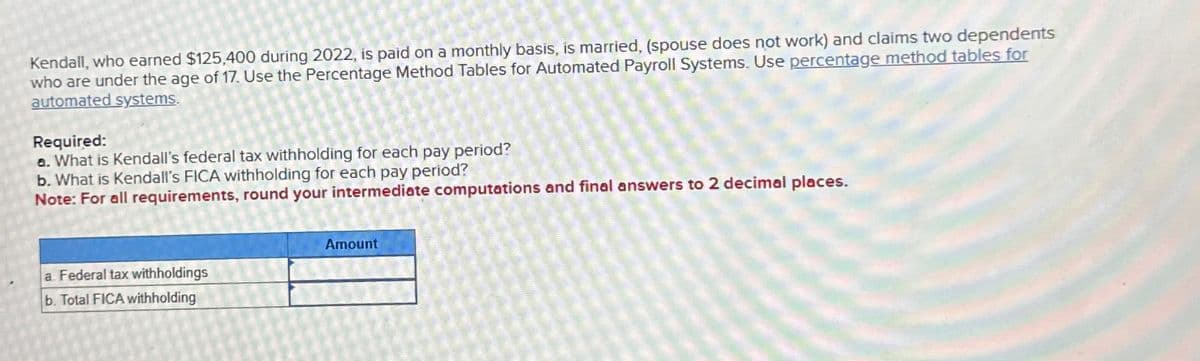

Kendall, who earned $125,400 during 2022, is paid on a monthly basis, is married, (spouse does not work) and claims two dependents who are under the age of 17. Use the Percentage Method Tables for Automated Payroll Systems. Use percentage method tables for automated systems. Required: a. What is Kendall's federal tax withholding for each pay period? b. What is Kendall's FICA withholding for each pay period? Note: For all requirements, round your intermediate computations and final answers to 2 decimal places. a. Federal tax withholdings b. Total FICA withholding Amount

Kendall, who earned $125,400 during 2022, is paid on a monthly basis, is married, (spouse does not work) and claims two dependents who are under the age of 17. Use the Percentage Method Tables for Automated Payroll Systems. Use percentage method tables for automated systems. Required: a. What is Kendall's federal tax withholding for each pay period? b. What is Kendall's FICA withholding for each pay period? Note: For all requirements, round your intermediate computations and final answers to 2 decimal places. a. Federal tax withholdings b. Total FICA withholding Amount

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 21CE: On January 1, 2019, Kunto, a cash basis taxpayer, pays 46,228 for a 24-month certificate. The...

Related questions

Question

Gadubhai

Transcribed Image Text:Kendall, who earned $125,400 during 2022, is paid on a monthly basis, is married, (spouse does not work) and claims two dependents

who are under the age of 17. Use the Percentage Method Tables for Automated Payroll Systems. Use percentage method tables for

automated systems.

Required:

a. What is Kendall's federal tax withholding for each pay period?

b. What is Kendall's FICA withholding for each pay period?

Note: For all requirements, round your intermediate computations and final answers to 2 decimal places.

a. Federal tax withholdings

b. Total FICA withholding

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT