DECISION MAKING ACROSS THE ORGANIZATION

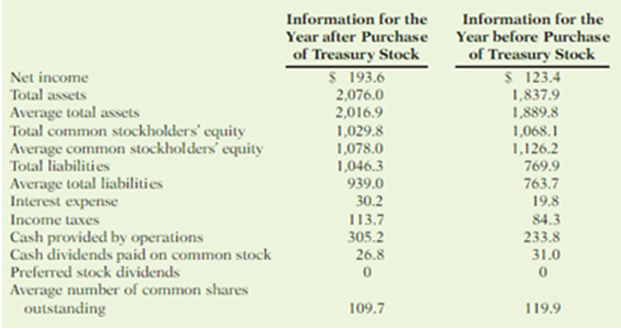

During a recent period, the fast-food drain Wendy’s International purchased many treasury shares. This caused the number of shares outstanding to fall from 124 million to 105 million. The following information was drawn from the company’s financial statements (in millions).

Instructions

Use the information provided to answer the following questions.

(a) Compute earnings per share, return on common stockholders’ equity and return on assets for both years. Discuss the change in the company’s profitability over this period.

(b) Compute the dividend payout ratio. Also compute the average cash dividend paid per share of common stock (dividends paid divided by the average number of common shares outstanding). Discuss any change in these ratios during this period and the implications for the company’s dividend policy.

(c) Compute the debt to assets ratio and limes interest earned. Discuss the change in the company’s solvency.

(d) Based on your findings in (a) and (c), discuss to what extent any change in lie return on common stockholders’ equity was tire result of increased reliance on debt.

(e) Does it appear that the purchase of

(a)

Financial Ratios: Financial ratios are the metrics used to evaluate the overall financial performance of a company during a specific period of time.

To compute: the earnings per share for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Calculate the earnings per share for W International.

For year ended after purchase of treasury stock

For year ended before purchase of treasury stock

Explanation of Solution

Earnings per share (EPS) refers to the share of earnings earned by the shareholder on each owned. The formula to calculate the earnings per share is as follows:

Therefore, the earnings per share for year ended after purchase of treasury stock is $1.76 per share and for year ended before purchase of treasury stock is $1.03 per share.

To Compute: the return on common stockholders’ equity for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Compute the return on common stockholders’ equity for W International:

For year ended after purchase of treasury stock

For year ended before purchase of treasury stock

Explanation of Solution

Return on common stockholders’ equity ratio: It is a profitability ratio that measures the profit generating ability of the company from the invested money of the shareholders. The formula to calculate the return on common stockholders’ equity is as follows:

Therefore, the Return on Common Stockholders’ equity for year ended after purchase of treasury stock is 18% and, for year ended before purchase of treasury stock is 11%.

To Compute: the return on assets ratio for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Compute the return on assets ratio:

For year ended after purchase of treasury stock.

For year ended before purchase of treasury stock.

Explanation of Solution

Return on assets is used to measure the overall earning ability of the company. Thus, it shows the relationship between the net income and the average total assets.

The formula to calculate the return on assets ratio is as follows:

Therefore, the Return on assets for year ended after purchase of treasury stock is 9.6% and, for year ended before purchase of treasury stock is 6.5%.

To discuss: the change in the company’s profitability over this period.

Explanation of Solution

The change in the company’s profitability over this period is discussed below:

- The purchase of treasury stock increased the earnings per share from $1.03 per share to $1.76 per share thereby reducing the number of outstanding shares in the for the year ended after the purchase of treasury stock.

- The return on common stockholders’ equity increased from 11% to 18% after the purchase of treasury stock due to increased return on assets from 6.5% to 9.6%. This implies that the company is able to earn more on the money invested on assets than interest paying on its borrowings.

- Thus, the above explanations imply that the purchase of treasury stock has increased the profitability of W International.

(b)

To Compute: the payout ratio for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Compute the payout ratio for W International:

For year ended after purchase of treasury stock

For year ended after purchase of treasury stock

Explanation of Solution

Payout Ratio: It refers to a measure that evaluates the amount of dividends paid to the shareholders out of the net income earned by a corporation. It is generally expressed as a percentage. The formula to calculate the payout ratio is as follows:

Therefore, the Payout ratio for year ended after purchase of treasury stock is 13.8% and, for year ended before purchase of treasury stock is 25.1%.

To Compute: the average cash dividend paid per share for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Compute the average cash dividend paid per share for W International:

For year ended after purchase of treasury stock

For year ended after purchase of treasury stock

Explanation of Solution

Average cash dividend paid per share: It refers to a measure that evaluates the amount of cash dividend paid on each share owned by the common shareholders out of the total cash dividends paid by a corporation. The formula to calculate the average cash dividend paid per share as follows:

Therefore, the average cash dividend paid per share for year ended after purchase of treasury stock is $0.24 per share and, for year ended before purchase of treasury stock is $0.26 per share.

To discuss: the change in these ratios during this period and the implications for the company’s dividend policy.

Explanation of Solution

After the purchase of treasury stock, the company has paid lesser dividends to its common stockholders as compared to before the purchase of treasury stock. Thus, it implies that the company is intentionally retained its earnings for investing in operations.

(c)

To Compute: the debt to assets ratio for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Compute the debt to assets ratio for W International:

For year ended after purchase of treasury stock.

For year ended before purchase of treasury stock.

Explanation of Solution

Debt to assets ratio: It is the ratio that measures the ability of a company to meet its long-term obligations out of its total assets available. It shows the relationship of total liabilities and total assets.

The formula to calculate the debt to assets ratio is as follows:

Therefore, the Debt to assets ratio for year ended after purchase of treasury stock is 50.4% and, for year ended before purchase of treasury stock is 41.9%.

To Compute: the times interest earned ratio for year ended after and before purchase of treasury stock.

Answer to Problem 11.6EYCT

Calculate the times interest earned ratio for W International:

For year ended after purchase of treasury stock.

For year ended after purchase of treasury stock.

Explanation of Solution

Times interest earned ratio: This ratio that measures a company’s ability to meet its interest payments with its available earnings.

The formula to calculate the times interest earned ratio is as follows:

Therefore, the Times interest earned ratio for year ended after purchase of treasury stock is 11.2 times and, for year ended before purchase of treasury stock is 11.5times.

To discuss: the change in company’s solvency.

Explanation of Solution

The change in company’s solvency is discussed below:

- Although the purchase of treasury stock has increased the profitability of the company but reduced its solvency.

- The company has increased the debts to assets ratio from 41.9% to 50.4% that decreased the solvency rate.

- The times interest earned ratio also slightly decreased from 11.5 times to 11.2 times due to the increase in interest expenses.

- Thus, this decrease in solvency might not much worry the investors.

(d)

To discuss: to what extent the increased reliance on debts changes in the return on common stockholders’ equity.

Explanation of Solution

As from the above calculated ratios, it is seen that there is an increase in both return on assets and return on common stockholders’ equity. Thus, it can be implied that the increased reliance and debt financing as well as the increased return on assets lead to the increase in the return on common stockholders’ equity.

(e)

To explain: whether the purchase of treasury stock and the reliance on debt financing was a wise strategic move.

Explanation of Solution

From the above calculated ratios, it is found that all the calculated ratios showed an improvement after the purchase of treasury stock. Thus, it indicates that the company has effectively used its available resources to increase its profitability significantly. However, there is seen a slight decrease in solvency rate and hence, it should not be a matter of concern for the company. It can smoothly handle its debt payments.

Therefore, it can be concluded that the purchase of treasury stock and the reliance on debt financing was a wise strategic move for W International.

Want to see more full solutions like this?

Chapter 11 Solutions

Financial Accounting: Tools for Business Decision Making, 8th Edition

- Lucas Hunter, president of Simmons Industries Inc., believes that reporting operating cash flow per share on the income statement would be a useful addition to the companys just completed financial statements. The following discussion took place between Lucas Hunter and Simmons controller, John Jameson, in January, after the close of the fiscal year: Lucas: Ive been reviewing our financial statements for the last year. I am disappointed that our net income per share has dropped by 10% from last year. This wont look good to our shareholders. Is there anything we can do about this? John: What do you mean? The past is the past, and the numbers are in. There isnt much that can be done about it. Our financial statements were prepared according to generally accepted accounting principles, and I dont see much leeway for significant change at this point. Lucas: No, no. Im not suggesting that we cook the books. But look at the cash flow from operating activities on the statement of cash flows. The cash flow from operating activities has increased by 20%. This is very good newsand, I might add, useful information. The higher cash flow from operating activities will give our creditors comfort. John: Well, the cash flow from operating activities is on the statement of cash flows, so I guess users will be able to see the improved cash flow figures there. Lucas: This is true, but somehow I think this information should be given a much higher profile. I dont like this information being buried in the statement of cash flows. You know as well as I do that many users will focus on the income statement. Therefore, I think we ought to include an operating cash flow per share number on the face of the income statementsomeplace under the earnings per share number. In this way, users will get the complete picture of our operating performance. Yes, our earnings per share dropped this year, but our cash flow from operating activities improved! And all the information is in one place where users can see and compare the figures. What do you think? John: Ive never really thought about it like that before. I guess we could put the operating cash flow per share on the income statement, underneath the earnings per share amount. Users would really benefit from this disclosure. Thanks for the ideaIll start working on it. Lucas: Glad to be of service. How would you interpret this situation? Is John behaving in an ethical and professional manner?arrow_forward1).Big Rock is listed on the local stock exchange and its stock has had mixed performanceover the last few months. The company’s directors are interested in seeing how BigRock’s performance compares to other companies in the sector. Company Initial Investment Value End of Year 1 Value Endof Year 2 Value Endof Year 3Big Rock Building Inc. $1,000 $1,268 $1334 $1,105 Required: Calculate the arithmetic mean and the geometric mean over the three-yearperiod for the investments made. 2).The company’s pension plan is managed by Castle Fund Managers, a leading provider ofpension services. It is a defined contribution plan, where the employees’ contributions arematched by the employer. Each employee had to choose one of the following investmentoptions for their individual plans: a. Preferred Accumulator (PA): Short-term focusb. Balanced Accumulator (BA): Medium-term focusc. Select…arrow_forwardThe company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company’s relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Ratios Calculated Year 1 Year 2 Year 3 Price-to-cash-flow 2.80 1.96 1.57 Inventory turnover 5.60 4.48 3.58 Debt-to-equity 0.60 0.48 0.38 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. A plausible reason why Blue Hamster Manufacturing Inc.’s price-to-cash-flow ratio has decreased is that investors expect lower cash flow per share in the future. Blue Hamster Manufacturing Inc.’s ability to meet its debt obligations has improved since its debt-to-equity ratio…arrow_forward

- The right side of the balance sheet shows the firm’s liabilities and stockholders’ equity. Which of the following best describes shareholders’ equity? Equity is the difference between the company’s assets and retained earnings. Equity is the sum of shareholders’ capital provided by shareholders and retained earnings. NOW Inc. released its annual results and financial statements. Grace is reading the summary in the business pages of today’s paper. In its annual report this year, NOW Inc. reported a net income of $192 million. Last year, the company reported a retained earnings balance of $442 million, whereas this year it increased to $520 million. How much was paid out in dividends this year? $3 million $114 million $270 million $575 millionarrow_forwardAl- Hind Hardware Ltd. is a recently started distribution company in Muscat. The management of the company mulls to improve their operational efficiency based on their previous year experience. The finance manager of Al- hind company is seeking your help in assessing the stock turnover ratio and debtor’s turnover ratio from the given financial data; Stock on 1-1-2020 was OMR 8,000, during the year 2020 the company made a total purchase of OMR 18,000 out of which OMR 3000 was on cash basis. Total sales of the company during the year 2020 is 35,000 of which 19,000 was on cash basis. Stock on 31-12-2020 is given as 6,000. The following are the other information extracted from the last year financial statements. Choose the correct Stock turn over ratio and Debtors turnover ratio from the following? Stock turnover ratio is 1.57 and Debtors turnover ratio is 2.57 Stock turnover ratio is 1.68 and Debtors turnover ratio is 2.57 Stock turnover ratio is 2.57 and…arrow_forwardAmeen traders. is a recently started stationery business in Muscat. The management of the company is planning to improve their operational efficiency based on their previous year experience. The finance manager of Ameen traders is seeking your help in assessing the stock turnover ratio and debtor's turnover ratio from the given financial data; Stock on 1-1-2020 was OMR 10,000, during the year 2020 the company made a total purchase of OMR 20,000 out of which OMR 3000 was on cash basis. Total sales of the company during the year 2020 is 40,000 of which 20,000 was on cash basis. Stock on 31-12-2020 is given as 6,000. The following are the other information extracted from the last year financial statements. Particulars Amount in OMR Return outwards Return inwards Carriage outwards Salaries and wages Opening debtors Closing debtors 3,000 2,000 2,500 3,500 10,000 15,000 Choose the correct Stock turn over ration and Debtors turnover ratio from the following? Stock turnover ratio is 1.57 and…arrow_forward

- Ameen traders. is a recently started stationery business in Muscat. The management of the company is planning to improve their operational efficiency based on their previous year experience. The finance manager of Ameen traders is seeking your help in assessing the stock turnover ratio and debtor’s turnover ratio from the given financial data; Stock on 1-1-2020 was OMR 10,000, during the year 2020 the company made a total purchase of OMR 20,000 out of which OMR 3000 was on cash basis. Total sales of the company during the year 2020 is 40,000 of which 20,000 was on cash basis. Stock on 31-12-2020 is given as 6,000. The following are the other information extracted from the last year financial statements. Choose the correct Stock turn over ration and Debtors turnover ratio from the following? a)Stock turnover ratio is 1.57 and Debtors turnover ratio is 2.57 b)Stock turnover ratio is 2.85 and Debtors turnover ratio is 1.68 c)Stock turnover ratio is 2.625 and Debtors…arrow_forwardIdentify any favorable and unfavorable trends in the following income statements by preparing a vertical analysis. Write a paragraph explaining what you find. (Round percentages to two decimal places.) Becker Corporation Income Statements For the Years Ended December 31 Year 2 Revenues Operating expenses: Wages expense Rent expense Utilities expense Interest expense Total operating expenses Net income Year 1 $394,000 $212,500 $ 79,000 $ 65,000 19,000 21,000 7,500 18,000 14,200 7,800 $126,500 $105,000 $267,500 $107,500arrow_forwardSuppose you are conducting an analysis of the financial performance of Cold Goose Metal Works Inc. over the past three years. The company did not issue new shares during these three years and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios. Ratios Calculated Year 1 Year 2 1.00 1.30 2.40 Inventory turnover 2.00 Debt-to-equity Price-to-cash-flow Year 3 1.46 2.69 0.30 0.32 0.38 Based on the preceding Information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. Cold Goose Metal Works Inc.'s ability to meet its debt obligations has worsened since its debt-to-equity ratio Increased from 0.30 to 0.38. The company's creditworthiness has improved over these…arrow_forward

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardAnalyze and compare Zynga, Electronic Arts, and Take-Two Data (in millions) from recent financial statements of Zynga Inc. (ZNGA), Electronic Arts Inc. (EA), and Take-Two Interactive Software, Inc. (TTWO) are as follows: a. Compute the working capital for Year 2 and Year 1 for each company. b. Which company has the largest working capital? c. Compute the current ratio for Year 2 and Year 1 for each company. Round to one decimal place. d. For Year 2, rank the companies from most liquid to least liquid based upon the current ratio.arrow_forwardAmeen traders. is a recently started stationery business in Muscat. The management of the company is planning to improve their operational efficiency based on their previous year experience. The finance manager of Ameen traders is seeking your help in assessing the stock turnover ratio and debtor's turnover ratio from the given financial data; Stock on 1-1-2020 was OMR 10,000, during the year 2020 the company made a total purchase of OMR 20000 out of which OMR 3000 was on cash basis. Total sales of the company during the year 2020 is 40,000 of which 20,000 was on cash basis. Stock on 31-12-2020 is given as 6,000. The following are the other information extracted from the last year financial statements. Particulars Amount In OMR Return outwards Return inwards Carriage outwards Salaries and wages 3,000 2,000 2,500 3,500 Opening debtors Closing debtors 10,000 15,000 Choose the correct Stock tum over ration and Debtors turnover ratio from the following? O Stock turnover ratio is 2.85 and…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning