Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 32BEB

During 20X2, Evans Company had the following transactions:

- a. Cash dividends of $6,000 were paid.

- b. Equipment was sold for $2,880. It had an original cost of $10,800 and a book value of $5,400. The loss is included in operating expenses.

- c. Land with a fair market value of $15,000 was acquired by issuing common stock with a par value of $3,600.

- d. One thousand shares of

preferred stock (no par) were sold for $4.20 per share.

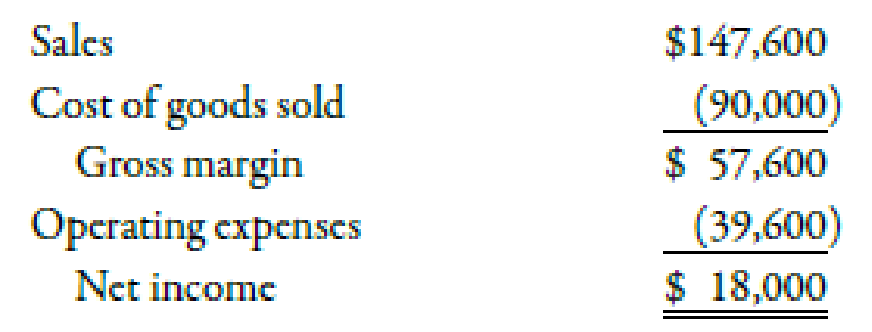

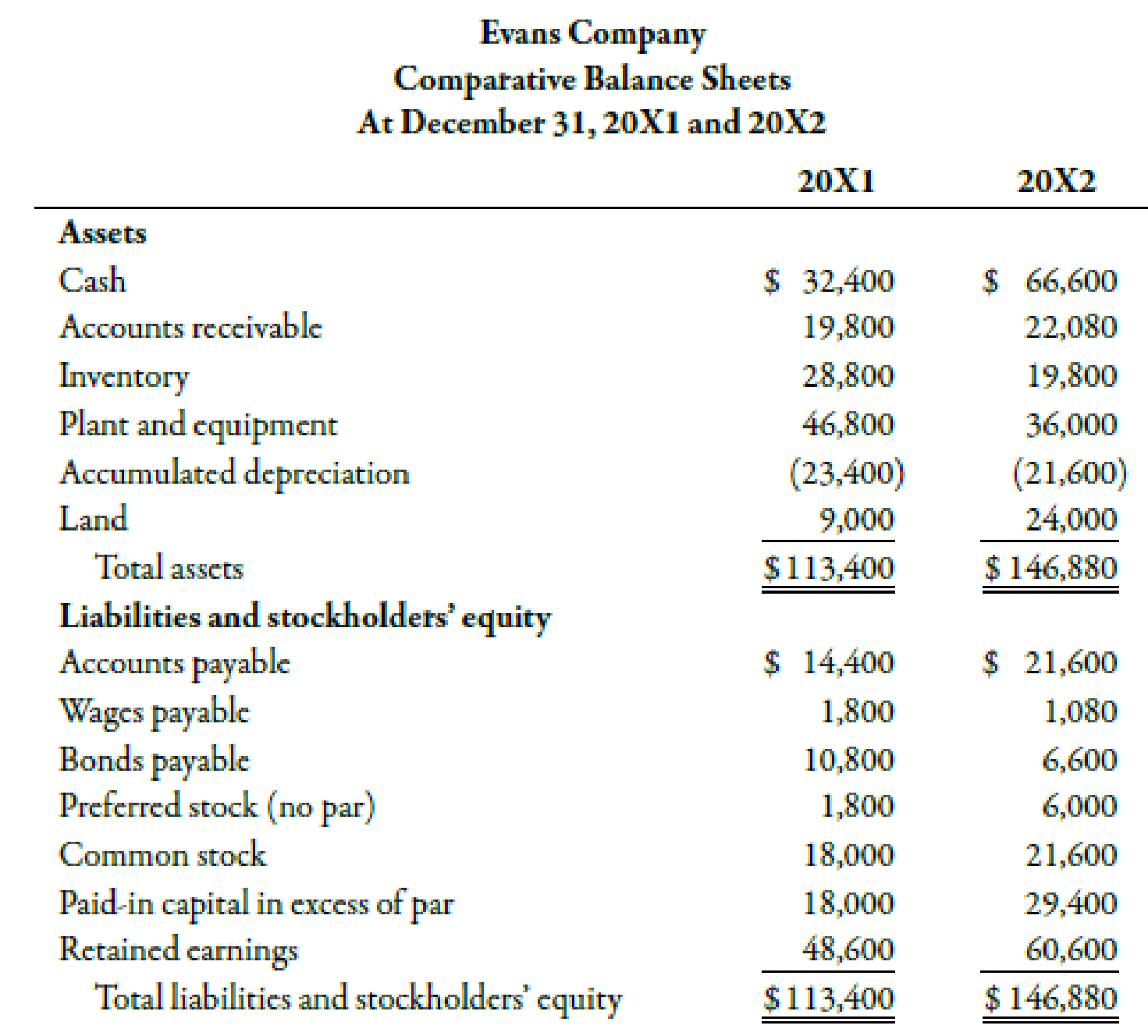

Evans provided the following income statement (for 20X2) and comparative balance sheets:

Required:

Prepare a worksheet for Evans Company.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

For each of the following separate transactions:Sold a building costing $31,500, with $20,600 of accumulated depreciation, for $8,600 cash, resulting in a $2,300 loss.Acquired machinery worth $10,600 by issuing $10,600 in notes payable.Issued 1,060 shares of common stock at par for $2 per share.Note payables with a carrying value of $40,300 were retired for $47,600 cash, resulting in a $7,300 loss.

(a) Prepare the reconstructed journal entry.

1. Record Sale of Building

2. Record Acquisition of machinery

3. Record the issuance of common stock for cash

4. Record payment of cash to retire debit

Ryan Ltd. sold equipment with a book value of $80.000 for a $10,000 loss, sold Ryan Ltd. common

stock for $145,000, repaid a notes payable for $220,000 (this amount includes $20,000 of interest

on the notes payable), paid dividends of $35.000, resold treasury stock for $25,000 (the treasury

stock was originally purchased for $15.000), and received dividends in the amount of $30,000. The

net cash outflow from financing activities was:

For each of the following separate transactions:

Sold a building costing $37,000, with $22,800 of accumulated depreciation, for $10,800 cash, resulting in a $3,400 loss.

Acquired machinery worth $12,800 by issuing $12,800 in notes payable.

Issued 1,280 shares of common stock at par for $2 per share.

Note payables with a carrying value of $41,400 were retired for $49,800 cash, resulting in a $8,400 loss.

(a) Prepare the reconstructed journal entry.(b) Identify the effect it has, if any, on the investing section or financing section of the statement of cash flows.

Chapter 14 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 14 - Prob. 1DQCh. 14 - Prob. 2DQCh. 14 - Of the three categories on the statement of cash...Ch. 14 - Prob. 4DQCh. 14 - Why is it better to report the noncash investing...Ch. 14 - Prob. 6DQCh. 14 - Prob. 7DQCh. 14 - Explain how a company can report a loss and still...Ch. 14 - In computing the periods net operating cash flows,...Ch. 14 - Prob. 10DQ

Ch. 14 - In computing the periods net operating cash flows,...Ch. 14 - Explain the reasoning for including the payment of...Ch. 14 - What are the advantages in using worksheets when...Ch. 14 - Prob. 14DQCh. 14 - Cash inflows from operating activities come from...Ch. 14 - Prob. 2MCQCh. 14 - Prob. 3MCQCh. 14 - Sources of cash include a. profitable operations....Ch. 14 - Uses of cash include a. cash dividends. b. the...Ch. 14 - Prob. 6MCQCh. 14 - Prob. 7MCQCh. 14 - Which of the following adjustments to net income...Ch. 14 - An increase in accounts receivable is deducted...Ch. 14 - An increase in inventories is deducted from net...Ch. 14 - The gain on sale of equipment is deducted from net...Ch. 14 - Which of the following is an investing activity?...Ch. 14 - Which of the following is a financing activity? a....Ch. 14 - Prob. 14MCQCh. 14 - A worksheet approach to preparing the statement of...Ch. 14 - In a completed worksheet, a. the debit column...Ch. 14 - Prob. 17BEACh. 14 - Prob. 18BEACh. 14 - Prob. 19BEACh. 14 - Prob. 20BEACh. 14 - Swasey Company earned net income of 1,800,000 in...Ch. 14 - Prob. 22BEACh. 14 - Prob. 23BEACh. 14 - During 20X2, Norton Company had the following...Ch. 14 - Prob. 25BEBCh. 14 - Prob. 26BEBCh. 14 - Roberts Company provided the following partial...Ch. 14 - Prob. 28BEBCh. 14 - Prob. 29BEBCh. 14 - Prob. 30BEBCh. 14 - Prob. 31BEBCh. 14 - During 20X2, Evans Company had the following...Ch. 14 - Stillwater Designs is a private company and...Ch. 14 - Prob. 34ECh. 14 - Jarem Company showed 189,000 in prepaid rent on...Ch. 14 - During the year, Hepworth Company earned a net...Ch. 14 - During 20X1, Craig Company had the following...Ch. 14 - Tidwell Company experienced the following during...Ch. 14 - Prob. 39ECh. 14 - Oliver Company provided the following information...Ch. 14 - Prob. 41ECh. 14 - Prob. 42ECh. 14 - Prob. 43ECh. 14 - Solpoder Corporation has the following comparative...Ch. 14 - Solpoder Corporation has the following comparative...Ch. 14 - The following financial statements were provided...Ch. 14 - Prob. 47PCh. 14 - Prob. 48PCh. 14 - Booth Manufacturing has provided the following...Ch. 14 - The following balance sheets and income statement...Ch. 14 - The following balance sheets and income statement...Ch. 14 - Balance sheets for Brierwold Corporation follow:...Ch. 14 - Balance sheets for Brierwold Corporation follow:...Ch. 14 - Prob. 54PCh. 14 - Prob. 55PCh. 14 - The following balance sheets were taken from the...Ch. 14 - The following balance sheets were taken from the...Ch. 14 - The comparative balance sheets and income...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 20X2, Norton Company had the following transactions: a. Cash dividends of 20,000 were paid. b. Equipment was sold for 9,600. It had an original cost of 36,000 and a book value of 18,000. The loss is included in operating expenses. c. Land with a fair market value of 50,000 was acquired by issuing common stock with a par value of 12,000. d. One thousand shares of preferred stock (no par) were sold for 14 per share. Norton provided the following income statement (for 20X2) and comparative balance sheets: Required: Prepare a worksheet for Norton Company.arrow_forwarda. A building with a book value of $400,000 was sold for $500,000 b. Additional common stock was issued for $160,000. c. Dristell purchased its own common stock as treasury stock at a cost of $75,000. d. Land was acquired by issuing a 6%, 10-year, $750,000 note payable to the seller. e. A dividend of $40,000 was paid to shareholders. f. An investment in Fleet Corp.'s common stock was made for $120,000. g. New equipment was purchased for $65,000. h. A $90,000 note payable issued three years ago was paid in full. i. A loan for $100,000 was made to one of Dristell's suppliers. The supplier plans to repay Dristell this amount plus 10% interest within 18 months. Required: Calculate net cash flows from financing activities. (Cash outflows should be indicated with a minus sign.) Net cash flowsarrow_forwardThe balance sheet data of Minx Company at the end of 20x7 and 20x6 follow: Land was acquired for $100,000 in exchange for ordinary shares, par $100,000, during the year; all equipment purchased was for cash. Equipment costing $10,000 was sold for $4,000; book value of the equipment was $8,000 and the loss was reported in net income. Cash dividends of $20,000 were charged to retained earnings and paid during the year; the transfer of net income to retained earnings was the only other entry in the Retained Earnings account. In the statement of cash flows for the year ended December 31, 20x7, for Minx Company: a The net cash provided by operating activities was $ Answer b The net cash provided (used) by investing activities was $ Answer c The net cash provided (used) by financing activities was $ Answerarrow_forward

- On January 1, Vienna Corporation purchased 40% of the outstanding common stock of the Marietta Corporation for $137,500. During the year, Marietta Corporation reported net income of $50,000 and paid cash dividends of $25,000.The balance of the Investment in the Marietta Corporation account on the books of Vienna Corporation at year-end is: Select one: A. $147,500 B. $135,000 C. $100,000 D. $110,000arrow_forwardCarleton Builders Ltd. recorded the following summarized transactions during the current year:a. The company originally sold and issued 108,000 common shares. During the current year 10,000 shares were repurchased from the shareholders and retired. Near the end of the current year, the board of directors declared and paid a cash dividend of $9 per share. The dividend was recorded as follows: General Journal Debit Credit Retained earnings 972,000 Cash ($9 × 98,000) 882,000 Dividend income ($9 × 10,000) 90,000 Carleton Builders Ltd. purchased a machine that had a list price of $98,000. The company paid for the machine in full by issuing 10,000 common shares (market price = $8.90). The purchase was recorded as follows: General Journal Debit Credit Machine 98,000 Share capital ($8.90 × 10,000) 89,000 Gain on purchase of equipment 9,000 Carleton needed a small…arrow_forwarda. On January 1, Yourkie Company acquired 30% of the outstanding stock of Harris Company for $300,000. DATE Debit Credit X/X b. For the year ended December 31, Harris Company earned income of $50,000. DATE Debit Credit X/X c. For the year ended December 31, Harris Company paid dividends of $8,000. DATE Debit Credit X/X d. On January 8th of the next year, Yorkshire Company sold the Harris Company stock for $301,000. DATE Debit Credit X/X i have a-c PLEASE ONLY HELP ON PART Darrow_forward

- a. On January 1, Yourkie Company acquired 30% of the outstanding stock of Harris Company for $300,000. DATE Debit Credit X/X b. For the year ended December 31, Harris Company earned income of $50,000. DATE Debit Credit X/X c. For the year ended December 31, Harris Company paid dividends of $8,000. DATE Debit Credit X/X d. On January 8th of the next year, Yorkshire Company sold the Harris Company stock for $301,000. DATE Debit Credit X/Xarrow_forwardm. Sold, at $38 per share, 2,600 shares of treasury common stock purchased in (g). Description Debit Credit n. Received interest of $6,000 from the Solstice Corp. investment in (f). Description Debit Credit o. Sold Solstice Corp. bonds with a face value of $40,020 for $45,000, realizing a gain of $4,980. Description Debit Credit p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for 6 months. The amortization is determined using the straight-line method. Description Debit Credit q. Accrued interest for 3 months on the Dream Inc. bonds purchased in (1). Description Debit Creditarrow_forwardDuring 20X1, Blue Corporation sold products for $2,500,000 (gross amount) with the sales returns and allowances of $50,000. The company incurred selling expenses for $120,000 and administrative expenses for $330,000. During the year, the company purchased 23,000 common shares of Francis Corporation at $8 per share and recorded the FV-NI investments, and purchased 18,000 shares of Davis Corporation at $12 per share and recorded the FV-OCI investments. On December 31, 20X1, the share prices of Francis Corporation and Davis Corporation were $11 per share and $10 per share, respectively. The company recognized interest expense for $62,000. The beginning-of-year balance of inventory was $640,000 and the end-of-year balance of inventory was $590,000. During the year, the company purchased inventory for $1,600,000. On September 1, 20X1, the company discontinued operation of a division that had a loss of $150,000 for its operation in 20X1. The discontinued division had the carrying value…arrow_forward

- Jackson Moving & Storage Co. paid $120,000 for 25% of the common stock ofMcDonough Co. at the beginning of the year. During the year, McDonough earned netincome of $50,000 and paid dividends of $20,000. The carrying value of Jackson’s investment in McDonough at the end of the year isa. $150,000.b. $170,000.c. $120,000.d. $127,500.arrow_forwardPresented below is information related to Cullumber Company.1. On July 6, Cullumber Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised value of the property is: Land $200,000 Buildings 600,000 Equipment 400,000 Total $1,200,000 Cullumber Company gave 12,000 shares of its $100 par value common stock in exchange. The stock had a market price of $168 per share on the date of the purchase of the property.2. Cullumber Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building. (Prepare consolidated entry for all transactions below.) Repairs to building $168,000 Construction of bases for equipment to be installed later 216,000 Driveways and parking lots 195,200 Remodeling of office space in building, including new partitions and walls 257,600 Special assessment by city on land 28,800 3. On December 20, the company paid cash…arrow_forwarda. Purchased 16,000 common shares of Heller Co. at $16 cash per share. b. Received a cash dividend of $1.25 per common share from Heller. c. Year-end market price of Heller common stock is $17.50 per share. d. Sold all 16,000 common shares of Heller for $252,480 cash. Note: For each account catégory, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Balance Sheet Transaction Cash Asset Noncash Assets Liabilities Contrib. Capital Earned Capital Income Statement Revenues Expenses Net Income (256,000)✔ 256,000 0 ✓ Cash = Investment = ✓ N/A ✔ N/A = N/A M/A N/A (b) 20,000 ▼ 20,000✓ 20,000 ✔ 0✓ = 20,000 ✓ Cash ✓ N/A ÷ N/A ÷ ✓ N/A = Retained earnings Dividend income = ✓ N/A = (c) 0✓ 24,000 ✔ 0✓ 0✓ 24,000 ▼ 24,000 く 24,000 Cash = Investment ✓ N/A = N/A Retained earnings nrealized gain ÷ (d) 252,480✔ (2.240,000) x- 28,480 x Cash ÷ ✓…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License