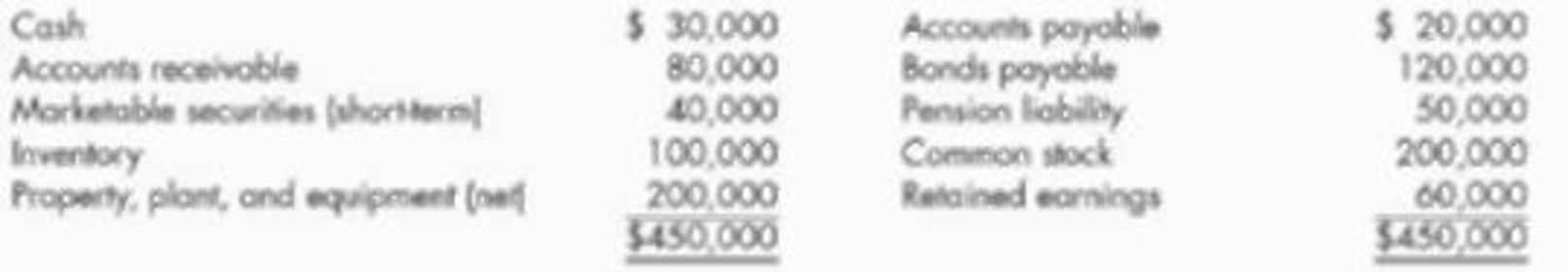

Hamilton Company’s balance sheet on January 1, 2019, was as follows:

Korbel Company is considering purchasing Hamilton (a privately held company) and discovers the following about Hamilton:

- a. No allowance for doubtful accounts has been established. A $10,000 allowance is considered appropriate.

- b. Marketable securities are valued at cost. The current market value is $60,000.

- c. The LIFO inventory method is used. The FIFO inventory of $140,000 would be used if the company is acquired.

- d. Land, included in property, plant, and equipment, which is recorded at its cost of $50,000, is worth $120,000. The remaining property, plant, and equipment is worth 10% more than its

depreciated cost. - e. The company has an unrecorded trademark that is worth $70,000.

- f. The company’s bonds are currently trading for $130,000.

- g. The pension liability is understated by $40,000.

Required:

- 1. Compute the amount of

goodwill if Korbel agrees to pay $500,000 cash for Hamilton. - 2. Next Level What are the reasons that the book value of Hamilton’s net identifiable assets differ from their market value?

- 3. Prepare the

journal entry to record the acquisition on the books of Korbel assuming Hamilton is liquidated. - 4. If Korbel agrees to pay only $400,000 cash, how much goodwill exists?

- 5. If Korbel pays only $400,000 cash, prepare the journal entry to record the acquisition on its books, assuming Hamilton is liquidated.

1.

Calculate the amount of goodwill of Company H.

Explanation of Solution

Goodwill: Goodwill is the good reputation developed by a company over years. This is recorded as an intangible asset, and is quantified when other company acquires. Goodwill should be recorded only when one company is acquired by another company. Goodwill value would be impaired, if the book value of goodwill is less than fair market value.

Calculate the amount of goodwill of Company H:

| Particulars | Amount ($) |

| Amount willing to pay | $500,000 |

| Less: Identifiable net assets | $415,000 |

| Goodwill | $85,000 |

Table (1)

Compute the identifiable net assets:

| Assets | Amount ($) |

| Cash | $30,000 |

| Accounts receivable (net) (1) | 70,000 |

| Marketable securities (short-term) | 60,000 |

| Inventory | 140,000 |

| Land | 120,000 |

| Plant Property &Equipment (2) | 165,000 |

| Trademark | 70,000 |

| Total assets (a) | $655,000 |

| Liabilities | |

| Accounts payable | 20,000 |

| Bonds payable | 130,000 |

| Pension liability | 90,000 |

| Total liabilities (b) | $240,000 |

| Identifiable net assets | 415,000 |

Table (2)

Working note (1):

Compute the accounts receivable (net):

Working note (2):

Compute the plant, property and equipment (net):

2.

State the reason for the difference in the book value of Company H’s identifiable net assets from the market value.

Explanation of Solution

Identifiable intangibles: The identifiable intangibles are the intangible assets that can be easily separated from the company, and it would be sold, transferred, licensed, rented or exchanged. Examples: trademarks, patents, copyrights, franchises, customer lists and relationships, non-compete agreements, and licenses.

The book value of H Company’s identifiable net assets differs from its market value for the following reason:

- Some of the assets of Company H are listed on the balance sheet at amounts other than their market value. For instance: The marketable securities are listed at cost and not at a fair value, likewise the inventory is valued using LIFO, instead of FIFO. The land is reported at cost but not at its market value, if it would have reported at its market value, then the cost would be much higher. Equipment is reported at depreciated cost while its market value is much higher.

- Company H has a valuable internally developed trademark that is not recorded.

- An unidentifiable intangible asset (goodwill) exists. However, it is not reported on H Company’s books.

3.

Prepare journal entry for the given transaction.

Explanation of Solution

Prepare journal entry in the books of Company K assume that Company H has been liquidated.

| Date | Account Title and Explanation | Post Ref |

Debit ($) | Credit ($) |

| Cash | 30,000 | |||

| Accounts Receivable | 70,000 | |||

| Marketable Securities | 60,000 | |||

| Inventory | 140,000 | |||

| Land | 120,000 | |||

| Property, Plant, and Equipment | 165,000 | |||

| Trademark | 70,000 | |||

| Goodwill | 85,000 | |||

| Accounts Payable | 20,000 | |||

| Bonds Payable | 130,000 | |||

| Pension Liability | 90,000 | |||

| Cash | 500,000 | |||

| (To record the acquisition of company H) |

Table (3)

4.

Compute the amount of goodwill that exist, when Company K agrees pay only $400,000 cash.

Explanation of Solution

Compute the amount of goodwill that exist, when Company K agrees pay only $400,000 cash

| Particulars | Amount ($) |

| Amount willing to pay | $400,000 |

| Less: Identifiable net assets | 415,000 |

| Goodwill | (15,000) |

Table (4)

5.

Prepare journal entry for the given transaction.

Explanation of Solution

Prepare journal entry in the books of Company K assume that Company H had paid only $400,000.

| Date | Account Title and Explanation | Post Ref |

Debit ($) | Credit ($) |

| Cash | 30,000 | |||

| Accounts Receivable | 70,000 | |||

| Marketable Securities | 60,000 | |||

| Inventory | 140,000 | |||

| Land | 120,000 | |||

| Property, Plant, and Equipment | 165,000 | |||

| Trademark | 70,000 | |||

| Accounts Payable | 20,000 | |||

| Bonds Payable | 130,000 | |||

| Pension Liability | 90,000 | |||

| Cash | 400,000 | |||

| Gain on purchase of Company H | 15,000 | |||

| (To record the gain on acquisition of company H) |

Table (5)

Want to see more full solutions like this?

Chapter 12 Solutions

Intermediate Accounting: Reporting And Analysis

- . During 2019, Blackpink Company purchased marketable equity securities to be measured at fair value through other comprehensive income. On December 31, 2019, the balance in the unrealized loss on these securities was P200,000. There were no security transactions during 2020. Pertinent data on December 31, 2020 are: Cost Security Value Marketable A 2,100,000 1,600,000 1,850,000 2,000,000 C 1,050,000 900,000 In the statement of changes in equity for 2020, what amount should be included as cumulative unrealized loss as component of other comprehensive income? *arrow_forwardPresented below is information related to the purchases of common stock by Indigo Company during 2020. Cost(at purchase date) Fair Value(at December 31) Investment in Arroyo Company stock $ 90,000 $ 69,000 Investment in Lee Corporation stock 229,000 279,000 Investment in Woods Inc. stock 188,000 199,000 Total $ 507,000 $ 547,000 (Assume a zero balance for any Fair Value Adjustment account.) (a) What entry would Indigo make at December 31, 2020, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option? (b) What entry would Indigo make at December 31, 2020, to record the investments in the Lee and Woods corporations, assuming that Indigo did not select the fair value option for these investments? (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0…arrow_forwardDuring 2019, XYZ Co. purchased marketable equity securities to be measured at fair value thru other comprehensive income. On December 31, 2019, the balance of unrealized loss was P75,000. There were no security transactions during 2020. Pertinent data on December 31, 2020 are as follows: Security Cost Market Value АВС P1,000,000 850,000 950,000 P900,000 800,000 1,000,000 DEF MNO In the statement of changes in equity for 2020, how much should be included as cumulative unrealized loss as component of other comprehensive income?arrow_forward

- During 2020 Carne Corporation transferred inventory to Nolan Corporation and agreed to repurchase the merchandise early in 2021. Nolan then used the inventory as collateral to borrow from Norwalk Bank, remitting the proceeds to Carne. In 2021 when Carne repurchased the inventory, Nolan used the proceeds to repay its bank loan.On whose books should the cost of the inventory appear at the December 31, 2020 balance sheet date? Nolan Corporation Carne Corporation Nolan Corporation, with Carne making appropriate note disclosure of the transaction Norwalk Bankarrow_forwardThe following selected transactions relate to investment activities of Ornamental Insulation Corporation during 2024. The company buys debt securities, not intending to profit from short-term differences in price and not necessarily to hold debt securities to maturity, but to have them available for sale in years when circumstances warrant. Ornamental's fiscal year ends on December 31. No investments were held by Ornamental on December 31, 2023. March 31 Acquired 6% Distribution Transformers Corporation bonds costing $540,000 at face value. September 1 Acquired $1,110,000 of American Instruments' 8% bonds at face value. September 30 Received semiannual interest payment on the Distribution Transformers bonds. October 2 Sold the Distribution Transformers bonds for $579,000. November 1 Purchased $1,560,000 of M&D Corporation 4% bonds at face value. December 31 Recorded any necessary adjusting entry(s) relating to the investments. The market prices of the investments are: American…arrow_forward2. Edwards Company began business in February of 2021. During the year, Edwards purchased the three trading securities listed below. On its December 31, 2021, balance sheet, Edwards appropriately reported a P4,000 credit balance in its Market Adjustment-Trading securities account. There was no change during 2022 in the composition of Edward's portfolio of trading securities. Pertinent data are as follows: Security A B с Cost P120,000 90,000 160,000 P370,000 Fair Value 12/31/22 P126,000 80,000 157,000 P363,000 What amount of loss on these securities should be included in Edward's income statement for the year ended December 31, 2022? d. P0| a. P11,000 b. P7,000 c. P3,000arrow_forward

- 6 7 8 10 October 02, 2024 Fair value adjustment Investment in bonds November 01, 202 Investment in bonds Cash December 31, 202 Investment in bonds Gain on investments (unrealized, OCI) December 31, 202 Gain on investments (unrealized, OCI) Investment in bonds December 31, 202 Interest receivable Interest revenue Besplat Xxx x 425,000 1,400,000 50,000 x 60,000 x 30,000 X Required 2 > 25,000 x 1,400,000 50,000 X 60,000 X 30,000 xarrow_forwardA company purchases debt securities for $100,000 at the beginning of 2022. It classifies as trading securities and $60,000 as AFS securities. It sells the securities in 2023. Required For each of the following scenarios, indicate the net effect on income and other comprehensive income in each year 2022 and 2023. In each case, any unrealized decline in value below cost is expected to be recovered and is attributed to market factors. a. Fair value, end of 2022 Selling price, 2023 Note: Use a negative sign with an answer to indicate the net effect amount decreases Income or OCI. OCI End of 2022 $ 2023 b. Trading securities AFS securities $38,000 $65,000 43,000 64,000 Income Fair value, end of 2022 Selling price, 2023 End of 2022 $ 2023 (2,000)✓ $ 9,000 ✓ Trading securities AFS securities $45,000 $56,000 42,000 68,000 Note: Use a negative sign with an answer to indicate the net effect amount decreases Income or OCI. OCI (4,000) ✔ 0 x 5,000 ✓ 0 x Income 5,000 $ 5,000 ✓arrow_forwardMarigold Company in its first year of operations provides the following information related to one of its available-for-sale debt securities at December 31, 2020. Amortized cost $51,100 Fair value 42,200 Expected credit losses 12,600 A. What is the amount of credit loss that marigold should report on this available-for-sale security at december 31, 2020? Amount of the credit loss $ 8,900 B. Prepare the journal entry to record the credit loss, if any ( and other adjustments needed), at December 31, 2020? date account titles and explanations debit credit 12/31/20 8,900 8,900 Please note that the answer is NOT Debit Loss on available for sale debt securities and Credit avilable for sale debt securities. These are the account titles I can choose from... Accumulated Other…arrow_forward

- Presented below is information related to the purchases of common stock by Lilly Company during 2020. Cost(at purchase date) Fair Value(at December 31) Investment in Arroyo Company stock $100,000 $ 80,000 Investment in Lee Corporation stock 250,000 300,000 Investment in Woods Inc. stock 180,000 190,000 Total $530,000 $570,000 Instructions (Assume a zero balance for any Fair Value Adjustment account.) a. What entry would Lilly make at December 31, 2020, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option? b. What entry(ies) would Lilly make at December 31, 2020, to record the investments in the Lee and Woods corporations, assuming that Lilly did not select the fair value option for these investments?arrow_forwardOn February 18, 2018, Union Corporation purchased $1,139,000 of IBM bonds. Union will hold the bonds indefinitely, and may sell them if their increases sufficiently. On December 31, 2018, and December 31, 2019, the market value of the bonds was $1,105,000 and $1,156,000, respectfully. Prepare the adjusting entry for December 31, 2018 and 2019. The answer they have is: Dec 31,2018 Unrealized holding gain 34,000 Fair value adjustment 34,000 Dec 31,2019 Fair value adjustment 51,000 Unrealized holding gain 51,000 Please show me the calculation steps for the answer: $51,000. How do you get this number?arrow_forwardDuring 2020, Boston Company purchased marketable securities as a trading investment. For the year ended December 31, 2020, the entity recognized an unrealized loss of P230,000. There were no security transactions during 2021. The entity provided the following information on December 31, 2021: Trading security = A; Cost = 2,450,000; Market Value = 2,300,000. Trading security = B; Cost = 1,800,000; Market value = 1,820,000. In the 2021 income statement, what amount should be reported as unrealized gain or loss?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning