Comprehensive Problem 4 Part 2: Note: You must complete part 1 before part 2. After all of the transactions for the year ended December 31, 20Y8, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data below were taken from the records of Equinox Products Inc. Unless otherwise stated, assume a December 31 balance after adjusting entries. Income statement data: Advertising expense $150,000 Cost of goods sold 3,700,000 Delivery expense 30,000 Depreciation expense—office buildings and equipment 30,000 Depreciation expense—store buildings and equipment 100,000 Income tax expense 140,500 Interest expense 21,000 Interest revenue 30,000 Miscellaneous administrative expense 7,500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,313,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable $194,300 Accounts receivable 545,000 Accumulated depreciation—office buildings and equipment 1,580,000 Accumulated depreciation—store buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Bonds payable, 5%, due in 10 years 500,000 Cash 282,850 Common stock, $20 par (400,000 shares authorized; 85,000 shares issued, 94,600 outstanding), January 1, 20Y8 1,700,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 700,000 Income tax payable 44,000 Interest receivable 1,200 Inventory (December 31, 20Y8), at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4,320,000 Paid-in capital from sale of treasury stock, January 1, 20Y8 0 Paid-in capital in excess of par—common stock, January 1, 20Y8 736,800 Paid-in capital in excess of par—preferred stock, January 1, 20Y8 70,000 Preferred 5% stock, $80 par (30,000 shares authorized; 16,000 shares issued), January 1, 20Y8 1,280,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 20Y8 8,197,220 Store buildings and equipment 12,560,000 Treasury stock, January 1, 20Y8 0 b. Prepare a statement of stockholders’ equity for the year ended December 31, 20Y8. Decreases in equity and purchase should be entered as negative amounts by using a minus sign. If your answer is zero, enter “0”. Equinox Products Inc. Statement of Stockholders' Equity For the Year Ended December 31, 20Y8 Preferred Stock Paid-In Capital in Excess of Par— Preferred Stock Common Stock Paid-In Capital in Excess of Par— Common Stock Paid-In Capital from Sale of Treasury Stock Retained Earnings Treasury Stock Total $fill in the blank 43 $fill in the blank 44 $fill in the blank 45 $fill in the blank 46 $fill in the blank 47 $fill in the blank 48 $fill in the blank 49 $fill in the blank 50 fill in the blank 52 fill in the blank 53 fill in the blank 54 fill in the blank 56 fill in the blank 57 fill in the blank 58 fill in the blank 60 fill in the blank 61 fill in the blank 63 fill in the blank 64 fill in the blank 66 fill in the blank 67 fill in the blank 68 fill in the blank 70 fill in the blank 71 $fill in the blank 73 $fill in the blank 74 $fill in the blank 75 $fill in the blank 76 $fill in the blank 77 $fill in the blank 78 $fill in the blank 79 $fill in the blank 80 c. Prepare a balance sheet in report form as of December 31, 20Y8. Equinox Products Inc. Balance Sheet December 31, 20Y8 Assets Current assets: $fill in the blank 82 $fill in the blank 84 fill in the blank 86 fill in the blank 88 fill in the blank 90 fill in the blank 92 fill in the blank 94 Total current assets $fill in the blank 95 Property, plant, and equipment: $fill in the blank 97 fill in the blank 99 $fill in the blank 101 $fill in the blank 103 fill in the blank 105 fill in the blank 107 Total property, plant, and equipment fill in the blank 108 Intangible assets: fill in the blank 110 Total assets $fill in the blank 111 Liabilities Current liabilities: $fill in the blank 113 fill in the blank 115 Total current liabilities $fill in the blank 116 Long-term liabilities: $fill in the blank 118 fill in the blank 120 fill in the blank 121 Total liabilities $fill in the blank 122 Stockholders’ Equity Paid-in capital: $fill in the blank 124 fill in the blank 126 $fill in the blank 128 $fill in the blank 130 fill in the blank 132 fill in the blank 134 fill in the blank 136 Total paid-in capital $fill in the blank 137 fill in the blank 139 fill in the blank 141 Total stockholders’ equity fill in the blank 142 Total liabilities and Stockholders’ Equity $fill in the blank 143

Comprehensive Problem 4 Part 2: Note: You must complete part 1 before part 2. After all of the transactions for the year ended December 31, 20Y8, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data below were taken from the records of Equinox Products Inc. Unless otherwise stated, assume a December 31 balance after adjusting entries. Income statement data: Advertising expense $150,000 Cost of goods sold 3,700,000 Delivery expense 30,000 Depreciation expense—office buildings and equipment 30,000 Depreciation expense—store buildings and equipment 100,000 Income tax expense 140,500 Interest expense 21,000 Interest revenue 30,000 Miscellaneous administrative expense 7,500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,313,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable $194,300 Accounts receivable 545,000 Accumulated depreciation—office buildings and equipment 1,580,000 Accumulated depreciation—store buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Bonds payable, 5%, due in 10 years 500,000 Cash 282,850 Common stock, $20 par (400,000 shares authorized; 85,000 shares issued, 94,600 outstanding), January 1, 20Y8 1,700,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 700,000 Income tax payable 44,000 Interest receivable 1,200 Inventory (December 31, 20Y8), at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4,320,000 Paid-in capital from sale of treasury stock, January 1, 20Y8 0 Paid-in capital in excess of par—common stock, January 1, 20Y8 736,800 Paid-in capital in excess of par—preferred stock, January 1, 20Y8 70,000 Preferred 5% stock, $80 par (30,000 shares authorized; 16,000 shares issued), January 1, 20Y8 1,280,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 20Y8 8,197,220 Store buildings and equipment 12,560,000 Treasury stock, January 1, 20Y8 0 b. Prepare a statement of stockholders’ equity for the year ended December 31, 20Y8. Decreases in equity and purchase should be entered as negative amounts by using a minus sign. If your answer is zero, enter “0”. Equinox Products Inc. Statement of Stockholders' Equity For the Year Ended December 31, 20Y8 Preferred Stock Paid-In Capital in Excess of Par— Preferred Stock Common Stock Paid-In Capital in Excess of Par— Common Stock Paid-In Capital from Sale of Treasury Stock Retained Earnings Treasury Stock Total $fill in the blank 43 $fill in the blank 44 $fill in the blank 45 $fill in the blank 46 $fill in the blank 47 $fill in the blank 48 $fill in the blank 49 $fill in the blank 50 fill in the blank 52 fill in the blank 53 fill in the blank 54 fill in the blank 56 fill in the blank 57 fill in the blank 58 fill in the blank 60 fill in the blank 61 fill in the blank 63 fill in the blank 64 fill in the blank 66 fill in the blank 67 fill in the blank 68 fill in the blank 70 fill in the blank 71 $fill in the blank 73 $fill in the blank 74 $fill in the blank 75 $fill in the blank 76 $fill in the blank 77 $fill in the blank 78 $fill in the blank 79 $fill in the blank 80 c. Prepare a balance sheet in report form as of December 31, 20Y8. Equinox Products Inc. Balance Sheet December 31, 20Y8 Assets Current assets: $fill in the blank 82 $fill in the blank 84 fill in the blank 86 fill in the blank 88 fill in the blank 90 fill in the blank 92 fill in the blank 94 Total current assets $fill in the blank 95 Property, plant, and equipment: $fill in the blank 97 fill in the blank 99 $fill in the blank 101 $fill in the blank 103 fill in the blank 105 fill in the blank 107 Total property, plant, and equipment fill in the blank 108 Intangible assets: fill in the blank 110 Total assets $fill in the blank 111 Liabilities Current liabilities: $fill in the blank 113 fill in the blank 115 Total current liabilities $fill in the blank 116 Long-term liabilities: $fill in the blank 118 fill in the blank 120 fill in the blank 121 Total liabilities $fill in the blank 122 Stockholders’ Equity Paid-in capital: $fill in the blank 124 fill in the blank 126 $fill in the blank 128 $fill in the blank 130 fill in the blank 132 fill in the blank 134 fill in the blank 136 Total paid-in capital $fill in the blank 137 fill in the blank 139 fill in the blank 141 Total stockholders’ equity fill in the blank 142 Total liabilities and Stockholders’ Equity $fill in the blank 143

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter15: Financial Statements And Year-end Accounting For A Merchandising Business

Section: Chapter Questions

Problem 10SPA: END-OF-PERIOD SPREADSHEET, ADJUSTING, CLOSING, AND REVERSING ENTRIES Vickis Fabric Store shows the...

Related questions

Topic Video

Question

Comprehensive Problem 4

Part 2:

Note: You must complete part 1 before part 2.

After all of the transactions for the year ended December 31, 20Y8, had been

| Income statement data: | ||

| Advertising expense | $150,000 | |

| Cost of goods sold | 3,700,000 | |

| Delivery expense | 30,000 | |

| 30,000 | ||

| Depreciation expense—store buildings and equipment | 100,000 | |

| Income tax expense | 140,500 | |

| Interest expense | 21,000 | |

| Interest revenue | 30,000 | |

| Miscellaneous administrative expense | 7,500 | |

| Miscellaneous selling expense | 14,000 | |

| Office rent expense | 50,000 | |

| Office salaries expense | 170,000 | |

| Office supplies expense | 10,000 | |

| Sales | 5,313,000 | |

| Sales commissions | 185,000 | |

| Sales salaries expense | 385,000 | |

| Store supplies expense | 21,000 | |

| Accounts payable | $194,300 | |

| Accounts receivable | 545,000 | |

| 1,580,000 | ||

| Accumulated depreciation—store buildings and equipment | 4,126,000 | |

| Allowance for doubtful accounts | 8,450 | |

| Bonds payable, 5%, due in 10 years | 500,000 | |

| Cash | 282,850 | |

| Common stock, $20 par (400,000 shares authorized; 85,000 shares issued, 94,600 outstanding), January 1, 20Y8 |

1,700,000 | |

| Dividends: | ||

| Cash dividends for common stock | 155,120 | |

| Cash dividends for |

100,000 | |

| Goodwill | 700,000 | |

| Income tax payable | 44,000 | |

| Interest receivable | 1,200 | |

| Inventory (December 31, 20Y8), at lower of cost (FIFO) or market | 778,000 | |

| Office buildings and equipment | 4,320,000 | |

| Paid-in capital from sale of |

0 | |

| Paid-in capital in excess of par—common stock, January 1, 20Y8 | 736,800 | |

| Paid-in capital in excess of par—preferred stock, January 1, 20Y8 | 70,000 | |

| Preferred 5% stock, $80 par (30,000 shares authorized; 16,000 shares issued), January 1, 20Y8 |

1,280,000 | |

| Premium on bonds payable | 19,000 | |

| Prepaid expenses | 27,400 | |

| Retained earnings, January 1, 20Y8 | 8,197,220 | |

| Store buildings and equipment | 12,560,000 | |

| Treasury stock, January 1, 20Y8 | 0 |

b. Prepare a statement of

| Equinox Products Inc. Statement of Stockholders' Equity For the Year Ended December 31, 20Y8 |

||||||||

|---|---|---|---|---|---|---|---|---|

| Preferred Stock | Paid-In Capital in Excess of Par— Preferred Stock |

Common Stock | Paid-In Capital in Excess of Par— Common Stock |

Paid-In Capital from Sale of Treasury Stock |

Retained Earnings |

Treasury Stock |

Total | |

| $fill in the blank 43 | $fill in the blank 44 | $fill in the blank 45 | $fill in the blank 46 | $fill in the blank 47 | $fill in the blank 48 | $fill in the blank 49 | $fill in the blank 50 | |

| fill in the blank 52 | fill in the blank 53 | fill in the blank 54 | ||||||

| fill in the blank 56 | fill in the blank 57 | fill in the blank 58 | ||||||

| fill in the blank 60 | fill in the blank 61 | |||||||

| fill in the blank 63 | fill in the blank 64 | |||||||

| fill in the blank 66 | fill in the blank 67 | fill in the blank 68 | ||||||

| fill in the blank 70 | fill in the blank 71 | |||||||

| $fill in the blank 73 | $fill in the blank 74 | $fill in the blank 75 | $fill in the blank 76 | $fill in the blank 77 | $fill in the blank 78 | $fill in the blank 79 | $fill in the blank 80 |

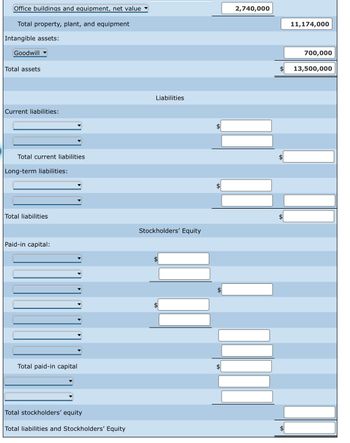

c. Prepare a balance sheet in report form as of December 31, 20Y8.

| Equinox Products Inc. Balance Sheet December 31, 20Y8 |

|||

|---|---|---|---|

| Assets | |||

| Current assets: | |||

| $fill in the blank 82 | |||

| $fill in the blank 84 | |||

| fill in the blank 86 | |||

| fill in the blank 88 | |||

| fill in the blank 90 | |||

| fill in the blank 92 | |||

| fill in the blank 94 | |||

| Total current assets | $fill in the blank 95 | ||

| Property, plant, and equipment: | |||

| $fill in the blank 97 | |||

| fill in the blank 99 | |||

| $fill in the blank 101 | |||

| $fill in the blank 103 | |||

| fill in the blank 105 | |||

| fill in the blank 107 | |||

| Total property, plant, and equipment | fill in the blank 108 | ||

| Intangible assets: | |||

| fill in the blank 110 | |||

| Total assets | $fill in the blank 111 | ||

| Liabilities | |||

| Current liabilities: | |||

| $fill in the blank 113 | |||

| fill in the blank 115 | |||

| Total current liabilities | $fill in the blank 116 | ||

| Long-term liabilities: | |||

| $fill in the blank 118 | |||

| fill in the blank 120 | fill in the blank 121 | ||

| Total liabilities | $fill in the blank 122 | ||

| Stockholders’ Equity | |||

| Paid-in capital: | |||

| $fill in the blank 124 | |||

| fill in the blank 126 | |||

| $fill in the blank 128 | |||

| $fill in the blank 130 | |||

| fill in the blank 132 | |||

| fill in the blank 134 | |||

| fill in the blank 136 | |||

| Total paid-in capital | $fill in the blank 137 | ||

| fill in the blank 139 | |||

| fill in the blank 141 | |||

| Total stockholders’ equity | fill in the blank 142 | ||

| Total liabilities and Stockholders’ Equity | $fill in the blank 143 |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Office buildings and equipment, net value

Total property, plant, and equipment

Intangible assets:

Goodwill

Total assets

Current liabilities:

Total current liabilities

Long-term liabilities:

Total liabilities

Paid-in capital:

Total paid-in capital

Total stockholders' equity

Total liabilities and Stockholders' Equity

Liabilities

Stockholders' Equity

$

2,740,000

11,174,000

700,000

13,500,000

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning