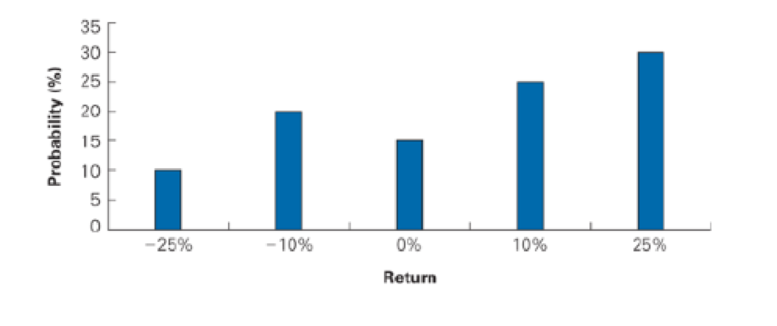

The figure on page informalfigure shows the one-year return distribution for RCS stock. Calculate

- a. The expected return.

- b. The standard deviation of the return.

a)

To determine: The expected return.

Introduction:

Expected return refers to a return that the investors expect on a risky investment in the future.

Answer to Problem 1P

The expected return is 5.5 percent.

Explanation of Solution

Given information:

The probability of a stock is 10% and the stock return is -25%, probability of another stock is 20% and its return is -10%, the probability of a stock is 25% and the stock return is 10%, and probability of a stock is 30% and the stock return is 25%.

The formula to calculate the expected return on the stock:

Compute the expected return:

Hence, the expected return is 5.5 percent.

b)

To determine: The standard deviation of the return.

Introduction:

Standard deviation refers to the variation in the actual returns from the expected returns.

Variance refers to the average difference of squared deviations of the actual data from the mean or average

Answer to Problem 1P

The standard deviation of the return is 16.13%.

Explanation of Solution

Given information:

The probability of a stock is 10% and the stock return is -25%, probability of another stock is 20% and its return is -10%, the probability of a stock is 25% and the stock return is 10%, and probability of a stock is 30% and the stock return is 25%.

The formula to calculate the standard deviation:

Calculate the standard deviation:

Hence, the standard deviation of the return is 16.13%.

Want to see more full solutions like this?

Chapter 10 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Additional Business Textbook Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Foundations Of Finance

Corporate Finance

Financial Accounting (12th Edition) (What's New in Accounting)

- The last four years of returns for a stock are as shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 4 Return +3.51% 1 - 4.17% 2 +27.82% 3 + 11.88% Xarrow_forwardConsider information given in the table below and answers the question asked thereafter: State Probability return on stock A Return on stock B A 0.15 10% 9% B 0.15 6% 15% C 0.10 20% 10% D 0.18 5% -8% E 0.12 -10% 20% F 0.30 8% 5% Calculate covariance and coefficient of correlation between the returns of thestocks A and B.v. Now suppose you have $100,000 to invest and you want to a hold a portfoliocomprising of $45,000 invested in stock A and remaining amount in stock B.Calculate risk and return of your portfolio.arrow_forwardhe last four years of returns for a stock are as shown here: LOADING... . a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. Question content area bottom Part 1 a. What is the average annual return? The average return is enter your response here%. (Round to two decimal places.) Part 2 b. What is the variance of the stock's returns? The variance of the returns is enter your response here. (Round to five decimal places.) Part 3 c. What is the standard deviation of the stock's returns? The standard deviation is enter your response here%. (Round to two decimal places.) Time Remaining: 00:26:16 pop-up content starts Data table (Click on the following icon in order…arrow_forward

- The last four years of returns for a stock are as shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format.arrow_forward1.2. Refer to the following observations for stock A and the market portfolio in the table: Month Rate of return Stock A Market portfolio 1 0.30 0,12 0.24 0,08 3 -0,04 -0,10 -0,02 0,08 0,07 4 0,10 5 0,06 6 0,10 a) Calculate the main statistic measures to explain the relationship between stock A and the market portfolio: i) The sample covariance between rate of return for the stock A and the market. ii) The sample Beta factor of stock A. iii) The sample correlation coefficient between the rates of return of the stock A and the market. iv) The sample coefficient of determination associated with the stock A and the mar- ket. b) Draw in the characteristic line of the stock A and give the interpretation - what does it show for the investor? c) Calculate the sample residual variance associated with stock's A characteristic line and explain how the investor would interpret the number of this statistic. d) Do you recommend this stock for the investor with the lower tolerance of risk?arrow_forwardTwo stock prices for six days are given below. Price A Price B 25 55 27 59 30 64 28 62 26 58 32 61 1. Calculate the Standard Deviation of Stock A? 2. Calculate the Mean Return of Stock A? 3. Calculate the Coefficient of Variation (CV) of Stock A?arrow_forward

- From the following informatongiven below , calculate and differentiate between a. Arithmetic Mean, b. Geometric Mean and c. Standard Deviation Partiulard stock A stock B Year 1 13% 19% Year 2 15% 23% Year 3 12% 20% Year 4 11% 18%arrow_forwardThe index model has been estimated for stock A with the following results: RA = 0.01 + 1.2RM + eA. σM = 0.15; σ(eA) = 0.10. The standard deviation of the return for stock A isarrow_forwardYou are given the following probability distribution of returns for a stock. Use the data to calculate the expected return, standard deviation of returns, and coefficient of variation of returns for the stock. Report the CV to 4 decimal places (13.36% = 0.1336). Return Probability 8.0% 0.20 10.0% 0.10 12.0% 0.40 15.0% 0.20 16.0% 0.10arrow_forward

- What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format. Year 1 2 3 4 Return (%) Year1: -4.1% Year2: 27.6% Year 3: 12.3% Year 4: 3.6%arrow_forwardThe following table represents the rate of returns of two stocks in different economic conditions along with their probabilities (the data are also uploaded on moodle) RATES OF RETURN ON STOCKS EXPECTED ECONOMIC PROBABILITY STOCK A STOCK B CONDITIONS RECESSION 0.55 -0.04 -0.02 STABLE 0.35 0.25 0.30 EXPANDING 0.10 0.15 0.20 Answer the following by using mathematical calculations: a) Calculate the expected rate of return for each stock respectively. Explain what the expected value implies. b) Calculate the standard deviation for each stock respectively. Explain what the standard deviation implies. c) If you were an investor in which stock you were going to invest? Justify your answer. d) Calculate the covariance between Stock A and stock B. Discuss. e) Calculate the expected return and the standard deviation of the portfolio consisting 40% in stock A and 60% in stock B. f) Discuss the risk and return associated with investing i All of your funds in stock A ii. All of your funds in stock…arrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period: Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.)arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning