Fundamentals Of Cost Accounting (6th Edition)

6th Edition

ISBN: 9781259969478

Author: WILLIAM LANEN, Shannon Anderson, Michael Maher

Publisher: McGraw Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 43P

Comparing Business Units Using Divisional Income,

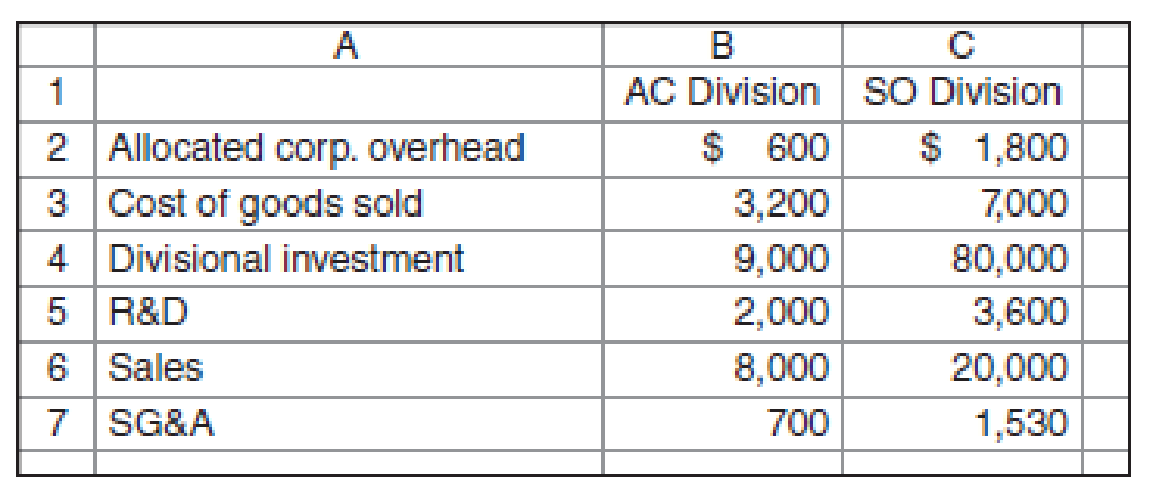

Colonial Pharmaceuticals is a small firm specializing in new products. It is organized into two divisions, which are based on the products they produce. AC Division is smaller and the life of the products it produces tend to be shorter than those produced by the larger SO Division. Selected financial data for the past year is shown below. Divisional investment is as of the beginning of the year. Colonial Pharmaceuticals uses a 9 percent cost of capital and uses beginning-of-the-year investment when computing ROI and residual income. Ignore income taxes.

Required

- a. Compute divisional income for the two divisions.

- b. Calculate the operating margin, which is equivalent to the return on sales, for the two divisions.

- c. Calculate ROI for the two divisions.

- d. Compute residual income for the two divisions.

- e. Assess the financial performance of the two divisions based on your analysis.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Check my work

Problem 14-44 (Algo) Comparing Business Units Using Economic Value Added (EVA) (LO 14-4)

Colonial Pharmaceuticals is a small firm specializing in new products. It is organized into two divisions, which are based on the

products they produce. AC Division is smaller and the life of the products it produces tend to be shorter than those produced by the

larger SO Division. Selected financial data for the past year is shown as follows. Divisional investment is as of the beginning of the

year. Colonial Pharmaceuticals uses a 8 percent cost of capital and uses beginning-of-the-year investment when computing ROI and

residual income. Ignore income taxes.

AC Division

sO Division

Allocated corp. overhead

Cost of goods sold

2$

695

850

3,390

5,100

70,500

3,600

17,500

Divisional investment

10,900

2,950

11,800

R&D

Sales

SG&A

985

580

R&D is assumed to have a two-year life in the AC Division and a nine-year life in the SO division. All R&D expenditures are spent at the

beginning of the…

Exercise 25.4 (Algo) ROI versus EVA Measures (LO25-2, LO25-3, LO25-4)

Bailey uses ROI to measure the performance of its operating divisions and to reward its division managers. A summary of the annual

eports from two of Bailey's divisions is shown provided below. The company's weighted-average cost of capital is 11 percent.

Division A

Division B

$6,220,000

$4

650,000

$ 1,060,000

$ 8,530,000

$ 1,850,000

$ 1,182,100

Total assets

Current liabilities

After-tax operating income

ROI

21%

13%

a. Based on ROI, Division A generates more profit per dollar of invested capital than Division B. Compute the EVA for Division A and

Division B.

c. Suppose the manager of Division A was offered a one-year project that would increase her investment base by $340,000 and

increase her divisional operating income by $34,000. Would she be motivated to invest in this project?

Comple

this question by entering your answers in the tabs below.

Required A

Required B

Based on ROI, Division A generates more profit per…

Hardin Company is a division of a major corporation. The following data are for the latest year ofoperations:Sales $ 19,600,000 Net operating income $ 470,400 Average operating assets $ 5,000,000 The company's minimum required rate of return 10 %

Required:a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?

Chapter 14 Solutions

Fundamentals Of Cost Accounting (6th Edition)

Ch. 14 - What are the advantages of divisional income as a...Ch. 14 - How is divisional income like income computed for...Ch. 14 - How is return on investment (ROI) computed?Ch. 14 - What are the advantages of using an ROI-type...Ch. 14 - How can ratios, such as ROI, be used for control...Ch. 14 - How does residual income differ from ROI?Ch. 14 - How does EVA differ from residual income?Ch. 14 - What impact does the use of gross book value or...Ch. 14 - What are the dangers of using only business unit...Ch. 14 - A company prepares the master budget by taking...

Ch. 14 - Prob. 11CADQCh. 14 - What problems might there be if the same methods...Ch. 14 - Prob. 13CADQCh. 14 - The chapter identified some problems with ROI-type...Ch. 14 - Failure to invest in projects is not a problem...Ch. 14 - How would you respond to the following comment?...Ch. 14 - Prob. 17CADQCh. 14 - Prob. 18CADQCh. 14 - Prob. 19CADQCh. 14 - Prob. 20CADQCh. 14 - Prob. 21CADQCh. 14 - Compute Divisional Income Arlington Clothing,...Ch. 14 - Compute Divisional Income Refer to Exercise 14-22....Ch. 14 - Computing Divisional Income: Incomplete...Ch. 14 - Compute RI and ROI The Campus Division of...Ch. 14 - Prob. 26ECh. 14 - Compare Alternative Measures of Division...Ch. 14 - Comparing Business Units Using ROI Back Mountain...Ch. 14 - Comparing Business Units Using Residual Income...Ch. 14 - Prob. 30ECh. 14 - Universal Electronics, Inc. (UEI), which started...Ch. 14 - Comparing Business Units Using Residual...Ch. 14 - Comparing Business Units Using Economic Value...Ch. 14 - Impact of New Asset on Performance Measures The...Ch. 14 - Refer to the data in Exercise 14–34. The division...Ch. 14 - Refer to the information in Exercises 14–34 and...Ch. 14 - Impact of an Asset Disposal on Performance...Ch. 14 - Impact of an Asset Disposal on Performance...Ch. 14 - Compare Historical Cost, Net Book Value to Gross...Ch. 14 - Prob. 40ECh. 14 - Prob. 41ECh. 14 - Effects of Current Cost on Performance...Ch. 14 - Comparing Business Units Using Divisional Income,...Ch. 14 - Comparing Business Units Using Economic Value...Ch. 14 - Prob. 45PCh. 14 - Equipment Replacement and Performance Measures...Ch. 14 - Prob. 47PCh. 14 - Prob. 48PCh. 14 - Prob. 49PCh. 14 - Prob. 50PCh. 14 - Prob. 51PCh. 14 - Evaluate Performance Evaluation System: Behavioral...Ch. 14 - ROI, EVA, and Different Asset Bases Hys is a...Ch. 14 - Economic Value Added Bisbee Health Products...Ch. 14 - Prob. 55PCh. 14 - Prob. 56PCh. 14 - Refer to the information in Exercise 14-39. Assume...Ch. 14 - Refer to the information in Exercise 14-42. Assume...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Xenold, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands): The income tax rate for Xenold, Inc., is 40 percent. Xenold, Inc., has two sources of financing: bonds paying 5 percent interest, which account for 25 percent of total investment, and equity accounting for the remaining 75 percent of total investment. Xenold, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Xenold stock has an opportunity cost of 5 percent over the 4 percent long-term government bond rate. Xenolds total capital employed is 5.04 million (2,600,000 for the Home Division, 1,700,000 for the Restaurant Division, and the remainder for the Specialty Division). Required: 1. Prepare a segmented income statement for Xenold, Inc., for last year. 2. Calculate Xenolds weighted average cost of capital. (Round to four significant digits.) 3. Calculate EVA for each division and for Xenold, Inc. 4. Comment on the performance of each of the divisions.arrow_forwardThe condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?arrow_forwardMargin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the following income statement for the last year: At the beginning of last year, Elway had 28,300,000 in operating assets. At the end of the year, Elway had 23,700,000 in operating assets. Required: 1. Compute average operating assets. 2. Compute the margin and turnover ratios for last year. (Note: Round the answer for margin ratio to two decimal places.) 3. Compute ROI. (Note: Round answer to two decimal places.) 4. CONCEPTUAL CONNECTION Briefly explain the meaning of ROI. 5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company is relatively high (as compared to the lower ROI of a typical manufacturing company).arrow_forward

- The following selected data pertain to the Argent Division for last year: Required: 1. How much is the residual income? 2. How much is the return on investment? (Rounded to four significant digits.)arrow_forwardThe Custodial Division of Clark's Corporate Services (CCS) has assets of $1.2 million. During the past year, the division had profits of $228,000. CCS has a cost of capital of 7.5 percent. Ignore taxes. Required: a. Compute the divisional ROI for the Custodial Division. b. Compute the divisional RI for the Custodial Division. Complete this question by entering your answers in the tabs below. Required A Required B Compute the divisional ROI for the Custodial Division. Divisional ROI % Required A Required B >arrow_forwardWhat was the Paper Division's net operating income last year? The following information relates to last year's operations at the Paper Division of Germane Corporation: 15% Minimum required rate of return Return on investment (ROI) Sales Turnover (on operating assets) 18% P810,000 5 times P24,300 P29,160 P145,800 P162,000 Product differentiation is evident in the following cases EXCEPT The entity creates products that have features that are significantly of a high level compared to competitors. The entity continuously manufactures products in a pace that competitors cannot match. The entity provides superior customer service with the organization mindset of quick response. The entity sells products that are priced significantly lower compared to competitors.arrow_forward

- Augustus Electrical Company has 2 divisions, one in Georgetown and one in Berbice Guyana and information on the both divisions are as follows: Georgetown Berbice Total assets $100,000 $500,000 Current liabilities 25,000 150,000 Revenue 50,000 50,000 Income before tax 20,000 75,000 Required: Calculate the return on investment (ROI) using net income and total assets as the measure of income and investment for the Berbice division. a.150% b.1.5% c.15% d.20%arrow_forwardTerra Company has two divisions, the Retail Division and the Wholesale Division. The following information was gathered for the two divisions for the current year: Retail Division Wholesale Division Operating income $ 2,750,000 $ 6,250,000 Operating assets $ 18,500,000 $ 38,500,000 Terra Company has set a target return on investment (ROI) of 14% for both divisions. Which of the following statements is accurate? Residual income for the wholesale division was $160,000. Residual income for the wholesale division was $860,000. Residual income for the retail division was $860,000. None of these answers are correct.arrow_forwardEacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales $14,720,000 Net operating income $1,000,960 Average operating assets $4,000,000 The company’s minimum required rate of return 14% a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?arrow_forward

- Tan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Sales Set operating income. Average operating assets Required: 1. For each division, compute the return on investment (ROI). 2. Compute the residual income for each division assuming the company's minimum required rate of return is 16%. Complete this question by entering your answers in the tabs below. Division Osaka Yokohana $9,600,000 $ 26,000,000 $672,000 $2,340,000 $3,200,000 $ 13,000,000 Required 1 Required 2 For each division, compute the return on investment (ROI). RO Osaka Yokohama Required Required 2 >arrow_forwardEacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales 24,480,000 Net operating assets 1,000,960 average operatign assets 4,000,000 the company minimum required rate of return 14% Required: a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?arrow_forwardSher Manufacturing Pty Ltd has two retail divisions., which have the following reported results for the year: (i) Calculate the ROI for both divisions (ii) Calculate residual income assuming the firm requires a return of 18% on invested capital (iii) Which was the more successful division? Explain. (Hint: think carefully about this) (b) Giratina is a retailer and is a division of a larger retail company. The following data relate to the most recent year of operations: Furnishing department Dress making Division Profit $2,160,000 $441,000 Average invested Capital 12,000,000 2,100,000 Sales Revenue $9,000,000 Cost of Goods Sold 4,950,000 Operating Expenses 3,600,000 Average Invested Capital 4,500,000 (i) Calculate the division’s return on sales, investment turnover and return on investment. (ii) Describe how the division improve its ROI. (hint issue the 2 component ratios to explainarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License