College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 1PB

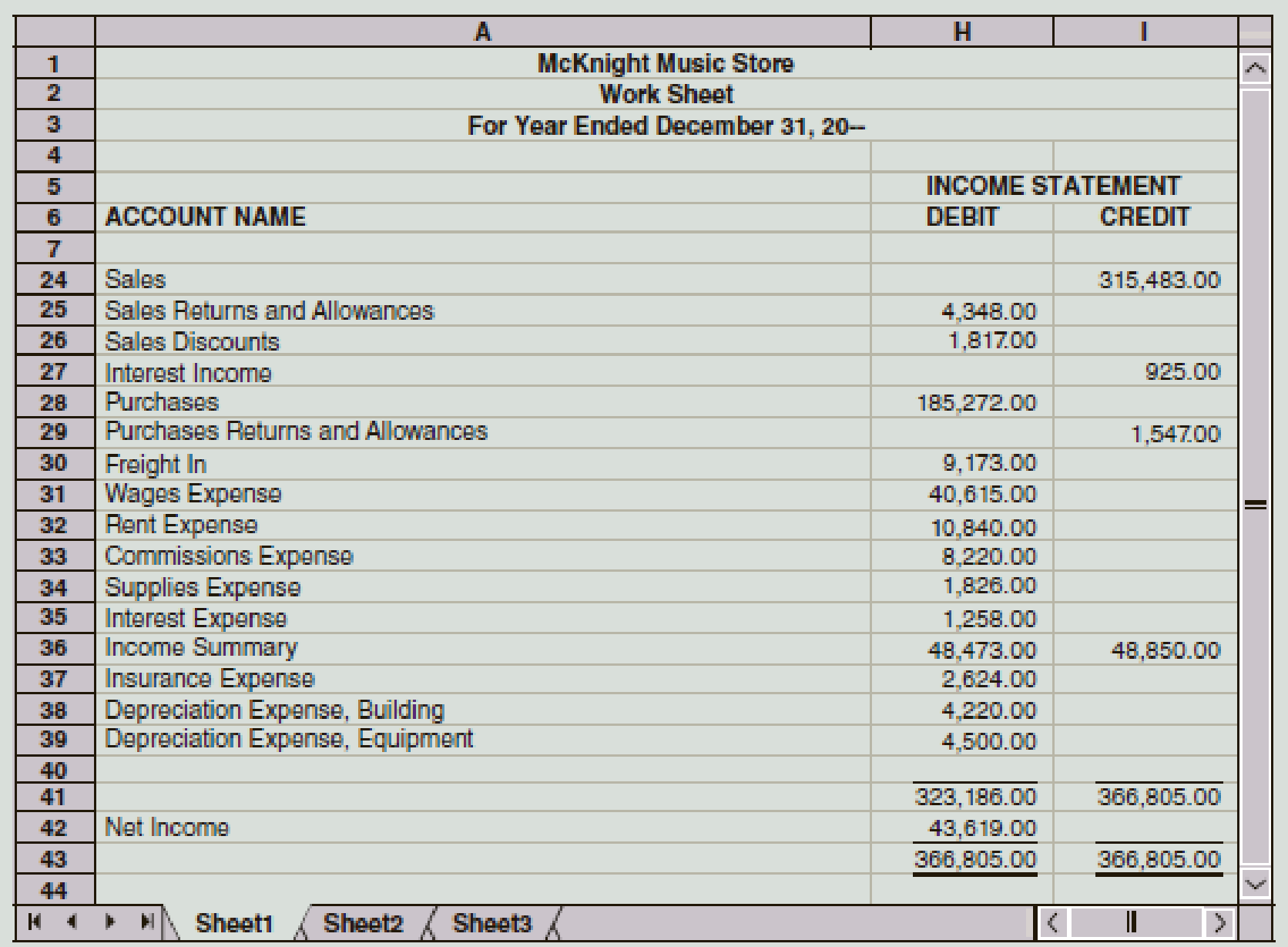

A partial work sheet for McKnight Music Store is presented here. The merchandise inventory at the beginning of the fiscal period was $48,473. W. J. McKnight, the owner, withdrew $40,000 during the year.

Required

- 1. Prepare an income statement.

- 2. Journalize the closing entries.

Check Figure

Cost of Goods Sold, $192,521

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Patricia Flynn owns a business called Patty's Place. The company uses a periodic inventory system. The beginning inventory balance was $31,000. A physical count determined her ending inventory was $25,000. Based on past experience, Patricia estimates that $3,000 of sales from this year will be returned next year. The cost of the merchandise expected to be returned is $900. Which of the following journal entries would record the ending inventory?

a.Debit Income Summary for $25,000 and credit Merchandise Inventory for $25,000

b.Debit Income Summary for $6,000 and credit Merchandise Inventory for $6,000

c.Debit Merchandise Inventory for $6,000 and credit Cost of Goods Sold for $6,000

d.Debit Merchandise Inventory for $25,000 and credit Income Summary for $25,000

At the beginning of the year, Snaplt had $11,800 of inventory. During the year, Snaplt purchased $38,600 of merchandise and sold

$32,700 of merchandise. A physical count of inventory at year-end shows $12,800 of inventory exists. Prepare the entry to record

inventory shrinkage.

View transaction list

Journal entry worksheet

<

1

Record the inventory shrinkage.

Note: Enter debits before credits.

Date

December

31

General Journal

Debit

Credit

Litton Industries uses a perpetual inventory system. The company began its fiscal year with inventory of $268,000. Purchases of

merchandise on account during the year totaled $850,000. Merchandise costing $903,000 was sold on account for $1,430,000.

Prepare the journal entries to record these transactions. (If no entry is required for a transaction/event, select "No journal entry

required" In the first account fleld.)

View transaction list

Journal entry worksheet

< 1 2 3

Record the merchandise purchased on account for $850,000.

Note: Enter debits before credits.

Transaction

1

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Chapter 12 Solutions

College Accounting (Book Only): A Career Approach

Ch. 12 - What is the term used for the profit on a sale...Ch. 12 - Which of the following is not an example of a...Ch. 12 - Prob. 3QYCh. 12 - What is the third entry of the closing procedure...Ch. 12 - What general journal entry is used to undo a...Ch. 12 - Prob. 1DQCh. 12 - What is the difference between the cost of goods...Ch. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - Prob. 5DQ

Ch. 12 - Explain the calculation of net sales and net...Ch. 12 - Prob. 7DQCh. 12 - What are the rules for recognizing whether an...Ch. 12 - Prob. 9DQCh. 12 - Calculate the missing items in the following:Ch. 12 - Using the following information, prepare the Cost...Ch. 12 - Identify each of the following items relating to...Ch. 12 - The Income Statement columns of the August 31...Ch. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - From the following T accounts, journalize the...Ch. 12 - From the following information, journalize the...Ch. 12 - A partial work sheet for The Fan Shop is presented...Ch. 12 - Prob. 2PACh. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - A partial work sheet for McKnight Music Store is...Ch. 12 - Here is the partial work sheet for Meyer Mountain...Ch. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - Costco is the largest chain of membership...Ch. 12 - A music store sells new instruments. The store...Ch. 12 - You are an owner/bookkeeper in a country whose...Ch. 12 - Prob. 4ACh. 12 - Prob. 5ACh. 12 - It is now August 31. You have journalized and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Calculate profit margin on sales ratio. (LO 5). Suppose a firm had sales of $200,000 and net income of $7,000 f...

Financial Accounting

For each of the following transactions, state which special journal (Sales Journal, Cash Receipts Journal, Cash...

Principles of Accounting Volume 1

What are assets limited as to use and how do they differ from restricted assets?

Accounting for Governmental & Nonprofit Entities

Using the information from Problem 1-2B and the inventory information for the Best Bikes below, complete the re...

Managerial Accounting

Based on your answers to the above questions, should Lockwood invest in the machinery?

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A partial work sheet for The Fan Shop is presented here. The merchandise inventory at the beginning of the year was 52,300. P. G. Ochoa, the owner, withdrew 30,500 during the year. Required 1. Prepare an income statement. 2. Journalize the closing entries. Check Figure Cost of Goods Sold, 206,120arrow_forwardJohn Neff owns and operates Waikiki Surf Shop. A year-end trial balance is provided on page 561. Year-end adjustment data for the Waikiki Surf Shop are shown below. Neff uses the periodic inventory system. Year-end adjustment data are as follows: (a, b)A physical count shows that merchandise inventory costing 51,800 is on hand as of December 31, 20--. (c, d, e)Neff estimates that customers will be granted 2,000 in refunds of this years sales next year and the merchandise expected to be returned will have a cost of 1,200. (f)Supplies remaining at the end of the year, 600. (g)Unexpired insurance on December 31, 2,600. (h)Depreciation expense on the building for 20--, 5,000. (i)Depreciation expense on the store equipment for 20--, 3,000. (j)Wages earned but not paid as of December 31, 1,800. (k)Neff also offers boat rentals which clients pay for in advance. Unearned boat rental revenue as of December 31 is 3,000. Required 1. Prepare a year-end spreadsheet. 2. Journalize the adjusting entries. 3. Compute cost of goods sold using the spreadsheet prepared for part (1).arrow_forwardPalisade Creek Co. is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 20Y6 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Record the following transactions on Page 21 of the journal: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. Assume that additional common stock of 10,000 was issued in January 20Y6. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account. 10. Prepare a post-closing trial balance.arrow_forward

- The accounts and their balances in the ledger of Markeys Mountain Shop as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows. Assume that Markeys Mountain Shop uses the perpetual inventory system. a. Merchandise Inventory at December 31, 140,357. b. Store supplies inventory (on hand) at December 31, 540. c. Depreciation of building, 3,400. d. Depreciation of store equipment, 3,800. e. Salaries accrued at December 31, 1,250. f. Insurance expired during the year, 1,480. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 63.arrow_forwardPrepare journal entries to record each of the following sales transactions of a merchandising company. The company uses a perpetual inventory system and the gross method. Apr. 1 Sold merchandise for $6,000, with credit terms n/30; invoice dated April 1. The cost of the merchandise is $3,600. Apr. 4 The customer in the April 1 sale returned $680 of merchandise for full credit. The merchandise, which had cost $408, is returned to inventory. Apr. 8 Sold merchandise for $2,500, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the merchandise is $1,750. Apr. 11 Received payment for the amount due from the April 1 sale less the return on April 4.arrow_forwardCrane Company has the following merchandise account balances at its September 30 year end: Cost of goods sold $140,000, Sales $273,500, Delivery expense $2,100, Sales discounts $950, Merchandise inventory $22,000, Sales returns and allowances $3,200, Salaries expense $41,000, Supplies $2,700. Prepare the entries to close the appropriate accounts to the Income Summary account.arrow_forward

- Inventory at the beginning of the year cost $13,900. During the year, the company purchased (on account) inventory costing $86,500. Inventory that had cost $82,500 was sold on account for $97,000. Required: a. Calculate the amount of ending inventory. b. What was the amount of gross profit? c. Prepare journal entry to record sale of inventory assuming a perpetual system is used. Debit Credit Accountarrow_forwardPrepare journal entries to record each of the following sales transactions of a merchandising company. The company uses a perpetual inventory system and the gross method. April 1 Sold merchandise for $6,000, with credit terms n/30; invoice dated April 1. The cost of the merchandise is $3,600. April 4 The customer in the April 1 sale returned $680 of merchandise for full credit. The merchandise, which had cost $408, is returned to inventory. April 8 Sold merchandise for $2,500, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the merchandise is $1,750. April 11 Received payment for the amount due from the April 1 sale less the return on April 4. View transaction list Journal entry worksheet 1 2 4 5 6 > Sold merchandise for $6,000, with credit terms n/30. Note: Enter debits before credits. Date General Journal Debit Credit Apr 01arrow_forwardBest Hardware uses a periodic inventory system. Its inven-tory was $38,000 at the beginning of the year and $40,000 at the end. During the year, Best made purchases of mer-chandise totaling $107,000. Identify all of the correct answers:a. To use this system, Best must take a complete physicalinventory twice each year.b. Prior to making adjusting and closing entries atyear-end, the balance in Best’s Inventory account is$38,000.c. The cost of goods sold for the year is $109,000.arrow_forward

- Bronson Inc. is a retailer of sporting goods. Bronson’s beginning inventory is $80,000 and itspurchases during the year are $250,000. Its ending inventory is $30,000. Make the closing entriesnecessary given that Bronson uses a periodic inventory system.arrow_forwardFrisbee Hardware uses a perpetual inventory system. At year-end, the Inventory account has abalance of $250,000, but a physical count shows that the merchandise on hand has a cost of only$246,000.a. Explain the probable reason(s) for this discrepancy.b. Prepare the journal entry required in this situation.c. Indicate all the accounting records to which your journal entry in part b should be posted.arrow_forwardPrepare journal entries to record each of the following sales transactions of a merchandising company. The company uses a perpetual inventory system and the gross method. April 1 Sold merchandise for $4,000, with credit terms n/30; invoice dated April 1. The cost of the merchandise is $2,400. April 4 The customer in the April 1 sale returned $480 of merchandise for full credit. The merchandise, which had cost $288, is returned to inventory. April 8 Sold merchandise for $1,500, with credit terms of 1/10, n/30; invoice dated April 8. Cost of the merchandise is $1,050. April 11 Received payment for the amount due from the April 1 sale less the return on April 4. View transaction list Journal entry worksheet 1 2 3 4 5 6 7 Sold merchandise for $4,000, with credit terms n/30. Note: Enter debits before credits. Date General Journal Debit Credit Apr 01 Record entry Clear entry View generaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY