2 - Prob. 2.4ECh. 2 - Acquisition Price Phillips Company bought 40...Ch. 2 - Prob. 2.6ECh. 2 - Prob. 2.7ECh. 2 - Carrying an investment at Fair Value versus Equity...Ch. 2 - Carrying an Investment at Fair Value versus Equity...Ch. 2 - Prob. 2.10ECh. 2 - Prob. 2.11ECh. 2 - Prob. 2.12ECh. 2 - Prob. 2.13ECh. 2 - Income Reporting Grandview Company purchased 40...Ch. 2 - Investee with Preferred Stock Outstanding Reden...Ch. 2 - Prob. 2.16AECh. 2 - Prob. 2.17AECh. 2 - Changes ¡n the Number of Shares Held Idle...Ch. 2 - Investments Carried at Fair Value and Equity...Ch. 2 - Carried at Fair Value Journal Entries Marlow...Ch. 2 - Consolidated Worksheet at End of the First Year of...Ch. 2 - Consolidated Worksheet at End of the Second Year...Ch. 2 - Prob. 2.23PCh. 2 - Prob. 2.24PCh. 2 - Prob. 2.25APCh. 2 - Equity-Method income Statement Wealthy...Ch. 2 - Prob. 2.27BPCh. 2 - Prob. 2.28BP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, Vienna Corporation purchased 40% of the outstanding common stock of the Marietta Corporation for $137,500. During the year, Marietta Corporation reported net income of $50,000 and paid cash dividends of $25,000.The balance of the Investment in the Marietta Corporation account on the books of Vienna Corporation at year-end is: Select one: A. $147,500 B. $135,000 C. $100,000 D. $110,000arrow_forwardWinston Corporation purchased 40 percent of the stock of Fullbright Company on January 1, 20X2, at underlying book value. During the period of January 1, 20X2, through December 31, 20X4, the market value of Winston's investment in Fullbright's stock increased by $20,000 each year. The companies reported the following operating results and dividend payments during the first three years of intercorporate ownership: Year 20X2 20X3 20X4 Winston Corporation Operating Income $100,000 Year 20X2 20X3 20X4 60,000 250,000 Dividends $ 40,000 80,000 120,000 Fullbright Company Dividends Net Income Fair Value Equity Method Net Income $70,000 40,000 25,000 Required: Compute the net income reported by Winston for each of the three years, assuming it accounts for its investment in Fullbright by carrying the investment at fair value, or using the equity method. $30,000 60,000 50,000arrow_forwardCurrent Attempt in Progress These are two independent situations: 1. Pharoah Cosmetics acquired 13% of the 278,500 shares of common stock of Elite Fashion at a total cost of $14 per share on March 18, 2022. On June 30, Elite declared and paid a $69,800 dividend. On December 31, Elite reported net income of $263,120 for the year. At December 31, the market price of Elite Fashion was $15 per share. 2. Sheffield Inc. obtained significant influence over Kasey Corporation by buying 25% of Kasey's 30,500 outstanding shares of common stock at a total cost of $11 per share on January 1, 2022. On June 15, Kasey declared and paid a cash dividend of $32,100. On December 31, Kasey reported a net income of $120,900 for the year. Prepare all the necessary journal entries for 2022 for Sheffield Inc. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No…arrow_forward

- Fairbanks Corporation purchased 400 ordinary shares of Sherman Inc. as a trading investment for E13,200. During the year, Sherman paid a cash dividend of £3.25 per share. At year-end, Sherman shares were selling for £34.50 per share. How much total revenues (all revenues) should be recognized from this investment during the year? Select one: Oa. $1900 Ob. $700 OC $1300 Od. $600arrow_forwardInstructions At a total cost of $6,950,000, Herrera Corporation acquired 229,500 shares of Tran Corp. common stock as a long-term investment. Herrera Corporation uses the equity method of accounting for this investment. Tran Corp. has 850,000 shares of common stock outstanding, including the shares acquired by Herrera Corporation. Required: A. Journalize the entries by Herrera Corporation on December 31 to record the following information (refer to the Chart of Accounts for exact wording of account titles): 1. Tran Corp. reports net income of $974,000 for the current period. 2. A cash dividend of $0.28 per common share is paid by Tran Corp. during the current period. B. Why is the equity method appropriate for the Tran Corp. investment?arrow_forwardFollowing are the non-strategic investment transactions of Corona Inc.: 2023 Jan. 1 Purchased for $93,059 an 9.5%, $88,000 bond that matures in 22 years from Hanna Corporation when the market interest rate was 8.9%. There was a $50 transaction fee included in the above-noted payment amount. Interest is paid semiannually beginning June 30, 2023. The acquisition was made with intention to hold to maturity. June 30 Received interest on the Hanna bond. July 1 Paid $128,591 for a Trust Inc. bond with a par value of $133,000 and a seventeen-years term. The bond pays interest quarterly beginning September 30, 2023, at the annual rate of 9.3%; the market interest rate on the date of purchase was 9.7%. There was a $50 transaction fee included in the above-noted payment amount. Sept. 30 Received interest on the Trust bond. Dec. 31 Received interest on the Hanna and Trust bonds. 31 The fair values of the bonds on this date equalled the fair values. Required: 1. For each of the bond investments,…arrow_forward

- On August 1 2018, Sea Food Co., purchased 80% of the common stock of Dolphin Co.,. The common stock issue 70,000 shares of its (Sea Food) OMR 25 par value. Common stock market price of OMR 30 per share. Calculate the investment of Dolphin Co., Select one: a. 1,750,000 b. 2,100,000 c. 1,400,000 d. 1,680,000arrow_forwardTanner-UNF corporation acquired as a long-term investment $260 million of 5% bonds, Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 7% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $215 million. Required: Suppose Moody’s bond rating agency downgraded the risk rating of the bonds motivation Tanner-UNF to sell the investment on January 2, 2022, for $190 million. Prepare the journal entries necessary to record the sale, including updating the fair-value adjustment, recording any reclassification adjustment, and recording the sale. (If no entry is required for a transaction/event, select “No journal entry required” in the first account field. Enter your answers in millions rounded to 1 decimal place, (i.e.,…arrow_forwardTanner-UNF corporation acquired as a long-term investment $260 million of 5% bonds, Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 7% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $215 million.arrow_forward

- Gant Company purchased 30 percent of the outstanding shares of Temp Company for $87,000 on January 1, 20X6. The following results are reported for Temp Company: Net income Dividends paid Fair value of shares held by Gant: January 1 December 31 a. Carries the investment at fair value. b. Uses the equity method. 20X6 $ 43,000 14,000 Income from investment Balance in investment S $ 87,000 106,000 Required: Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in Temp at the end of each year assuming that Gant uses the following options in accounting for its investment in Temp: Complete this question by entering your answers in the tabs below. 20X7 $ 38,000 28,000 20X6 106,000 103,000 20X7 (800) $ 39,400 95,700 $ 109,000 Answer is complete but not entirely correct. Required A Required B Determine the amounts reported by Gant as income from its investment in Temp for each year and the balance in Gant's investment in…arrow_forwardOn January 2, 20Y4, Destiny Company acquired 42% of the outstanding stock of Emerald Company for $350,000. For the year ended December 31, 20Y4 Destiny Company earned income of $200,000 and paid dividends of $25,000. On January 31, 20Y5, Destiny Company sold all of its investment in Emerald Company stock for $400,000. Journalize the entries for Destiny Company for the purchase of the stock, the share of Emerald income, the dividends received from Emerald Company, and the sale of the Emerald Company stock.arrow_forwardCurrent Attempt in Progress On April 1, 2024, Sunland Company purchased 35,200 common shares in Ecotown Ltd. for $13 per share. Management has designated the investment as FVTOCI. On December 5, Ecotown paid dividends of $0.10 per share and its shares were trading at $15 per share on December 31. Prepare the required entries to record the purchase, dividends, and year-end adjusting journal entry (if any) for this investment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License