Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 40P

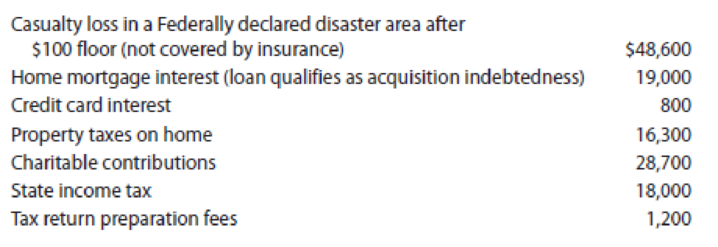

LO.2, 3, 4, 5, 6, 7 For calendar year 2019, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows:

Calculate the amount of itemized deductions the Gibsons may claim for the year.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

<

Daniel's standard deduction for 2023 is $13,850.

a. Classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible".

Payment of alimony (divorce finalized in March 2021)

Mortgage interest on residence

Property tax on residence

Contribution to traditional IRA (assume the amount is fully

deductible)

Contribution to United Church

Loss on the sale of real estate (held for investment)

Medical expenses

State income tax

Federal income tax

What is Daniel's gross income and his AGI?

Gross income: $

AGI: $

b. Should Daniel itemize his deductions from AGI or take the standard deduction?

Because Daniel's total itemized deductions (after any limitations) are $

he would benefit from

10:34

Robin's financial records from 2020 show the following information from the forms she received:

Interest income from bank CD's: $1,600

Taxable annuity payment total: $3,200

City ad valorem property on investments: $240

Investment interest expense: $5,600

Calculate Robin's net investment income and her current investment deduction. How is a deduction for any potential excess investment interest treated? Why is it treated this way?

During 2020, Catherine had the following deductions and adjustments to income: Schedule C (Form 1040) expenses of $15,000, standard deduction of $12,400, $8,400 alimony paid, and $3,700 casualty loss attributable to a federal disaster area. Compute her total nonbusiness deductions for NOL purposes.

$15,000

$18,700

$20,800

$27,400

Chapter 10 Solutions

Individual Income Taxes

Ch. 10 - Prob. 1DQCh. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Prob. 4DQCh. 10 - LO.2 David, a sole proprietor of a bookstore, pays...Ch. 10 - LO.2 Jayden, a calendar year taxpayer, paid 16,000...Ch. 10 - Prob. 7DQCh. 10 - Prob. 8DQCh. 10 - Prob. 9DQCh. 10 - Prob. 10DQ

Ch. 10 - LO.5 Thomas purchased a personal residence from...Ch. 10 - Prob. 12DQCh. 10 - Prob. 13DQCh. 10 - LO.6, 8 William, a high school teacher, earns...Ch. 10 - LO.2 Barbara incurred the following expenses...Ch. 10 - Prob. 16CECh. 10 - Prob. 17CECh. 10 - Prob. 18CECh. 10 - Prob. 19CECh. 10 - Prob. 20CECh. 10 - Prob. 21CECh. 10 - Prob. 22PCh. 10 - Prob. 23PCh. 10 - LO.2 Paul suffers from emphysema and severe...Ch. 10 - LO.2 For calendar year 2019, Jean was a...Ch. 10 - LO.2 During 2019, Susan incurred and paid the...Ch. 10 - In May, Rebeccas daughter, Isabella, sustained a...Ch. 10 - Prob. 28PCh. 10 - Prob. 29PCh. 10 - Prob. 30PCh. 10 - Prob. 31PCh. 10 - Prob. 32PCh. 10 - Prob. 33PCh. 10 - Prob. 34PCh. 10 - On December 27, 2019, Roberta purchased four...Ch. 10 - Prob. 36PCh. 10 - Prob. 37PCh. 10 - Prob. 38PCh. 10 - LO.2, 3, 4, 5, 6, 7 Linda, who files as a single...Ch. 10 - LO.2, 3, 4, 5, 6, 7 For calendar year 2019, Stuart...Ch. 10 - Prob. 41CPCh. 10 - Marcia, a shareholder in a corporation with stores...Ch. 10 - Prob. 4RPCh. 10 - Prob. 1CPACh. 10 - Prob. 2CPACh. 10 - Prob. 3CPACh. 10 - Kurstie received a 800 state income tax refund...Ch. 10 - Which of the following would preclude a taxpayer...Ch. 10 - Prob. 6CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Renee and Sanjeev Patel, who are married, reported taxable income of 1,008,000 for 2019. They incurred positive AMT adjustments of 75,000 and tax preference items of 67,500. The couple itemizes their deductions. a. Compute the Patels AMTI for 2019. b. Compute their tentative minimum tax for 2019.arrow_forwardFor calendar year 2019, Stuart and Pamela Gibson file a joint return reflecting AGI of $375,900. Their itemized deductions are as follows. Note: All expenses are before any applicable limitations, unless otherwise noted. Casualty loss in a Federally declared disaster area after $100 floor (not covered by insurance) $53,200 Home mortgage interest (loan qualifies as acquisition indebtedness) 21,280 Credit card interest 1,064 Property taxes on home 15,960 Charitable contributions 29,260 State income tax 18,620 Tax return preparation fees 1,596 Round your final answers to the nearest whole dollar. Calculate the amount of itemized deductions the Gibsons may claim for the year.arrow_forwardCompute the taxable income for 2023 in each of the following independent situations. Click here to access the Exhibits 3.4 and 3.5 to use if required. a. Aaron and Michele, ages 40 and 41, respectively, are married and file a joint return. In addition to four dependent children, they have AGI of $125,000 and itemized deductions of $29,000. AGI Less: Itemized deductions Taxable income b. Sybil, age 40, is single and supports her dependent parents who live with her, as well as her grandfather who is in a nursing home. She has AGI of $80,000 and itemized deductions of $8,000. AGI Less: Standard deduction Taxable income AGI Less: Standard deduction c. Scott, age 49, is a surviving spouse. His household includes two unmarried stepsons who qualify as his dependents. He has AGI of $76,800 and itemized deductions of $10,100. Taxable income $125,000 AGI Less: Standard deduction $80,000 d. Amelia, age 33, is an abandoned spouse who maintains a household for her three dependent children. She has…arrow_forward

- For calendar year 2023, Stuart and Pamela Gibson file a joint return reflecting AGI of $355,100. Their itemized deductions are as follows: Note: All expenses are before any applicable limitations, unless otherwise noted. Casualty loss in a Federally declared disaster area (not covered by insurance; before the 10%-of-AGI limitation but after the $100 floor) Home mortgage interest (loan qualifies as acquisition indebtedness) Credit card interest Property taxes on home Charitable contributions State income tax Tax return preparation fees $72,400 28,960 1,448 21,720 39,820 25,340 2,172 Round your final answers to the nearest whole dollar. Calculate the amount of itemized deductions the Gibsons may claim for the year.arrow_forwardDuring 2020, Rick and his wife, Sara, had the following items of income and expense to report: Gross receipts from business $400,000 Business expenses 525,000 Interest income from bank savings accounts 8,000 Sara's salary 50,000 Long-term capital gain on stock held as an investment 4,000 Itemized deductions $15,000 a. Assuming that Rick and Sara file a joint return, calculate their taxable income (or loss) for 2020. Adjusted gross income/loss? Taxable income/loss? b. What is the amount of Rick and Sara's NOL for 2020?arrow_forwardClarke, age 39, and Jessica, age 50, are married with two dependent children. They file a joint return for 2020. Their income from salaries totals $105,000; they receive $2,000 in taxable interest and $2,000 in royalties. Their deductions for adjusted gross income amount to $5,100; they have itemized deductions totalling $40,000. Calculate the following amounts: a. Gross income b. Adjusted gross income c. Itemized deduction or standard deduction amount d. Deduction for exemptions e. Taxable income f. Regular income tax liability from rate schedulearrow_forward

- Tyrone and Akira, who are married, incurred and paid the following amounts of interest during 2021: Home acquisition debt interest Credit card interest Home equity loan interest (used for home improvement) Investment interest expense Mortgage insurance premiums (PMI) Required: $ 13,250 4,300 6,365 10,600 1,000 With 2021 net investment income of $1,325, calculate the amount of their allowable deduction for investment interest expense and their total deduction for allowable interest. Home acquisition principal and the home equity loan principal combined are less than $750,000. Amounts Deduction for investment interest expense Total deduction for allowable interest $ 1,325 $ 20,940arrow_forwardDuring 2019, Carl (a single taxpayer) has a salary of $91,500 and interest income of $11,000. Calculate the maximum contribution Carl is allowed for an educational savings account. $0 $400 $1,000 $2,000 Some other amountarrow_forwardXinran, who is married and files a joint return, owns a grocery store. In 2019 his gross sales were 276,000, and operating expenses were 320,000. Other In 2020, Xinran provides the following information: The 2019 married filing jointly standard deduction is 24,400; Xinrans itemized deductions will exceed the 2020 standard deduction (after adjustment for inflation). The medical expense AGI floor is 10% in 2019. a. What is Xinrans 2019 NOL? b. Determine Xinrans taxable income for 2020.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License