Concept explainers

Capital Structure of any company is the mix of different levels of debt and equity. An optimal capital structure is the appropriate mix of debt and equity, striking a balance between risk and return to achieve the goal of maximizing the price of the firm’s stock. Therefore, a target proportion of capital structure and cost of each financing can be used to determine the WACC of the company.

Weighted Average Cost of Capital (WACC) is the required

Here,

Proportion of debt in the target capital structure “

Proportion of preferred stock in the target capital structure “

Proportion of equity in the target capital structure “

After tax cost of debt, preferred stock,

EPS analysis at a given level of EBIT helps in determining the optimal capital structure of the firm, that is the structure at which the EPS will be the highest.

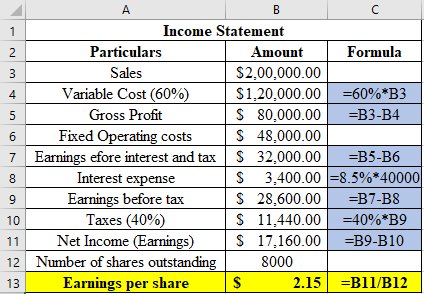

At a sale of $200,000 and debt to total asset ratio of 20%, the company has total assets $200,000, cost of debt 8.5% and number of shares outstanding 8,000.

Explanation of Solution

Income statement of the company is prepared with a debt of $40,000 (20%*$200,000) and interest rate on the debt of 8.5%.

Therefore, when D/TA is 20% and sales is $200,000, the company’s EPS would be

Want to see more full solutions like this?

- Given the following details, what is Layla Inc.’s debt ratio?Sales/Total assets - 1.5xReturn on assets - 3%Return on equity - 5%arrow_forwardUse the selected balance sheet and income statement information below for Anka Inc. to compute the current ratio. Explain what information this ratio provides. Current Assets $26,300,450 Current Liabilities $14,879,200 Pretax Income $4,300,600 Interest Expense $1,300,000arrow_forwardReview of the financial statements revealed the following for Cullumber Inc.: sales $1256000, net income $43700, total assets $653120, long- term debt $761000, interest expense $65312 and cost of goods sold $781000. When preparing common- size financial statements, interest expense would be shown as a) 10.0% b) 9.2%. c) 8.4%. d) 5.2%.arrow_forward

- Margaret O'Flaherty, a portfolio manager for MCF Investments, is considering investing in Alpine Chemical 7% bonds, which mature in 10 years. She asks you to analyze the company to determine the riskiness of the bonds. Alpine Chemical Company Financial Statements Years Ended December 31, ($ in millions) 20X1 20X2 20X3 20X4 20X5 20X6 Assets Cash $ 55 $ 1,637 2,021 190 $ 2,143 1,293 157 249 $ 1,394 1,258 3,493 1,322 Accounts receivable 3,451 1,643 2,087 Inventories 945 Other current assets 17 27 55 393 33 171 5,097 6,181 Current assets 3,114 5,038 2,543 2,495 3,986 5,757 3,138 3,865 2,707 5,619 2,841 2,778 5,265 4,650 2,177 2,473 Gross fixed assets 7,187 3,893 3,465 2,716 Less: Accumulated depreciation Net fixed assets 2,619 3,294 Total assets $6,338 $5,609 $5,485 $6,605 $7,813 $8,559 Liabilities and net worth Notes payable Accounts payable $1,300 338 $ 525 2$ 750 $1,750 $1,900 673 638 681 743 978 Accrued liabilities 303 172 359 359 483 761 Current liabilities 1,501 1,985 1,997 1,457…arrow_forwardSouthern Style Realty has total assets of $485,390, net fixed assets of $250,000, current liabilities of $23,456, and long-term liabilities of $148,000. What is the total debt ratio? Can you provide the formula?arrow_forwardFrom the following compute: (b) Total Assets to Debt Ratio (a) Debt to Equity Ratio (c) Proprietary Ratio S.No. Items Amount 1. Long-Term Borrowings 2,00,000 2 Long-Term Provisions 1,00,000 3 Current Liabilities 50,000 Non-Current Assets 3,60,000 Current Assets 90,000 4.arrow_forward

- Paddy's Pub reported the following year-end data: Income before interest expense and income tax expense Cost of goods sold Interest expense Total assets Total liabilities Total equity Compute the (a) debt-to-equity ratio and (b) times Interest earned. Complete this question by entering your answers in the tabs below. Debt To Equity Times Interest Ratio Earned Compute the debt-to-equity ratio. Numerator: 1 1 Debt-To-Equity Ratio Denominator: IIarrow_forwardCredit Card of America (CCA) has a current ratio of 3.5 and a quick ratio of 3.0. If its total current assets equal $73,500, what are CCA’s (a)current liabilities and (b)inventory?arrow_forwardAccounting XYZ Company has the following information: Total Assets $500,000, Total Liabilities $200,000, and Equity $300,000. Calculate the debt-to-equity ratio and the equity multiplier.arrow_forward

- Calculate the debt-to-equity ratio. Total asset = $1,500,000 Total debts = $1,200,000 Current liabilities = $600,000arrow_forwardUsing the following facts to calculate the Current Ratio, and the Debt Ratio: Ending Total Assets = $705,000; Ending Total Liabilities = $360,000; Ending Current Assets = $295,000; and Long Term Liabilities = $210,000arrow_forwardGiven the following details, what is OXFORD Inc.'s debt ratio? Sales/Total assets Return on assets Return on equity 1.5x 3% 5%arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning