Principles of Financial Accounting.

22nd Edition

ISBN: 9780077632892

Author: John J. Wild

Publisher: McGraw Hill

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 1MCQ

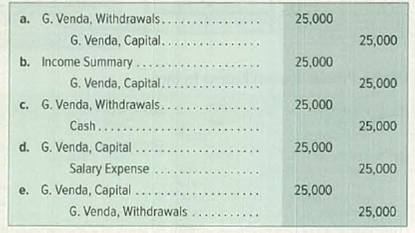

G. Venda, owner of Venda Services, withdrew $25,000 from the business during the current year. The entry to close the withdrawals account at the end of the year is:

Expert Solution & Answer

To determine

The entry to close the withdrawals account at the end of the year.

Answer to Problem 1MCQ

Option (e) is the correct answer.

Explanation of Solution

Person G is the owner of Company V, who has withdrawn $25,000 from the business during the present year. As it is given that the amount is withdrawn, it must be credited and the capital amount should be debited. Hence, the following entry shows that correct answer.

Therefore, Option e is the correct answer.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Judy Smith owed the Flower Company $3,200 on account by February 25. After several attempts to the collect the money that was owed, Flower Company wrote off Judy's account as uncollectible on August 31. On December 15 Flower Company received a check from Judy Smith for the full $3,200 that she had owed the company. The company's fiscal year ended on December 31. Which of the following journal entries is recorded to reinstate the account when using the direct write-off method?

a.Debit Accounts Receivable $3,200 and credit Uncollectible Accounts Recovered $3,200

b.Debit Bad Debt Expense $3,200 and credit Accounts Receivable $3,200

c.Debit Accounts Receivable $3,200 and credit Bad Debt Expense $3,200

d.Debit Allowance for Doubtful Accounts $3,200 and credit Bad Debt Expense $3,200

Ben Quayson Social Club has 160 members who contributed an amount of GH¢ 150 each as Life membership fee on 01/01/2017. One tenth of the Life membership fee is charged to Income and expenditure account each year. But when a member dies, the whole amount is transferred to income and expenditure account. Unfortunately, 8 members died in 2017 and 10 members were enrolled in 01/01/2018. Ben Sarpong, the Accountant is confused on how to treat the fees. The club prepares account to 31st December each year.Required :Show how Ben Sarpong should treat the Life membership fee in the financial Statements of Ben Quayson’sSocial Club for 2017 and 2018 years.

Sam is a small business owner. In the year ended at the 30th of June 2019 the business has the below information: Beginning of Sam’s Capital account: $55,000 Net Income: $32,000 Outstanding Note Payable: $150,000 Total Expenses: $125,000 Ending of Sam’s Capital account: $54,000 Amounts withdrawn by Sam during 2019 will be

Chapter 4 Solutions

Principles of Financial Accounting.

Ch. 4 - G. Venda, owner of Venda Services, withdrew 25,000...Ch. 4 - The following information is available for the R....Ch. 4 - Which of the following errors would cause the...Ch. 4 - The temporary account used only in the closing...Ch. 4 - Prob. 5MCQCh. 4 - Prob. 1DQCh. 4 - What accounts are affected by closing entries?...Ch. 4 - What two purposes are accomplished by recording...Ch. 4 - Prob. 4DQCh. 4 - Prob. 5DQ

Ch. 4 - Prob. 6DQCh. 4 - Prob. 7DQCh. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - Prob. 10DQCh. 4 - What are the characteristics of plant assets?Ch. 4 - Prob. 12DQCh. 4 - Prob. 13DQCh. 4 - Prob. 14DQCh. 4 - Prob. 15DQCh. 4 - Prob. 16DQCh. 4 - Prob. 17DQCh. 4 - Prob. 1QSCh. 4 - Prob. 2QSCh. 4 - Prob. 3QSCh. 4 - Prob. 4QSCh. 4 - Prob. 5QSCh. 4 - The ledger of Mai Company includes the following...Ch. 4 - Prob. 7QSCh. 4 - Prob. 8QSCh. 4 - Prob. 9QSCh. 4 - Prob. 10QSCh. 4 - Prob. 11QSCh. 4 - Prob. 12QSCh. 4 - These 16 accounts are from the Adjusted Trial...Ch. 4 - The Adjusted Trial Balance columns of a 10-column...Ch. 4 - Use the following information from the Adjustments...Ch. 4 - Prob. 4ECh. 4 - Capri Company began the current period with a...Ch. 4 - Prob. 6ECh. 4 - Prob. 7ECh. 4 - Use the May 31 fiscal year-end information from...Ch. 4 - Prob. 9ECh. 4 - The adjusted trial balance for Salon Marketing Co....Ch. 4 - Prob. 11ECh. 4 - Prob. 12ECh. 4 - Use the following adjusted year-end trial balance...Ch. 4 - Prob. 14ECh. 4 - Prob. 15ECh. 4 - Hawk Company records prepaid assets and unearned...Ch. 4 - Prob. 17ECh. 4 - Prob. 1APCh. 4 - Prob. 2APCh. 4 - Prob. 3APCh. 4 - Prob. 4APCh. 4 - Problem 4-5A The adjusted trial balance of Karise...Ch. 4 - Prob. 6APCh. 4 - Prob. 1BPCh. 4 - Problem 4-2B The following unadjusted trial...Ch. 4 - Prob. 3BPCh. 4 - Prob. 4BPCh. 4 - Problem 4-5B Santo Company’s adjusted trial...Ch. 4 - Prob. 6BPCh. 4 - Prob. 4SPCh. 4 - BTN 4-1 Refer to Apple's financial statements in...Ch. 4 - Prob. 2BTNCh. 4 - Prob. 3BTNCh. 4 - One of your classmates states that a companys...Ch. 4 - Prob. 7BTNCh. 4 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sam is a small business owner. In the year ended at the 30th of June 2019 the business has the below information: Beginning of Sam’s Capital account: $55,000 Net Income: $32,000 Outstanding Note Payable: $150,000 Total Expenses: $125,000 Ending of Sam’s Capital account: $54,000 Amounts withdrawn by Sam during 2019 will be: Select one: a. $33,000 b. $31,000 c. $23,000 d. $25,000arrow_forwardOn January 13, 2004, Daniel Hernandez deposited P^(62),500 at 8.25% exact interest at exact time. Without withdrawal during the term, Daniel withdrew P^(64),943.92 at the end of the term. When did he withdraw his account?arrow_forwardBelow are four independent cases (a to d) affecting Wong Auto Repair Inc. (WARI) in 2019. a. Each Friday, WARI pays employees for the current week's work. The amount of the payroll is $6,000 for a five-day week. The current accounting period ends on Monday. b. WARI has received notes receivable from some clients for services. During the current year, WARI has earned accrued interest revenue of $3,250, which will be received next year. c. The beginning balance of supplies was $15,500. During the year, then entity purchased supplies costing $55,400, and at December 31 the inventory of supplies on hand is $12,650. d. WARI is conducting test of new hinges to be used in the rebuilding of a dump truck, and the client paid WARI $15,000 at the start of the project. WARI recorded this amount as Unearned Service Revenue. The tests will take several months to complete. WARI executives estimate that the company has earned two-thirds of the total fee during the current year. Required Journalize the…arrow_forward

- Below are four independent cases (a to d) affecting Wong Auto Repair Inc. (WARI) in 2019.a. Each Friday, WARI pays employees for the current week’s work. The amount of the payroll is$6,000 for a five-day week. The current accounting period ends on Monday.b. WARI has received notes receivable from some clients for services. During the current year, WARIhas earned accrued interest revenue of $3,250, which will be received next year.c. The beginning balance of supplies was $15,500. During the year, then entity purchased suppliescosting $55,400, and at December 31 the inventory of supplies on hand is $12,650.d. WARI is conducting test of new hinges to be used in the rebuilding of a dump truck, and the clientpaid WARI $15,000 at the start of the project. WARI recorded this amount as Unearned ServiceRevenue. The tests will take several months to complete. WARI executives estimate that thecompany has earned two-thirds of the total fee during the current year.RequiredJournalize the adjusting…arrow_forwardOn December 31 (the end of the fiscal year), Ramesh Company received the PBO report from the actuary. The following information was included in the report: ending PBO, $112,000; benefits paid to retirees, $14,500; interest cost, $8,800. The discount rate applied by the actuary was 10%. What was the beginning PBO?arrow_forwardAs of May 31, 2020, Mr. Michael Kors has a capital balance of P 235,000. During the month of June, he withdrew P15,000 to be used for his annual medical checkup. His company’s Statement of Comprehensive Income reveals various expenses totaling P 89,000 thereby a Net Loss of P 7,150. During the same period, he was unable to pay a note amounting to P 50,000. How much would be the capital balance of Mr. Michael Kors at the end of June, 2020?arrow_forward

- ASLEY is in the business of purchasing accounts receivable from businesses at a discount and then collecting them. Last year, she purchased a $30,000 account receivable for $25,000. This year, the account was settled for $25,000. How much loss can Peggy deduct and in which year? a.$5,000 for the prior year. b.$5,000 for the prior year and $5,000 for the current year. c.$5,000 for the current year. d.$-0- for the current year.arrow_forwardSally is in the business of purchasing accounts receivable. Last year, Sally purchased an account receivable with a face value of $80,000 for $60,000. During the current year, Sally settled the account, receiving $65,000. Determine the maximum amount of the bad debt deduction for Sally for the current year. If an amount is zero, enter "0". Sally's basis in the account receivable is $fill in the blank 1 . Therefore, she has a bad debt deduction of $fill in the blank 2 and income of $fill in the blank 3 .arrow_forwardMr. jones had balances on his credit card his last period. He did not pay the card in the previous month, so he have pay a Inance charge The APR 23.4%arrow_forward

- Following are transactions for Veilstone Jewelers. November 1 Accepted a $15,000, 180-day, 5% note from Vitalo in granting a time extension on her past-due account receivable. December 31 Adjusted the year-end accounts for the accrued interest earned on the White note. April 30 Vitalo honored her note when presented for payment. Calculate the interest amounts at December 31st and April 30th and use those calculated values to prepare your journal entries. Note: Do not round intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. General Journal Use those calculated values to prepare your journal entries. View transaction list Journal entry worksheet 1 2 3 4 Accepted a $15,000, 180-day, 5% note from Vitalo in granting a time extension on her past-due account receivable.arrow_forwardAn employee is required to use her own automobile for employment duties. She acquired a new car at the beginning of the year for $40000 (including GST and HST of 8 %) and during the year she incurred the following expenses. Gasoline $2200, repairs and maintenance $400, insurance and registration $800, meals while away from the office $420 ($200 relates to out of town travel), parking during employment duties $ 300 and interest on loan to acquire car $3900. During the year, the employee drove 26000 km of which 14000 were for employment duties and the remaining were personal. Compute the personal and employment expenses.arrow_forwardBrady is hired in 2021 to be the accountant for Anderson Manufacturing, a private company. At the end of 2021, the balance of Accounts Receivable is $29,000. In the past, Anderson has used only the direct write-off method to account for bad debts. Based on a detailed analysis of amounts owed, Brady believes the best estimate of future bad debts is $9,000. If Anderson continues to use the direct write-off method to account for uncollectible accounts, what adjustment, if any, would Brady record at the end of 2021? What adjustment, if any, would Brady record if Anderson instead uses the allowance method to account for uncollectible accounts?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY