Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 15P

WACC Estimation

On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $30 million in new projects. The firm’s present market value capital structure, shown here, is considered to be optimal. There is no short-term debt.

New bonds will have an 8% coupon rate, and they will be sold at par. Common stock is currently selling at $30 a share. The stockholders’ required

- a. In order to maintain the present capital structure, how much of the new investment must be financed by common equity?

- b. Assuming there is sufficient cash flow for Tysseland to maintain its target capital structure without issuing additional shares of equity, what is its WACC?

- c. Suppose now that there is not enough internal cash flow and the firm must issue new shares of stock. Qualitatively speaking, what will happen to the WACC? No numbers are required to answer this question.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

WACC Estimation

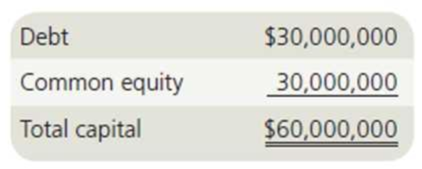

On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $20 million in new projects. The firm's present market value capital structure, here below, is considered to be optimal. There is no short-term debt.

Debt

$30,000,000

Common equity

30,000,000

Total capital

$60,000,000

New bonds will have an 7% coupon rate, and they will be sold at par. Common stock is currently selling at $30 a share. The stockholders' required rate of return is estimated to be 12%, consisting of a dividend yield of 4% and an expected constant growth rate of 8%. (The next expected dividend is $1.20, so the dividend yield is $1.20/$30 = 4%.) The marginal tax rate is 40%.

In order to maintain the present capital structure, how much of the new investment must be financed by common equity? Enter your answer in dollars. For example, $1.2 million should be entered as $1200000.$

Assuming there is sufficient…

WACC Estimation

On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $15 million in new projects. The firm's present market value capital structure, here below, is considered to be optimal. There is no short-term debt.

Debt $30,000,000

Common equity 30,000,000

Total capital $60,000,000

New bonds will have a 9% coupon rate, and they will be sold at par. Common stock is currently selling at $30 a share. The stockholders' required rate of return is estimated to be 12%, consisting of a dividend yield of 4% and an expected constant growth rate of 8%. (The next expected dividend is $1.20, so the dividend yield is $1.20/$30 = 4%.) The marginal tax rate is 25%. $

a. In order to maintain the present capital structure, how much of the new investment must be financed by common equity? Round your answer to the nearest dollar.

b. Assuming there is sufficient cash flow for Tysseland to maintain its target capital…

WACC Estimation

On January 1, the total market value of the Tysseland Company was $60 million. During the year, the company plans to raise and invest $20 million in new projects. The firm's present market value capital structure, here below, is considered to be optimal. There is no short-term debt.

Debt

$30,000,000

Common equity

30,000,000

Total capital

$60,000,000

New bonds will have an 6% coupon rate, and they will be sold at par. Common stock is currently selling at $30 a share. The stockholders' required rate of return is estimated to be 12%, consisting of a dividend yield of 4% and an expected constant growth rate of 8%. (The next expected dividend is $1.20, so the dividend yield is $1.20/$30 = 4%.) The marginal tax rate is 30%.

In order to maintain the present capital structure, how much of the new investment must be financed by common equity? Enter your answer in dollars. For example, $1.2 million should be entered as $1200000.$

Assuming there is sufficient…

Chapter 11 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 11 - Define each of the following terms:

Weighted...Ch. 11 - Prob. 2QCh. 11 - Prob. 3QCh. 11 - Distinguish between beta (i.e., market) risk,...Ch. 11 - Suppose a firm estimates its overall cost of...Ch. 11 - 11-1 After-Tax Cost of Debt

Calculate the...Ch. 11 - Prob. 2PCh. 11 - Cost of Preferred Stock

Duggins Veterinary...Ch. 11 - Prob. 4PCh. 11 - Prob. 5P

Ch. 11 - Prob. 6PCh. 11 - Prob. 7PCh. 11 - Prob. 8PCh. 11 - Bond Yield and After-Tax Cost of Debt A companys...Ch. 11 - Prob. 10PCh. 11 - Prob. 11PCh. 11 - Calculation of gL and EPS Spencer Suppliess stock...Ch. 11 - The Cost of Equity and Flotation Costs

Messman...Ch. 11 - Prob. 14PCh. 11 - WACC Estimation

On January 1, the total market...Ch. 11 - Prob. 16PCh. 11 - During the last few years, Jana Industries has...Ch. 11 - What is the market interest rate on Jana’s debt,...Ch. 11 - Prob. 3MCCh. 11 - Prob. 4MCCh. 11 - Prob. 5MCCh. 11 - Prob. 6MCCh. 11 - Prob. 7MCCh. 11 - Prob. 8MCCh. 11 - Prob. 9MCCh. 11 - Prob. 10MCCh. 11 - What procedures can be used to estimate the...Ch. 11 - Prob. 12MCCh. 11 - Prob. 13MCCh. 11 - Prob. 14MCCh. 11 - What four common mistakes in estimating the WACC...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The stock of Nogro Corporation is currently selling for $29 per share. Earnings per share in the coming year are expected to be $3.90. The company has a policy of paying out 50% of its earnings each year in dividends. The rest is retained and invested in projects that earn a 21% rate of return per year. This situation is expected to continue indefinitely. a. Assuming the current market price of the stock reflects its intrinsic value as computed using the constant-growth DDM, what rate of return do Nogro's investors require (round to 2 decimal places)? Rate of Return ?% b. By how much does its value exceed what it would be if all earnings were paid as dividends and nothing were reinvested (round to 2 decimal places)? PVGO $?arrow_forwardThe stock of Nogro Corporation is currently selling for $16 per share. Earnings per share in the coming year are expected to be $4 The company has a policy of paying out 40% of its earnings each year in dividends. The rest es retained and invested in projects that earn a 25% rate of return per year. This situation is expected to continue indefinitely Required: a. Assuming the current market price of the stock reflects its intrinsic value as computed using the constant-growth DDM, what rate of return do Nogro's investors require? (Do not round intermediate calculations.) Rate of retur Return to question Answer is complete and correct. 250% b. By how much does its value exceed what it would be if all earnings were paid as dividends and nothing was reinvested?arrow_forwardGMA corporation is preparing to issue common stock. The Chief Financial Officer is attempting to estimate GMR’s cost of new common stock. The next dividend is expected to be P4.25 and will be paid one year from now. The current market price reflects an 18% expected annual return on investors. Dividends are expected to grow at a constant 8% per year. Flotation costs on the new issue will be P 1.25 per share. GMR’s cost of new common stock is nearest: a. 18.30% b. 18.00% c. 19.25% d. 19.44%arrow_forward

- The stock of Nogro Corporation is currently selling for $28 per share. Earnings per share in the coming year are expected to be $7.00. The company has a policy of paying out 50% of its earnings each year in dividends. The rest is retained and invested in projects that earn a 25% rate of return per year. This situation is expected to continue indefinitely. Required: Assuming the current market price of the stock reflects its intrinsic value as computed using the constant-growth DDM, what rate of return do Nogro’s investors require? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. By how much does its value exceed what it would be if all earnings were paid as dividends and nothing were reinvested? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. If Nogro were to cut its dividend payout ratio to 25%, what would happen to its stock price? Note: Round your answer to 2 decimal places. What would happen to its…arrow_forwardThe stock of Nogro Corporation is currently selling for $10 per share. Earnings per share in the coming year are expected to be $2. The company has a policy of paying out 50% of its earnings each year in dividends. The rest is retained and invested in projects that earn a 20% rate of return per year. This situation is expected to continue indefinitely. a. Assuming the current market price of the stock reflects its intrinsic value as computed using the constant-growth DDM, what rate of return do Nogro’s investors require?b. By how much does its value exceed what it would be if all earnings were paid as dividends and nothing were reinvested?c. If Nogro were to cut its dividend payout ratio to 25%, what would happen to its stock price?d. What if Nogro eliminated the dividend?arrow_forwardThe analyst estimates that after three years the National Inc’s free cash flow will grow at a constant rate of 6% per year. The analyst estimates that the company’s WACC is 10%. The total market value of debt and preferred stock is P25,000 and there are 1,000 outstanding shares of common stock. What is the intrinsic value of the company’s common stock? a. P99.50 b. P84.34 c. P75.31 d. P112.22arrow_forward

- Flatworld Airlines Inc. is expected to generate free cash flow of $308.834 million at the end of the year. Analysts expect Flatworld's cash flows to grow in perpetuity at the rate of 2.5%. Flatworld has debt worth $1,667.67 million. The annual coupon rate is 8% and the yield on the bonds is also 8%. Flatworld's debt-to-value ratio is 40% and management plan to maintain that ratio in perpetuity. Flatworld's stockholders require a return of 13%. The tax rate is 34%. Use this information to answer the questions that follow. Part 1 What is free cash flow to equity? Express your answer in millions of dollars rounded to one decimal place. Free cash flow to equity = $ M Part 2 What is the value of the equity using the FCFE approach? Express your answer in millions of dollars rounded to one decimal place. Value of equity = $ M Part 3 What is the value of the equity using the DCF/WACC approach? Express your answer in millions of dollars rounded to one decimal place. Value of equity = $ Marrow_forwardSidman Products’s common stock currently sells for $60.00 ashare. The firm is expected to earn $5.40 per share this year and to pay a year-end dividendof $3.60, and it finances only with common equity.a. If investors require a 9% return, what is the expected growth rate?b. If Sidman reinvests retained earnings in projects whose average return is equal tothe stock’s expected rate of return, what will be next year’s EPS?arrow_forwardJohn Adam, an analyst with T.D. Wyse Securities, is trying to evaluate Company A’s target stock price per share. Free cash flow (FCF) estimates for the next 3 years are -$2, $12, and $18 million, after which the FCF is expected to grow at 4%. The overall firm cost of capital is 10%. The firm has $40 million in debt and has 16 million shares of stock. What is the estimated value per share? Show your calculations.arrow_forward

- An analyst is trying to estimate the intrinsic value of Blue Co. that has a weighted average cost of capital at 10%. The estimated free cash flows for the company for the following years are: Year 1 P3,000 Year 2 P4,000 Year 3 P5,000 The analyst estimates that after three years, free cash flow will grow at a constant annual percentage of 6%. What is the total intrinsic value of the company's common stock if combined debt and preferred stock has a P25,000 market value? *arrow_forwardSidman Products's common stock currently sells for $67 a share. The firm is expected to earn $7.37 per share this year and to pay a year-end dividend of $2.60, and it finances only with common equity. a. If investors require an 11% return, what is the expected growth rate? Do not round intermediate calculations. Round your answer to two decimal places. % b. If Sidman reinvests retained earnings in projects whose average return is equal to the stock's expected rate of return, what will be next year's EPS? (Hint: g - (1 - Payout ratio)ROE). Do not round intermediate calculations. Round your answer to the near ent. per sharearrow_forwardSidman Products's common stock currently sells for $49 a share. The firm is expected to earn $4.41 per share this year and to pay a year-end dividend of $2.80, and it finances only with common equity. If investors require a 9% return, what is the expected growth rate? Round your answer to two decimal places. Do not round your intermediate calculations. % If Sidman reinvests retained earnings in projects whose average return is equal to the stock's expected rate of return, what will be next year's EPS? (Hint: g = (1 – Payout ratio)ROE). Round your answer to the nearest cent. Do not round your intermediate calculations.$ per sharearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

What is WACC-Weighted average cost of capital; Author: Learn to invest;https://www.youtube.com/watch?v=0inqw9cCJnM;License: Standard YouTube License, CC-BY