Concept explainers

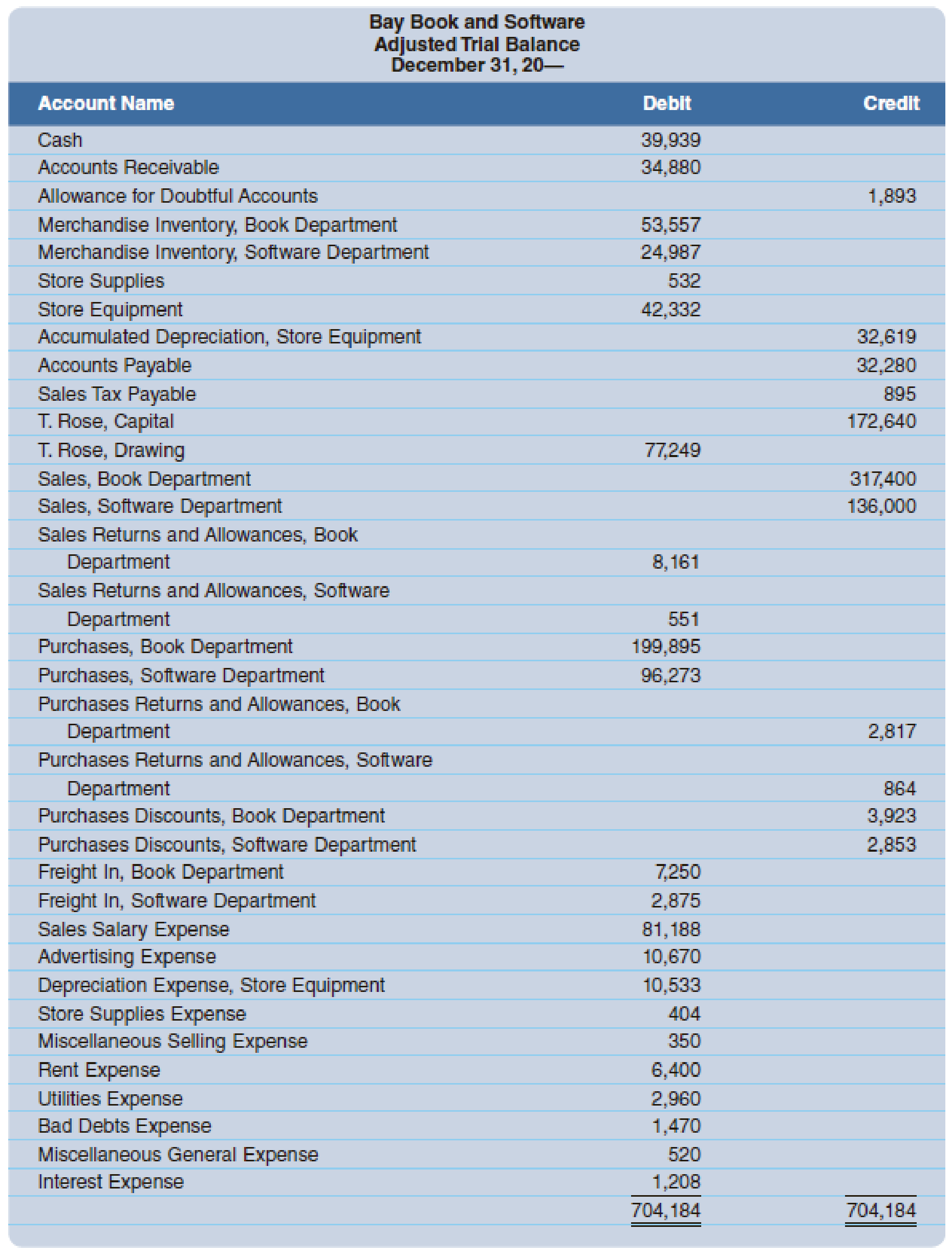

Bay Book and Software has two sales departments: Book and Software. After recording and posting all adjustments, including the adjustments for merchandise inventory, the accountant prepared the adjusted

Merchandise inventories at the beginning of the year were as follows: Book Department, $53,410; Software Department, $23,839. The bases (and sources of figures) for apportioning expenses to the two departments are as follows (rounded to the nearest dollar):

- Sales Salary Expense (payroll register): Book Department, $45,559; Software Department, $35,629

- Advertising Expense (newspaper column inches): Book Department, 550 inches; Software Department, 450 inches

- Depreciation Expense, Store Equipment (property and equipment ledger): Book Department, $7,851; Software Department, $2,682

- Store Supplies Expense (requisitions): Book Department, $205; Software Department, $199

- Miscellaneous Selling Expense (volume of gross sales): Book Department, $240; Software Department, $110

- Rent Expense and Utilities Expense (floor space): Book Department, 9,000 square feet; Software Department, 7,000 square feet

Bad Debts Expense (volume of gross sales): Book Department, $1,029; Software Department, $441- Miscellaneous General Expense (volume of gross sales): Book Department, $364; Software Department, $156

Required

Prepare an income statement by department to show income from operations, as well as a nondepartmentalized income statement (using the Total columns) to show net income for the entire company.

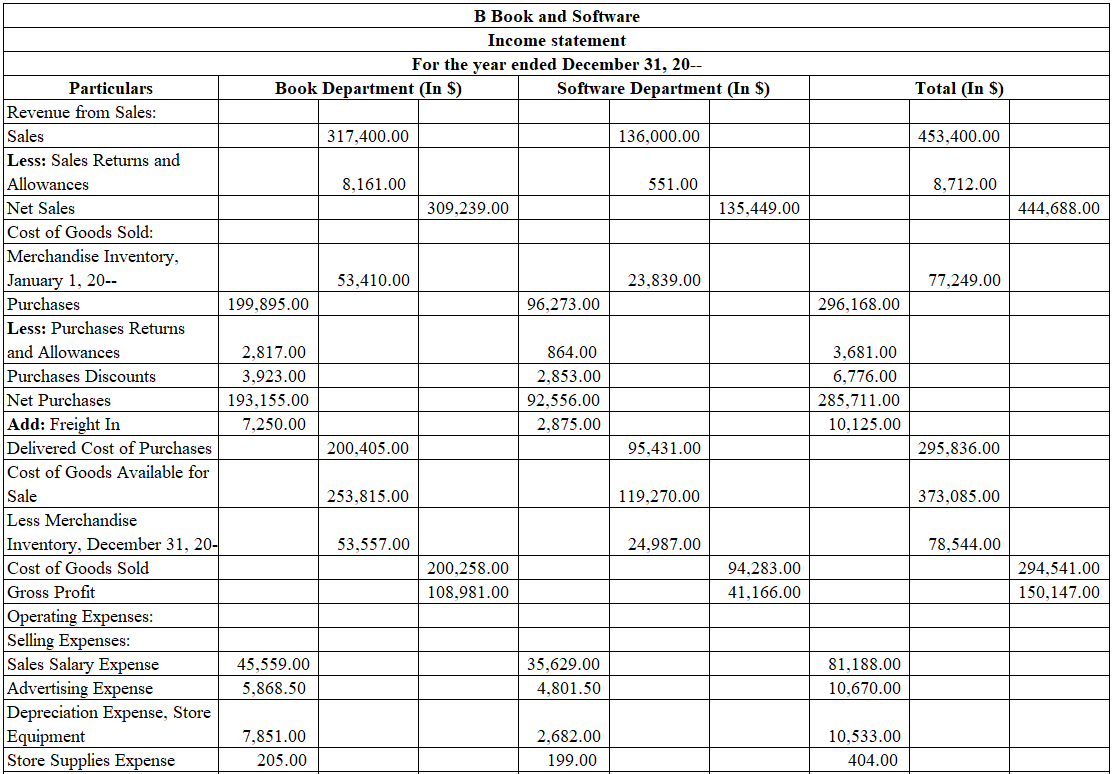

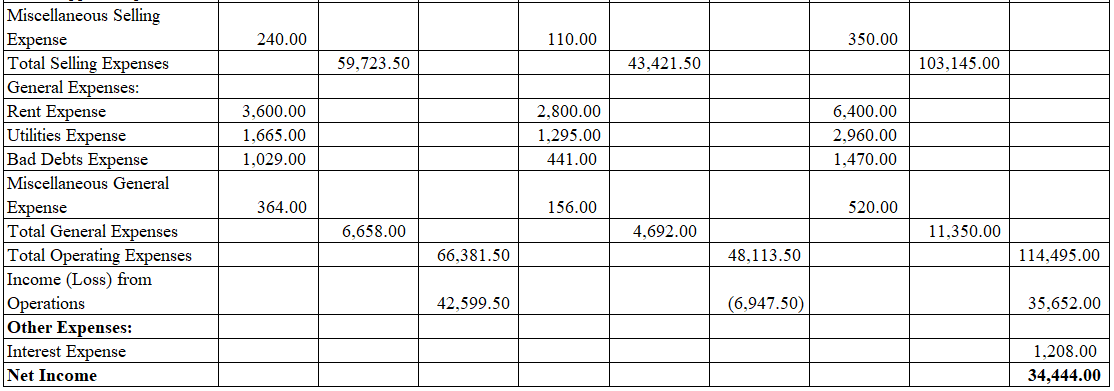

Prepare an income statement for B Book and Software by department, and non-departmentalized (total) income statement for the year ended December 31, 20--.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for B Book and Software by department, and non-departmentalized (total) income statement for the year ended December 31, 20--.

Table (1)

Thus, the income statement of B Book and Software for the year ended December 31, 20—reports income from operations of $42,599.50 for Book Department, and loss from operations of $6,947.50 for Software Department, and total net income of $34,444.00.

Want to see more full solutions like this?

Chapter E Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Fundamentals of Cost Accounting

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

INTERMEDIATE ACCOUNTING

Financial Accounting

Financial Accounting (11th Edition)

Managerial Accounting: Tools for Business Decision Making

- Chloe Company employs the perpetual inventory system. Cost of Goods Sold for the year before any adjustment is $275,450. The computer record shows the amount of ending inventory to be $55,382, while the physical count shows ending inventory to be $51,405. Record the adjustment into T accounts and then journalize the adjusting entry.arrow_forwardCrane Company has the following merchandise account balances at its September 30 year end: Cost of goods sold $140,000, Sales $273,500, Delivery expense $2,100, Sales discounts $950, Merchandise inventory $22,000, Sales returns and allowances $3,200, Salaries expense $41,000, Supplies $2,700. Prepare the entries to close the appropriate accounts to the Income Summary account.arrow_forwardThe Income Statement columns of the August 31 (year-end) work sheet for Ralley Company are shown here. To save time and space, the expenses have been grouped together into two categories. INCOME STATEMENT ACCOUNT NAME DEBIT CREDIT Income Summary 31,100.00 31,130.00 Sales 324,360.00 Sales Returns and Allowances 13,970.00 Sales Discounts 7,620.00 Purchases 126,210.00 Purchases Returns and Allowances 1,020.00 Purchases Discounts 1,110.00 Freight In 8,460.00 Selling Expenses 61,470.00 General Expenses 51,751.00 300,581.00 357,620.00 Net Income 57,039.00 357,620.00 357,620.00 From the information given, prepare an income statement for the company. Ralley CompanyIncome StatementFor Year Ended August 31, 20-- (See images)arrow_forward

- Flounder Company had the following account balances at year-end: Cost of Goods Sold $64,510, Inventory $14,660, Utilities Expense $29,240, Sales Revenue $126,730, Sales Discounts $1,140, and Sales Returns and Allowances $1,830. A physical count of inventory determines that merchandise inventory on hand is $12,760. They use the perpetual inventory system. (a) Prepare the adjusting entry necessary as a result of the physical count. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount (b) Prepare closing entries. (List all…arrow_forwardThe following purchase transactions occurred during the last few days of Yellow Orange Company's business year, which ends October 31, or in the first few days after that date. A periodic inventory system is used. 1. An invoice for P30,000, terms fob shipping point, was received and entered November 1. The invoice shows that the material was shipped October 29, but the receiving report indicates receipts of goods on November 3. 2. An invoice for P27,000, terms fob destination, was received and entered November 2. The receiving report indicates that the goods were received October 29. 3. An invoice for P31,500, terms fob shipping point, was received October 15 but never entered. Attached to it is a receiving report indicating that the goods were received October 18. Across the face of the receiving report is the following notation:" Merchandise not of same quality as ordered returned for credit October 19." 4. An invoice for P36,000, terms fob shipping point, was received and entered…arrow_forwardCheyenne Company had the following account balances at year-end: Cost of Goods Sold $62,020, Inventory $17,320, Utilities Expense $29,150, Sales Revenue $121,470, Sales Discounts $1,380, and Sales Returns and Allowances $1,890. A physical count of inventory determines that merchandise inventory on hand is $12,230. They use the perpetual inventory system. (a) Prepare the adjusting entry necessary as a result of the physical count. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation $ Debit Creditarrow_forward

- Home office shipped merchandise costing $120,000 to branch at a billed price of $168,000. Assume at the end of the accounting period, the branch reports its inventories (at billed price) at $28,000. Instructions: Prepare the working paper for a home office to analyze the flow of merchandise to the branch.arrow_forward[The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. Cash Merchandise inventory Store supplies Prepaid insurance Store equipment NELSON COMPANY Unadjusted Trial Balance January 31 Accumulated depreciation-Store equipment Accounts payable Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Depreciation expense-Store equipment Sales salaries expense Office salaries expense Insurance expense Rent expense-Selling space Rent expense-Office space Store supplies expense Advertising expense Totals Debit $ 1,000 12,500…arrow_forwardThe following purchase transactions occurred during the last few days of Whilczel Company's business year, which ends October 31, or in the first few days after that date. A periodic inventory system is used. · An invoice for P6,000, terms FOB shipping point, was received and entered November 1. The invoice shows that the material was shipped October 29, but the receiving report indicates receipt of goods on November 3. · An invoice for P2,700, terms FOB destination, was received and entered November 2. The receiving report indicates that the goods were received October 29. · An invoice for P3,150, terms, FOB shipping point, was received October 15, but never entered. Attached to it is a receiving report indicating that the goods were received October 18. Across the face of the receiving report is the following notation: "Merchandise not of the same quality as ordered - returned for credit October 19". · An invoice for P3,600 terms FOB shipping…arrow_forward

- The following purchase transactions occurred during the last few days of Whilczel Company's business year, which ends October 31, or in the first few days after that date. A periodic inventory system is used. · An invoice for P6,000, terms FOB shipping point, was received and entered November 1. The invoice shows that the material was shipped October 29, but the receiving report indicates receipt of goods on November 3. · An invoice for P2,700, terms FOB destination, was received and entered November 2. The receiving report indicates that the goods were received October 29. · An invoice for P3,150, terms, FOB shipping point, was received October 15, but never entered. Attached to it is a receiving report indicating that the goods were received October 18. Across the face of the receiving report is the following notation: "Merchandise not of the same quality as ordered - returned for credit October 19". · An invoice for P3,600 terms FOB shipping…arrow_forwardUse the following information to prepare a multiplestep income statement, including the revenue section and the cost of goods sold section, for Aeito's Plumbing Supplies for the year ended December 31, 20--.arrow_forwardThe following purchase transactions occurred during the last few days of Whilczel Company's business year, which ends October 31, or in the first few days after that date. A periodic inventory system is used. · An invoice for P6,000, terms FOB shipping point, was received and entered November 1. The invoice shows that the material was shipped October 29, but the receiving report indicates receipt of goods on November 3. · An invoice for P2,700, terms FOB destination, was received and entered November 2. The receiving report indicates that the goods were received October 29. · An invoice for P3,150, terms, FOB shipping point, was received October 15, but never entered. Attached to it is a receiving report indicating that the goods were received October 18. Across the face of the receiving report is the following notation: "Merchandise not of the same quality as ordered - returned for credit October 19". · An invoice for P3,600 terms FOB shipping…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,