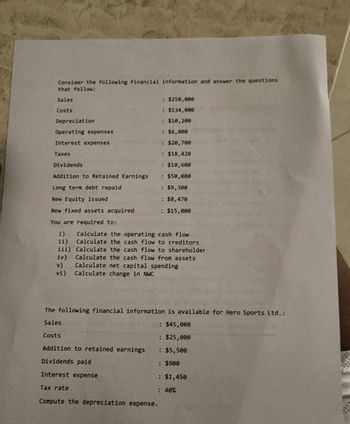

Consider the following financial information and answer the questions that follow: Sales Costs Depreciation Operating expenses Interest expenses Taxes Dividends Addition to Retained Earnings : $250,000 : $134,000 : $10,200 : $6,000 : $20,700 : $18,420 : $10,600 : $50,080 : $9,300 : $8,470 : $15,000 Long term debt repaid New Equity issued New fixed assets acquired You are required to: i) Calculate the operating cash flow ii) Calculate the cash flow to creditors iii) Calculate the cash flow to shareholder

Consider the following financial information and answer the questions that follow: Sales Costs Depreciation Operating expenses Interest expenses Taxes Dividends Addition to Retained Earnings : $250,000 : $134,000 : $10,200 : $6,000 : $20,700 : $18,420 : $10,600 : $50,080 : $9,300 : $8,470 : $15,000 Long term debt repaid New Equity issued New fixed assets acquired You are required to: i) Calculate the operating cash flow ii) Calculate the cash flow to creditors iii) Calculate the cash flow to shareholder

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 1MCQ: Which of the following statements is true? Under cash-basis accounting, revenues are recorded when a...

Related questions

Question

Please assist and show working with explan

Transcribed Image Text:Consider the following financial information and answer the questions

that follow:

Sales

Costs

Depreciation

Operating expenses

Interest expenses

Taxes

Dividends

Addition to Retained Earnings

Long term debt repaid

New Equity issued

New fixed assets acquired

You are required to:

ii)

iii)

i) Calculate the operating cash flow

Calculate the cash flow to creditors

Calculate the cash flow to shareholder

Calculate the cash flow from assets

Calculate net capital spending

iv)

v)

vi) Calculate change in NWC

: $250,000

: $134,000

: $10,200

: $6,000

: $20,700

: $18,420

: $10,600

: $50,080

: $9,300

: $8,470

: $15,000

The following financial information is available for Hero Sports Ltd.:

Sales

Costs

Addition to retained earnings

Dividends paid

Interest expense

Tax rate

Compute the depreciation expense.

: $45,000

: $25,000

: $5,500

: $900

: $1,450

: 40%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Question iv, v, vi. Please assist and show working

Transcribed Image Text:Consider the following financial information and answer the questions

that follow:

Sales

Costs

Depreciation

Operating expenses

Interest expenses

Taxes

Dividends

Addition to Retained Earnings

Long term debt repaid

New Equity issued

New fixed assets acquired

You are required to:

ii)

iii)

i) Calculate the operating cash flow

Calculate the cash flow to creditors

Calculate the cash flow to shareholder

Calculate the cash flow from assets

Calculate net capital spending

iv)

v)

vi) Calculate change in NWC

: $250,000

: $134,000

: $10,200

: $6,000

: $20,700

: $18,420

: $10,600

: $50,080

: $9,300

: $8,470

: $15,000

The following financial information is available for Hero Sports Ltd.:

Sales

Costs

Addition to retained earnings

Dividends paid

Interest expense

Tax rate

Compute the depreciation expense.

: $45,000

: $25,000

: $5,500

: $900

: $1,450

: 40%

Solution

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College