Chapter11: Long-term Assets

Section: Chapter Questions

Problem 9Q: Explain the difference between depreciation, depletion, and amortization.

Related questions

Question

Define each of the following terms:

d.

Expert Solution

Step 1

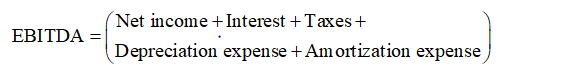

The formula to compute EBITDA as follows:

Step 2

Depreciation:

Depreciation is the decrease in the market value of fixed assets due to the reasons like wear and tear obsolescence passage of time and depletion. Depreciation is an accounting technique of assigning the cost of a touchable or physical asset throughout its useful lifetime or life expectation. Depreciation signifies how much worth of an asset has been utilized.

Depreciation is defined as the decrease of noted value of a fixed asset in an organized manner until the worth of the asset turn out to be zero or insignificant.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT