Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 2MC

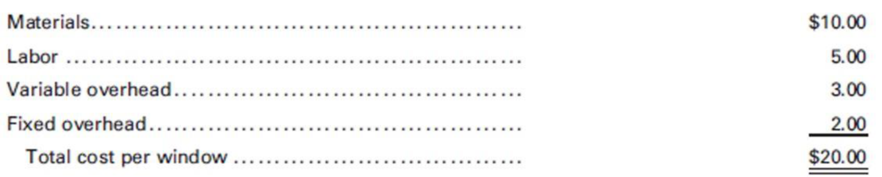

Denali Company manufactures household products such as windows, light fixtures, ladders, and work tables. During the year it produced 10,000 Model 10X windows but only sold 5,000 units at $40 each. The remaining units cannot be sold through normal channels. Cost for inventory purposes on December 31 included the following data on the unsold units:

Denali can sell the 5,000 windows at a liquidation price of $20.00 per window, but it will incur a packaging and shipping charge of $7.50 per window.

Required:

- 1. Identify the relevant costs and revenues for the liquidation sale alternative. Is Denali better off accepting the liquidation price rather than doing nothing?

- 2. Assume that Model 10X can be reprocessed to another size window, Model 20X, which will require the same amount of labor and overhead as was required to initially produce, but sells for only $33. Determine the most profitable course of action—liquidate or reprocess.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Varto Company has 7,200 units of its product in inventory that it produced last year at a cost of $154,000. This year’s model is better than last year’s, and the 7,200 units cannot be sold at last year’s normal selling price of $44 each. Varto has two alternatives for these units: (1) They can be sold as is to a wholesaler for $79,200 or (2) they can be processed further at an additional cost of $150,400 and then sold for $223,200.(a) Prepare a sell as is or process further analysis of income effects.(b) Should Varto sell the products as is or process further and then sell them?

Varto Company has 7,400 units of its product in inventory that it produced last year at a cost of $157,000. This year's model is better

than last year's, and the 7,400 units cannot be sold at last year's normal selling price of $46 each. Varto has two alternatives for these

units: (1) They can be sold as is to a wholesaler for $96,200 or (2) they can be processed further at an additional cost of $146,600 and

then sold for $236,800.

(a) Prepare a sell as is or process further analysis of income effects.

(b) Should Varto sell the products as is or process further and then sell them?

(a) Sell or Process Analysis

Revenue

Costs

Income

Incremental income (loss) to sell as is

(b) The company should:

$

Sell As Is

0 $

Process Further

ABC Co. has the following items in inventory:

i) Goods purchased for resale at a cost of $40,000. The recent downturn in the economy has

meant that these goods will now sell for $42,000 with costs to sell of $2,500.

ii)Materials purchased at a cost of $30,000 per tonne which will be sold at a profit. The

manufacturer of the materials has just announced that from now on they will sell these materials

to you at a lower price of $28,000 per tonne.

iii)Plant constructed for a specific customer at a cost of $50,000 and an agreed price to the

customer of $60,000. New health and safety requirements mean that the plant will need to be

modified at a cost to ABC Co. of $4,000 before it can be delivered to the customer.

At what value should each of the above be included in the inventory of ABC Co?

Chapter 10 Solutions

Principles of Cost Accounting

Ch. 10 - What is the difference between absorption costing...Ch. 10 - Distinguish between product costs and period...Ch. 10 - What effect will applying variable costing have on...Ch. 10 - What are the advantages and disadvantages of using...Ch. 10 - Prob. 5QCh. 10 - What is the difference between gross margin and...Ch. 10 - Why are there objections to using absorption...Ch. 10 - What are common costs?Ch. 10 - How is a contribution margin determined, and why...Ch. 10 - What are considered direct costs in segment...

Ch. 10 - What is cost-volume-profit analysis?Ch. 10 - Prob. 12QCh. 10 - What steps are required in constructing a...Ch. 10 - What is the difference between the contribution...Ch. 10 - What impact does income tax have on the break-even...Ch. 10 - Define differential analysis, differential...Ch. 10 - Prob. 17QCh. 10 - Prob. 18QCh. 10 - What are distribution costs?Ch. 10 - What is the purpose of the analysis of...Ch. 10 - In cost analysis, what determines which costs...Ch. 10 - Yellowstone Fabricators uses a process cost system...Ch. 10 - Using the information presented in E10-1, prepare...Ch. 10 - The chief executive officer of Acadia, Inc....Ch. 10 - The following production data came from the...Ch. 10 - A company had income of 50,000, using variable...Ch. 10 - The fixed overhead budgeted for Ranier Industries...Ch. 10 - Columbia Products Inc. has two divisions, Salem...Ch. 10 - The sales price per unit is 13 for the Voyageur...Ch. 10 - Teton, Inc. sells its only product for 50 per...Ch. 10 - A new product is expected to have sales of...Ch. 10 - Augusta Industries manufactures and sells two...Ch. 10 - A company has sales of 1,000,000, variable costs...Ch. 10 - Prob. 13ECh. 10 - A company has prepared the following statistics...Ch. 10 - Prob. 15ECh. 10 - Prob. 16ECh. 10 - Redwood Industries needs 20,000 units of a certain...Ch. 10 - Prob. 18ECh. 10 - Biscayne Industries has determined the cost of...Ch. 10 - Roosevelt Enterprises has determined the cost of...Ch. 10 - Prob. 3PCh. 10 - Prob. 4PCh. 10 - Prob. 5PCh. 10 - Arctic Software Inc. has two product lines. The...Ch. 10 - Prob. 7PCh. 10 - The production of a new product required Zion...Ch. 10 - Grand Canyon Manufacturing Inc. produces and sells...Ch. 10 - Prob. 10PCh. 10 - Emerald Island Company is considering building a...Ch. 10 - Royale Aluminum desires an after-tax income of...Ch. 10 - Deuce Sporting Goods manufactures a high-end model...Ch. 10 - Prob. 14PCh. 10 - Prob. 15PCh. 10 - Prob. 1MCCh. 10 - Denali Company manufactures household products...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hurricane, an entity, had 1500 units of product Y at 30 June 20X8. The product had been purchased at cost of $30 per unit and normally sells for $40 per unit. Recently, product Y started to deteriorate and can now be sold for only $38 per unit, provided that some rectification work is undertaken at a cost of $10 per unit. What was the value of inventory at 30 June 20X8?arrow_forwardRacine Co. determined its desiccated coconut inventory on a FIFO basis at P520,000 with a replacement cost of P400,000 based on physical inventory taken on December 31, 2021. After further processing costs of P240,000, Racine estimated that the desiccated coconut inventory could be sold as finished desiccated coconut candies for P800,000. Normal profit margin for Racine is 10% of sales. What amount should Racine report as desiccated coconut inventory in its December 31, 2021 balance sheet under the lower of cost or market value? a. 480,000 b. 520,000 c. 560,000 d. 400,000arrow_forwardXYZ, Inc. sold 100 widgets to ABC, Inc. on 1/1/18 for $50 per widget on account. The sales agreement allows ABC to return widgets that they are unsatisfied with or exceed their needs within 30 days of the sale. The widgets cost XYZ $30 to produce. XYZ doesn’t anticipate any material cost of restocking the inventory nor any inability to resell them at $50 per unit. ABC expects that 10 widgets will be returned within the return period. Discuss the criteria for recognizing sales returns and allowances covered in the text and determine whether this arrangement meets the requirements Record the journal entry for the sale on 1/1/18. ABC returned 5 widgets on 1/18/18. Record the journal entry for this event. XYZ prepared a balance sheet on 1/31/18. Record any journal entries that they would need make prior to preparing their financial statements. Show how their accounts receivable and related accounts would be reported on that balance sheet. Show how the sales and gross profit section of…arrow_forward

- Crane Company had 500 units of “Dink” in its inventory at a cost of $10 each. It purchased 800 more units of “Dink” at a cost of $16 each. Crane then sold 1000 units at a selling price of $26 each. The LIFO liquidation overstated normal gross profit byarrow_forwardOn July 1st. Comfort Furnishings purchased all the remaining inventory of a competitor for $100,000 when their competitor, Lazy Days, went out of business. The products and their estimated selling price for each listed below. Estimated Selling Price Per Unit Sofas Recliners Tables Chairs Maku 200 600 100 Qty 150 $400 $220 $130 $85 1. What is the amount of Gross Profit that Comfort will realize if they sell half of the sofas (100 units) in July? 2. What should the chairs be valued at in Comfort's ending inventory as of 7/31 if 100 chairs were sold during July?arrow_forwardB. Massy Estate, a subsidiary of Hollywood Estate had the following inventory items at the end of its financial year 30 September 2021: Units Cost per Unit ($) Raw materials 5 000 25 Work in progress 2 000 30 Finished goods 1 000 35 Finished items usually sell for $50 per unit. However, water damage caused by improper storage of inventory will mean that 300 units of finished goods will be sold at 60% of the normal selling price less costs to sell of $5 per item. Required: In accordance with IAS 2 Inventories, at what amount should inventories be stated in the statement of financial position of Massy Estate at 30 September 2021. Complete the schedule provided. Units Cost ($) NRV ($) Total ($) Raw materials: Work in progress: Finished goods: Totalarrow_forward

- Poe, Co. uses LIFO for its inventory valuation. The original cost of Item #BB-8, the only inventory item of Poe, was $12,000. The current selling price and replacement cost are $13,500 and $9,500, respectively. Costs to sell are estimated to be $2,700. The normal profit margin is 10% of the original cost.arrow_forwardSequoia Co. is evaluating its inventory, computer paper, at the end of the period. The cost of each package of paper costs Sequoia $5 and there are 5,000 units in ending inventory. They sold 27,000 packages during the period. Due to increased use of the electronic cloud, the net realizable value of each package of paper is $3.50. What is the correct amount of the inventory write-down?arrow_forwardStorm, an entity, had 500 units of product X at 30 June 20X5. The product had been purchased at a cost of $18 per unit and normally sells for $24 per unit. Recently, product X started to deteriorate but can still be sold for $24 per unit, provided that some rectification work is undertaken at a cost of $3 per unit. What was the value of closing inventory at 30 June 20X5?arrow_forward

- Tristan, Inc., uses the LIFO cost-flow assumption to value inventory. It began the current year with 2,000 units of inventory carried at LIFO cost of $20 per unit. During the first quarter, it purchased 8,000 units at an average cost of $40 per unit and sold 9,500 units at $60 per unit.Assume the company does not expect to replace the units of beginning inventory sold; it plans to reduce inventory by year-end to 500 units. What amount of cost of goods sold should be recorded for the quarter ended March 31?a. $335,000b. $350,000c. $380,000d. $387,500arrow_forwardBonita Industries had 640 units of “Tank” in its inventory at a cost of $6 each. It purchased 880 more units of “Tank” at a cost of $9 each. Bonita then sold 1070 units at a selling price of $15 each. The LIFO liquidation overstated normal gross profit by $ -0-. $570. $720. $1290.arrow_forwardIndicate the assumption or principle that is most clearly violated using the following terms, chosen from the terms listed: 1. Dollar Saver has 20,000 Model 44G cell phones in inventory at a cost of $64 each. Due to the advancement of technology and newer models available, only 4 of Model 44G phones were sold last month. To avoid recognizing a loss on writing off this inventory, Dollar Saver has decided not to issue financial statements until at least half of the remaining Model 44G phones have been sold. select an appropriate term 2. Homer Bates, president of Bates Machinery, took an iPod Touch case out of inventory to use as a birthday present for his son. The cost was debited to Supplies Expense. select an appropriate term 3. Wilson, Inc. made no entry to record depreciation on its equipment for 2014. select an appropriate term…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License